Annual Returns of Asset Classes Over the Last 20 Years

As we know, there are multiple asset classes you can invest in for your portfolio, but which asset class gives you the best returns?

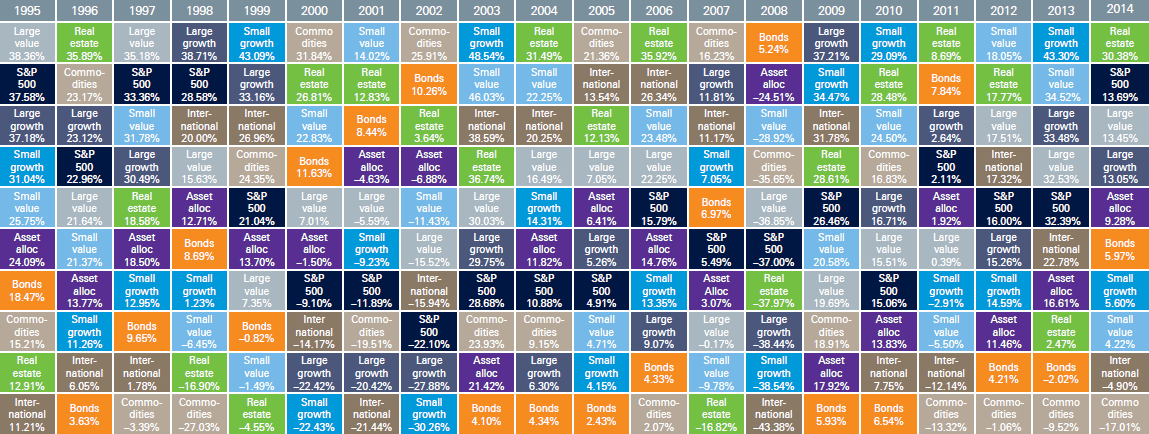

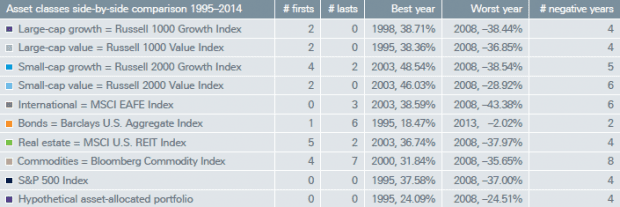

Deutsche Asset & Wealth Management did some research on the U.S. markets and ranked the annual returns for key indices– which represent the various asset classes — from 1995 to 2014 and these are the results (click below to enlarge):

Source: Deutsche Asset & Wealth Management

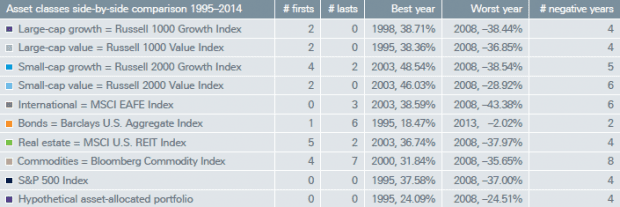

The key indices used for this report:

So what does the research tell you?

- As you can see, no asset class stays on top (or at the bottom) for long. Certain asset classes do well in certain years and not so well in other years.

- Equity gave the highest annual returns 10 out of 20 years in the study, which goes to show you that stocks, in general, still give you the best asset growth.

- Real estate (represented by the MSCI U.S. REIT index) also performed well, topping the list for 5 out of 20 years and was top three for 11 years.

- Commodities can be extremely volatile. They gave the highest annual returns for 4 out of the 20 years but also the lowest returns for 7 years.

- Bonds don’t give high overall returns but are very stable investments. The asset class only had 2 negative years out of 20. They did the best in 2008 when stock markets were crashing everywhere during the Great Recession.

- The S&P 500 gives solid overall returns. The index was negative for only 4 years — during the dotcom bust and the 2008 recession.

- In the study, a hypothetical asset-allocated portfolio of 40% bonds, 15% large-cap growth stocks, 15% large-cap value stocks, 10% international stocks, 5% small-cap value stocks, 5% small-cap growth stocks, 5% real estate investment trusts (REITs) and 5% commodities helped to diversify risk and reduce volatility.

As you can see, it is important to diversify your overall investment portfolio into various asset classes as no one asset class performs every single year. Of course, how you allocate your assets depends on your individual investment goals, risk appetite, time horizon, etc. And as the saying goes: Don’t put all your eggs in one basket!