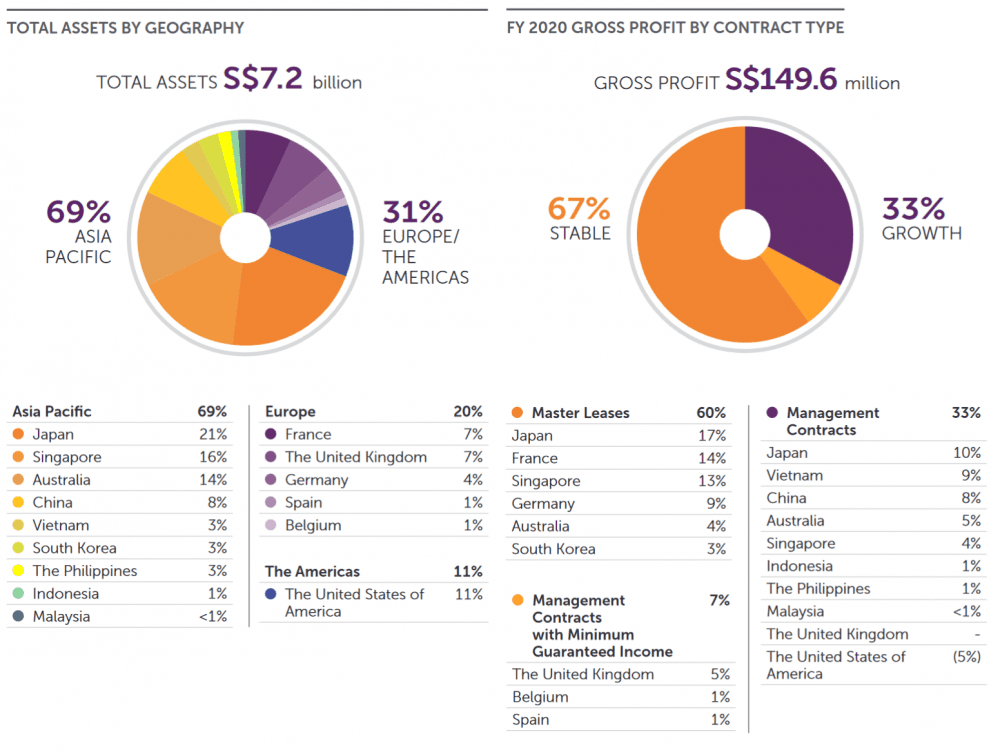

Ascott Residence Trust (ART) is a hospitality trust in Asia Pacific with an asset value of S$7.2 billion as at 31 December 2020. ART’s international portfolio comprises 86 properties with more than 16,000 units in 38 cities across 15 countries in Asia Pacific, Europe, and the United States. ART invests primarily in serviced residences, hotels, rental housing properties, student accommodation and other hospitality assets.

2020 was an unprecedented year as global visitor arrivals fell by more than 70% due to border closures caused by the COVID-19 pandemic. This had a significant impact on the hospitality industry as losses in international tourism receipts totaled US$1.3 trillion.

Unsurprisingly, ART’s FY2020 business and financial performance were not spared. At its latest AGM, CEO Beh Siew Kim reviewed ART’s 2020 performance, its response to challenges brought about by the pandemic, and its developments ahead.

1. Due to the impact of COVID-19, ART’s revenue and gross profit for FY2020 declined 28% and 41% year-on-year to S$369.9 million and S$149.6 million respectively. Distributable income also declined 43% to S$94.2 million, while distribution per stapled security (DPS) fell 60% to 3.03 cents y-o-y.

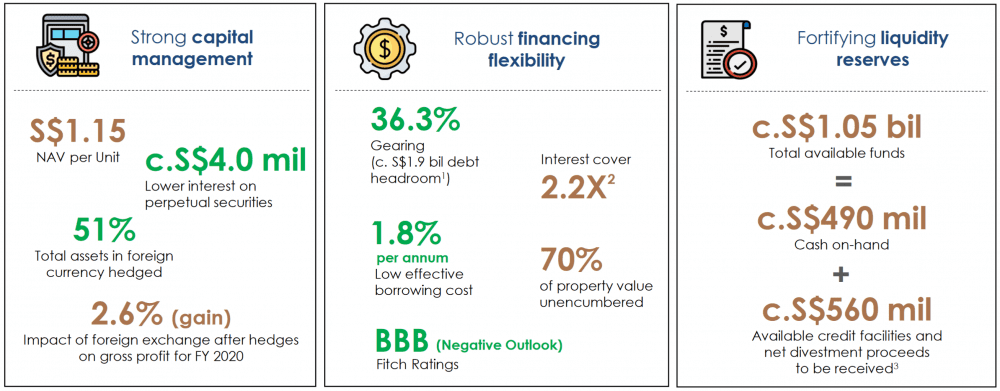

On a positive note, despite declines in international business arrivals, the CEO said that ART’s properties continue to generate positive cash flow, due to a base of long stays, master leases, and minimum guaranteed income contracts. ART also distributed S$45 million of past divestment gains to unitholders to mitigate the pandemic’s impact on distributions.

2. ART is expanding its presence in Sydney’s business sistrict through the acquisition of Quest Macquarie Park Sydney, a freehold service residence that provides rental income under a master lease arrangement. In Singapore, portfolio enhancements are ongoing with the development of lyf one-north Singapore, a co-living property; and Somerset Liang Court Singapore, a 192-unit Somerset serviced residence.

ART unlocked a cumulative divestment value of S$570M in proceeds from completed and ongoing divestments, achieving a net gain of S$216 million. The CEO said these divestments provide enhanced liquidity, flexibility to paydown debt, and recycle capital into higher yielding assets.

3. Geographical diversification, longer duration properties, and master leases enabled ART to tide through the uncertain recovery of COVID-19. The CEO shared that ART’s presence in 15 countries and more than 30 cities as well as the Trust’s longer stay lodging assets provided income stability through master leases and minimum guaranteed income contracts.

Approximately 69% of ART’s portfolio is in Asia Pacific, with master leases in Japan, Singapore, and South Korea providing downside protection. Longer stay properties in China, Malaysia, Philippines, and Vietnam continue to generate positive operating cashflow, while properties in Australia and Singapore secured block bookings.

Properties in Europe which accounted for 20% of the portfolio’s value were impacted by the pandemic during the year. Properties in Europe are predominantly under master leases or minimum guaranteed income contracts.

Eleven percent of ART’s portfolio of properties are in the U.S. Three properties in New York have been hard hit by the pandemic due to the lack of international travel. ART also pursued alternative long stays and residences leases, securing businesses from frontline essential workers and government block bookings to replace the lack of leisure and corporate travels.

4. The CEO said that the Trust has about a billion of available funds comprising cash, credit facilities and divestment proceeds to cover three years of fixed costs. She added that ART manages its risks well with diversified sources of funding, successfully refinanced its debt due in 2020, has a well-staggered debt maturity, and maintained an investment grade rating of BBB. NAV per unit stood at S$1.15, gearing at 36.3% with S$1.9 billion of debt headroom, and interest cover at 2.2 times (as at 31 December 2020).

5. ART stepped up efforts towards sustainability and the ‘greening’ of its portfolio of properties. In 2020, the Trust obtained green certification for 15 properties and increased its portfolio of green properties by about four times. It is also the first hospitality trust in Singapore to secure a green loan and will use its maiden green loan of S$50 million to finance its first development project and co-living property lyf one-north.

The CEO said ART aims to progressively contribute to the targets set out under CapitaLand’s 2030 sustainability master plan and added that various initiatives are in place to educate its staff, tenants, and guests in going green.

6. In response to COVID-19, ART prioritized safety and health, pursued alternative sources of business, and streamlined operations. ART deployed service robots, self-check-in kiosks, and 3D virtual tours to minimize physical contact at its properties.

Accommodation was also provided to healthcare personnel, persons on quarantine and those affected by border shutdowns. Apartments in about 40 ART properties were reconfigured into alternative locations for professionals and students to work-from-home or study. Rental relief was granted to some lessees, while a revised rent structure and extension of leases by another 2-3 years was applied to expired master leases in France.

7. ART is pivoting towards longer stay accommodation for income stability. At the start of 2021, ART acquired its first student accommodation asset, Signature West Midtown, in Atlanta, Georgia in the U.S. As part of its expanded investment mandate, the CEO explained that the student accommodation asset class offers a new platform for growth and is counter-cyclical as students tend to invest in education during a downturn. Rental housing and multi-family properties were also some of these longer stay properties mentioned as the Trust focuses on building a larger proportion of longer stay accommodation.

8. A unitholder asked about the performance of ART’s geographical markets — which performed better, which less so, and which properties were temporarily closed? ART’s response was that COVID-19 had impacted each market to varying degrees. The pace of recovery varies across countries and is dependent on the easing of travel restrictions.

China and Vietnam, which have longer average length of stay, have been more resilient and performed better in FY2020. Properties traditionally dependent on transient travelers, such as Japan and the U.S. have been more impacted.

A recovery pattern is being observed in large domestic markets that include Australia, Japan, and Malaysia. There is notable pent-up domestic demand as movement restrictions are eased, supported by a higher take-up in vaccines and the reopening of borders. Europe is expected to take a longer time to recover as lockdown measures have been re-introduced in some countries experiencing a resurgence.

Operations at 10 ART properties (five in France, two in Japan, one each in Belgium, Spain, and South Korea) were temporarily ceased to consolidate resources (as at 31 December 2020). Several of the properties are on master leases and ART continues to receive rent even when they are closed. The properties will be progressively reopened depending on market conditions.

The fifth perspective

Ascott Residence Trust’s geographical diversification and income through master contract leases enabled it to weather the pandemic. While its financial performance was badly hit, unitholders would have appreciated the distribution of S$45 million from past divestment gains.

ART’s response throughout the pandemic year has been encouraging through achieving various firsts in 2020:

- It made its first foray into student accommodation in its pivot towards longer stay assets for income stability.

- It is the first hospitality trust in Singapore to obtain a green loan, reflecting the Group’s commitment and strides towards sustainability.

- It was successfully included in the FTSE EPRA Nareit Global Developed Index in 2020, broadening ART’s reach to institutional investors globally and enhancing the trading liquidity of its shares.

ART’s prudent capital management, strong cash position, and focus on longer stay accommodation assets to enhance the income stability will help to cushion the impact from the absence of international and transient travellers in the near term.

However, the Trust’s performance in the longer term will be largely dependent on the easing of travel restrictions. According to the UNWTO, international arrivals are expected to decline about 85% in the first quarter of 2021 before a potential rebound in the second half of the year. A full recovery to pre-pandemic levels could take 2.5 to 4 years.

ART is hopeful that advancements in vaccine deployment will help to uplift consumer and business confidence, spurring the quicker reopening of global travel lanes to meet the demand for travel once again.

Liked our analysis of this AGM? Click here to view a complete list of AGMs we’ve attended »