StarHub provides a quad-play service comprising mobile services, pay-TV, fixed broadband and enterprise solutions. It is Singapore’s second largest telecommunications (telco) operator, just behind Singtel.

Operating in Singapore’s highly-saturated mobile market, telco operators have engaged in several price wars over the past few years to attract consumers. Compounded with the limited growth prospects in Singapore’s mature telco market, StarHub’s share price has taken a 49% plunge from three years ago to $1.37 today (as of 28 May 2020).

I attended StarHub’s 2020 virtual AGM to find out how StarHub plans to navigate this competitive telco market and of course, the impact of COVID-19 on StarHub’s business. So here are seven things I learned at StarHub’s 2020 AGM:

1. StarHub’s financials were dismal in FY2019. For context, StarHub reports the revenue of five business segments: Mobile, Pay-TV, Fixed Broadband, Enterprise, and Sales of Equipment. The first four fall under Starhub’s broader business segment of ‘service revenue’, while Sales of Equipment accounts for the sale of mobile handsets and smart home equipment to StarHub’s customers. Service revenue comprised 78% of StarHub’s revenue in FY2019.

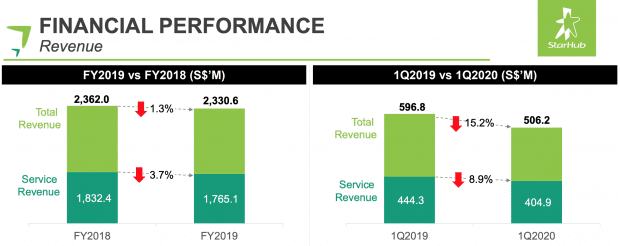

StarHub’s total revenue and service revenue decreased by 1.3% and 3.7% year-on-year respectively in FY2019. This was mainly due to the 7.2% drop in revenue of StarHub’s Mobile segment due to a lower average revenue per user. This is despite the increase in StarHub’s mobile customer base. This just shows how Singapore’s telco market operates — telco operators maintaining their market share by engaging in price competition. This does not bode well for telcos’ profitability in the long run. The Mobile segment is StarHub’s largest business segment by revenue contribution, taking up 36% of Starhub’s revenue in FY2019.

2. Starhub’s Q1 2020 total revenue and service revenue also fell sharply — by 15.2% and 8.9% year-on-year respectively — due to COVID-19. StarHub’s Sales of Equipment segment also decreased by a third as COVID-19 disrupted handset supply chains. Revenue fell by the low to mid double-digit percentages across almost all StarHub’s business segments during this period.

Source: StarHub 2020 AGM presentation slides

3. StarHub CEO Peter Kaliaropoulos addressed concerns about COVID-19’s impact on StarHub’s business. He mentioned how the pandemic has affected StarHub in a number of ways:

- As international travel has come to a virtual halt, StarHub has recorded lower roaming revenues. Migrant workers in Singapore were also not able to purchase pre-paid plans as Singapore entered the circuit breaker. Hence, Starhub’s Mobile segment has been affected.

- Starhub experienced project and tender delays as its commercial customers deferred its spending which has affected Starhub’s enterprise revenue.

- As supply chains were disrupted due to Covid-19, Starhub also faced issues selling its handsets, affecting its Sale of Equipment segment.

4. The CEO then responded to shareholders’ pre-submitted questions on how StarHub is evaluating and responding to the longer-term impact of COVID-19 on its business. He highlighted three key points:

- A disciplined approach to capital management and managing liquidity — StarHub has secured refinancing for bank loans due in 2020, and no further refinancing of loans is required until 2022.

- Digital transformation will be accelerated to support online sales and customer care. StarHub will collaborate with partners to capture growth areas in remote healthcare, education, and other digital services that serve homes and offices.

- StarHub has obtained a 5G provisional licence from IMDA to ensure long-term growth and competitiveness. StarHub’s acquisition of Strateq is also expected to strengthen the telco’s enterprise capabilities, according to the CEO.

5. One bright spot was Ensign, StarHub’s cybersecurity arm, which posted 79% growth in revenue for FY2019 and its first-ever quarterly profit in the Q1 2020. Ensign is a pure-play cybersecurity firm that offers bespoke, end-to-end security solutions to enterprises and governments worldwide. It was formed from a joint venture between Temasek Holdings and StarHub. Ensign has growth opportunities in the following three areas over the next several years:

- Sectoral: The public sector and financial services house very sensitive information that malicious actors would like to get their hands on. So they would continue to spend on security services to be more cyber secure.

- Geographical: According to IMDA, the Asia-Pacific cybersecurity market is expected to expand at a CAGR of 14.6% between 2017 and 2022 — outperforming the global market. Ensign intends to expand its footprint in the region, taking advantage of the huge regional demand for cybersecurity services.

- Technology: With the secular growth towards the cloud and the deployment of 5G networks, being able to secure these environments will be a key priority for governments, businesses and telcos worldwide.

6. StarHub and M1 have no plans to merge presently. As the telco market faces operational challenges, investors queried if a merger with M1 was on the cards. StarHub and M1 have collaborated before, the latest being a successful joint bid for the 5G licence.

The CEO said that ‘mergers depend on market conditions, are subject to regulatory approvals, and driven by value creation requirements for stakeholders.’ Both StarHub and M1 will continue launching ‘their own offerings and solutions for customers with separate go-to-market strategies.’

StarHub’s 5G partnership with M1 should not be an indication for future plans for merger; it was done to allow cost sharing on rolling out the 5G radio network infrastructure.

7. StarHub is yet to be awarded the full 5G licence as there are further technical details to be discussed with IMDA. StarHub will only offer guidance on its 5G plans and investments once the full 5G licence has been awarded. 5G network-related investments will be shared with M1 to optimise infrastructure and spectrum costs. 5G will be an enabler for new technologies like virtual reality, augmented reality, real-time data analytics, and Internet of Things. This will help accelerate Singapore’s digital economy and smart nation initiatives by creating an ecosystem for combining 5G, devices, apps, data analytics, and AI.

Investors raised concerns about the impact of StarHub’s 5G investments on its cash flow and dividends. The CEO replied that StarHub’s net debt-to-EBITDA remains healthy at 1.4 as at 31 March 2020. StarHub’s free cash flow has also improved 5.6 times to S$118.9 million in Q1 2020 from S$21.4 million in Q1 2019.

Regarding its dividend, StarHub has withdrawn its FY2020 guidance due to uncertainties brought about by COVID-19. Guidance will be updated once there is greater visibility on the aggregate nature of COVID-19’s impact.

Liked our analysis of this AGM? Click here to view a complete list of AGMs we’ve attended »