When we think of local F&B companies, we may find it hard to identify one that has achieved consistent success on an international scale. But the truth is, while many local companies choose to stay within our borders, there are many who are successfully established overseas as well.

We all know that Singapore’s domestic market is pretty small. For a company to really make it big, it has to look beyond our island for growth and expansion. As investors, we all prefer companies which are able to grow successfully beyond their local markets.

So in the case of the F&B industry, here are four local companies listed on the SGX that are doing (very) well outside of Singapore.

Super Group Limited (SGX: S10)

You might already be familiar with Super 3-in-1 coffee mix across supermarkets island-wide but Super doesn’t just have its ubiquitous coffee brand on every supermarket shelf here, it also distributes a whole range of consumer products (Super Cup instant noodle, Owl Coffee, NutreMill, etc.) and food ingredients across Asia.

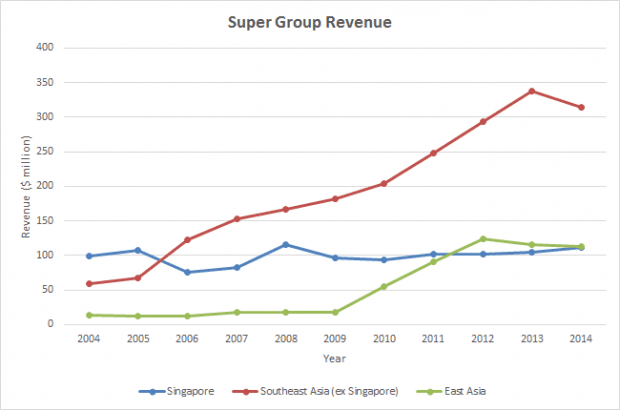

In fact, Super Group generates substantially more revenue in the rest of Southeast Asia than in its home market of Singapore. East Asia sales also overtook Singapore sales in 2014.

Compound annual growth rate (CAGR) is 20% for Southeast Asia and 26% for East Asia over the last 11 years.

Super.

QAF Limited (SGX: Q01)

QAF may not sound familiar to some of you but its brand Gardenia most certainly will! Gardenia bread has been a mainstay for many a sleepy-eyed student’s early morning breakfast for decades now. Besides bread, QAF also produces and distributes meat, dairy, seafood, and beverages around the region.

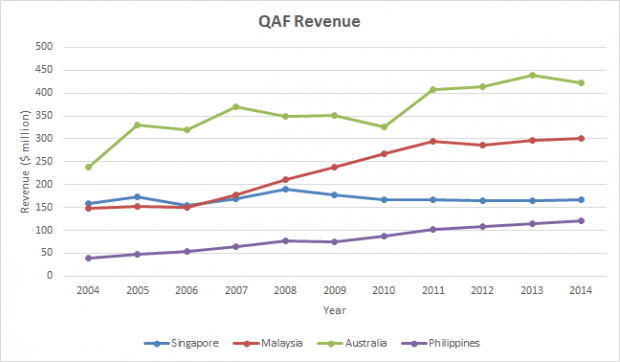

While Singapore growth has remained stagnant, its core foreign markets of Australia, Malaysia, and Philippines are all doing very well with CAGR over the last 11 years at 7%, 8%, and 13% respectively.

BreadTalk Group Limited (SGX: 5DA)

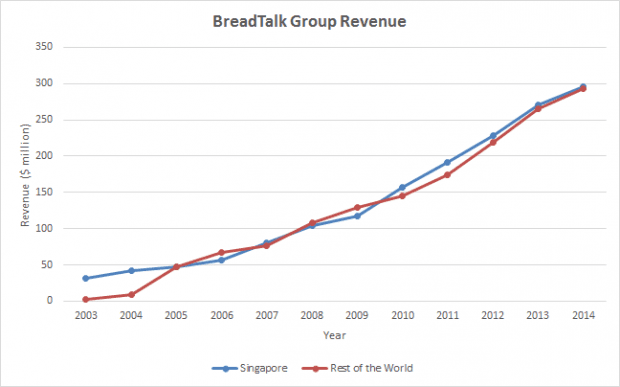

We’re all pretty familiar with this company by now. We’ve covered BreadTalk multiples times in that past – and with good reason too! Its growth has been on a tear over the last 12 years:

Founded in 2000 as a single bakery in Singapore, the company now operates in 17 countries and its brand portfolio includes BreadTalk, Toast Box, Food Republic, Din Tai Fung, The Icing Room, Bread Society, RamenPlay, etc. BreadTalk’s revenue from the rest of the world (including Hong Kong and China) has kept pace with Singapore’s and its CAGR over the last 12 years is 62%. BreadTalk is definitely not just all ‘all talk, no action’ only.

Petra Foods Limited (SGX: P34)

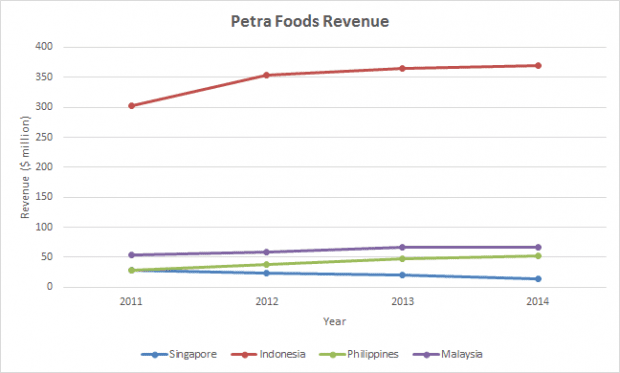

Petra Foods might not necessarily qualify as local (its roots are from Indonesia) but we’re going to sneak it in as well because it was first established and incorporated in Singapore and listed on SGX. Founded by the Chuang family from Indonesia, you might be more familiar with Petra Foods’ portfolio of chocolate and confectionary brands like Delfi, Top, and SilverQueen.

While revenue from Singapore has been falling the last few years, Indonesia, Philippines and Malaysia is still steadily growing. CAGR over the last four years is 11%, 38%, and 11% respectively. As you can see, the bulk of Petra Foods’ revenue still comes from Indonesia. We all love chocolate!

If you’d like to find out more about the F&B sector in Singapore, you can watch this presentation by Voyage Research on their take of the outlook of the industry and the potential risks and returns of investing in F&B stocks. You can also check out this playlist on Youtube that covers a recent seminar on the F&B sector organised by SGX.

Happy investing!

This article is written in collaboration with SGX. If you’d like to stay updated with the latest SGX news, you can like the SGX My Gateway Facebook page.