Hong Leong Bank Berhad (Bursa: 5819) is the fifth largest banking group in Malaysia. As I write, Hong Leong Bank is worth around RM34 billion in market capitalization. In this article, I’ll bring a detailed account of Hong Leong Bank’s tremendous success and achievements thus far and its outlook towards the near future. Therefore, here are 10 things you need to know about Hong Leong Bank before you invest.

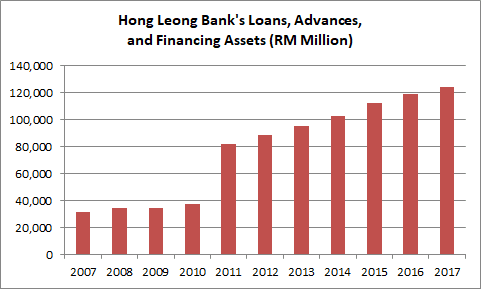

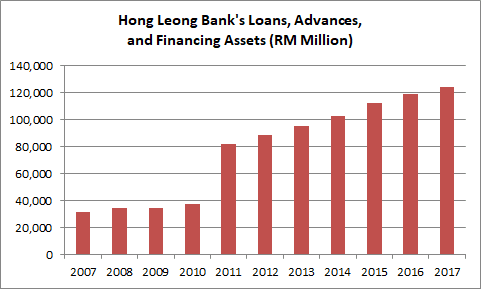

1. On 6 May 2011, Hong Leong Bank completed its acquisition of EON Capital for RM5.06 billion. Thus, EON Bank Group — comprising of EON Bank, EONCAP Islamic Bank, MIMB Investment Bank and related subsidiaries became wholly-owned subsidiaries of Hong Leong Bank. This resulted in substantial growth in loans, advances, and financing assets, from RM37.75 billion in 2010 to RM81.95 billion in 2011.

2. Since 2011, Hong Leong Bank has achieved a CAGR of 7.15% in loans, advances, and financing assets over the last six years. It increased from RM81.95 billion in 2011 to RM123.99 billion in 2017. This is due to growth in lending in major segments like purchase of residential and non-residential properties, purchase of vehicles, and working capital during the six-year period.

Source: Annual Reports of Hong Leong Bank

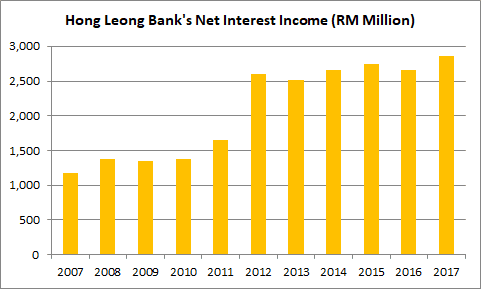

3. Upon the acquisition of EON Capital, Hong Leong Bank increased its net interest income from RM1.38 billion in 2010 to RM2.60 billion in 2012. Since then, Hong Leong Bank has maintained its net interest income at RM2.5 billion to RM3.0 billion a year despite continuous growth in loans, advances, and financing assets. This was due to a reduction in net interest margins from 2.30% in 2012 to 2.09% in 2017.

Source: Annual Reports of Hong Leong Bank

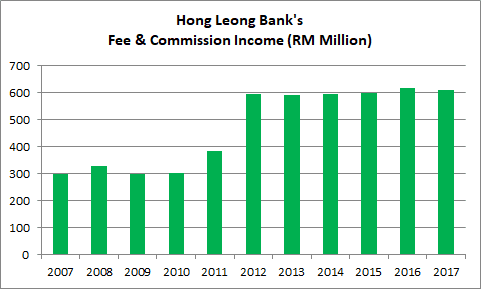

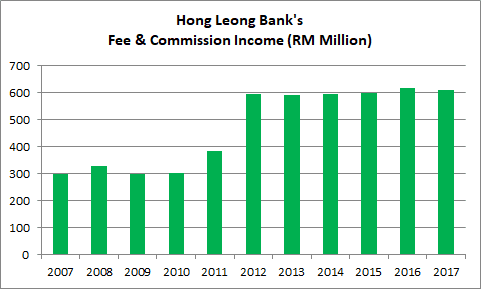

Similarly, Hong Leong Bank has substantially grown its fee & commission income upon the merging exercise with EON Capital in 2011. It increased from RM300.8 million in 2010 to RM596.5 million in 2012. Since then, Hong Leong Bank has maintained its fee & commission income at around RM600 million a year.

Source: Annual Reports of Hong Leong Bank

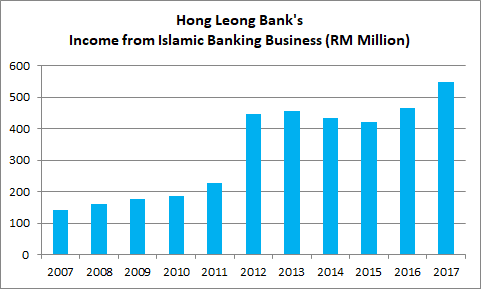

4. Also, Hong Leong Bank has reported substantial growth in income from Islamic Banking Business after its merging with EON Capital. It increased from RM184.8 million in 2010 to RM447.6 million in 2012. Income declined marginally from RM454.9 million in 2013 to RM419.8 million in 2015, before achieving back-to-back growth to RM550.1 million in 2017.

Source: Annual Reports of Hong Leong Bank

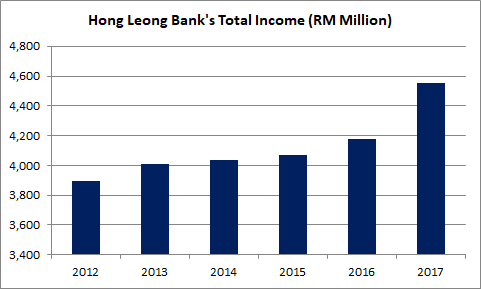

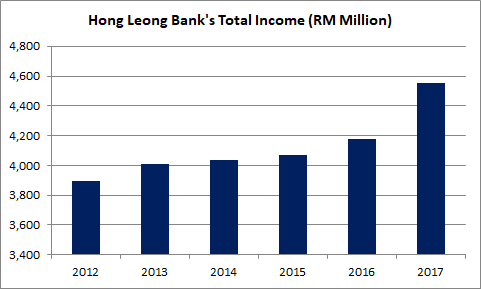

Since the merger, Hong Leong Bank has achieved a CAGR of 3.17% in total income over the last five years. It increased from RM3.89 billion in 2012 to RM4.55 billion in 2017. This was contributed by marginal growth in net interest income, fee & commission income, and income from Islamic Banking Business during the five-year period.

Source: Annual Reports of Hong Leong Bank

5. Hong Leong Bank kept its cost-to-income ratio between 44% to 46% over the last three years. In 2017, Hong Leong Bank had a cost-to-income ratio of 44.1%, slightly below the current industry average of 45.8%. This means, it is more cost-efficient compared to its peers in the local banking industry.

6. On 25 October 2007, Hong Leong Bank entered into a share subscription agreement to subscribe 650 million shares of Chengdu City Commercial Bank Co. Ltd (Chengdu Bank) for a total price of RMB1.95 billion (approximately RM877.5 million). Chengdu Bank is a 20%-owned associate company of Hong Leong Bank. Since 2009, Chengdu Bank has achieved a CAGR of 16.73% in profits. The profits attributed to Hong Leong Bank has increased from RM99.5 million in 2009 to RM342.9 million in 2017.

Source: Annual Reports of Hong Leong Bank

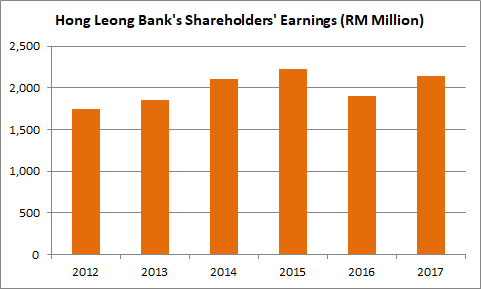

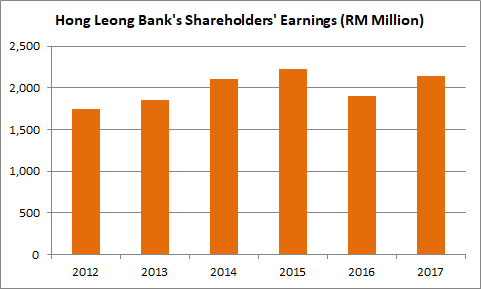

7. Since the merger, Hong Leong Bank has achieved a CAGR of 4.23% in shareholders’ earnings, increasing from RM1.74 billion in 2012 to RM2.15 billion in 2017. This was contributed by marginal growth in total income, a stable cost-to-income ratio, and continuous growth in profits derived from Chengdu Bank during the five-year period.

Source: Annual Reports of Hong Leong Bank

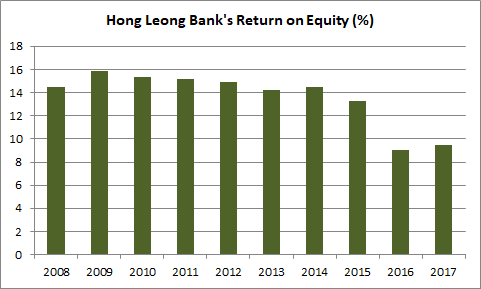

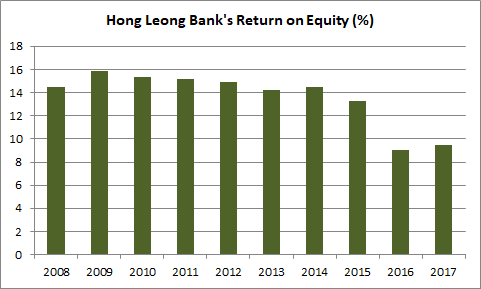

8. On 28 December 2015, Hong Leong Bank completed the issuance of 287.8 million rights shares to entitled shareholders. It is an effort of Hong Leong Bank to be well-capitalized to meet the capital requirements of the implementation of Basel III. This has substantially increased shareholders’ equity from RM16.79 billion in 2015 to RM21.12 billion in 2016. As a result, Hong Leong Bank recorded a drop in return on equity from 13.30% in 2015 to 9.01% in 2016. In 2017, Hong Leong Bank recorded achieved ROE of 9.46%.

Source: Annual Reports of Hong Leong Bank

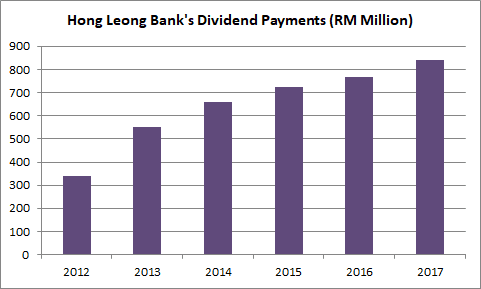

9. Hong Leong Bank has achieved a CAGR of 19.73% in dividend payments over the last five years. It increased from RM340.8 billion in 2012 to RM838.7 billion in 2017. In 2017, Hong Leong Bank declared 45 sen in dividend per share. As of 2 November 2017, Hong Leong Bank is trading at RM 15.98 a share. If Hong Leong Bank is able to maintain its dividend per share at 45 sen, its expected dividend yield is 2.8%.

Source: Annual Reports of Hong Leong Bank

10. Inevitably, Hong Leong Bank faces several risks which are inherent to the banking industry. They are:

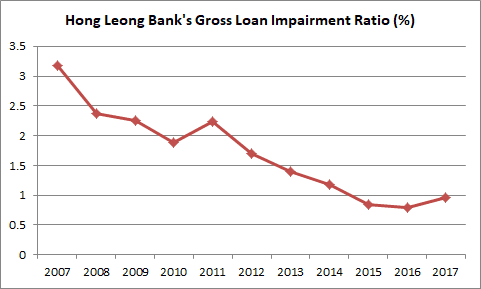

- Credit risk – the risk of loss if a borrower fails to meet its obligations. In this aspect, Hong Leong Bank has improved its asset quality as its gross loan impairment ratio has dropped from 3.18% in 2007 to 0.96% in 2017. It is below the current industry average of 1.6%. This means, Hong Leong Bank has better asset quality than its peers in the local banking industry.

Source: Annual Reports of Hong Leong Bank

- Market risk – the risk of loss in financial instruments due to adverse market movements such as interest rates and foreign exchanges.

- Liquidity risk – the risk of loss arising from the unavailability of sufficient funds to fulfill its financial commitments as they fall due. As such, Hong Leong Bank has adopted the liquidity coverage ratio (LCR) which measures its ability to meet liquidity needs for a 30-day period in an acute liquidity stress scenario. The full implementation of LCR in 2017 is set at minimum of 80%. As at 30 June 2017, Hong Leong Bank has recorded 137% in LCR, thus, exceeding LCR requirements.

- Cyber security – there is an increasing threat of important data being accessed via unauthorized means with malicious intent. Presently, Hong Leong Bank has installed an anti-persistent threat mitigation platform to anticipate, detect and prevent evolving forms of cyber threats from infiltrating its IT systems.

The fifth perspective

In summary, Hong Leong Bank has continued to improve its asset quality and delivered sustainable increase in total income, shareholders’ earnings, and dividend payments to its shareholders. As at 30 June 2017, Hong Leong Bank remains well-capitalized as it has reported to have RM10.39 billion in cash reserves, 15.8% in total capital ratio, and 96% in loan impairment coverage ratio. Hong Leong Bank looks resilient enough to weather any potential financial storms ahead.

Looking to invest in Singapore banks? Here’s what you need to watch out for when investing in Singapore banks and when you should avoid them.