Previously, I updated an article about the top 10 Singapore REITs that would have made you money if you invested from their IPOs. Out of the 20 S-REITs that have been listed for listed for at least 10 years, 16 of them gave a positive overall return for investors.

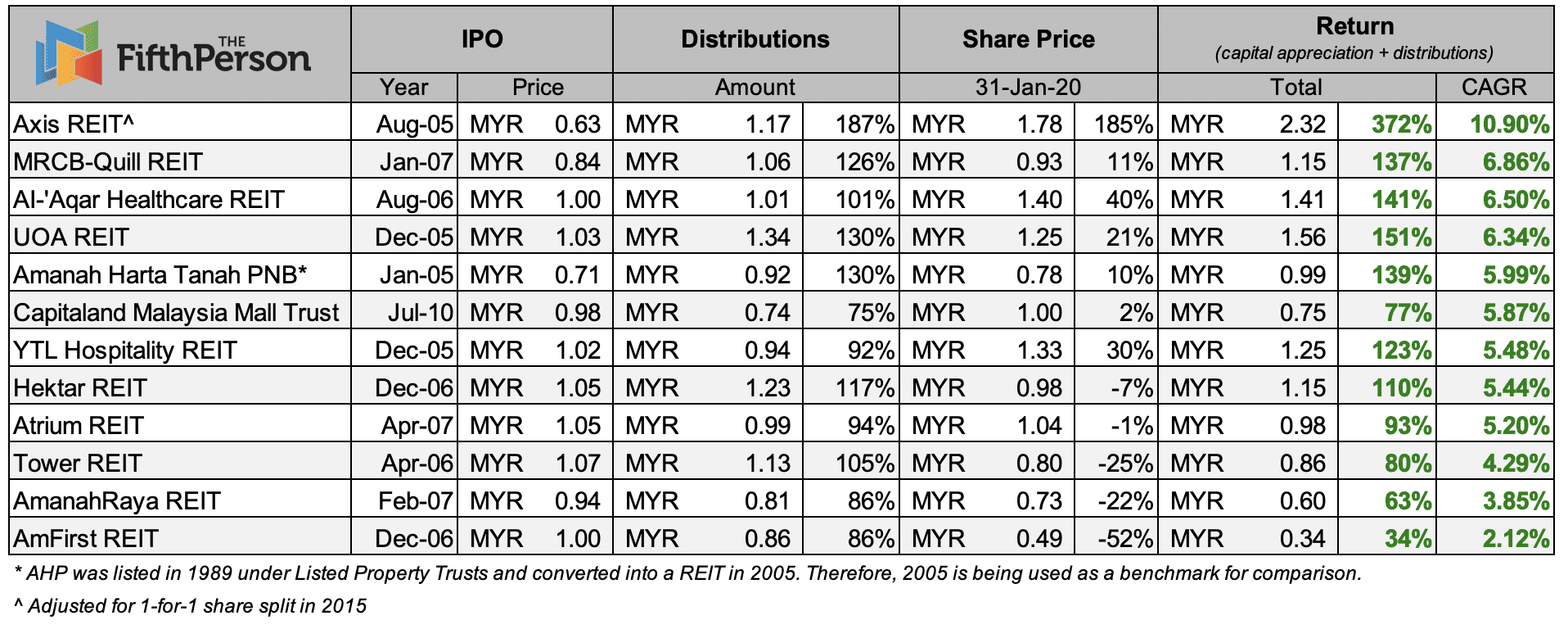

In this article, we will look at their counterparts from across the causeway and do a similar study on the performance of Malaysian REITs (M-REITs) that have been listed for at least ten years. In total, there are 12 M-REITs that IPOed in 2010 or earlier.

We will make a similar assumption that Sophia (a fictional character) invests RM1,000 in each of these REITs from the day it listed. Since Sophia is a hard-core income investor, she doesn’t want to come out with any money to subscribe to any rights (if any) and is prepared for any share dilution. Let’s also assume that she neglects to sell her nil-paid rights from which she can make a profit from.

For example, if Sophia invested in Al-Aqar Healthcare REIT from its IPO in 2006, her initial investment of RM1,000 would have grown to RM1,400 (+40% in capital gains) by end-Janaury 2020. On top of that, she would have collected total dividends of RM1,010 (+101% in dividends).

From the table above, Sophia would’ve made a nice return in Al-Aqar Healthcare REIT as her initial investment of RM1,000 would have grown to RM2,410 including the dividends received over the years. If she invested RM10,000, then her investment would’ve grown to RM24,100. Basically, the more money she had invested, the more she would have made. And the longer she holds onto her investments, the more dividends she will receive. In all, her annualised return from Al-Aqar Healthcare REIT alone is 6.50% from August 2006 to January 2020.

So after investing for more than ten years, here are the top five best-performing Malaysian REITs for Sophia.

Note: We’ve excluded brokerage costs, currency exchange movements, and taxes that might be applicable to foreign investors.

5. Amanah Harta Tanah PNB (annualised return: +5.99%)

Since 2006, every RM1,000 investment in AHP REIT would’ve turned into RM1,100. Including dividends, every RM1,000 would cumulatively become RM2,390.

4. UOA REIT (annualised return: 6.34%)

Since 2005, every RM1,000 investment in UOA REIT would’ve turned into RM1,210. Including dividends, every RM1,000 would cumulatively become RM2,510.

4. Al-Aqar Healthcare REIT (annualised return: 6.50%)

Since 2006, every RM1,000 investment in Al-Aqar Healthcare REIT would’ve turned into RM1,400. Including dividends, every RM1,000 would cumulatively become RM2,410.

2. MRCB-Quill REIT (annualised return: 6.86%)

Since 2007, every RM1,000 investment in MQREIT would’ve turned into RM1,110. Including dividends, every RM1,000 would cumulatively become RM2,370.

1. Axis REIT (annualised return: 10.90%)

Since 2005, every RM1,000 investment in Axis REIT would’ve turned into RM2,850. Including dividends, every RM1,000 would cumulatively become RM4,720.

In summary, here is Sophia’s overall performance:

As you can see, the Sophia’s Malaysian REIT portfolio is a sea of green! Out of the 12 M-REITs that have been listed for at least 10 years or more, all of them have given consistent dividends and positive overall returns if you invested from their IPOs.

However, Atrium REIT, Hektar REIT, AmanahRaya REIT, Tower REIT, and AmFirst REIT are sitting on capital losses of 1%, 7%, 22%, 25% and 52% respectively. But when we include dividends, their overall return is still positive.

Singaporeans and foreign investors who are not comfortable with forex risks are unlikely to be interested in Malaysian REITs as the ringgit continues to weaken. However, Malaysians are unaffected by this as Malaysian REITs are traded in their home currency. So if you’re a Malaysian, M-REITs do seem to be a viable option to build consistent streams of passive income.

Finally, just a quick reminder: 2020 applications to join Dividend Machines close on Sunday, 1 March 2020, at 23:59 hours. If you’re looking for a way to learn how to invest in dividend stocks and REITs and build multiple streams of passive dividend income, then we highly recommend you check out Dividend Machines before applications close!

Once the deadline has passed, Dividend Machines will only reopen in 2021. So if you miss this round, you’ll have to wait a year (or more) before we accept new applications again.

Happy investing and we hope to see you on the inside 🙂

I would like to invest and it all depend on the R.O.I t.q

Can you please let me know which is better for long term investment, unit trust or reit?

Hi Faisal,

This is a very general question that’s impossible to answer as you’ll have both certain unit trusts and REITs that will outperform their peers.

However, in general, REITs have much lower fees and costs — compared to unit trusts — which will eat into your returns over the long term.

I am a Malaysian , if interested to invest in Singapore REIT ,does it any withholding tax incur for dividends ?

Hi Dennis,

There’s no withholding tax on dividends for Malaysians investing in Singapore REITs 🙂

I am Malaysian and interested to invest in Singapore Reits.Pls advice how to proceed?

Hi Theresa,

You can purchase through your own Malaysian brokerage if they offer access to the SGX. Or you can open a Singapore brokerage account like Saxo Markets which accepts non-resident foreigners.

Hi Adam, I would like to invest in these Reits, but before that i would like to know which of these reits are sharie complaints ? Also it seems Saxo Markets doesn’t have access to Malaysia stock exchange, Can you suggest other platform who accept foreigners and have access to Malaysia stock exchange ?

Kind regards, Feras

Hi Feras,

You can refer to this link for a list of Shariah-compliant securities: https://www.sc.com.my/development/islamic-capital-market/list-of-shariah-compliant-securities-by-scs-shariah-advisory-council

If you’re a foreigner but a Singapore resident, you can still open an account with a Singapore brokerage account to access the Malaysian market.

If not, you can check with the brokerages from wherever you’re from and whether they offer access to Malaysia.

Hi Adam,

There have many Malaysia REITS listed in Bursa Malaysia, Which sector is best to invest and high return. What aspect should study before invest?

Hi Chin,

There isn’t a ‘best’ sector to invest in. Each sector has its own characteristics and advantages. This article will help:

https://fifthperson.com/5-important-factors-you-need-to-consider-before-you-invest-in-any-reit/

Hi, I just wandering why IGBREIT, KLCC, PAVREIT and SUNREIT is not in yr list?

Did I miss something?

Thk you

Hi NK, we only did the calculation for REITs with a listing record of at least 10 years. The four REITs you highlighted have less than ten years. We may include Sunway REIT in a couple of years time as it IPOed in July 2010.

Need your opinion, refer to Sunway REIT VS MRCB REIT, which one should like consider.

The office market in Malaysia is suffering from an oversupply issue. A pure office player like MRCB is facing a lot more headwinds than a mixed-development player like Sunway REIT.

I can’t give you any recommendations on which is a better investment as your financial situation, investment goals, and risk profile are all unique to you.

Hi i am 19 years old and looking to invest some of my small savings. what would you advise? Thank you

Hi SD,

We suggest learning the fundamentals of investing first and making sure your personal finances are in order before you invest 🙂

https://fifthperson.com/how-to-invest-in-malaysia/

Hi and good day, I have read your article and is really interested in investing in REIT. So for me to begin should I approach the bank for broker or there is alternative available?? I am expecting a rough amount of minimum. Thank you~~

Hi Poro, you can read more how you can start investing here — https://fifthperson.com/how-to-invest-in-malaysia/. Once you have a few thousand saved up, you can begin your investment journey. It is also important to educate yourself first before buying any stocks/REITs 🙂

Hi, I tried to find information in regards to AmFirst REIT but can’t seem to dig up anything. The price has continually dropped since 2013 and I think it’s probably attributable to the quality of the assets/writedowns but I cannot be sure. Do you happen to have any available information on this particular please? Their dividends have been declining atrociously in the last 3 years but again, I can’t seem to find a reason.

Hi Koh,

The office market in Malaysia is suffering from ultra high vacancy rates at more than 20%; it is an industry wide problem. Coupled with the rights issues, it has made the decline worse.