Auric Pacific Group Limited (APGL) (SGX: A23) came to our attention recently when our editor-in-chief, Adam Wong, was trawling company announcements on the SGX. (I know… he has no life.)

He noticed a number of insider trades in APGL – particularly by one executive director, Dr Andy Adhiwana. Executive director Dr Andy Adhiwana has been acquiring shares of APGL from September 2015 till date. He has purchased a total of 3.2 million shares at a total value of $2.3 million so far. The average purchase price is $0.72 per share. In the process, he has increased his ownership from 21.88% to 24.46%. Adam shared the news with me and I decided to find out more about the company to see if there was any potential investment opportunity brewing.

So let me give you a brief background on APGL’s business.

APGL’s operations spread across Singapore, Malaysia, Indonesia, Hong Kong and China. They have three business segments:

- Distribution & Marketing. This business segment markets and distributes global consumer brands and APGL’s house brands in Singapore and Malaysia. Some consumer brands you might be familiar with include Kraft, Kellogg’s, Pringles, Post, Anlene, Heinz, Abbott, Planters, Oreo, Ovaltine and many more.

- Food Manufacturing. This business segment includes Sunshine Bakeries which has over 80 years of history and is one of Singapore’s largest bread manufacturers, and Délifrance which manufactures a range of frozen breads, danishes, pastries and savouries segment for hotels, restaurants, airline carriers and ship chandlers. In Malaysia, Auric Pacific Food Processing manufactures Buttercup’s range of chilled and ambient butterblend products.

- Food Retail. This business segment includes food retail outlets like Délifrance, 1Market, MEDZ, Alfafa, Food Junction, Toast Junction and Lippo Chiuchow Restaurant.

With that, let’s move on to four important things you need to know about Auric Pacific Group:

1. APGL Made a Net Loss of $40.9 Million for FY2015

APGL recorded an exceptional loss of $44 million which caused the company to make a total net loss of $40.9 million for FY2015. The exceptional loss items included:

- Impairment loss of intangible assets

- Impairment on investment in associated company

- Costs attributed to the closure of non-performing retail outlets

- Impairment on unquoted investment funds

- Provision for closure costs

Of which, impairment loss of intangible assets recorded a loss of $37.2 million. This impairment stems from APGL’s food retail segment. APGL’s intangible assets were valued at $109.3 million when they acquired Délifrance and Food Junction in 2008. It seems both acquisitions are not doing too well and intangible assets have been significantly written down to $36.6 million by 2015.

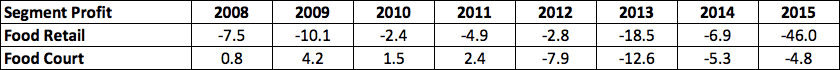

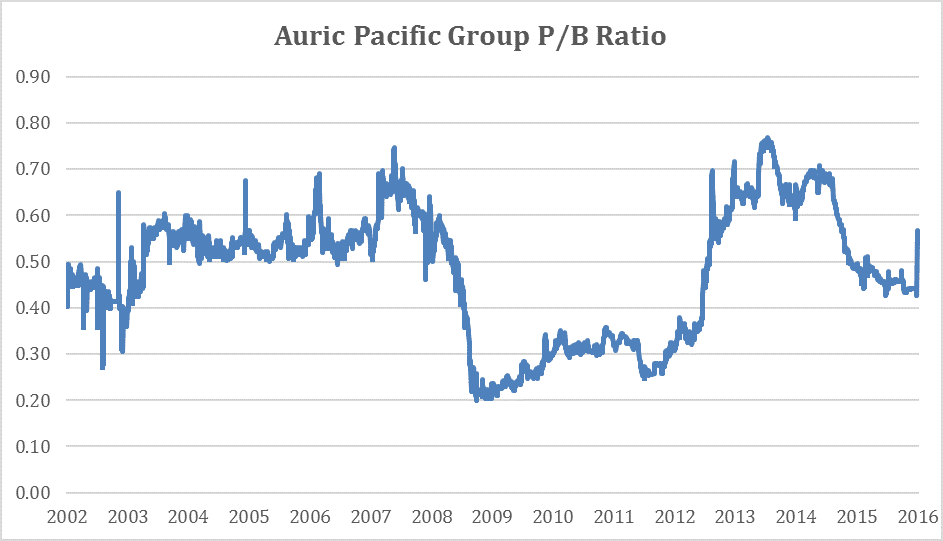

2. Food Retail and Food Court Segments Have Been Poor

From the table above, APGL’s food retail business has been operating at loss for the past eight years and its food court business has been operating at a loss for the past four years. The numbers tell their own story here.

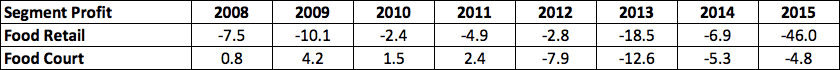

3. Dividends Suspended for the First Time in 14 Years

Due to the losses made, APGL decided not to pay a dividend for FY2015 — the first time the company has suspended dividends in the last 14 years. In any case, APGL’s dividend per share has been steadily declining since 2002.

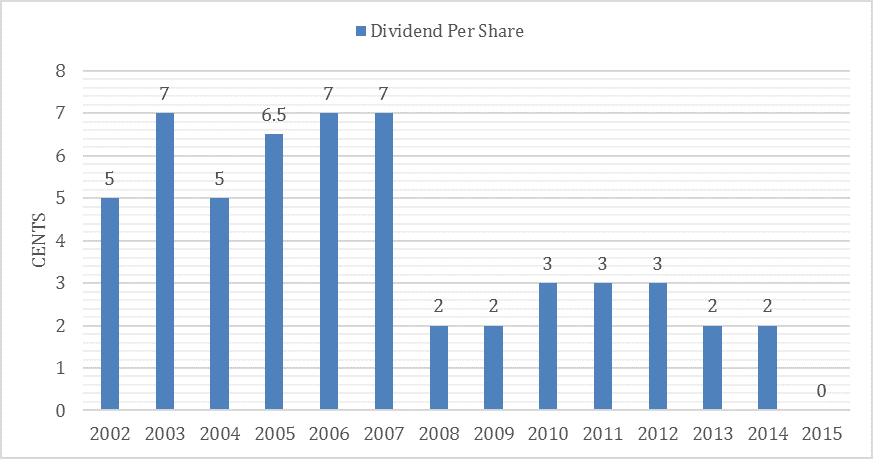

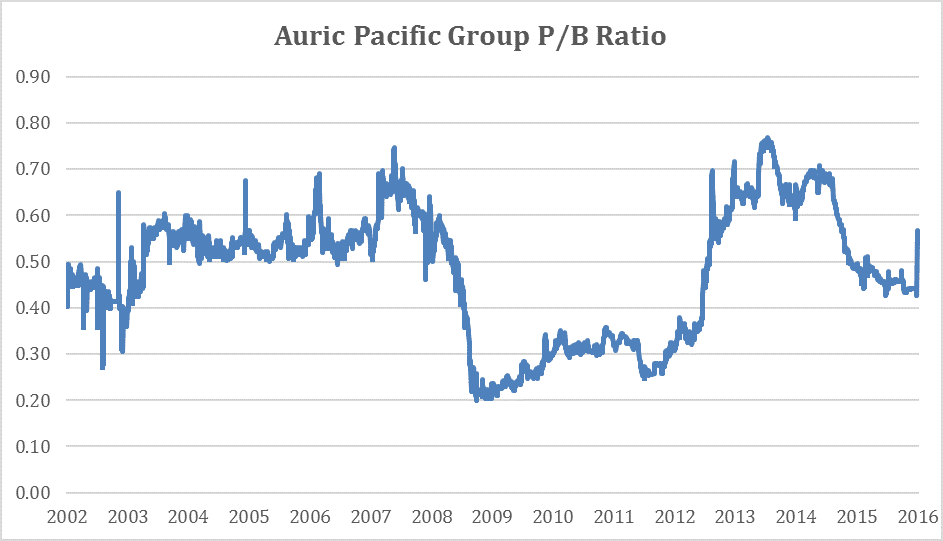

4. Price-to-Book Ratio is not Attractive Enough

APGL’s price-to-book ratio is 0.56 as of 9 March 2016. While this might seem like a significant discount to its book value, the chart above shows that the stock has been historically trading at this range the last 14 years. Moreover, APGL’s book value dropped recently due to the impairment losses which caused its P/B to spike.

So even though an insider is heavily buying shares (for whatever reasons), it doesn’t mean you should blindly follow suit. It’s important to have a buffer for error whenever you invest and there really isn’t a sizeable margin of safety right now based on APGL’s historical P/B ratios.

(Photo: Wikipedia)