Established in 1979 and listed in 1996, Kossan Rubber Industries Berhad manufactures gloves, technical rubber products, and cleanroom products such as personal protective equipment, face masks, and safety shoes. It is primarily a glove player with an annual manufacturing capacity of 29 billion pieces of gloves. The majority of its gloves are exported to the developed markets of the U.S., Eurozone, and Asia Pacific.

The Malaysian Rubber Glove Manufacturers Association projects the global glove demand to reach 345 billion pieces in 2020. The market share of Malaysia, Thailand, and China in the glove industry is expected to be 65%, 18%, and 9% respectively.

Kossan is one of the ‘big four’ glove players in Malaysia alongside Top Glove, Hartalega, and Supermax which have largely benefited from COVID-19. Since the beginning of 2020, Kossan’s share price skyrocketed threefold from RM4.16 to RM12.08 year-to-date and its earnings multiple stands at 50.5 at the point of writing. At such a high P/E ratio, does Kossan’s business fundamentals justify such a high valuation?

Here are eight things I learned from the 2020 Kossan Rubber Industries AGM:

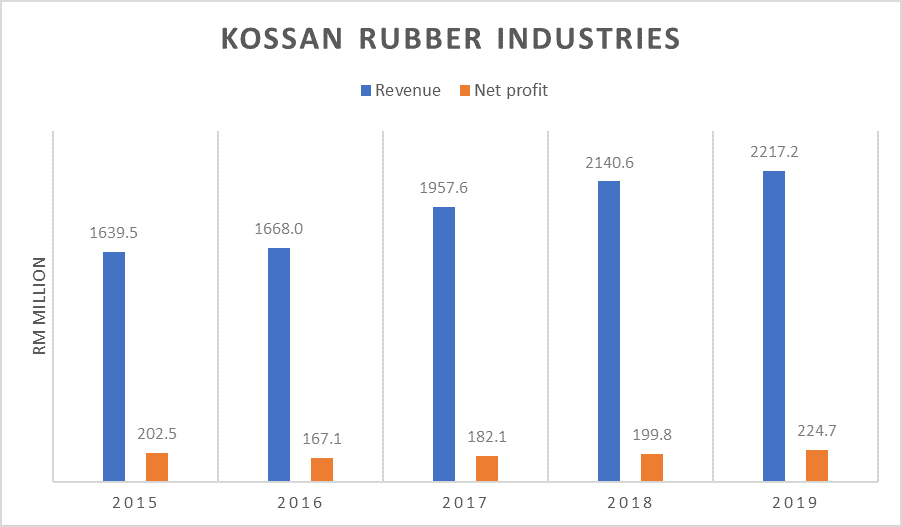

1. Kossan posted a 3.6% year-on-year increase in revenue to RM2.2 billion in 2019 because of stronger demand for gloves. Net profit improved 12.5% year-on-year as a result of improved manufacturing efficiency and effective cost controls.

Kossan is predominantly a glove original equipment manufacturing (OEM) player that derived more than 90% of its revenue in 2019 from this segment. Its own-brand gloves with higher margins accounted for the remaining revenue. It sells own-brand gloves to non-medical sectors only to avoid potential conflict of interests with its clients that operate in the medical sector. Each year, Kossan allocates approximately 5% of its net profit on research and development.

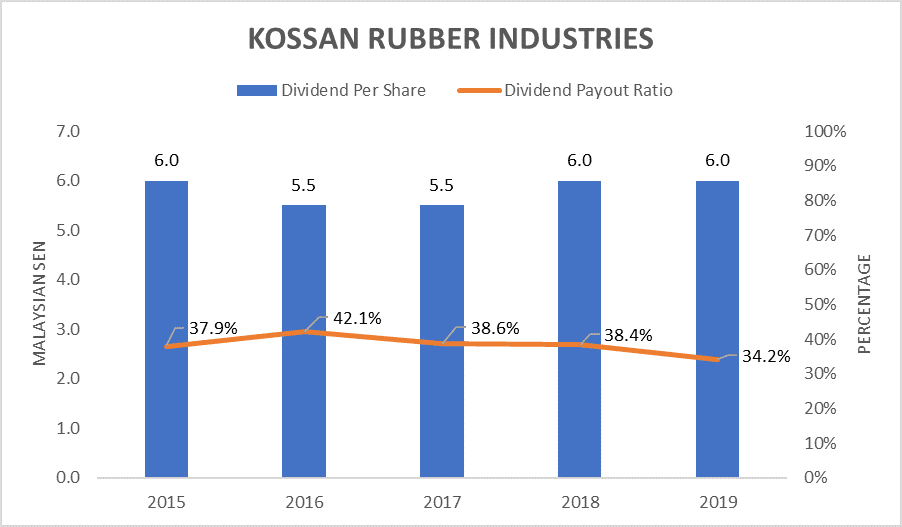

2. Annual dividend per share over the past five years was between 5.5 sen and 6.o sen. Kossan’s dividend payout over past five years was in-line with its dividend payout policy (i.e. to distribute at least 30% of its net profit to shareholders as dividends).

3. The COVID-19 pandemic triggered the panic buying of gloves which has caused the spike in demand for gloves. Minority Shareholder Watch Group (MSWG) raised its concern for a possible oversupply of gloves once the pandemic subsides. CEO Tan Sri Dato’ Lim Kuang Sia did not view it as an issue. He explained that the demand for gloves has been increasing at a rate of 8-10% each year on average in the past 20 years.

He also takes a slightly different view towards the barriers to entry to the mask and the glove industries. It takes a few months and at least two years to set up a mask and a glove factory respectively based on his experience. Therefore, it takes time for glove players to ramp up their manufacturing capacity. Once the pandemic is over, the demand for gloves may return to pre-pandemic levels. However, he also noted that awareness about the importance of wearing and changing gloves frequently has increased.

Kossan has also increased the utilisation rate of its glove factories from 85% to above 90% to support the presently high demand for gloves. The company has its orders secured until the second half of 2021 as a result of the pandemic. Consequently, only a small proportion of its manufacturing capacity was allocated to the more competitively priced spot orders coming from non-medical players and traders in 2020.

4. Kossan has accelerated and embarked on several capacity expansion initiatives to drive greater returns for shareholders. Construction work for its long-term capacity expansion in Bidor, Perak began in early 2020 and the first phase of glove production will start by 2022. In July 2020, Kossan announced that it had entered into a sales and purchase agreement to acquire a piece of freehold industrial land measuring 4.0 hectares in Selangor next to its existing factory for RM40 million. This acquisition will see its glove manufacturing capacity expand by another five billion pieces across its 16 new production lines.

The glove industry also relies a lot on foreign and manual labour at this stage. The CEO plans to slowly wean off the dependence on foreign and manual labour as the company rolls out its automation initiatives progressively and hires more local skilled workers.

5. The CEO foresees at least a 15% year-on-year increase in manufacturing capacity in 2020. Nitrile gloves will still be the main growth driver of the company as it made up 79% of the company’s sales volume in 2019 while natural rubber gloves contributed to the remaining 21%. Generally, the lead time (days between giving a quotation and the delivery of goods) for Kossan ranges between 45 and 60 days. Executive director Lim Siau Tian highlighted that 80% of the gloves Kossan produces are dedicated to long-term clients in the medical sector while the rest are for non-medical use.

6. In line with the 20% increase in average selling prices (ASPs) of gloves in the market, Kossan increased its glove prices in stages of about 5% in June 2020 for its long-term clients. The CEO expects a more substantial increase in the overall ASPs of gloves in the second half of 2020 depending on the supply and demand for gloves.

7. The CEO added that there is an oversupply of natural rubber raw materials in the market as the automotive industry that purchases around 70% of the natural rubber supply to manufacture tyres is in limbo amid the pandemic. Meanwhile, the supply of nitrile raw materials remains stable and its price hit a historical low in May 2020. While there is an acute shortage of nitrile glove supply, he believes that Kossan is able to pass on any cost increases in raw materials to its clients.

8. The CEO was surprised to find out that some glove factories were up for sale at this time given that glove players can profit from COVID-19. Kossan does not rely solely on acquisitions to grow its business as the assets acquired often need to be retrofitted and phased out. Kossan focuses on creating synergies and value when it comes to mergers and acquisitions instead of just increasing its manufacturing capacity.

Liked our analysis of this AGM? Click here to view a complete list of AGMs we’ve attended »