Photo: SIA Engineering

Following up on last year’s SIA Engineering 2014 AGM, I attended this year’s meeting to find out the latest updates on the company and the aircraft maintenance, repair and overhaul (MRO) industry.

#1 The MRO industry is facing headwind

In January, SIA Engineering welcomed a new CEO, Png Kim Chiang, whose track record boasts three decades of experience in the MRO industry. Png started his speech at the AGM by sharing some of the major challenges faced by SIA Engineering in the MRO industry.

The 4 key challenges in the aircraft MRO industry:

- Technological advancement and the new batch of commercial aircraft like the Airbus A350 and Boeing 787 require less maintenance than older fleets. This technological advancement is a structural change in the industry. As technology progresses, aircraft spend less time in maintenance and maintenance fees go down which will affect SIA Engineering. At the same time, SIA Engineering must build up new capabilities to handle and maintain the newer aircraft.As chairman Stephen Lee pointed out: “In the future we expect less aircraft visits to the hangar and the stay in the hanger for each visit will be shorter.”

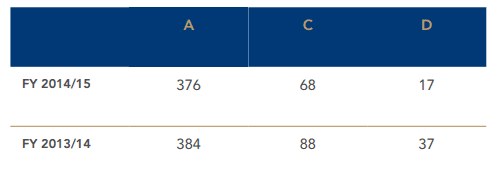

- Older aircraft like the Boeing 747 and Airbus A330 typically require more maintenance. However, these fleets are gradually being phased out by airlines as the costs of maintaining them are relatively higher. The reduction in heavy overhauls (column D) has sent SIA Engineering’s repair and overhaul unit into losses of $14.3 million compared to profits of $32.4 million in the previous year.

Number of aircraft & component service checks. Source: SIA EngineeringAnother example: SilkAir has moved on to the newer Boeing 737 and phased out the older A320. Subsequently, SilkAir’s recent contract renewal with SIA Enginnering was $197 million – a 30% drop compared to the $300 million contract signed five years ago.

- Both aircraft OEMs like Boeing and component OEMs are entering the after-sales market and this increases the competition in the MRO industry.

- Aircraft fleet size in Asia Pacific is expected to double by 2025 and this will attract more competitors into the MRO industry, although this is somewhat mitigated in my next point.

#2 MRO companies must be authorized maintenance partners

SIA Engineering’s tie-up with Boeing is an example of partnering with OEMs. SIA Engineering no longer go directly to its parent company, Singapore Airlines (which contributes 50% of SIA Engineering’s revenue in 2014/15), for direct maintenance services; Boeing is now the intermediary between the two entities. Because of this SIA Engineering has to share a portion of its profits with OEMs like Boeing moving forward.

However, should SIA Engineering successfully adapt themselves to this new challenge, the company is likely to be remain profitable as this new environment erects a barrier to entry and reduces a number of MRO players. According to the chairman this transition will take around two to three years.

#3 SIA Engineering’s line maintenance profit grew to $98 million

This figure grew from $83 million the previous year. Line maintenance contributed close to 48% of SIA Engineering’s total profit before tax. The main reason is because SIA Engineering has a near-monopoly on line maintenance business in Singapore.

Investing in SIA Engineering? Discover 4 Things You Need to Know About SIA Engineering’s Business Before You Invest