How the China Stock Market Crashed 40% in 15 Days

- The Chinese equity market has risen 250% since the start of its rally in July 2014 before it plunged 40.45% from its peak in June 2015. It is still up 78% overall but there were warning signs before the plunge

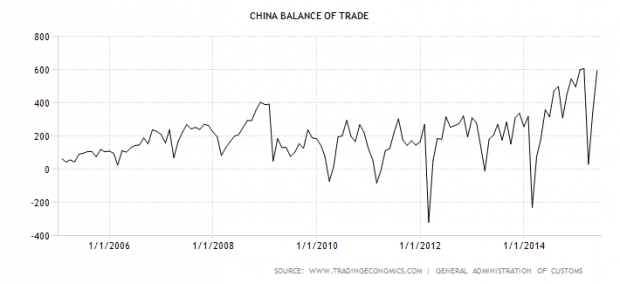

- The Chinese economy is growing steadily and it is still an export powerhouse despite the dent after the Great Recession. However overcapacity and bad debt threatens to derail the recovery which forced the People’s Bank of China to ease monetary policy from April to June 2015

- The strong rally started in March 2015 which drew in hordes of amateur investors who are not even supposed to be there in the first place. They leveraged their margin accounts significantly which drove the SSE Composite Index to unrealistic levels and alarmed institutional investors

The Chinese Equity Market Condition

The best way to look at the overall Chinese equity market is to refer to the Shanghai Stock Exchange Composite Index or SSE Composite in short. It consists of all the A and B shares listed on the Shanghai Stock Exchange. A shares are traded in the Chinese currency Renminbi and B shares are traded in US dollars on the Shanghai Stock Exchange. The creation of these two share classes are to segregate domestic and international investors and it was not until 19 February 2001 that the China Securities Regulatory Commission allowed Chinese citizens to trade on the secondary market.

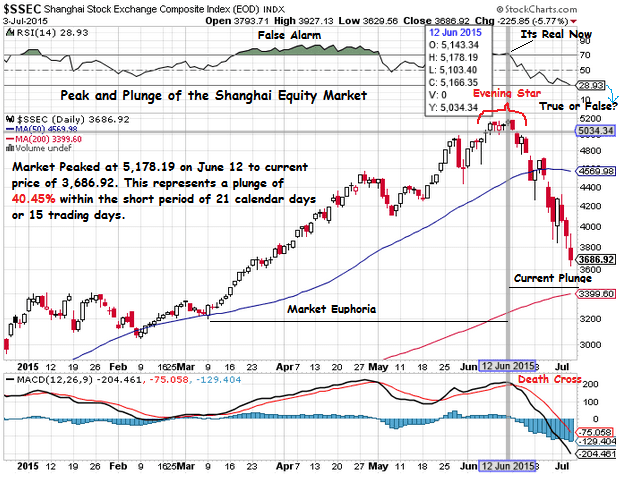

As you can see on the SSE Composite chart above, the Chinese stock market peaked on 12 June 2015 with a high of 5,178 points before it dropped to a low of 3686 points on 3 July. This represents an alarming 40.45% plunge within a period of 15 trading days. (The SSE Composite hit a new low of 3,507 points on 8 July.)

Actually there were many warning signs for investors to get out as seen on the chart above. If you’re into technicals, the relative strength index (RSI) was overbought. This indicates that the market is about to suffer from buyer exhaustion. Once the RSI goes above 70, it is an indication to sell. The MACD provided additional and very clear confirmation with a death cross when the fast moving average crossed below the slow moving average. Lastly, an evening star had formed.

Of course, the technical warning signs are not always accurate. For example, during March to April, the market was overbought (but no death cross then) for an extended period and the market continued to rise. When the correction came, it was a slight retracement in early May which rebounded quickly. The death cross was present but it turned out to be a mild decline. This turned out to be a false alarm and it lured many investors into complacency. Those who survived and made money felt invincible and those who lost money were determined to make it back.

Overall, the market euphoria from March 2015 to early June 2015 made investors blind to the cliff that was awaiting them ahead. Actually the SSE Composite rally started in 16 July 2014 at 2067.28 and rallied 250% to the June 12 peak of 5187.19. This is an amazing rally within 12 months. This proved unsustainable and even with the recent 40.45% decline, the Composite is still up 78% from when it first started its rally.

The Chinese equity market rose too quickly and made an even faster and painful correction. Ironically when the market rose, it went by largely unnoticed in the global markets outside the investment community but when it plunged, it obviously caught the world’s attention.

Strengths and Weaknesses of the Chinese Market

Now that we have the brief overview of the Chinese equity market, let us look at the fundamental conditions of the Chinese economy. Let us start with the broadest measure of the Chinese economy: gross domestic product (GDP).

China’s GDP has grown consistently even during the 2008 to 2009 Great Recession as seen in the chart above. For China, it is a question of how fast the economy will grow and not whether it will grow. China is aiming for a 7% growth rate this year which is slower than the double-digit growth in its earlier decade. As early as 2010, China’s GDP grew by 18.84% from US$4,990 billion to US$5,930 billion.

China remains an export powerhouse but its status was weakened after the Great Recession as foreign demand shrunk. In addition, its rising labor costs have made it less attractive to MNCs. Nevertheless, China is moving up the value chain and is still a strong exporter despite the recent volatility.

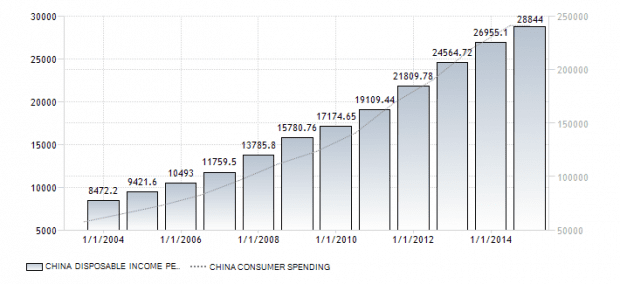

As China is the second largest economy in the world, it naturally has a very large domestic consumption market as well. As their economy grew, the disposable income of the Chinese grew accordingly as seen in the chart below. This led the Chinese to increase their consumption and this is why China is an important consumer market for MNCs.

Hence China has become a place for production and consumption. While the overall Chinese economy is strong, it is not without its flaws beside the well-known issue of its slowing growth rate.

Its state-owned enterprises are inefficient and large borrowers of credit which resulted in little left over for its small and medium enterprises. These SMEs have to resort to shadow banking for credit unless their owners have solid political patronage. There has been excess investment in China as seen in the rise of empty cities where no one is willing to move to due to various factors such as high prices, inconvenient locations that are far from jobs, and other general factors.

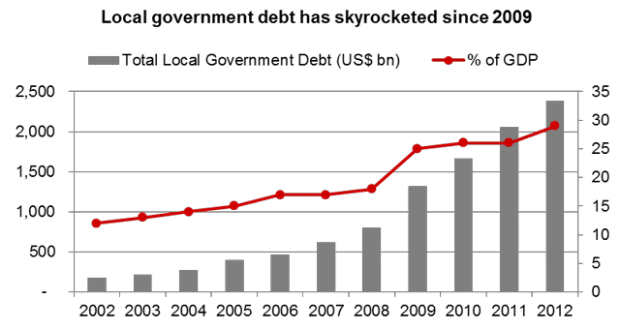

While SMEs are constrained by the amount of credit they can get from both official and unofficial sources, the large state-owned enterprises do not have these constraints. They have the backing of provincial governments and as the chart below shows, the problem had been growing.

Source: Frontier Strategy Group

In order to deal with these problems, China’s central bank, the People’s Bank of China (PBoC) eased its monetary policy three times from April to June 2015. The unfortunate side effect was to blow up the stock bubble. As soon as the PBOC had intentions to ease monetary policy, the SSE Composite started to rally.

The monetary easing was to allow banks to continue lending to these big enterprises and to prevent a meltdown of the Chinese economy. If the large enterprises were to fail on a large scale, it would cascade down to their suppliers who are mostly SMEs and numerous workers would be out of work. This would cause major economic and social unrest if the PBoC did not act. For example, a major property developer, Kaisa, defaulted on its debt in April which sent shock waves across the Chinese economy and the Chinese property market entered a new period of sustained weakness. The PBoC acted to swap $1 trillion yuan of local Chinese government bonds to allow them to reduce their interest payments in April. This was followed by another $1 trillion yuan aid package on June 10 which preceded the stock market meltdown.

The Herd Arrives

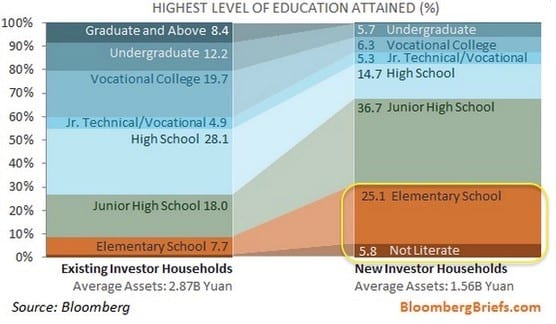

Ordinary Chinese investors did not fully understand the conditions of their economy and rushed into the stock market. As early as April 1, Bloomberg reported that 4 million new equity accounts were opened in March 2015 alone. That is more than the entire population of Singaporean citizens! This was just the early wave of investors who rushed in after they saw the SSE Composite’s bullish performance and thought that easy money was there for the taking. However what was more alarming was the fact that most of them did not even have a high school education. How could they have understood the complexity of the equity market? They didn’t and they simply piled on debt to finance their stock gambles.

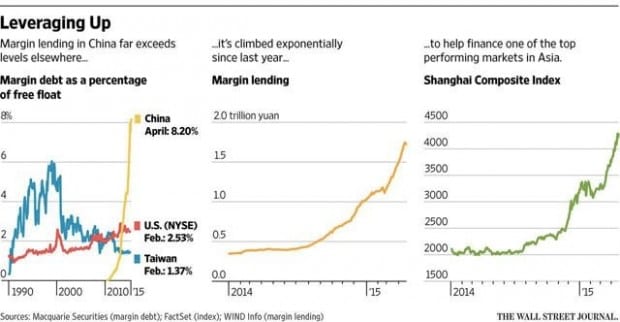

In fact, a full 5.8% of new investors were actually illiterate and should not have even been allowed to open brokerage accounts in the first place. This new wave of Chinese amateurs pushed up the Chinese equity market substantially by using ever increasing levels of debt through margin accounts as the chart below shows:

China’s margin debt even exceeded that of the United States which has a more mature equity market. So it should not come as a surprise that the equity market came tumbling down once the music stopped playing. However when the good times were rolling, the Chinese splurged and consumer confidence soared.

As this Bloomberg article reported, when institutional investors saw the arrival of this wave of amateur investors, they started to exit the market gradually as they knew that a bubble was being formed. However ordinary investors did not share the same caution as they were inundated with news (e.g. PBoC rate cuts) why the stock market should continue to rise and heard of anecdotal stories of how their friends and relatives made fortunes in the stock market. Their greed made them blind to the risk involved and it was the start of a tragedy.

The Fifth’s Perspective

We have seen how amateur Chinese retail investors were attracted to the equity market like bees to honey and why they should not even be there in the first place. The meteoric rise of the SSE Composite was fuelled by debt and margin trading rather than solid fundamentals and hence it is only normal that it should now return back to reality.

In my next article, we will look at the “human” aspect of the 40.45% SSE Composite decline and how the Chinese authorities tried to stop the plunge. And more importantly, the potential investment opportunities you can take advantage of in this current market collapse. So stay tuned!