Raffles Medical & The Hour Glass: 3 Key Metrics to Examine as Interest Rates Rise

After years of near-zero interest rates, the US Federal Reserve has positioned itself for a rate hike this year. When the Fed raises interest rates, Singapore’s SOR and SIBOR follow suit. Rising interest rates affect all our investments and investors like us need to consider the implications and select only the best companies that can deal with a rising interest rate environment.

So how we know if a company is able to survive or even thrive (as weaker competitors get weeded out) in a rising interest rate environment? For me, there are three criteria:

1. Low Debt

Companies with a strong balance sheet have relatively low liabilities and are able to service their debts better. For this, I like to use the debt-to-asset ratio:

Debt-to-Asset Ratio = Total Debt ÷ Total Assets

The debt-to-asset ratio measures the total amount of debt relative to assets. Ideally, the ratio should be 0.5 or below. (A ratio of 0.5 means that half the company’s assets are financed by debt.)

2. Strong Liquidity

A good cash position and strong liquidity allows a company to easily cover their existing obligations and to have the resources to seize opportunities when they arise. For this, I use the quick ratio.

Quick Ratio = (Cash & Cash Equivalents + Marketable Securities + Accounts Receivable) ÷ Current Liabilities

The quick ratio measures a company’s liquidity and ability to raise cash quickly. The quick ratio excludes inventory specifically because inventory cannot be sold quickly without incurring losses from its book value. A quick ratio of 1 means that a company has $1 of liquid assets to cover $1 of current liabilities. Ideally, the ratio should be 1.5 or above.

3. Earnings Growth

Lastly when the company fulfils the above two criteria, I then consider its earnings potential. In general, the value of a company is simply its ability to make a profit. In order to do so, its products/services have to be competitive and management needs to control costs well for a company to be consistently profitable.

There are a minority of companies on the SGX that fit the above criteria. I will share two examples below:

Raffles Medical Group (SGX: R01)

Photo: Wikipedia

Raffles Medical Group should be familiar to most Singaporeans — especially its flagship Raffles Hospital located at Bugis. Raffles Medical also operates a chain of clinics all over Singapore. In addition, the group expanded into China in 2013. Raffles Medical has a market capitalization of $2.6 billion. Notably, the company was able to strengthen its balance sheet since 2010 even as it expanded overseas.

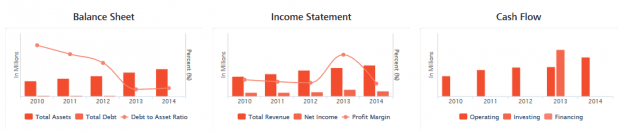

Source: DBS Vickers

Raffles Medical took steps to de-leverage its balance sheet since 2010. This is a company that recognized the rising interest environment early on and took decisive action – especially in 2013. Its operating cash flow has also been rising steadily over the past five years. Cash flow from financing in 2013 was due to a sale of a building. Its revenue and earnings have also been rising steadily the past five years.

Raffles Medical has a debt-to-asset ratio of 0.18 and a quick ratio of 1.78.

The drawback is that its share price has risen so much that its dividend yield is currently only around 1.28% and its P/E is 38. In short, Raffles Medical is a good company but is overpriced at the moment.

Source: Yahoo Finance

The Hour Glass (SGX: AGS)

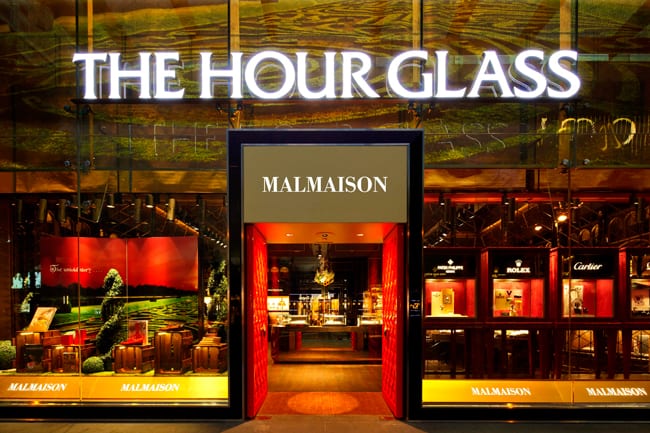

Photo: The Hour Glass

The Hour Glass is another familiar household name in Singapore. The luxury watch retailer was first stablished in 1979 and the company now has 41 boutiques in nine cities throughout Asia. It has a market capitalization of $500 million.

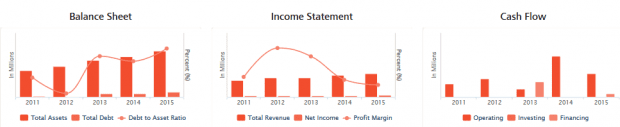

Source: DBS Vickers

Even though its debt-to-asset ratio has been rising the past five years, The Hour Glass overall still has a low ratio of 0.22. The company has a quick ratio of 1.27. Revenue, earnings and operating cash flows have generally been on an uptrend.

In terms of price, The Hour Glass’s P/E is a relatively low 8.5.

Source: Yahoo Finance

The drawback is that The Hour Glass’s profit margins are being squeezed as its revenue increases. This means the company is having problems controlling costs in its efforts to stay competitive in its industry. Its strong balance sheet and low debt means that The Hour Glass is in no danger of going insolvent anytime soon but its challenge is to improve its margins as it grows its business.

Conclusion

This is by no means an exhaustive analysis on these two companies and there are many other factors you need to consider as well for your due diligence if you plan on investing. However, through these two quick studies, I hope to have showed you how using a few key metrics can help you analyse a company’s debt and liquidity levels. Low debt levels and strong liquidity are crucial especially when interest rates are rising higher and higher.

The last thing you want in your portfolio is a stock that has trouble meeting its debt obligations and at risk of default.