5 reasons why you should invest in dividend stocks

Here at The Fifth Person, we’re big on dividends – it’s a great way for many, many people to generate stable, passive income that will grow in time and allow them to retire financially free.

Granted, it’s not the only way to invest and we also employ other investment strategies (like value-growth investing) in our portfolio as well, but if what you’re seeking is a proven way to generate stable investment returns and high amounts of passive income, then dividend investing is the way to go.

If you’re still not convinced and you think dividend investing is too slow, boring, and can’t give you the best return on your investment, then let me give you 5 reasons why you should still invest in dividend stocks:

1. Dividend stocks also give the best capital gains

A lot of times, investors have the misperception that all dividend stocks have slow growth and generate very little capital gains. While this may be true for some dividend stocks, the best dividend stocks are also the best capital gainers:

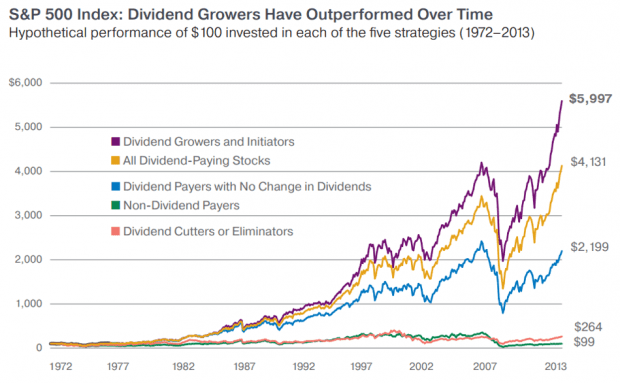

Source: Ned Davis Research

Ned Davis Research did a study on the S&P 500 from 1972-2013 and discovered that those stocks that grew their dividends over time also outperformed the rest of the index for capital growth. Every $100 invested in dividend growers grew to $5,997 compared to only $264 for non-dividend payers.

2. Dividend stocks have less risk

Besides providing exceptional capital gains, dividend growers also outperformed with less risk! In other words, you stand to earn a higher return while facing lower risk. You no longer have to subscribe to the idea that “higher risk equals higher return”.

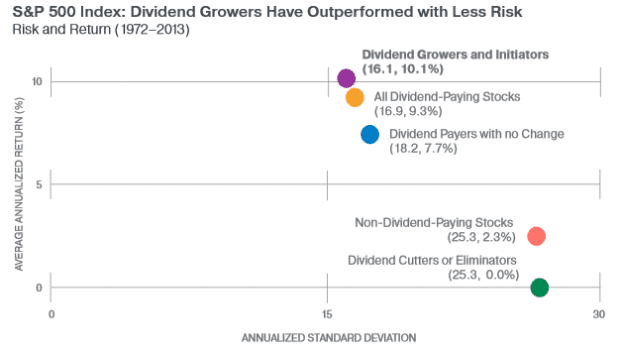

Source: Oppenheimer Funds (data from Ned Davis Research)

From the chart above, dividend growers again give the highest annualized returns (10.1%) while having the lowest standard deviation (16.1). A lower standard deviation means lower volatility and your returns are more stable.

So if you’re the sort that doesn’t enjoy the rollercoaster ride that is the stock market sometimes, dividend stocks are definitely your cup of tea.

[Pro Tip: Click Here for Our Quick 7-Step Guide to Picking the Best Dividend Stocks]

3. Receive stable passive income all the time

We’ve already proved that dividend growers can give the best returns while having the lowest risk and it’s easy to see why: regardless of how the stock market moves up or down, good dividend stocks will always pay you your dividends every single time. And the best ones will pay you a growing dividend.

So it doesn’t matter if Greece will or will not exit the Eurozone or if China’s stock market bubble burst, as long as you hold on to your stock, you can trust that you’ll receive you dividends on time every year like clockwork.

So if your financial needs require you to generate stable passive income from your investments regularly, then dividend stocks suit your needs extremely well.

4. Reinvesting your dividends gives you supercharged returns

It’s already awesome enough that dividend stocks give you great returns, lower risk, and stable passive income, but if you can afford to wait a bit and delay spending your dividends today, then reinvesting your dividends can supercharge your investment returns:

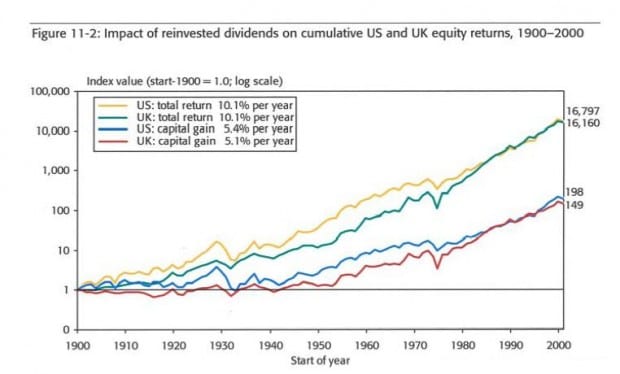

Source: Triumph of the Optimists, Elroy Dimson, Paul Marsh and Mike Stanton, Princeton University Press, 2002, p. 145

From the chart above, investing in the U.S. index for capital gains alone will multiply your returns 198-fold – impressive enough. But if you reinvested your dividends, your total gain would be 16,797 – a return 8,400% higher! Incredible.

Investors always talk about the power of compound interest and in this case, the effect is drastically obvious if you just follow the simple rule of reinvesting your dividends today.

5. Invest in the best companies in the world

Finally, investing in stocks that pay you stable and growing dividends year after year also means you’re investing in some of the very best companies in the world.

Why is this so?

The logic is simple. If a company can consistently pay you a growing dividend year after year, it means the company is also able to generate higher revenue, higher profit and, most importantly, higher cash flow to sustain its dividend growth. And only the best companies in the world with the most successful business models can do that every single year.

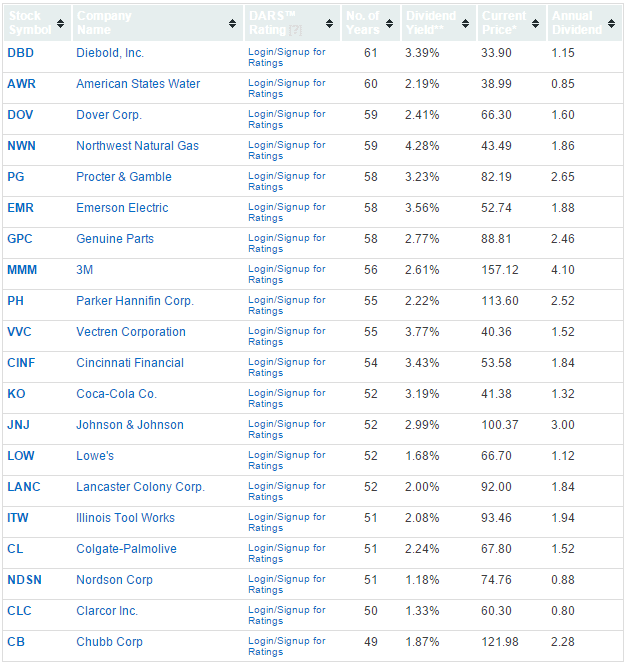

Take a look at the list of dividend stocks that have increased their dividend every year for at least the last 25 years:

Source: Dividend.com

On this list you can see some of best and most successful companies in the world today like Procter & Gamble, 3M, Coca-Cola, Johnson & Johnson, and Colgate-Palmolive. It’s no wonder that these ultra-successful companies have been able to increase their dividends year after year for more than 25 years; in fact, the top company on this list, Diebold, Inc., has increased its dividends every year for 61 years straight. Amazing.

[Pro Tip: A Step-By-Step Business Model Analysis of a Great Dividend-Paying Company]

The fifth perspective

As you can see, dividend stocks are awesome investments – they offer high returns, lower risk, stable passive income, and you can sleep soundly at night knowing that your money is parked with some of the strongest and most resilient companies in the world.

At the same time, we don’t recommend you buy a stock simply because it pays you a high dividend – that’s the most common mistake amateur income investors make. There’s a LOT more analysis to be done before you can identify a good dividend stock that’s not just able to pay you a high dividend but also sustainable and growing dividends many years (or decades) down the road.

That’s why in Dividend Machines we use a stringent 8-step investment process to screen and identify the best dividend stocks out there in the market. Because if a stock passes ALL eight steps, we know we have a winning dividend stock right in our hands.

So if being a successful income investor and receiving passive streams of growing dividend income sounds like your cup of tea, then isn’t high time you got started right away?

Hi Adam,

thanks for your knowledge and insights into dividend stocks. What is your experience in the local context (Malaysia) as the top dividend payers aren’t listed on Bursa.

Hi Julian,

There are actually some great dividend stocks listed in Malaysia. For example, Nestlé Malaysia — https://fifthperson.com/7-reasons-why-nestle-malaysia-is-on-my-dividend-watchlist/

Even then, you don’t have to limit yourself to Bursa, you can always invest in foreign markets like Singapore or Hong Kong and earn both dividends and potential forex gains (if the ringgit continues to weaken in the long run).

Hi Adam,

Is there any platform you’d recommend for trading Singapore/ Hong Kong stocks for Malaysian?

Hi Lee,

If you’re looking at Singapore/HK stocks specifically, then I would go with iFast as they offer the lowest rates among Singapore brokerages for both these markets:

https://secure.fundsupermart.com/fsm/new-to-fsm/pricing-structure

Great article! However, dividends on these US stocks are charged a 30% Witholding Tax before being paid to Non-US Residents. That is a lot of money being taxed simply on the dividends. What would you suggest would be an alternative for Singaporeans seeking to invest in US dividend stocks for stable income without such high fees?

Thanks Max!

I prefer to invest in Singapore and Hong Kong as dividends are tax free in those two markets.

The U.S. is much better for growth stocks seeing the size of the economy and runway for potential growth. Not to mention that some of most innovative tech companies in the last 20-30 years have come from there (e.g. Apple, Google, Facebook, etc.)

Hi Adam,

Few questions:

1. what is the percentage of dividend stocks one should have generally speaking?

2. If dividends are to be reinvested, when should the dividends be used as passive income eventually?

3. To reinvest dividends, dividends payout should be about 1% of trading fee? Meaning to say if trading fee is $25 and annual dividend yield is 5%, I need to have at least 50k worth of stock value to be able to reinvest the dividends yearly?

Thanks!

Hi Eli,

1. There is no hard and fast rule; it really depends on your investment goals and financial needs.

2. Again, this really goes back to your your investment goals and financial needs. If you can afford to hold off spending your dividends, then reinvesting would earn you more in the long run.

3. You don’t have to reinvest your dividends every year. I would accumulate my dividends and only reinvest them when an opportunity presents itself. So wait until you accumulate $2,500 or more — and you can also inject more capital along the way — and only invest when the time is right.

Hi Adam,

I am a 22 years old singaporean and at the moment i am only able to set aside a maximum amount of $1000 to invest. Having read about the dividend stocks investments, it is something that i am interested in. However i am very new to investing so i was hoping you could give some guidance on how and where i could get started in buying dividend stocks. And is $1000 even enough?

Hi Jayce,

I’d suggest reading and learning more about investing in general, and then about dividend investing at the start. These resources will be useful for you:

https://fifthperson.com/saving-just-11-day-can-make-millionaire/

https://fifthperson.com/2-financial-parachutes-ready-invest/

https://fifthperson.com/the-rule-of-300-how-much-you-need-for-retirement/

https://fifthperson.com/how-much-money-do-you-need-to-start-investing/

https://fifthperson.com/here-are-the-top-5-stock-investment-styles-find-out-which-one-works-best-for-you/

In the meantime, you can always save up your money while you gain more knowledge and skills about investing. When you’re ready, you can open a brokerage account:

https://fifthperson.com/how-to-open-a-brokerage-account-in-singapore/

A thousand is enough to start but you’d probably only be able to buy one stock and can’t diversify (unless you go with an index ETF).