IGB REIT owns Mid Valley Megamall and The Gardens Mall in Kuala Lumpur with a combined net lettable area (NLA) of about 2.7 million square feet.

The former is a lifestyle mall that targets mainly locals in the Klang Valley whereas the latter is a premium shopping centre. Mid Valley Megamall and The Gardens Mall have been in operation for the twentieth and twelfth year of operations respectively. As at 16 June 2019, IGB REIT has a market capitalisation of RM6.6 billion.

Both malls, which are connected via a link bridge, are well-patronised by locals and quite crowded on both weekdays and weekends alike. Based on my personal experience, it’s not easy to get a parking space at these two malls during peak hours.

Here are eight things I learned from the 2019 IGB REIT AGM:

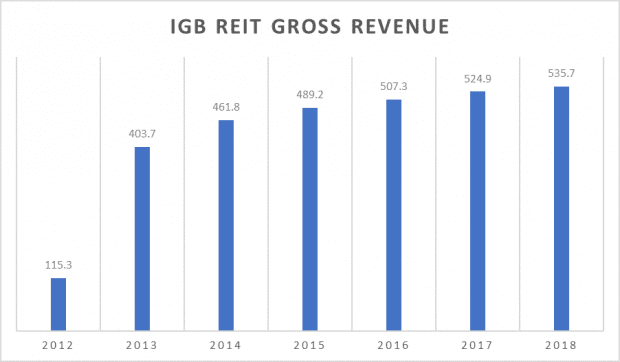

1. Gross revenue increased 2.1% year-on-year to RM535.7 million in 2018 – a five-year high. The improvement is due to steady growth primarily driven by higher rental income. gross revenue also reached a five-year high in 2018. Managing director Robert Tan was confident that the malls would stay relevant amidst the disruption of e-commerce as their overall occupancy rate remained high at 98.6% in 2o18.

2. Net profit decreased 2.8% year-on-year to RM333.8 million in 2018. The decline was mainly due to the lower fair value gain on investment properties in 2018. This was offset by lower property operating expenses which decreased by 1.3% to RM149.4 million. Distribution per unit (DPU) also decreased by 0.09 sen to 9.19 sen in 2018.

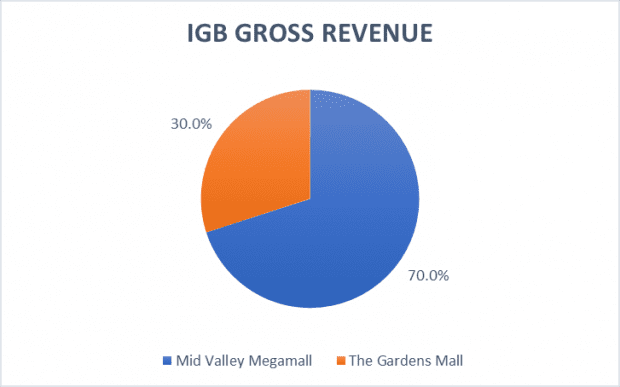

3. Mid Valley Megamall recorded an occupancy rate of 99.3% in 2018. The mall contributed to 70.0% of the REIT’s gross revenue in 2018.

Its 10 largest tenants occupied 49% of NLA, down from 53% the year before as REIT seeks to diversify the mall’s retail space. Asset enhancement initiatives (AEIs) were undertaken in the lower ground floor in the east entrance by shifting its escalators to bring traffic to tenants in the refurbished area.

4. Occupancy rate in The Gardens Mall stood at 97.2% in 2018. To improve shopper experience, AEIs were undertaken to revamp the north section in the lower ground floor, thereby adding about 7,000 square feet to The Gardens Mall. Its 10 largest tenants occupied 47% of NLA in 2018.

5. A unitholder wanted to more about IGB REIT’s rental reversion rate. Tan said that the REIT has been very careful with rental reversions in the last two years and lenient with tenants amidst the continuous new supply of retail space. According to Tan, IGB REIT managed to achieve an 8% increase in rental renewals in 2018. Leases with tenants are renewed every three years with around one-third of leases due yearly for renewal.

6. A unitholder asked if rental rates across both malls are identical. Tan explained that rental rates are based on tenant sales. At the ground floor where tenants achieve higher sales in the centre court of Mid Valley Megamall, rent is more expensive. Shopper traffic is also four times higher at Mid Valley Megamall than The Gardens Mall.

7. The same unitholder was also keen to know more about the progress of link bridge that’s being built to connect KL Eco City to The Gardens Mall. Tan shared that the bridge would be opened to the public in May 2019. The long delay was due to the collapse of the bridge in November 2016. IGB REIT needed the other party to construct their part of the bridge before they connected it for safety purposes. As KL Eco City is located next to a light rail transit station, the link bridge also provides shoppers an additional mode of commuting to the mall. The bridge will also attract the office crowd from KL Eco City to both malls as food and beverage selections are limited in the retail podium at KL Eco City.

8. The managing director revealed that IGB Berhad — IGB REIT’s sponsor — owns another subsidiary, Southkey Megamall Sdn Bhd, that also manages shopping malls. It currently manages The Mall, Mid Valley Southkey in Johor Bahru that was recently opened in April 2019. In my opinion, there may be competition between IGB REIT and Southkey Megamall for injection of new properties from their parent in the future.

Liked our analysis of this AGM? Click here to view a complete list of AGMs we’ve attended »

Will there be any chances that Southkey Mid Valley to be injected into IGB REIT?

Hi Joo Parn,

It could happen according to managing director Robert Tan depending on the price IGB REIT is willing to pay. He was actually quite blunt with shareholders during the AGM. Fyi, he also sits on the board of the sponsor, IGB Berhad.

I refer to your comments regarding SouthKey which is reproduced below:

“In my opinion, there may be competition between IGB REIT and Southkey Megamall for injection of new properties from their parent in the future.”

It is unlikely that there will be “competition” between IGB REIT and Southkey Megamall for injection of Southkey into IGB REIT as it is in IGB Berhad’s best interest to have Southkey part of IGB REIT. The reasons are as follows:

(1) Southkey is modeled after MidValley Megamall and as such from a commercial perspective it is best managed by the IGB REIT management team who has more than 2 decades managing and operating MidValley and Gardens.

(2) The injection of Southkey into IGB REIT will enable IGB Berhad to free up more cash for IGB Berhad core property business as IGB REIT could either raised more borrowing to pay for the acquisition of Southkey combined possibly with the issuance of new IGB REIT units.

(3) The injection of Southkey into IGB REIT will benefit IGB REIT as it will still retain control of this mall and at the same time enjoy the returns as IGB Berhad is the major shareholder of IGB REIT. Furthermore, its subsidiary, IGB REIT Management Sdn Bhd currently collect around RM34 million of management fees from IGB REIT to manage MidValley and Gardens and this amount will increase with the inclusion of Southkey.

Thanks for pointing that out! You have a valid point 🙂