Formed in 1960, Malayan Banking Berhad (Maybank) operates more than 2,400 branches across 20 countries including all 10 nations in Southeast Asia. Presently, it is the fourth largest banking group in Southeast Asia. As of 22 June 2018, Maybank is worth RM100.4 billion in market capitalization and is the only stock in Malaysia that has exceeded the RM100 billion mark.

In this article, I’ll bring a detailed account of Maybank’s past performance over the last 10 years and its outlook toward the near future. Therefore, here are the 12 things you need to know about Maybank before you invest.

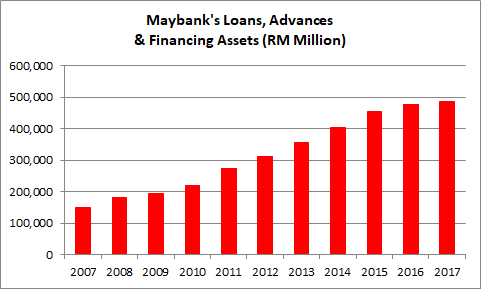

1. Maybank has achieved a CAGR of 12.6% in loans, advances and financing assets over the last 10 years. It has increased from RM148.6 billion in December 2007 to RM485.6 billion in December 2017. This is due to growth in lending in key segments such as purchases of residential and non-residential properties, hire purchases, and working capital during the period.

Source: Maybank Annual & Quarterly Reports

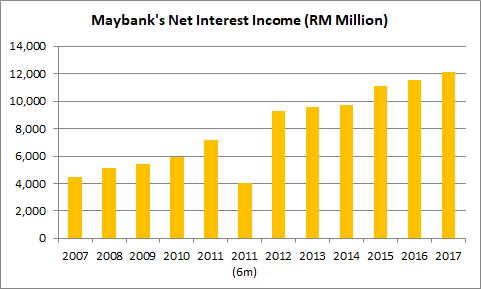

2. Maybank has reported consistent growth in net interest income over the last 10 years. It has increased steadily from RM4.5 billion in 2007 to RM12.2 billion in 2017. This is because Maybank’s increase in loans, advances and financing assets have exceeded a marginal decline in its net interest margins during the period. The dip in net interest margin in 2010-2012 was a result of rising competition for both loans and deposits during the period. Since 2013, Maybank has kept its net interest margin stable at 2.3-2.5%.

Source: Maybank Annual Reports

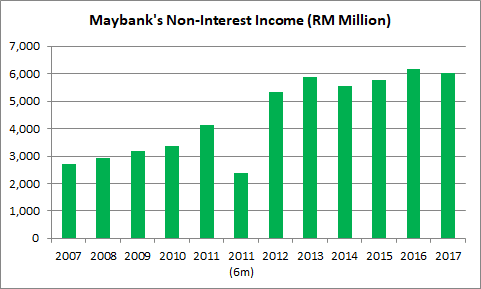

3. Maybank has also achieved consistent growth in non-interest income over the last 10 years. It has increased steadily from RM2.7 billion in 2007 to RM6.0 billion in 2017. The growth was mainly driven by Maybank’s Islamic Banking operations, and fees & commission-based income in the 10-year period.

Source: Maybank Annual Reports

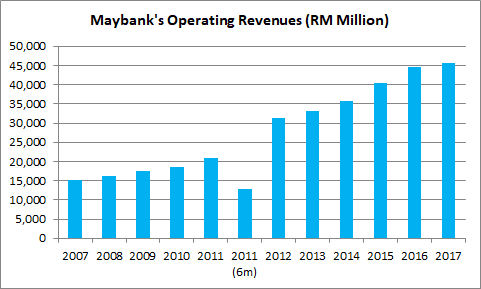

4. As a result, Maybank has reported consistent growth in operating revenues over the last 10 years. It has risen from RM15.2 billion in 2007 to RM45.6 billion in 2017. This is directly contributed by steady growth in both net interest income and non-interest income as explained in Points 2 and 3.

Source: Maybank Annual Reports

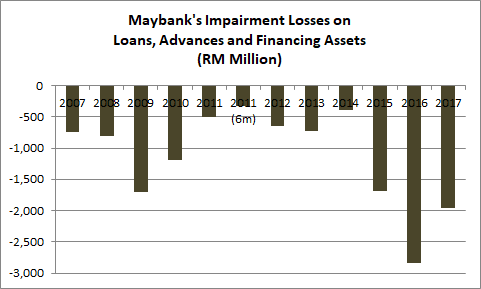

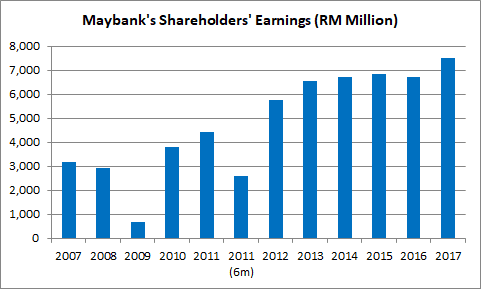

5. Maybank’s earnings are dependent on the amount of impairment losses incurred on its loans, advances, and financing assets. For instance:

- 2009: Maybank incurred RM1.70 billion in impairment losses, a substantial increase from the amount incurred in 2007 and 2008. The hike in impairment losses exceeded its growth in operating revenues in 2009. As a result, Maybank reported RM692 million in shareholders’ earnings — the lowest made in the 10-year period.

- 2010-2014: Since then, Maybank has reduced its impairment losses. This is evident as impairment losses were under RM1 billion from 2011 to 2014. In tandem with rising operating revenues, Maybank recorded steady growth in shareholders’ earnings, increasing from RM3.8 billion in 2010 to RM6.7 billion in 2014.

- 2015-2016: Maybank incurred substantially higher impairment losses in 2015 and 2016. This cancelled Maybank’s continuous growth in operating revenues. As a result, Maybank’s shareholders’ earnings were maintained at RM6.50-7.00 billion a year in 2015 and 2016.

- 2017: Maybank incurred RM2.0 billion in impairment loss in 2017 which is a reduction from the RM2.8 billion incurred in 2016. As a result, Maybank has successfully increased its shareholders’ earnings from RM6.7 billion in 2016 to RM7.5 billion in 2017.

Source: Maybank Annual Reports

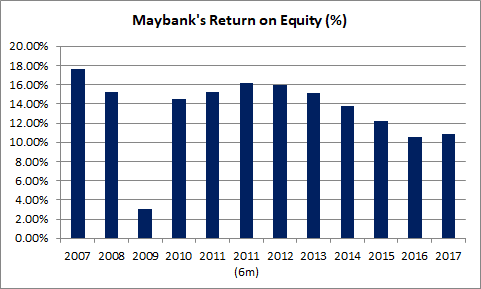

6. Maybank has reported continuous marginal decline in return on equity (ROE) since the financial year ended 31 December 2011. ROE dropped from 16.2% in 2011 to 10.9% in 2017. This is because Maybank’s growth in shareholders’ equity has surpassed its growth in shareholders’ earnings over the last five years. It is an effort of Maybank to be well-capitalized to meet the requirements of the implementation of Basel III in advance.

Source: Maybank Annual Reports

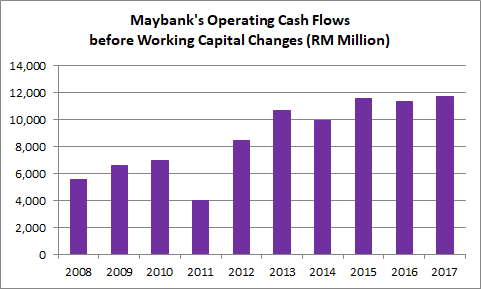

7. Maybank has huge fluctuations in net cash flows from operations. This is normal as banks have huge fluctuations in working capital. These include changes in customers’ deposits and changes in loans, advances and financing. As such, it is impossible to use the discounted cash flow method to estimate the intrinsic value of a bank stock. Excluding changes in working capital, I’ve discovered that Maybank has generated rising operating cash flows over the last 10 years. It increased from RM5.6 billion in 2008 to RM11.7 billion in 2017. In total, the total operating cash flows before working capital changes amounted to RM87.0 billion during the 10-year period.

Source: Maybank Annual Reports

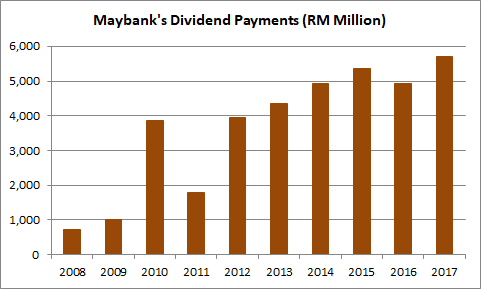

8. Maybank has paid out RM36.6 billion in dividends to its existing shareholders over the last 10 years. At present, Maybank has a long-term dividend policy to pay out 40-60% of its net profits to shareholders. However, Maybank’s dividend payout ratio has actually averaged 75.0% a year from 2007 to 2016. This means, Maybank has paid out, on average, RM75 in dividends from every RM100 in shareholders’ earnings during the period. Thus, Maybank has the highest dividend payout ratio among all public-listed banking groups in Malaysia and Singapore. In 2017, Maybank declared and paid RM0.55 in dividends per share. Based on its 2017 dividend and closing share price on 14 June 2018 of RM9.60, its dividend yield is 5.7%.

Source: Maybank Annual Reports

9. Maybank maintained a healthy liquidity coverage ratio (LCR) of 133% in 2017. It is above the minimum requirement of 80% set by Bank Negara Malaysia. LCR is used to assess a bank’s resilience to withstand an acute liquidity stress scenario over a 30-day horizon. It is calculated by dividing the amount of high-quality liquid assets (HQLA) with net cash outflows over a 30-day period. HQLA is defined as liquid assets that can be easily and immediately converted into cash at little or no loss of value. A high ratio indicates that a bank has adequate HQLA to meet liquidity requirements for the next 30 days under a significant stress scenario.

10. Maybank maintained a healthy capital position with a total capital ratio (TCR) of 19.38% in 2017. It is above the total regulatory requirement of 9.25% set by Bank Negara Malaysia for 2017. The total regulatory requirement is the addition of 8.0% in minimum total capital and 1.25% in phase-in capital conservation buffer for 2017.

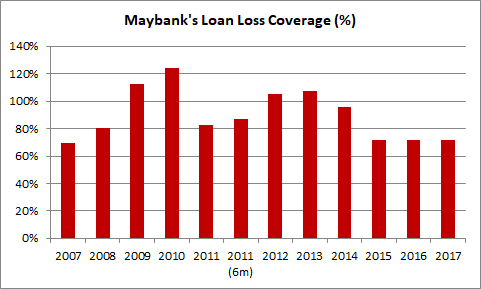

11. Maybank reported loan loss coverage of 71.5% in 2017, the lowest since 2008, and below the industry average of 82.9%. This means, in percentage terms, Maybank has set aside lower provisions to cover non-performing loans in comparison to most domestic banks in Malaysia in 2017.

Source: Maybank Annual Reports

12. In the mid-term, Maybank has identified five strategic objectives under Maybank 2020. They include:

- The Top ASEAN Community Bank. Maybank is strategically located to capture the continuous growth in the middle-income population across Southeast Asia. In 2018, Maybank will focus on stimulating revenue growth by enhancing its product propositions, manage costs, and mitigate risks through sound asset quality management.

- The Leading ASEAN Wholesale Bank Linking Asia. Presently, Maybank is the market leader in corporate lending, trade finance, and corporate deposits. In 2018, Maybank will focus on growing income from transactional banking activities in Southeast Asia, and expanding its wealth & investment management solutions to its customers across the region.

- The Leading ASEAN insurer. Maybank is the market leader in combined general insurance and takaful business in Malaysia. It has expanded its presence to Singapore and the Philippines. For 2017, Maybank intends to strengthen its bancassurance relationship between Etiqa and Maybank, and drive productivity by leveraging on digital tools such as Motortakaful.com and Etiqa’s direct sales portal.

- The Global Leader in Islamic Finance. Maybank is a leading Sukuk arranger as it ranked top two in the Global Sukuk League Table in 2016. In 2018, Maybank intends to grow its Islamic Wealth Management Portfolio and to further develop Islamic Trade Finance and Islamic Capital Market.

- Digital Bank of Choice. In 2016, Maybank launched MaybankPay, the first mobile wallet in Malaysia. For 2017, Maybank intends to explore more innovation digital solutions and to nurture regional growth in fintech to support its aspiration for Maybank 2020.

- Digital Bank of Choice. In 2016, Maybank launched MaybankPay, the first mobile wallet in Malaysia. In 2017, Maybank launched Maybank Sandbox to encourage collaboration with the fintech industry in ASEAN and around the world. In 2018, Maybank intends to maximize online customer engagement, especially in the areas of digital payments and lending, and continue engaging fintechs on potential collaborations.

The fifth perspective

In summary, Maybank has built a steady track record of delivering growth in operating revenues and shareholders’ earnings over the last 10 years. The bank is now intensifying its efforts on going digital to remain relevant, maintain its costs, and to pursue new revenue streams in the near future. Moving ahead, it strives to further cement its position as one of the leading banking groups in Southeast Asia.

Dear Ian,

from your report about Maybank, seems to me except possible future impairment, there is no other risk in investing to this stock. Am I correct?

Hi Soyan

Thanks for the question. For bank stocks, one of the biggest risk or, should I say, one of the largest expense item is impairment losses on their loans, advances, and financing assets. After all, the bread and butter of a bank stock is interest income derived from lending activities.

Suffice to say, it is best for a bank to be diverse in their lending portfolio in terms of customer base and industries to mitigate risk of loan default from a particular industry. If one is comfortable with a bank’s lending and credit risk management policies, then, investing in shares of the bank should be okay.

Regards

Ian

Hi Ian,

thanks for your kind explanation,

Regards,

Soyan

You are most welcome. Ian

Dear Ian, regarding the marginally reducing ROE due to effort in meeting Basel III requirement, mind explaining in more details?

Hi Mic

Thanks for the question. For a start, Basel 3 requires a bank to have better capital position so that a bank has the financial means to weather the storm of another economic crisis if it happens. This involves raising capital from investors.

In Malaysia, several measures have been taken. Public Bank and Hong Leong Bank have undertaken rights issue. Maybank adopts Dividend Reinvestment Plans which allows investors to receive Maybank shares as dividends instead of cash. It’s another way of returning cash in Maybank.

As such, Maybank has increased its shareholders’ equity.

Shareholders’ earnings have increased but not as fast as the growth in shareholders’ equity. As ROE is calculated by dividing shareholders’ earnings with shareholders’ equity, ROE for Maybank declined.

Regards

Ian

Hi Ian, a turbulent 2018 bringing Maybank’s share price to 9.08-9.11 levels today, what’s your opinion on the counter currently? I bought in earlier at 9.65 and assessing to average down my holding price. I am a long term investor with sufficient funds to average down but due to various global dynamics, just wanted an opinion if to continue observing before buying in. Personal goal for long term dividend and the current price is appealing based on Maybank’s previous payout strength.

Hi Chin, thanks for the question.

In the case for long-term investors who seek to earn recurring dividend income, the best is to find stocks that have solid fundamentals, resilient to economic ups and downs, have high dividend payout ratio and low & attractive prices.

So, at RM 9.00 – RM 9.20, I suppose, Maybank is more attractive as compared to RM 9.65 and hence, an investor may choose to average down his holdings if he has excess funds.

In a way, I believe, the question is not whether Maybank is a good buy at RM 9.00 but whether ‘is there a possibility that Maybank would drop further down to RM 8.50 or much lower?’ Let me bring you back to 2 years ago when Maybank is trading at RM 8.00+. Would you be asking, ‘Will Maybank drop to RM 7.00+?’

So, what’s my take on it? I think, nobody knows and can give you a guarantee as to where Maybank would go from here. If you believe Maybank would go much lower, then, wait and see. If you find that Maybank, at RM 9.14 (as I write) is able to give 6.02% in gross dividend yield and believe that deal is okay, then, you may choose to grab some today.

Here, I’ll leave you with one extra tip. If possible, try to calculate its dividend yields over the last 5 years. From which, you would know its lowest, highest and average dividend yields. Then, you may compare the 6.02% dividend yield with the lowest, highest and its average to guide your decision in buying / holding / selling shares of Maybank. Hope the above mentioned are helpful.

Regards

Ian

US S&L crisis forced the price to Rm4+, so many people bailed lol. Imagine the yields from RM4.. around 12% p.a. + capital appreciation of more than 100% 🙂

Hi Ian,

Greetings. Recently some institutional bodies (like EPF)are selling Maybank shares consistently.What is your take on that? Should we stay away from the stock for a while?

Hi Tan, thanks for your question. It depends on your objective of getting into the stock market. Why do you want to look at Maybank? How long do you intend to hold onto Maybank? Are you interested to subscribe its DRIP if it offers it to you?… etc. As I am not sure of your purpose, I can’t say whether or not, you should be buying shares of Maybank. But, if you are basing your buy-sell decision on who is buying what stock, then, I suppose we might differ in how we build our own investment portfolio for I rarely look into that as a criteria.

Re: Buy shares in M’sia ( open a M’sia brokerage account) – as a Sporean, open M’sia brokerage a/c require Passport, what about other documents (if any). # I alrdy have M’sia bank accounts for many years, do I still needs to produce

income statement as I am a retiree (anyway, I am working part-time ). TQ