How do you become a millionaire in Malaysia — effortlessly?

As the saying goes, many roads lead to Rome. Recently, I learned another way to make a million but this time around, it is rather passive and effortless. However, there is only one catch: You need to find someone like Teh Hong Piew and invest your money with him (or her) for the long haul.

Teh is the founder and chairman of Public Bank Berhad. If you bought a thousand shares of Public Bank in 1967 and subscribed to all its rights issuances, the value of your shares would be worth RM2.9 million by end 2016. If we include all dividends received, the total value of your investment is worth RM4.1 million!

When the CEO of Public Bank, Tan Sri Dato’ Sri Tay Ah Lek, announced this “little” fact, a large round of applause went round the annual meeting. Many shareholders were clearly impressed with the terrific results.

I often hear all sort of praises for Public Bank from my Malaysian friends but I only recently learned that Public Bank has compounded its shareholders’ wealth by 19% annually over 49 years! It is certainly a stock that many of us wished we had earlier in our portfolio. An old lady in her late 60s was telling me how much money she made from Public Bank. She told me she’s a customer of Public Bank and invested her money in the company at RM2+ a share many years ago. Today, Public Bank is trading at RM20 a share. That’s almost a ten-bagger, not including dividends.

The old lady was also kind enough to give me a piece of advice: “Young man, you must buy Public Bank shares — but you must hold it long term because it will go up and up.”

Obviously, you should not invest in a stock just because someone says so and I instinctively asked her why she thinks that way. She explained to me that Public Bank is the best bank in Malaysia and many of its competitors also admire them. As the meeting progressed, I gained a better understanding of Public Bank and slowly started to see the old lady’s point of view

Here are nine things I learned from Public Bank’s annual general meeting:

- Tan Sri Dato’ Seri Dr. Teh Hong Piow founded Public Bank in 1966 and has been widely credited for the success of Public Bank. Today, the company is the second largest bank in Malaysia with a market cap of RM77 billion (as at 31 March 2017) and is the third largest company on Bursa Malaysia. During the meeting, I was surprised that he did not answer any questions from shareholders. But after I discovered his age (he is 86 years old!), just like Charlie Munger (93 years old) and Warren Buffett (87 years old), I could see his deep commitment towards the company he founded and he is still tirelessly serving the board as chairman despite his age.

- Minority Shareholder Watchdog Group (MSWG) of Malaysia highlighted that the average age of Public Bank’s board is 71.5 years. The CEO answered that succession planning is always an on-going process and they will continue to look for suitable candidates to take over retiring directors. Over the past six months, three new directors have already been appointed to the board.

- Despite the challenging year, Public Bank managed to grow its full-year net profit to RM5.2 billion from RM5 billion in 2015. Despite the growth, ROE has been declining from 24% in 2012 to 16.5% in 2016. The decline is mainly due to higher capital retention over the years and an enlarged capital base from the rights issuance in 2014 due to a need for higher capital requirements. According to the CEO, it is an industry trend that can be seen at other banking institutions in Malaysia. Nevertheless, Public Bank’s ROE is still the highest among its peers and the management said they will continue to work hard to improve this ratio.

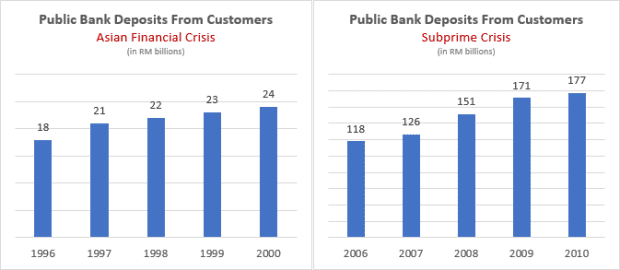

- Since its founding 1966, Public Bank has grown its customer deposits to RM310 billion. During the Deep Value Detector workshop, I learned from Tay Jun Hao that investors lose money when the bank suffers a bank run. With that, I did a quick check on Public Bank’s historical deposit base during major financial crisis like the subprime crisis in 2008/09 and the Asian Financial Crisis in 1997/98. Surprisingly, Public Bank has been able to grow its customer deposits even during crises.

- Public Bank is the only one of two banks globally that has been able to keep their cost-to-income ratio at 32% for many years. To put things into perspective, the three Singaporean Banks – UOB, OCBC and DBS – have their cost-to-income ratios above 40%. This explains why many of its peers admire Public Bank which has become the benchmark of many financial institutions around the world. In fact, the chairman believes that banking does not always need great people but rather ordinary people doing great things together.

- Public Bank is very stringent when it comes to lending money. This can be seen from a consistent gross impaired loan ratio of only 0.5%. Comparatively, Public Bank’s peers have a higher gross impaired loan ratio of 0.8% to as high as 3%. Such losses can often eat into profitability and hurt investors’ returns. The CEO shared that Public Bank has a prudent lending policy in place to keep the ratio low.

- Despite its stringent loan criteria, Public Bank’s market share in terms of loan financing and deposits from customers is 17.7% and 16.7% respectively. Simply said, RM167 of every RM1,000 deposited in Malaysia goes to Public Bank and RM177 of every RM1,000 loaned out comes from Public Bank. Moving forward, the CEO expects Public Bank’s loans to grow between 6% and 7% while its deposit from customers to grow between 5% to 6%.

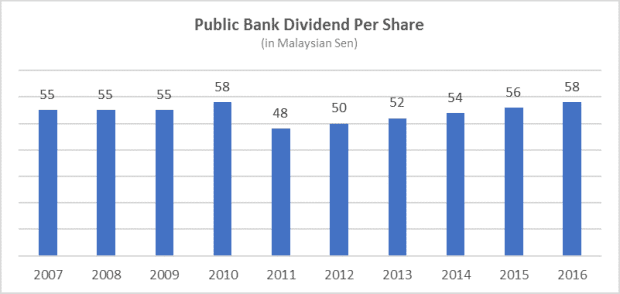

- Although there is no formal dividend policy, the board has been rewarding shareholders with a consistent dividend even during challenging times. I dug further into Public Bank’s historical dividend track record and was impressed with what I found. At the time of writing this article, the dividend yield of Public Bank is around 2.9%.

One shareholder, however, was not exactly pleased with the dividends as he noticed that the dividend payout ratio had been declining. Mr Singh who’s been invested in the company for the past 17 years voiced his unhappiness: “Do you know, for the last five years, your dividend payout has been going down from 49% (2012) to 42% (2016). You are on the downtrend. Your reserve is going up. Your directors’ fee is going up but you are returning less money relative to your earnings. It’s about time to return higher dividends.” As he continued whining about other operational matters, the CEO quickly intervened and politely asked him to let other shareholders have the chance to ask their questions. The CEO then explained that it is important for the bank to retain some its earnings due to the higher compliance costs and capital requirements needed to run a bank.

- Public Bank has been actively growing its footprint beyond Malaysia where it already has 259 branches. Today, the bank has a presence in countries like Hong Kong (82 branches), China (4 branches), Cambodia (30 branches), Vietnam (7 branches), Laos (4 branches), and Sri Lanka (3 branches). The CEO revealed that Public Bank will open six new bank branches in Vietnam this year and is confident that the country will contribute positively to the company’s bottom-line over the mid to long term. Overall, the management expects the growth of Public Bank to be moderate moving forward.

Liked our analysis of this AGM? Click here to view a complete list of AGMs we’ve attended »

Ive been a small investor in PB and have been holding the shares since CLOB days. I think u need to highlight the drop in value of the MR against the Sing$ which has eroded the gains.

Hi B Singh,

Good point. For overseas investors, they may see lower returns over the past three years due to the ringgit depreciating against the major currencies. So they have to take this into account in the calculation of their return.