Bursa Malaysia Berhad (Bursa: 1818) is the official bourse of Malaysia. Listed in 2005, it offers a wide range of exchange-related services. They include listing, trading, clearing, settlement, and depository services mainly for the local securities and the derivatives market.

As I write, Bursa Malaysia is worth around RM5.3 billion in market capitalization and is among the largest bourses in Southeast Asia. In this article, I’ll bring a detailed account of Bursa Malaysia’s success and achievements thus far and its outlook towards the near future. Here are nine things you need to know about Bursa Malaysia before you invest.

1. The securities market is the main income contributor to Bursa Malaysia. It accounted for 73.0% of Bursa Malaysia’s group revenues in 2016. This division operates the Malaysian stock market which houses 904 public-listed companies worth over RM1.6 trillion in total market capitalization. Revenue from the securities division declined substantially in 2008 due to lower trading activities as a result of the Global Financial Crisis. Since then, Bursa Malaysia has achieved a CAGR of 5.44% in revenue for the securities division over the last eight years, increasing from RM226.0 million in 2008 to RM345.3 million in 2016.

Source: Bursa Malaysia annual reports

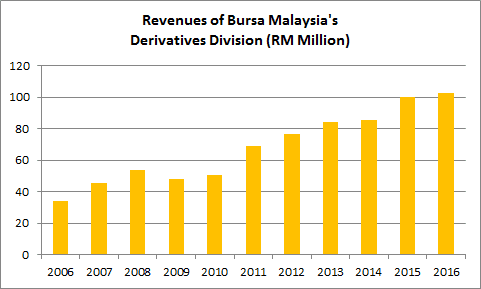

2. The derivatives market is the second largest income contributor to Bursa Malaysia. It accounted for 21.8% of Bursa Malaysia’s group revenues in 2016. This division offers three categories of derivatives. They include commodity derivatives, equity derivatives, and financial derivatives. At present, Bursa Malaysia is recognized as the market leader of crude palm oil (CPO) contracts as these contracts are used as a global benchmark for CPO settlement prices. The derivatives division has achieved a CAGR of 11.73% in revenues over the last 10 years, from RM33.9 million in 2006 to RM102.9 million in 2016. Thus, it is the main driver of growth for Bursa Malaysia.

Source: Bursa Malaysia annual reports

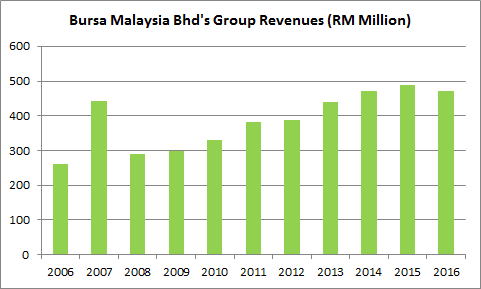

3. Overall, Bursa Malaysia has achieved a CAGR of 6.28% in group revenues over the past eight years, from RM290.3 million in 2008 to RM472.7 million in 2016. This was directly contributed by revenue growth from its securities and derivatives divisions during this period.

Source: Bursa Malaysia annual reports

4. Bursa Malaysia reduced its cost-to-income ratio over the years, from 56.1% in 2008 to 46.6% in 2016. Staff costs remains the largest expense for Bursa Malaysia, growing at a CAGR of 5.19% over the last eight years which is slightly lower than the growth in revenues during the period. As such, Bursa Malaysia was able to maintain its net profit margin at 30%-40% over the last eight years.

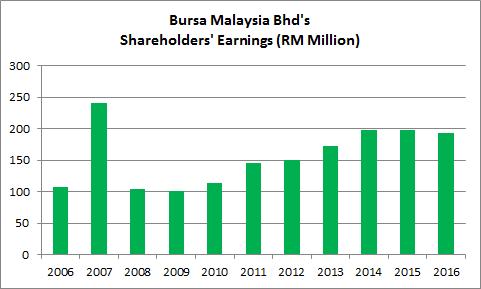

5. Since the crisis in 2008, Bursa Malaysia has achieved a CAGR of 8.02% in shareholders’ earnings over the last eight years, from RM104.4 million in 2008 to RM193.6 million in 2016. This was contributed by growth in revenues and a stable cost-to-income ratio during the period. Bursa Malaysia has a 10-year return on equity (ROE) average of 19.98%. (Here’s why we like companies with consistently high ROE.)

Source: Bursa Malaysia annual reports

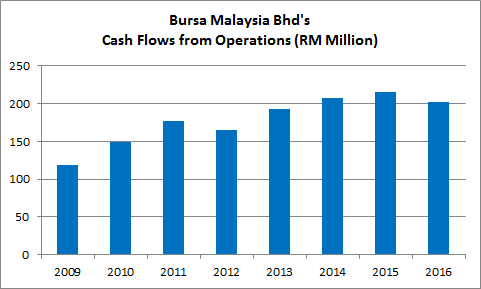

6. Bursa Malaysia has generated RM1.43 billion in cash flows from operations over the last eight years. Out of which, it has spent RM165.1 million in capital expenditures and RM1.35 billion in dividend payments to shareholders. This means, Bursa Malaysia is in itself a cash-producing business and doesn’t need to continually raise equity or debt to expand its business or reward its shareholders with dividends. As at 30 June 2017, Bursa Malaysia has RM230.3 million in cash reserves, a current ratio of 1.28, and a debt-to-equity ratio of 0.04.

Source: Bursa Malaysia annual reports

7. Bursa Malaysia has maintained a dividend payout ratio of above 90% in over the last 5 years. Bursa Malaysia paid out special dividends of 20 sen per share in 2013 and 2014; two years which exceeded 100% for its dividend payout ratio. As at 16 November 2017, Bursa Malaysia’s share price is trading at RM9.86 a share. It paid RM0.34 in dividend per share for financial year 2016. If Bursa Malaysia is able to maintain its dividend, its expected dividend yield is 3.44%.

| (Figures in Malaysian sen) | 2012 | 2013 | 2014 | 2015 | 2016 |

|---|---|---|---|---|---|

| Interim dividend per share | 13.5 | 16.0 | 16.0 | 16.5 | 17.0 |

| Final dividend per share | 13.5 | 16.0 | 18.0 | 18.5 | 17.0 |

| Special dividend per share | 0.0 | 20.0 | 20.0 | 0.0 | 0.0 |

| Total dividend per share | 27.0 | 52.0 | 54.0 | 34.5 | 34.0 |

| Dividend payout ratio (excluding special dividends) | 94.8% | 98.5% | 91.5% | 92.9% | 94.2% |

| Dividend payout ratio (including special dividends) | 94.8% | 160.0% | 145.2% | 92.9% | 94.2% |

Source: Bursa Malaysia annual reports

8. At present, Bursa Malaysia has revealed several potential risks involved and discussed initiatives to mitigate the impact on its business performance. They are:

- Bursa Malaysia’s operations are highly dependent on market activity. This includes the number of listed issuers, new listings, the volume of trading activities, and the value of securities and derivatives traded in the market. The level of market activity is influenced by numerous factors such as geopolitical, economic and regulatory developments, market stability, and competition from other bourses. These risks are beyond the control of Bursa Malaysia.

- Bursa Malaysia is heavily dependent on technology. Cybersecurity is a concern. Failure in technology and IT systems may result in interruptions which in turn will jeopardise Bursa Malaysia’s reputation and credibility among the investment community. As such, the management attempts to mitigate these risks by enhancing staff training, maintenance of protective systems, stress testing, and regular reviews of contingency plans.

- There is intense competition among bourses in Southeast Asia. For instance, Malaysians may invest in Singapore-based stocks and vice versa. As such, it takes more effort to maintain the attractiveness of the local stock market among local investors. Nevertheless, this challenges all major bourses, including Bursa Malaysia, to grow regionally as the ASEAN community becomes more connected than ever.

9. Looking ahead, Bursa Malaysia intends to continue its efforts to become “ASEAN’s Multinational Marketplace”. To name a few initiatives:

- In 2016, Bursa Malaysia launched Bursa Malaysia-i. It is the first end-to-end Shariah-compliant investing platform in the world. This platform supports a variety of Shariah-compliant products such as Shariah-compliant stocks, Islamic indices, Islamic REITs, trading on exchange traded bonds and sukuk (ETBS). Thus, Bursa Malaysia intends to enhance volume and value of Shariah-compliant securities and further differentiate itself as a key Islamic capital markets hub in Southeast Asia and beyond.

- Bursa Malaysia has deepened its collaboration with China. For instance, in November 2016, Bursa Malaysia signed an agreement of cooperation with Dalian Commodity Exchange to continue to jointly organise the China International Oils and Oilseeds Conference. This is an effort to enhance the development of the oils and oilseeds futures market in the world. In addition, in the first half of 2017, Bursa Malaysia signed a memorandum of understanding with the Shanghai Stock Exchange to allow both exchanges to explore potential ways to improve visibility and accessibility to market participants in both Malaysia and China. This initiative is to enhance Bursa Malaysia’s status as a preferred gateway for investments in Southeast Asia.

- In 2016, Bursa Malaysia facilitated more traded alternatives. For instance, it facilitated the listing of call and put warrants for the S&P 500 index, launched the enhanced 3-year, 5-year, and 10-year Malaysian Government Securities (MGS) futures contracts, and launched the U.S. dollar-denominated tin futures contracts. These initiatives are intended to attract both investors and hedgers to invest and trade with Bursa Malaysia.

The fifth perspective

In summary, Bursa Malaysia has built a track record of high ROE and consistent dividend payouts to shareholders. In the first half of 2017, Bursa Malaysia benefitted from higher trading activities in both the securities and the derivatives market. This in turn boosted Bursa Malaysia’s shareholders’ earnings to RM116.2 million in 1H 2017, up 16.9% from RM99.4 Million in 1H 2016. With its healthy balance sheet, Bursa Malaysia is also able to carry out its initiatives to enhance market participation among Malaysians and to capitalize on the continuous growth in ASEAN.