Mapletree Logistics Trust (MLT) is Singapore’s first Asia-Pacific focused logistics real estate investment trust with a portfolio of 124 properties in Singapore, Hong Kong, Japan, Australia, South Korea, China, Malaysia and Vietnam. As of 31 March 2018, MLT’s portfolio was valued at S$6.5 billion. We attended MLT’s most recent annual meeting to find out more about its past year’s performance and its outlook for the year ahead.

Here are 10 things I learned from the 2018 Mapletree Logistics Trust AGM:

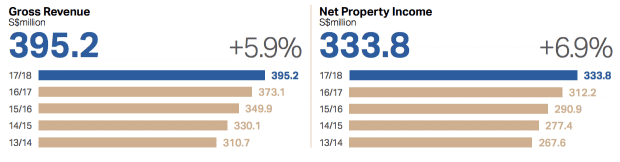

1. Gross revenue rose 5.9% year-on-year to $395.2 million while net property income increased 6.9% to S$333.8 million. The results were attributed to improved performance of existing properties, the acquisition of Mapletree Logistics Hub Tsing Yi and the remaining 38% stake in Shatin No.3 in Hong Kong, and the complete redevelopment of Mapletree Pioneer Logistics Hub in Singapore. Revenue growth was offset by the divestment of four older properties (Zama Centre and Shiroishi Centre in Japan, 4 Toh Tuck Link in Singapore, and Senai-UPS in Malaysia) and the ongoing redevelopment of one block of Ouluo Logistics Centre in China.

Source: Mapletree Logistics Trust

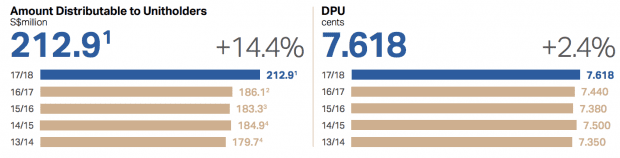

2. Distributable income to unitholders increased 14.4% year-on-year to S$212.9 million. Distribution per unit (DPU) grew 2.4% to 7.618 cents — this is after taking into account a S$640 million equity fundraising exercise which enlarged the equity base. The funds raised were partially deployed to finance the HKD4.8 billion (S$834.8 million) acquisition of Mapletree Logistics Hub Tsing Yi.

Source: Mapletree Logistics Trust

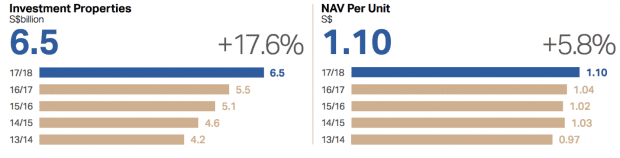

3. Value of investment properties grew by 17.6% to S$6.5 billion. The gain comprised a net fair value gain of $240 million in investment properties that was attributable mainly to properties in Hong Kong and approximately S$993 million in acquisitions and capital expenditure. Net asset value (NAV) per unit for the year rose by 5.8% to S$1.10.

Source: Mapletree Logistics Trust

4. Portfolio occupancy rate is at 96.6% and WALE is 3.5 years. 37.2% of total leases not due for renewal till 2021. MLT has low customer concentration risk — not a single customer accounts for more than 5% of total gross revenue, and its top 10 customers make up less than a quarter of total gross revenue.

5. MLT has a gearing ratio of 37.7%. During the year, the REIT redeemed S$350 million in 5.375% perpetual securities issued in 2012 and issued S$180 million in perpetual securities at a lower rate of 3.65%. MLT has an average debt maturity of 4.5 years.

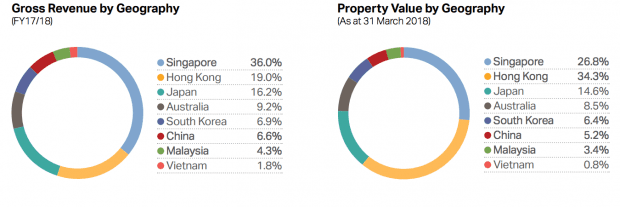

6. Hong Kong surpassed Singapore in terms of property value this year due to the acquisition of Mapletree Logistics Hub Tsing Yi and the remaining 38% of Shatin No.3. However, that will change very quickly next year with the acquisition of five ramp-up logistics properties in Singapore and a 50% interest in 11 logistics properties in China.

Source: Mapletree Logistics Trust

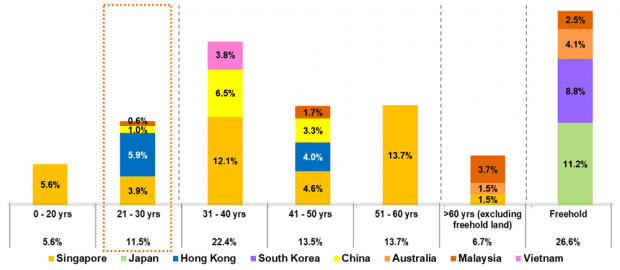

7. MLT has a weighted average land lease of 46 years (excluding freehold land), however, a shareholder was concerned that 11.5% of leases had only 21-30 years left to expiry. CEO Ng Kiat replied that JTC would only discuss a land lease extension when a property has less than six years to expiry. In hopes to extend its land leases earlier, MLT plans to reach out to JTC with a business proposal but no details were shared. With regards to Hong Kong, virtually all land leases on the territory expire in 2047, but MLT has been in talks with the Hong Kong authorities and believes that structures are in place to navigate the 2047 land lease expiry.

Source: Mapletree Logistics Trust

8. A shareholder queried about the significant difference in Hong Kong’s gross revenue and property value compared to other countries. To provide some contrast, CFO Ivan Lim explained that a market with a high gross revenue per dollar of investment may not necessarily generate a high cash return to unitholders. In Hong Kong’s case, land scarcity in its warehouse industry has led to compressed capitalization rates. However, the management also looks at non-financial aspects of an investment including potential growth, risk attributes, and scalability of the market. The CEO shared that MLT makes a return of five dollars for every hundred dollars of investment in Hong Kong, while MLT makes a return of six to eight dollars for every hundred dollars of investment in Singapore.

9. A shareholder asked if MLT should invest elsewhere since Hong Kong properties generate a lower return on investment. Chairman Lee Chong Kwee said that MLT doesn’t only consider revenue per dollar of property value. Its strategy is to be a well-balanced and well-diversified REIT with a presence in key logistics centres. Hong Kong is a dynamic market where property prices appreciate quickly and is a major logistics node.

10. A shareholder asked how MLT provides logistics solutions to e-commerce players like Alibaba that are looking to expand to Malaysia. The CEO replied saying that Alibaba is keen on expanding its e-commerce store, Lazada, in Malaysia. By partnering with MLT, Alibaba has the option to expand from 50,000 square feet to 100,000 square feet if/when the need arises. This ‘instant’ flexibility for expansion is very important for companies that are geared for explosive growth. She shared another example saying that when e-commerce giant, Amazon, entered Singapore, it was looking to reach every corner of the island within four hours. If competition intensifies and Amazon wants to further reduce delivery times, MLT is able to provide another location for Amazon to reach their customers within two hours in Singapore.

Liked our analysis of this AGM? Click here to view a complete list of AGMs we’ve attended »