5 things you need to know before investing in crowdfunding

The crowdfunding scene has undoubtedly sparked a high level of interest among investors.

Globally the industry is predicted to reach $34.4 billion by end of 2015, largely due to the strong rise of Asia as a major crowdfunding region.Singapore as the region’s financial hub, is also gaining fast traction in the industry.

The little red dot saw several new entrants to the crowdfunding scene this year, including the Singapore Exchange (SGX) and Clearbridge Accelerator, which in January unveiled a partnership to launch an equity-based platform, Sniffr.sg, a crowdfunding site for design entrepreneurs.

Even telcos like StarHub has joined the bandwagon with the launch of Crowdtivate.

Generally speaking, crowdfunding is the practice of funding a project or venture by pooling together money from a large number of people, usually via an internet platform. In the crowdfunding space, there are 4 ways of raising funds that are categorised by the type of returns for investors:

1. Equity-based crowdfunding

(Buying a small stake of shares into a company with promised growth)

2. Reward-based crowdfunding

(Access to the finished product which may not be for sale for mass-market)

3. Debt-based crowdfunding

(Lending money to enterprises and getting a monetary payment for it)

4. Real esatate -based crowdfunding

While such services are welcomed for the hot startup scene in the region, investors are also starting to get interested in the potential returns provided by such platforms.

For instance, it is not uncommon for crowdfunding platforms to market their services as a way for investors to gain some 20% returns by lending money to new enterprises. It sure does sound like a sweet deal for risk-taking investors. Or is it?

Take for instance debt-based crowdfunding, which is increasingly getting interest in Singapore.

And their success is not surprising since the benefits are both ways: for lenders, the amount of money they put up is low (minimum sum of $1,000) and they are paid a relatively high interest rate for the risk they take on.

For businesses, they get to bypass the often-stringent lending criteria of banks, cutting costly application costs and lengthy paperwork.

Before deciding to invest in these new ventures, it might be worth one’s time to delve into the nuances of how it works before jumping on the bandwagon.

Before you are enticed by the high returns of investing in crowdfunding platforms, it’s essential to keep the following points in mind.

1. Interest Rates – What You See May Not Be What You Get

Debt-crowdfunding is essentially a loan, so potential returns are definitely high on the priority list. There are lots of deals in the crowdfunding space that are baiting high interest like 20% p.a for investors.

Most retail investors are really not sure how these published rates translate to real returns.

Interest rates can be:

– Amortised

– Simple interest

– Effective interest

Amortised interest – Amortising a loan means establishing a series of equal monthly payments that will provide the lender with interest based on each month’s unpaid principal balance.

While each monthly payment is identical, the interest component of each payment will be decreasing and the principal component of each payment will be increasing during the life of the loan.

This is important because on most debt-crowdfunding websites, they show an annualised return interest rate which can differ vastly from the rate of returns you get after amortization.

For example:

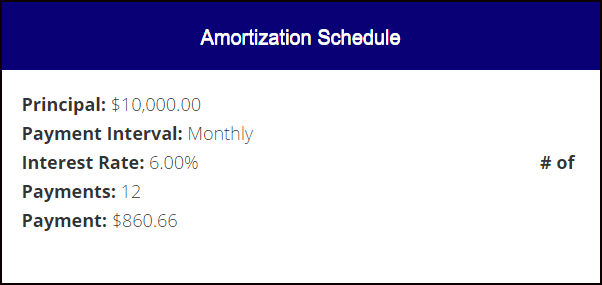

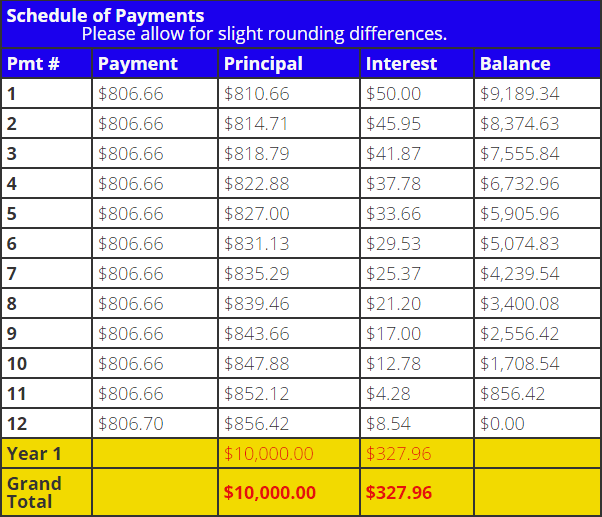

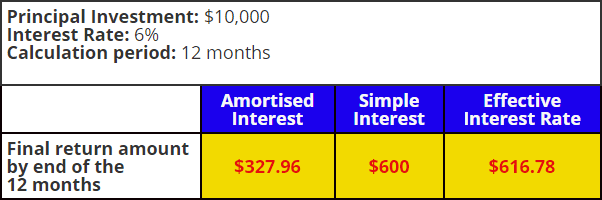

Danny decides to put up $10,000 to invest in debt-crowdfunding for 3 months and expects an annual 6% returns from his investments. This is how the amortization schedule could look like:

At the end of the period, Danny earned a total of $327.96 of interest payments – total interest earned as a percentage of principal is just 3.28%, way off the advertised annual returns of 10%.

This is because as the loan is amortised over the period, less interest is earned as more principal is paid back.

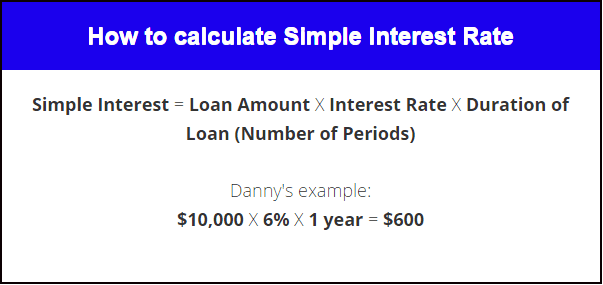

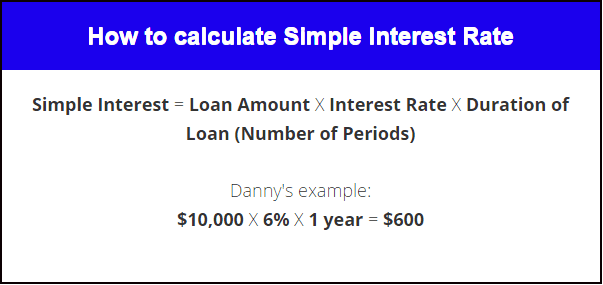

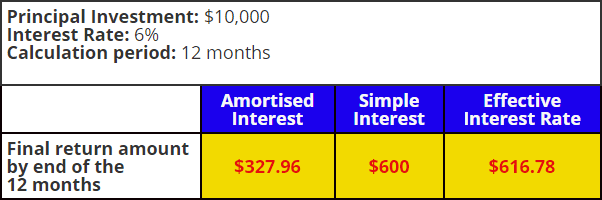

Simple interest – Simple interest is determined by loan amount * Interest rate * duration of loan(using number of periods). The interest charge is based on the original principal and ignores the effect of compounding.

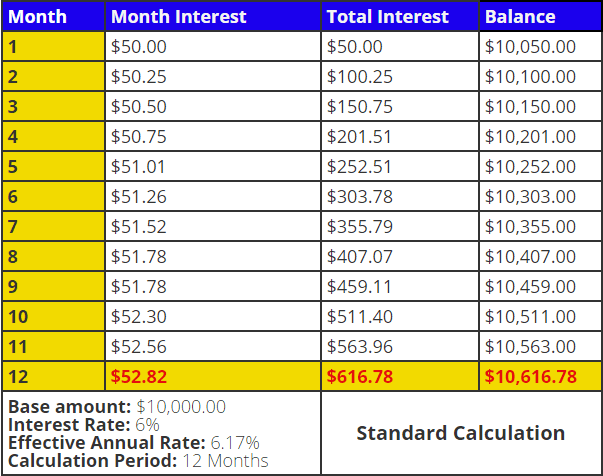

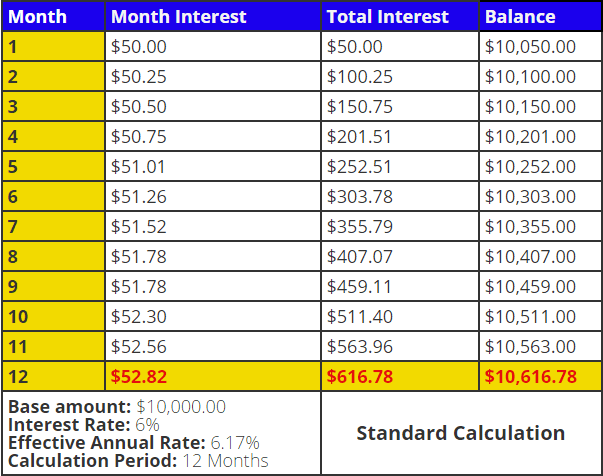

Effective Interest rate – in contrast to simple interest, the effective rate is calculated as compounded annually/monthly.

Compound interest means that the interest you earn each period is added to your principal, so that the balance grows at an increasing rate.

For instance, a nominal interest rate of 6% calculated on monthly compound equates to an effective interest rate of 6.17% p.a.

Here’s a brief summary of what 6% returns mean based on the different types of interest rates:

2. “Personal Guarantee” Isn’t A Big Deal

Some debt-based crowdfunding platforms offer companies with personal guarantee. As these debts are mostly unsecured loans, personal guarantees from the company directors are provided as a way to increase confidence levels in investors.

This may work to make lenders slightly more comfortable, but financially-savvy individuals would know that “Personal Guarantee” might not carry much weight in that individuals can still go bankrupt.

In other words, “Personal Guarantee” doesn’t stop the company’s owner from declaring bankruptcy, with all the crowdfunded cash parked under other people’s names.

This means that deals can turn sour, with investors losing their entire capital.

3. Understanding The Value Of Collateral’s

Most deals on debt-crowdfunding platforms are unsecured loans. Think about it, if these enterprises wanted secured loans, they could have turned to banks instead.

For investors, this means that there is nothing much you can do if the company ends up in default. There are some deals that provide collateral’s, but investors must understand the value of them.

Remember, the main reason for the high promised interest payments is due to the risk such loans hold. As with any other investments, do check the credit rating provided(if any) on the company before you decide if the returns are worth the risk.

4. Has The Company Tried Borrowing From A Bank Before?

The banks must have good reasons for choosing not to finance the company. Find out what that is, and decide if you are comfortable with it. Lending platforms usually provide a way for you to ask questions directly to the borrowers so make use of that to clarify any doubts.

Having said that, recognise that banks have a stringent lending criteria for business loans. The key reason why fast-growing enterprises look to such platforms for financing is because they don’t pass the banks’ stringent criterias.

As an investor, it is therefore crucial to find out the risk of every company’s funding opportunity before putting your money down.

5. What Are Your Risks?

The main risk of debt-crowdfunding for investors is a default by the company. You stand to lose the entire sum of money you have lent, and this excludes the opportunity cost of lost interest.

On the part of the lending platforms, they will employ a debt collection agency to attempt collection of debt from the borrowers but if the process is unsuccessful, lenders will need to start the legal action against the borrowers on their own, with lenders bearing the cost.

So what should one do? Other than carrying out the necessary due diligence on the companies’ credit ratings and business model, you should also find out how the new funds will be used.

Are they used to finance new projects or grow existing business? If it’s the former, do you have any information on what the project involves?

If the funds are used to expand existing business, can they provide evidence of signed purchase orders/invoices?

While the crowd lending platform has given investors access to a potentially high yield returns on a risk adjusted investment, the investors needs to know what they are getting into, the risk they are getting exposed to, as well as the terms and conditions that comes along with the investment to eventually make a sound investment.

This article first appeared on New Union.

This is a great assessment. I have always tried to warn others about the risk crowdfunding brings. At the same time it brings a fresh breathe of opportunity. It will be interesting to see how Equity crowdfunding pans out.

I really enjoyed this article. Please consider doing one on crowdspeaking which is a newer industry very similar to crowdfunding.

Thanks Yuz! Glad you enjoyed the article!