I have been attending Hartalega’s AGM for three consecutive years. This year, when I entered the meeting room, I was immediately greeted with a video that reminded me that regardless of what we do, it is important to stay protected at all the times.

In short… always wear protection.

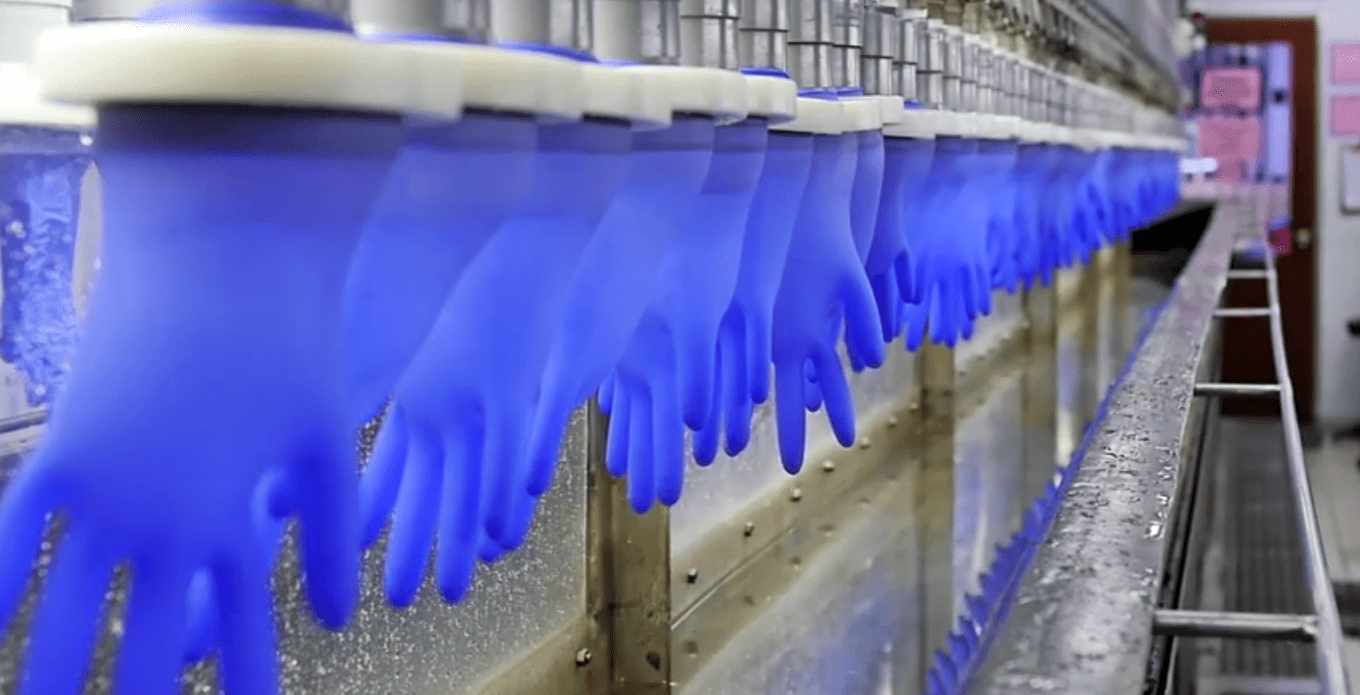

Not the sort of protection you are thinking of right now but the protection of wearing gloves in the healthcare industry.

This year, Hartalega launched a new video campaign, GloveOn, along with other initiatives in an attempt to build a global brand in the glove industry. We readily recognize global brands like Nike and Starbucks in the sportswear and coffee industries respectively, but can Hartalega achieve the same level of brand recognition like Nike and Starbucks in a commoditized industry like gloves?

Let’s find out the answer along with other insights at Hartalega’s AGM this year. So here are…

15 Quick Things I Learned from Hartalega’s AGM 2014

- Founder and chairman, Kuan Kam Hon, didn’t even complete his high school education. Yet today, the self-taught entrepreneur is running one of the most innovative and profitable glove companies in the world. He is not only passionate about what he does but he is also open-minded, hungry to learn, and always willing to try new ideas despite his long track record of successes.

- Hartalega disrupted the medical glove industry by being the first to introduce nitrile gloves. The company is now the global industry leader for nitrile gloves. Malaysia is the leading glove manufacturer in the world with over 60% of global market share, so most players in the Malaysia glove industry are very efficient in their glove manufacturing. So what makes Hartalega stand out from the others? In my opinion, Hartalega’s management possesses far-sighted vision and many other attributes that allows the company to successfully stay ahead of the curve in terms of profit margins, product innovation and technological advancement. For example, Hartalega broke another record again for being the first to launch the thinnest and lightest nitrile powder-free medical glove weighing in at just 2.7 grams that is in compliance with the Food and Drug Administration.

- Hartalega remains focused on the medical glove industry. Though the company has a stake in the semiconductor industry, there aren’t any aggressive plans to venture into other glove sectors. I personally like companies with management who stay focused on what they do best. Many corporate failures happen because of a loss of focus from the top management.

- Any fluctuation in raw material cost is unlikely to significantly impact Hartalega’s performance. According to chairman Kuan Kam Hon, one of the basic practices in the glove industry is that any change in raw material cost is shared with customers. Simply out, if costs fall, prices of the gloves fall as well and vice versa. The only issue is that there is a one-month time lag: if costs rise drastically in a particular month (though it is rare), Hartalega’s margins would be significantly affected that month before prices go up in tandem. With that said, not many industries have the benefit of passing down rising costs to its customers. Airline companies are a perfect example.

- The outbreak of the Ebola virus has caught the attention of the world recently. With no cure, the epidemic has claimed many lives in Africa. As a consciously-operated company, the management doesn’t wish to see any significant outbreak of disease like Ebola just to capitalize on sales of gloves. Instead, their mission is always to protect and prevent any disease from transmitting from one person to person. That’s what they stand for.

- In 2014, Hartalega’s installed capacity is around 11.7 billion pieces. According to managing director Kuan Mun Leong, the company’s Next Generation Integrated Glove Manufacturing Complex (NGC) project with a total of six state-of-the-art manufacturing plants and 72 production lines is expected to increase capacity by 15% annually till 2020. By then, Hartalega production capacity will increase to over 35 billion pieces per annum. However, investors must always take note that additional capacity doesn’t lead to instantaneous sales and profit. It depends on the demand of the gloves and how the company wins market share in time to come.

- This year the management reignited the company’s core values called SHIELD. It stands for Synergy, Honesty, Innovativeness, Excellence in Quality, Learning, and Dedication. The company is expected to grow its staff count to 9,000 people when the NGC project is completed. With so many employees, the management feels it is important to rearticulate these values so that everyone shares them as common core values. Core values are a moral compass that guides the direction of a company and is highly critical in every company’s success. Without it, a company could get lost along the way.

- Hartalega incurred substantial pre-operating expenses for the launch of NGC by recruiting talent in advance. This is to ensure smooth operations in the new facility. Consequently, net profit margin contracted slightly to 21.1% in FY2014 from 22.6% in FY2013. Moving forward, the management is confident in improving earnings per share gradually. As a minority shareholder, earnings per share are far more meaningful than absolute earnings growth.

- The NGC project is estimated to cost around RM2.2 billion. Out of which, RM900 million-1.2 billion is for machinery. The building is expected to cost around RM700 million. The rest of the resources will be channeled toward infrastructure, etc. Funding comes from different sources: internal cash flow, conversion of existing warrants and bank loans.

- Construction projects for the NGC (except proprietary production lines) are awarded to three to four parties through a tendering process. We always believe that a company shouldn’t have any related party transactions with its directors (and if there are, they should be disclosed and done at arm’s length). In this case, Hartalega passes the test.

- As a manufacturer in a commodity sector, the management is new to branding. So Hartalega engaged a branding consultant to introduce their brand in emerging markets. It is expected RM4 million-8 million a year will be earmarked for brand building purposes in emerging markets like China, India, Brazil, etc. These strategic locations are believed not to have direct conflicting products sold by their OEM customers in developed markets like America and Europe. It seems to be working so far — in 2014, Hartalega successfully brought in 16 new clients from the emerging markets and sales in China grew by an average of 253% over the past two years.

- Hartalega spends about 0.7-0.8% of annual sales in research and development. The figure may look small when benchmarked against tech companies (2-5%), but it is considerably huge when compared to manufacturing companies who operate in a commoditized industry. However, the most meaningful way to measure innovation is via the return generated and intangible benefits brought to the company and not just based on the amount spent on a percentage of the sales.

- Hartalega’s largest customer in North America contributed close to 25% of turnover in 2014. One major risk is that there isn’t a long-term contract between the two parties that may expose Hartalega naked if this customer switches to other nitrile glove suppliers. Though it is possible, the management wasn’t concerned at all because of the following reasons:

- Hartalega has been dealing with this customer since 2003

- There aren’t any suppliers able to take on the huge production demand of 3.8 billion nitrile gloves needed by this customer

- Hartalega has played a very important role in the success of this key customer — they have become one of the largest glove suppliers in the US and were the first mover in nitrile gloves in early 2003

- Nearly more than 70% of the purchases made by this customer is supplied by Hartalega. This key customer would suffer comparatively bigger losses if Hartalega decided to stop supplying them

With that said however, Hartalega lost one major customer before in 2012 who contributed 12% of FY2011 sales. The customer made the switch due to price rather than quality. Fortunately, Hartalega managed to attract new customers and replaced the lost revenue quickly.

- In FY2014, the total director remuneration stood around RM7 million. Compared against the company’s FY2014 net profit of RM233 million, in my opinion, the directors are underpaid. Moreover, Hartalega issued ESOS (a form of share options) to reward its employees. The founder, being the largest shareholder, has not received a single ESOS to date. (In case Hartalega management is reading this article, please maintain your remuneration arrangement and I know you will!) As a full-time investor myself, I have come across numerous companies whose directors excessively reward themselves with high salaries and share options. In my opinion, Hartalega has shown the good attributes where the management is keen to make money alongside its shareholders and not off them.

- Every year, the Minority Shareholder Watchdog Group would send questions to the management prior to the AGM. The management would then address them during the AGM. If you’re interested to view the four questions asked and addressed during the meeting, you can view them here.

Love these summary updates on companies? – Get the latest AGM updates from your favorite companies here.

We’ll done Rusmin! The chairman also mentioned that hartalega not only build up production capacity but also human capital in its NGC. I do feel that he is a man with vision.

Hey Lee,

Thanks for adding the point! I guess you were there at the meeting too. Yes, he is definitely a visionary. During a private conversation, his son was sharing with me that the NCG project was initially planned on a smaller scale, but chairman Kuan insisted on doing the project on a much larger scale and capacity.