3 Things You Need to Evaluate in a Company Before You Even Look at its Stock Price

“It’s far better to buy a wonderful company at a fair price than a fair company at a wonderful price.” – Warren Buffett

We all know that finding a wonderful company to invest in isn’t always that easy to do. There are thousands and thousands of companies out there in the stock markets around the world (776 in our SGX alone), so how do we tell which companies are quality and which aren’t.

A high-quality company is one that will continue to be more successful and profitable in the long term and see a rise in its share price over the years (think Apple!). A low-quality company, on the other hand, will see its results and share price sink like the Titanic; taking your hard-earned money along to the. Worse still, some companies are so bad, they’re the facades of manipulative pump-and-dump schemes, swindling speculators and amateur investors out of millions of dollars.

So what can we as investors do to, as they say, separate the “wheat from the chaff” and invest in high-quality companies that will rise in value over time?

Here are 3 things you need to evaluate to determine if a company is high-quality:

#1 Business Model & Industry

Investing in a stock means you literally become a part-owner of a business, so naturally the first thing you want to do is to research and understand the company’s business model. A company with a superior business model is one that is able to fend off competitors, scale large, and generate outsized profits. A company that is able to fend off its competitors usually means that it has a strong competitive advantage – an economic moat. Some very good companies have more than one economic moat! Some examples of economic moats include regulations, switching costs, patents, cost efficiencies and network effects.

“In business, I look for economic castles protected by unbreachable moats.” – Warren Buffett

For example, SGX has an economic moat as the only licensed stock exchange in Singapore. If any company wants to go public or if any investor wants to trade Singapore stocks, they have to go through SGX. No two ways about it. Another example – Walmart has built its reputation and entire business model on providing the lowest prices for its customers. Because of its humongous economies of scale, Walmart can charge prices so low that many competitors cannot match. But low prices do not mean low revenues; Walmart’s revenue for 2015 is $485 billion.

Besides economic moats, a company should be able to grow and scale its business larger and larger. A company limited by its scale will see its profits and share price constrained. Wilmar is a company that has tremendous scale; it is already one of the largest palm oil producers in the world and the company is replicating its business model in the sugar industry as well.

The industry that a company operates in is crucial as well. Even a large, successful company in a dying industry might no longer around in years to come (remember Kodak?) On the other hand, a smaller company in a rapidly growing industry can ride on the industry’s tailwinds and grow by leaps and bounds. For example, Cordlife Group operates in the cord blood industry. Cord blood stem cells are currently used to treat blood and immune system related genetic diseases, cancers, and blood disorders. Cordlife Group’s revenue has grown by 28.8% per year on average over the last three years. Now that is fast growth!

Certain industries also require very high capital investments. For example, the airline industry is notorious for being one of the toughest industries to operate in. Customers are extremely price sensitive and airline companies require billions of dollars just to get off the ground and some more to maintain an ever-aging fleet of aircraft. Which explains why many carriers have very thin profit margins and some need to be supported by governments just to stay alive!

Which is probably why Richard Branson made this joke:

“If you want to be a millionaire, start with a billion dollars and launch a new airline.” – Richard Branson

But owning the airline maintenance company that airlines pay millions of dollars to every year is a different thing altogether.

#2 Management

Companies are run by people after all and the most successful companies are usually managed by the most skilled and competent leadership.

Before Steve Jobs returned to Apple in June 1997, the company was in the doldrums. It even required a bailout from its arch-competitor, Microsoft, to stave off bankruptcy that year. Apple survived and the rest, as they say, is history.

Steve Jobs revitalized the company and gave us the iMac, iPod, iTunes, iPhone, App Store and the iPad as Apple swept the tech industry (and the world) by storm. Apple’s $2.3 billion market cap in 1997 was dwarfed by Microsoft which was worth $164 billion at that time. Today Apple is the largest company in the world by market cap – $665 billion as of Nov 2015. (But I’m still writing this on a PC. Sorry Steve!)

While exceptional leadership can take a company to new heights, it is also a double-edge sword; what happens when the leader goes? Investors understandably had the same worry when Steve Jobs passed on the reins were handed over to Tim Cook. Cook has so far managed to steer Apple in the same direction and keep growth on track, but the world is still waiting for the “next big thing” from Apple the company so regularly used to fashion when Jobs was around. Can Apple continue to grow and hit a trillion dollars in market cap? Let’s wait and see…

Next, you also want to invest in a company where its management has its interests aligned with shareholders.

When we invest in a company, we are essentially entrusting our hard-earned money with a group of people (the company’s management) to grow the value of our investment for us. At the same time, this becomes an agency problem. The problem is sometimes management may make decisions that enrich themselves in the short term but harm the company in the long term. So how can we tell if management interests are aligned with shareholders’?

One way is to check if management is overpaid. Tim Cook is paid $65 million a year as the CEO of Apple. That might seem like a lot but if you compare his remuneration to Apple’s profits ($53 billion in 2015), it’s a drop in the ocean. Also Tim Cook’s remuneration is largely based on performance; of his $65 million payout, only $9.2 million was for salary. On the other hand, if management insists on paying themselves well when a company is doing poorly, that’s a huge red flag and a sign that they probably don’t have shareholders’ interests at heart.

Besides that, it’s important and very useful to attend a company’s annual general meeting. It’s the one place where you can evaluate the management directly and ask them the hard questions that need to be answered. It’s something that we do regularly ourselves when a stock is on our watchlist/portfolio so join us from time to time when you can!

#3 Financial Performance

As successful as a company might appear to be, the proof in the pudding lies in its long-term financial performance. A successful company is one that’s able to grow its revenue, cash flow and profits consistently over the years while keeping its costs low. Besides growth, you also want a company to be based on a firm footing – which means having a healthy balance sheet and low debt.

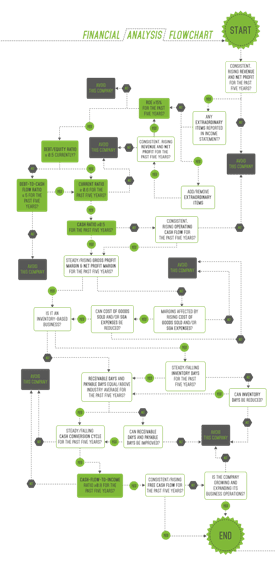

Now there are many financial metrics and ratios to consider when investing in a company — we actually cover 36 of them in The Investment Quadrant and use this financial analysis flow chart:

Source: The Investment Quadrant

But knowing these following basics will help you save time and filter the non-performing companies quickly before you decide to dig deeper into a company’s financial reports.

- Consistent or growing gross profit and net profit margins. A company that’s able to grow its revenues every year while maintaining/improving its margins reflects a company’s pricing power with consumers, a streamlined cost structure, and production efficiency. For example, Dutch Lady Malaysia is one such company that’s been growing its revenue and profit consistently over the last ten years while improving its margins! There is no hard and fast rule what margins should be; it varies from industry to industry. But compare a company’s margins with its industry averages to see how well they perform with their competitors. For example, Hartalega has profit margins nearly double its nearest competitor!

- Low debt to equity. The debt-to-equity ratio measures a company’s level of debt leverage. All things equal, investors generally prefer a company with low debt. Low debt means lower interest costs and less risk of a company facing insolvency if it is unable to meet its debt obligations. A company with high debt (like Noble Group) is a lot more risky. During the boom times, a company might easily generate enough cash flow to cover its interest payments but if a company’s cash flow falls during a recession and it is unable to finance its debt, it could go bankrupt. So look for a company with a debt-to-equity ratio below 0.5.

- High free cash flow. Free cash flow is the amount of cash a company generates after deducting capital expenditures from its operating cash flow. Free cash flow is the true amount of cash a company can generate. It can then use that cash to pay dividends, reduce its debt, execute share buybacks, etc. Obviously, the higher the free cash flow, the better. Warren Buffett himself uses free cash flow as a means of valuation:

“To value something, you simply have to take its free cash flows from now until kingdom come and then discount them back to the present using an appropriate discount rate. All cash is equal. You just need to evaluate a business’s economic characteristics.” – Warren Buffett

The Fifth’s Perspective

These 3 steps will give you a quick overview how to find a quality company. They will help to separate the wheat from the chaff so you can focus most of your time and research only on the companies that show the most promise. So always do your due diligence by understanding a company’s business model and industry, evaluating its management, and by examining the company’s financial performance over the last 5-10 years. Only once you’ve fully evaluated a company on these three aspects, do you then consider its stock price and valuation. Before that, it is moot.

So if you’ve always been the sort of investor who primarily picks a company based on its stock prices (yikes!), it might time you start looking at the underlying business behind that ticker symbol.