I recently came across a Thomson Reuters article that reported Singapore REITs have hit a five-year high in distribution yield. Their analysis of 14 REITs showed the median dividend yield was 6.7% at end-January — the highest since at least April 2011.

According to Thomson Reuters:

“The yield trend offers a timely reminder of the lingering allure of investments tied to brick-and-mortar such as REITs, which typically provide stable income streams, at a time when investors are on a knife-edge amid global market turmoil and fears about the health of banks and the broader economy.”

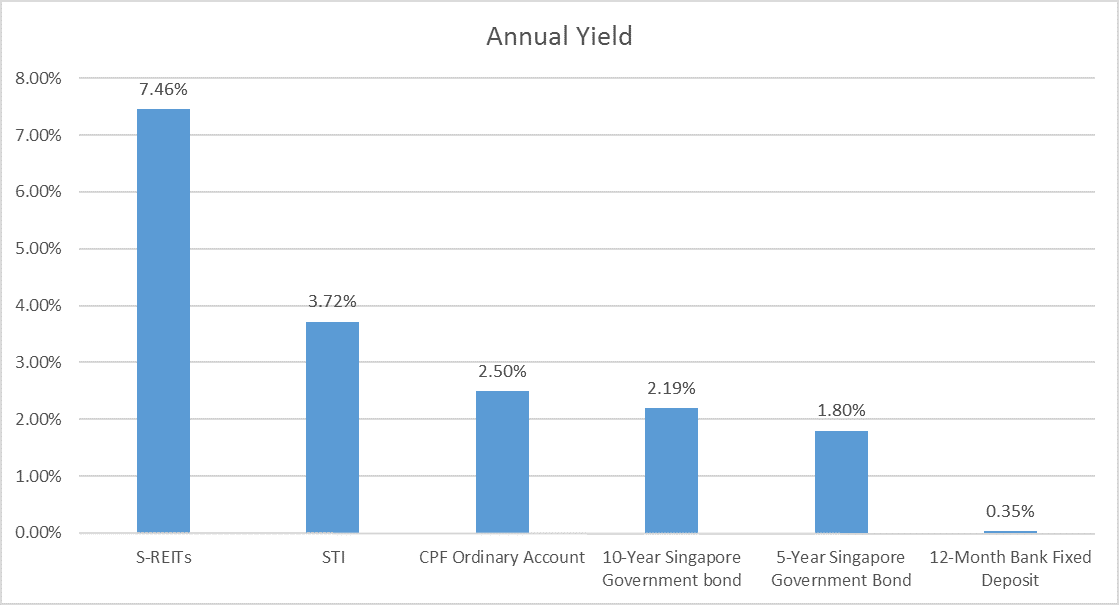

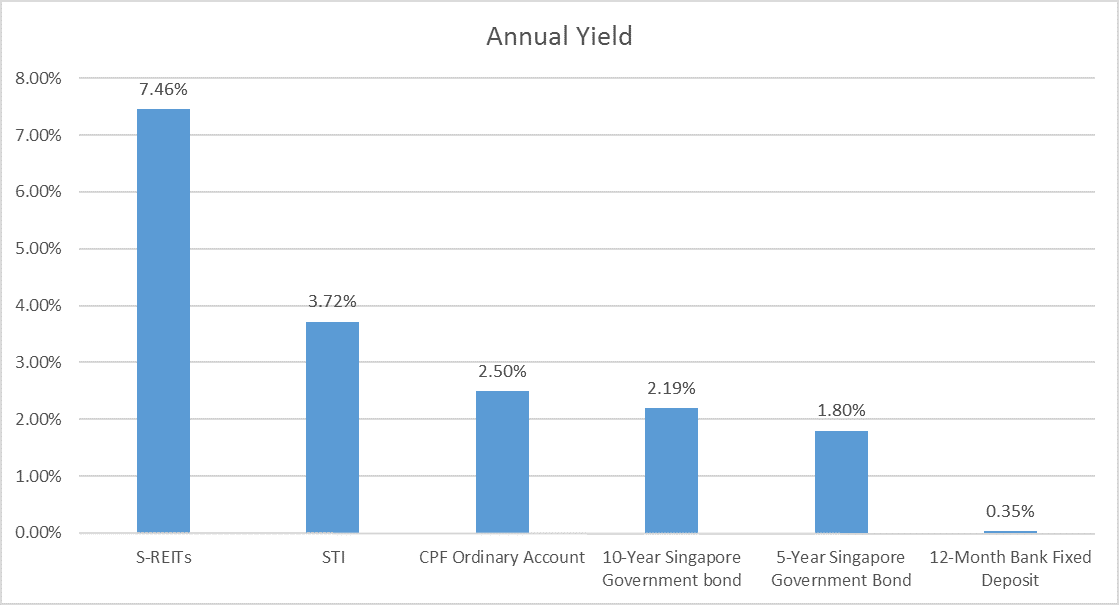

I decided to a quick comparison of annual yields across a handful of asset classes and instead of using the median yield of the 14 REITs used in the Thomson Reuters analysis, I went with the average yield of all 35 REITs in Singapore. Here are the yields (as at 23 Feb 2016):

As you can see, S-REITs in general offer very high yields compared to other asset classes. It comfortably beats the STI and Singapore government bond yields. And, of course, not to mention our highly attractive bank fixed deposit rates.

Yields have not reached the historical high of 13% last seen in 2008 during the Global Financial Crisis but we’d reckon an event like that doesn’t come by every so often. So as it is, yields are, in my opinion, highly attractive right now.

REITs offer a high, steady stream of passive income and if you’re planning to invest for dividends, now might be the time to start looking at some of the best-managed REITs in Singapore.

Read more: 5 Important Factors You Need to Consider Before You Invest in Any REIT

Higher yields could also be a function of the increasing risk of the country. Since yield plays tend to track the overall GDP of an economy, a higher yield is likely to mean that its a riskier time to invest,given the uncertain macro backdrop.

It all comes back to the risk-return principal. As it becomes riskier to invest in an asset class (in this case REITs because of an uncertainty surrounding the economy), a higher yield is required to attract investors.

In this vein, the higher yields may not be as attractive when you dig deeper.

Hi Timothy,

I agree entirely. Falling prices (which give you higher yields) signal pessimism in the markets/economy.

Yield alone should never be a reason to invest in any security. For example, some industrial REITs are now offering near double-digit yields but I wouldn’t invest in them because demand for industrial spaces is falling amid the manufacturing slowdown.

Similar challenges faced by office REITs due to a large supply of office space coming on-stream this year.

What’s more important is to look at a security from a fundamental approach from all angles. If the fundamentals still look secure and yields are high, it could be a great opportunity to invest. 🙂