Listed in 2001, TIME dotCom Berhad is a Malaysian-based fixed line telecommunications provider that delivers both domestic and global connectivity, data centre and managed services to its customers across ASEAN.

The company also offers fibre home broadband services. Compared with copper networks, fibre networks transmit more bits of data per second, offer significantly better signal durability, are more resistant to fire or other interferences.

In late 2018, TIME launched a fibre broadband plan offering speeds of 1 gigabit per second (Gbps), the fastest in Malaysia, as well as providing the most competitively priced home broadband services in the country:

| Home Broadband Plans Malaysia | ||||||

|---|---|---|---|---|---|---|

| 30Mbps | 100Mbps | 300Mbps | 500Mbps | 800Mbps | 1 Gbps | |

| TIME | - | RM99 | - | RM139 | - | RM199 |

| TM | RM79 | RM129 | RM199 | - | - | - |

| Maxis | RM89 | RM129 | RM149 | RM219 | RM299 | - |

| Astro | RM89 | RM129 | - | - | - | - |

Source: iMoney, vendor websites

I was interested to learn more about the company from an investor’s point of view, so here are 12 things I learned from the 2019 TIME dotcom AGM.

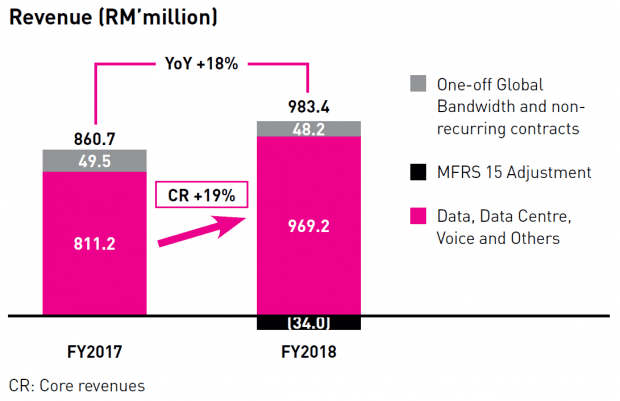

1. Revenue increased 18% year-on-year to RM1.017.4 million in 2018, while profit before tax jumped 69% to RM325.6 million, pre-MFRS 15. Adjusting for MFRS 15, which TIME adopted on 1 January 2018, revenue and profit before tax decreased RM34.0 million and RM20.8 million respectively. Management attributed revenue growth to higher Data and Data Centre sales which was offset by declining Voice and one-off revenues. Significantly, the company continues to see strong growth in its recurring core revenue streams.

2. A shareholder was concerned about the future of the voice business, but CEO Afzal Abdul Rahim reassured that TIME already has the needed voice networks in place and they require little additional cost to operate. The voice business still generated nearly RM70 million in revenue in 2018 and plays the role of a value-added service provided to enterprise customers.

3. For TIME’s Fixed Line business, all existing subscribers were automatically upgraded without contract extensions when it launched refreshed home broadband plans in Q4 2018. The CEO shared that TIME was recognized as the fastest fixed network in Malaysia and the eighth fastest in the world by Ookla’s Speedtest. Premises passed grew by 35% year-on-year to more than 600,000 premises domestically as at 31 December 2018. All core customer segments experienced revenue growth year-on-year, with Retail growing by 61%, Enterprise by 10% and Wholesale by 13%. The strong growth in Retail revenue was largely due to strong take-up of home broadband offerings.

4. TIME’s Data Centre revenue grew 18% year-on-year, supported by contributions from several large over-the-top content providers. The company expanded net lettable data centre space by 10,860 square feet in 2018, and has access to 36,875 square feet of additional space through its associates in Thailand and Vietnam. A shareholder noted that TIME had about three acres of vacant land in Cyberjaya and asked if there were any plans to develop a data centre there. The CEO revealed that the company has had plans to build a sizable data centre on the land for some time, and that the data centre will commence construction on 22 June 2019. He assured shareholders that as TIME is on the verge of becoming net cash, the company has sufficient capital expenditure headroom from the use of internal funds and additional debt instruments.

5. Capital expenditure (capex) increased 51% year-on-year to RM276.2 million in 2018. This was due to the significant increase in investments in regional telco networks — from 1% of capex in 2017 to 29% in 2018 — with the purpose of expanding the Group’s regional network in Cambodia and Singapore. This year, CEO forecasts higher capex for TIME’s Data Centre business to cater for increased demand for server space and supporting services.

6. The Minority Shareholder Watch Group (MSWG) asked TIME about its outlook and prospects on its newly-established operating presence in Cambodia and Japan. The CEO explained that the Cambodian network provides the vital missing piece for the group to complete its ASEAN telecommunications network, which will allow to create a seamless regional telco network across Indochina, Malaysia, and Singapore. Expansion in ASEAN is important to TIME as demand for data and cross-border connectivity in the region is expected to continue growing exponentially. The CEO highlighted that investment for the new subsidiary incorporated in Japan cost only 100,000 yen (RM3,800) and was set up in preparation to offer colocation and related services in the future.

7. MWSG also asked if TIME expects global bandwidth rates to experience further compression in 2019 and beyond. Management explained that due to competition and/or advances in technology, price erosion is a normal occurrence in the telecommunications industry. In the past, global bandwidth rates have typically eroded anywhere between 15% to 45% per annum. TIME’s management, however, believes that the erosion in rates will stabilize to between 10% to 25% in the near term, and reveals that it curbs such price erosion by either selling new higher bandwidth products, upgrading its infrastructure, or improving its cost efficiencies.

8. A shareholder asked about TIME’s plans for 5G. The CEO said that TIME’s strategy is to be part of the 5G value chain by partnering with other cellcos as a vendor that provides backhaul for cellcos to rollout their 5G sites, instead of directly offering 5G services itself. In January 2019, TIME announced that it was the first telco in Malaysia and the second service provider in the world to achieve the Metro Ethernet Forum (MEF) 3.0 certification. Under MEF 3.0, TIME’s network is verified as being capable of supporting 5G and 4G LTE-A connectivity, particularly for mobile backhaul networks. The same shareholder questioned why the company was not entering the wireless business at which the CEO explained that the business is extremely competitive where even more experienced players such as U-Mobile and Telekom Malaysia are still struggling. He also said that as TIME would be a late player in the industry and would be playing catch up. Going into wireless would also distract from TIME’s core business of broadband.

9. A shareholder asked about how the Malaysian Communications and Multimedia Commission’s Mandatory Standard on Access Pricing (MSAP) would affect the business. The CEO explained that with the gazetting of the MSAP, other telco players can now access TIME’s broadband network at mandated prices, which is positive to TIME’s Wholesale business as this increases the usage of its fibre networks. The CEO revealed that no wholesale deals in the industry have been transacted at the MSAP price, as commercial prices are actually lower for the access seekers, a trend which is similar globally.

10. Days before the AGM, Huawei and TIME entered into a memorandum of understanding to construct a pilot 10-gigabit passive optical network (10G PON), which aims to provide gigabit ultra-broadband for fixed-access users in Malaysia. 10G-PON is a computer networking standard for data links, capable of delivering share Internet access rates up to 10 Gbps over existing dark fibre, or unused fibre-optic cables. Back in May 2018, TIME partnered with Huawei to launch a horizontal setup of its network functions virtualization infrastructure (NFVI), which gives it the flexibility to integrate with host solutions from multiple vendors. NFVI is a set of resources that can host and connect virtualized network functions such as routers, firewalls and cloud computing systems, which can then be delivered to customers quickly without relying on costly hardware.

11. On the day of TIME’s AGM, seven Malaysian telcos (including TIME) and the Malaysian Communications and Multimedia Commission (MCMC) gathered to sign the Consumer First Pledge that promises to deliver better customer service experience to Malaysian mobile consumers. The MCMC assured consumers that complaints brought forward to telcos will now be comprehensively investigated with the signing of this pledge.

12. For 2019, due to regulations implemented by the Malaysian government with the goal of improving internet speeds and access quality while ensuring prices remain affordable, TIME foresees some margin compression in subsequent quarters but expects to offset this with improved sales volumes. MSWG voiced its concern about the potential long-term impact of Tenaga Nasional Berhad’s National Fiberisation and Connectivity Plan (NFCP) pilot project on TIME’s business. The CEO said that any impact would be dependent on the extent of TNB’s actual involvement, and it is currently difficult to assess such an impact as TNB itself mentioned that the degree of its participation would depend on returns on investments and government assistance.

Liked our analysis of this AGM? Click here to view a complete list of AGMs we’ve attended »

Dear 5thperson, do note the following statement “The CEO revealed that the company has building a sizable data centre on the land for some time, and that the data centre will commence operations on 22 June 2019.”

The 22 June 2019 date should be the ground breaking ceremony for the 3-acre land to be developed into a new Data Centre, not operations commencement. Nevertheless there is no news or press release from the company on this event yet.

Hi David,

Thanks for pointing this out. We’ve updated the article to reflect this. Thanks for reading!