Fraser & Neave Holdings Berhad (F&NHB) was founded in 1883 as a carbonated soft drinks producer by John Fraser and David Chalmers Neave. Listed on Bursa Malaysia, the company today owns a number of well-known household beverage and dairy brands like 100PLUS, F&N SEASONS, and FARMHOUSE.

While the company maintains leading positions in the carbonated soft drink, tea, and canned milk segments in Malaysia as well as the sweetened condensed and evaporated milk segments in Thailand, its recent five-year growth was lacklustre. At the same time, the company’s venture into the dairy farming business did not pan out as planned.

Here are eight things I learned from the 2021 F&NHB AGM and EGM:

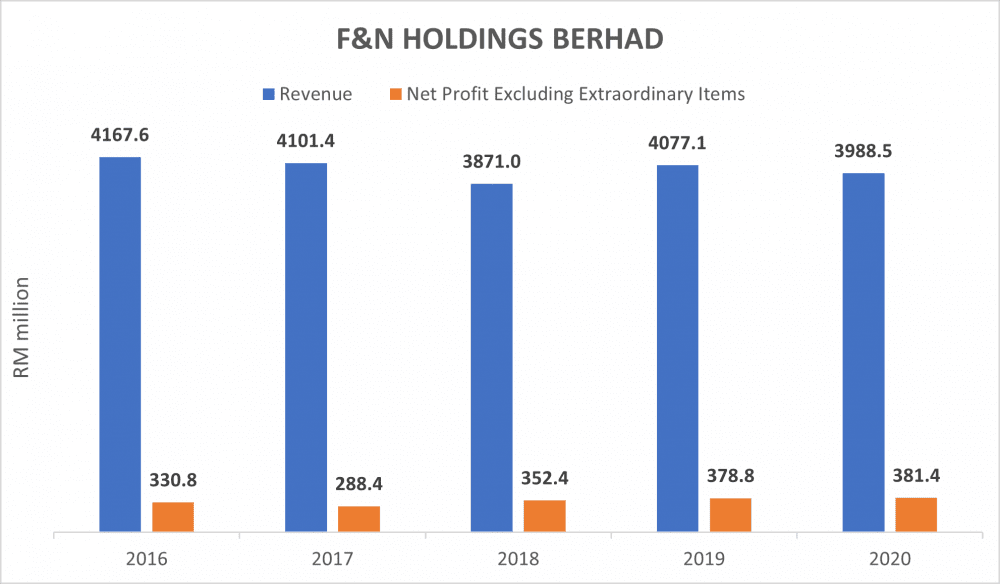

1. Revenue decreased by 2.2% year-on-year to RM4.0 billion in 2020 while net profit excluding other and finance income rose by 0.7% over the same period. Over the past five years, revenue growth was rather flat. Revenue growth was partially aided by the strengthening Thai baht against the Malaysian ringgit while net profit grew at a compound annual growth rate of 3.6%. Overall, its financial performance was satisfactory as the company was not affected much by the COVID-19 pandemic in 2020.

2. The Employees Provident Fund highlighted that the number of shares granted under the share grant plan approved in 2012 stood at just 1.2% of the total issued shares of F&NHB. Company secretary Timothy Ooi commented that the relatively low grants were performance-based and in line with the company’s performance. CEO Lim Yew Hoe further explained to shareholders that the share grant plan serves as a tool to reward and retain employees while aligning the interests of shareholders and employees.

3. The company tried to diversify into related businesses including the dairy farming operations. The acquisition of Ladang Chuping fell through as Lim shared that the company could not complete the lengthy processes to acquire it within the specific time frame. It was mentioned in the news that F&NHB was not given the green light from the Ministry of Economic Affairs to proceed with the land acquisition. Therefore, the vendor, MSM Perlis Sdn Bhd chose not to extend but rescinded the agreement instead. Lim added that the company is still sourcing for new pieces of land to restart its dairy farming business given its higher profit margins than that of the beverage segment.

The company also completed the RM60-million acquisition of three food and beverage (F&B) companies, namely Sri Nona Food Industries Sdn Bhd, Sri Nona Industries Sdn Bhd, and Lee Shun Hing Sauce Industries Sdn Bhd using internal cash. These companies manufacture, distribute, and sell a wide variety of F&B including ketupat (rice cakes) and oyster sauce. These acquisitions will serve as a growth area for F&NHB in the halal food segment.

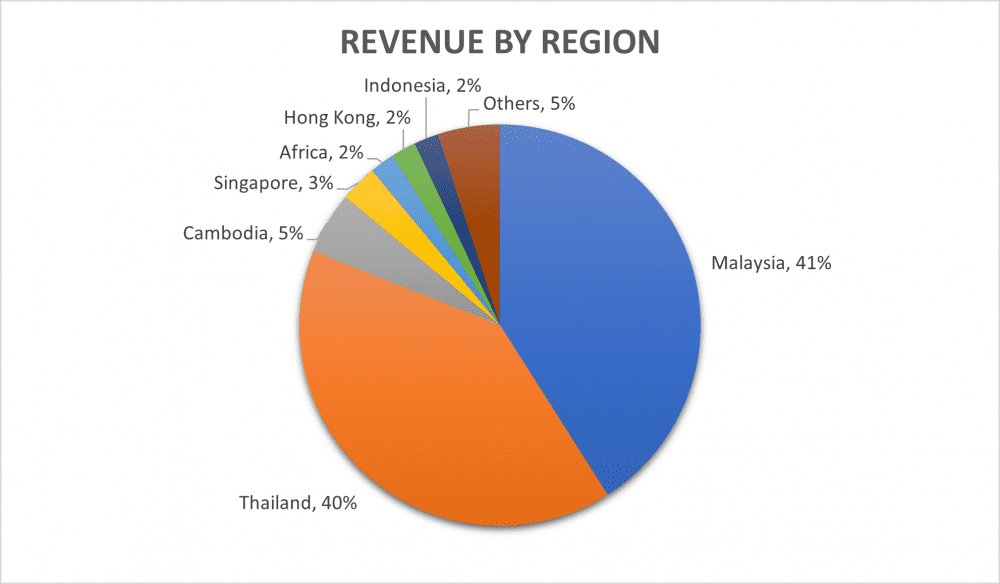

4. In 2020, the operating margin of the company’s Thailand business stood at 19.6% compared to its Malaysia operations at 7.1%. The margins of the beverage and condensed milk businesses in Malaysia are less desirable as a result of stiff competition.

On the other hand, the Thailand operations are solely dairy-focused. They are able to scale the business without incurring too much capital. The contribution of the exports business to revenue has increased from 11.4% in 2015 and to around 20% in 2020. The amount fell short of its RM800-million target due to the pandemic. The company plans to set up more regional offices in China and Southeast Asia to expand its exports business.

5. The company rolled out its e-commerce platform, F&N Life, in January 2020. The platform was scaled up in March 2020 during the Movement Control Order (MCO) period in Malaysia and plans are being incubated to develop the app into a lifestyle ‘super app’ that includes food recipes and fitness elements. A relevant fulfilment centre was opened in Kuala Lumpur in January 2021. F&NHB continues to work with other e-commerce giants such as Lazada, Shopee, Tmall, and JD.com to sell its products to a wider audience.

6. F&NHB’s wholly-owned subsidiary, Lion Share Management Limited, disposed its TEAPOT trademark to a related company that is wholly owned by its substantial shareholder, Fraser and Neave Limited, for RM83.2 million. According to Ooi, the transfer allows F&NHB to focus on its core competencies (i.e. to distribute and sell its products in key markets, while the TEAPOT brand will be managed by Fraser and Neave Limited together with other related brands as a whole.)

7. F&NHB aims to source at least 20% of its energy requirements from renewable energy by 2022. It embarked on a number of solar roof projects across four of its plants in Malaysia and Thailand.To date, the company has spent 30 million baht on a solar photovoltaic system in Thailand and has committed to invest another RM30 million in several solar roof projects in Malaysia. Ooi responded to Minority Shareholder Watch Group that the payback period of these investments will not exceed 10 years.

8. To meet the bulk purchase demands of F&B manufacturers, the company also sells its products in different sizes. This initiative helps its customers save time and manpower, and reduce costs and waste. As consumers are getting more health-conscious, the company also added many healthier variants of products to its portfolio including 100PLUS Zero and F&N ICE MOUNTAIN Sparkling with no sugar.

The fifth perspective

The company also faces fierce competition in the beverage market, and it has to evolve to meet the needs of more health-conscious consumers today. F&NHB’s current share price has hovered above RM30 in January 2021 which translates to a dividend yield of about 1.9%. While F&NHB pays a steady dividend, I would seek a higher yield as an income investor.

Liked our analysis of this AGM? Click here to view a complete list of AGMs we’ve attended »