3 easy ways I find new investment ideas fast

“Where do you get your ideas?”

This is a common question I often hear when someone approaches me about investing. Finding ideas is not always straightforward and it requires some level of effort and a knack for observing events and things around you. But if you’re willing to put in that bit of effort, I can guarantee that you will find many potentially profitable investment ideas through these three ways I’m going to share with you:

1. News

The most common way I find new ideas is through reading the newspaper or publications on investment/finance/business. You will be surprised at how many ideas you can find just by reading from news sources.

For the Singapore market, I read The Strait Times, The Business Times, and The Edge. For Malaysia, I usually just read the Malaysia edition of The Edge. For the Hong Kong and Thailand markets, I read South China Morning Post and Bangkok Post respectively.

Every time I read the news and I come across a company with a business model I find interesting, I download the annual report of the company to find out more about its business, management, financials and valuation.

2. Stock screener

The stock screener is one area I spend a bit of time with to find new ideas. I usually classify stocks into different categories like dividend, growth, and deep value. Different types of stocks require a unique set of screening ratios to find them.

For instance, if I want to screen for deep value stocks, I will usually screen for companies with a price-to-book ratio below 1.0 (because by definition, deep value stocks fall into this category), a low debt-to-equity ratio (to reduce risk), and consistent free cash flow (to confirm that the business model is still sustainable).

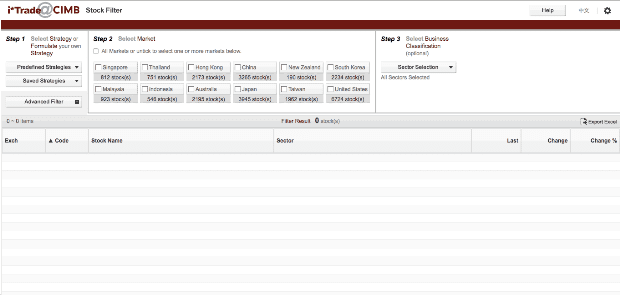

I have tested different screeners by several brokers and I personally find CIMB’s iTrade screener the best so far at screening fundamental data. It is user-friendly and provides fundamental data for 12 different markets as shown below. Just to clarify, I’m not recommending CIMB as a broker (nor am I paid to do this); I just find their screener the easiest to use for me.

3. Day-to-day observation

Investment ideas can be easily found in our everyday lives in the products/services we use every day. For instance, if you’re a guy, the razor you use every day is probably made by Gillette, which is owned by Procter & Gamble – one of the largest listed companies in the U.S.

Let me share another example based on my personal experience. Early this year, I went to Seoul, South Korea for a holiday with my girlfriend. As is usual, my girlfriend loves to visit Myeong Dong for shopping and I have (no choice) but to follow. As you can guess, throughout the entire shopping excursion, I was extremely bored.

However, I decided to put on my observation cap and survey the shops and businesses around the area. I observed that women liked to visit Myeong Dong to purchase cosmetics and I started to note which shops and brands were the most popular ones. After some time, I noticed that shoppers were always crowding into four shops: Innisfree, Etude House, Laneige and The Face Shop. I Googled to find out the companies that owned these cosmetic brands and, lo and behold, I discovered that three out of four of these brands were owned by one company listed on the Korean Exchange.

So, the next time you travel, shop, or buy groceries from the supermarket, etc., ask yourself if a listed company owns the product or service you use – it could be the source of your next profitable stock investment.