CapitaLand Integrated Commercial (CICT) is the largest REIT in Singapore and the third largest REIT in Asia Pacific. As of 31 December 2021, it owns a portfolio of 11 retail malls, 7 office buildings, and 5 integrated developments in Singapore and Germany valued collectively at S$22.5 billion.

CICT is primarily exposed to the Singapore economy as 95.7% of its revenue streams originate from the country. I attended CICT’s recent annual general meeting to learn more about its past year’s performance and its outlook ahead as Singapore emerges from the pandemic. Here are eight things I learned from the 2022 CapitaLand Integrated Commercial Trust AGM.

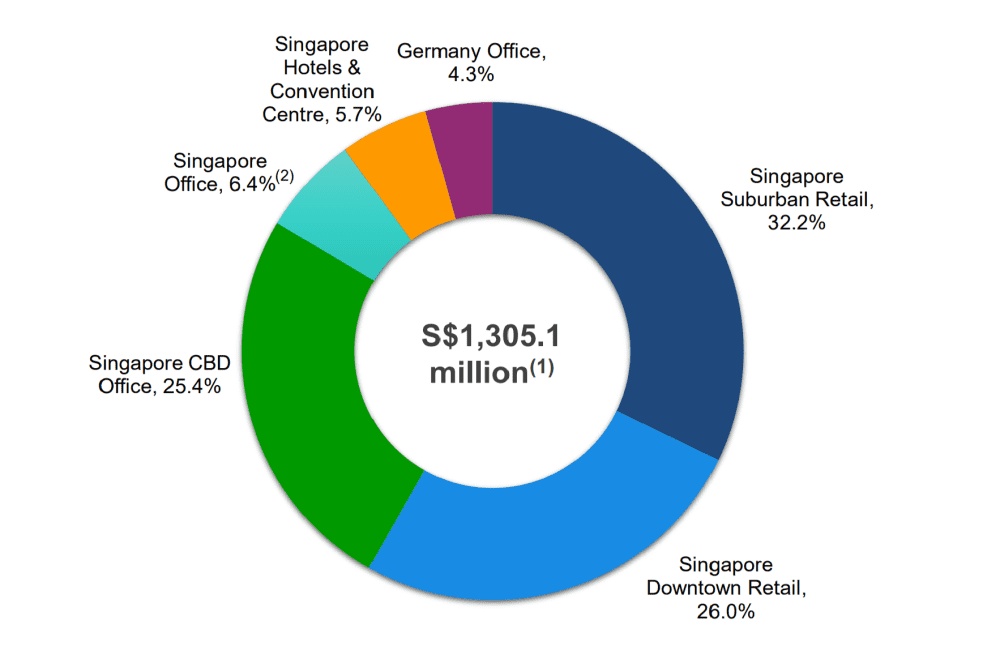

1. Gross revenue grew 74.6% to S$1.3 billion and net property income (NPI) grew 85.5% to S$951.1 million in FY2021. The increase in revenue and NPI is due to CICT’s enlarged portfolio following the merger of CapitaLand Mall Trust (CICT’s predecessor) and CapitaLand Commercial Trust. CICT’s revenue is primarily diversified across the Singapore retail and office sectors, with a small contribution from Germany.

2. Distributable income grew 82.6% to S$674.7 million, while distribution per unit (DPU) increased 19.7% to 10.40 cents in FY2021. The reason for the smaller percentage increase in DPU is due to the issuance of new units for the merger which enlarged the total unit base. CICT’s current distribution yield is 4.9% (as of 26 April 2022).

3. Gearing ratio is 37.2% as of 31 December 2021, well below the regulatory limit of 50%. Average cost of debt is 2.3% and average term to maturity is 3.9 years. Eighty-three percent of CICT’s debt is at fixed interest rates which will provide stability in the current rising interest rate environment. The management shared that for every 0.1 percentage point increase in interest rates would result in S$1.48 million of estimated additional annual interest expenses. The estimated impact on DPU would be negative 0.02 cents.

4. Portfolio occupancy rate is 93.9% as of 31 December 2021. The retail and office portfolio occupancy rates are 96.8% and 91.5% respectively. Monthly shopper traffic at CICT malls remain in line with that of FY2020 but is still only 61.9% of FY2019. On the other hand, retail tenant sales have recovered to 87.8% of FY2019’s monthly average.

Shopper traffic and tenant sales are expected to improve as Singapore recently announced the major easing of pandemic restrictions. CEO Tony Tan added that downtown malls will benefit more from the reopening compared to suburban malls, as workers return to downtown offices and more tourists gradually arrive in Singapore.

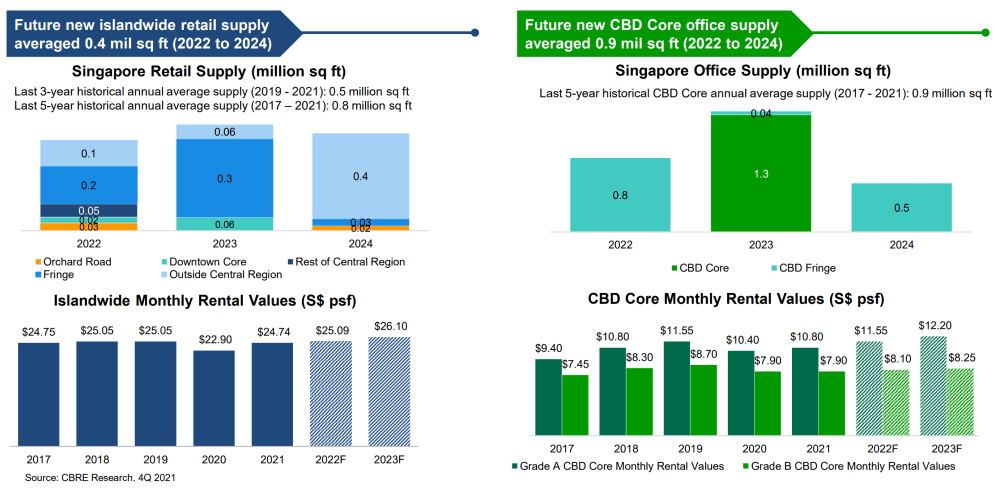

Retail and office supply in Singapore remains limited in the near term and rents are projected to increase for both retail and office sectors.

5. The CEO that the enhancement of a property can also benefit its surrounding buildings. For example, the reopening of the new Funan mall in 2019 led an uplift in shopper traffic to nearby Raffles City. This positive effect is also seen at other CICT clusters including Plaza Singapura with the Atrium@Orchard, and Bugis Junction with Bugis+. Close proximity with sister malls can also offer cross-marketing opportunities to increase shopper traffic within the cluster.

6. A unitholder asked if the work-from-home trend would lead to dampening effect on office rents in Singapore. The CEO replied that the flexible working arrangements are here to stay for the medium term, but no one can really tell for the long term. He added that some tenants have reduced their office footprint due to the work-from-home trend, but new demand will come in to replace the gap due to the limited supply in Singapore.

7. In Singapore, CICT completed the divestment of One George Street and JCube in December 2021 and March 2022 respectively. It also completed the acquisition of a 70% interest in 79 Robinson Road in April 2022. The CEO said that CICT continually evaluates the best use of a property and will divest it when it has reached an ‘optimum’ level for divestment and there is no longer a case for redevelopment. At the same time, with every divestment comes the need to reinvest the capital in higher yielding properties.

8. CICT completed the acquisition of two Australian properties, 66 Goulburn Street and 100 Arthur Street, in March 2022. Another Australian acquisition, 101-103 Miller Street Greenwood Plaza, is expected to complete in the second quarter of the year. This marks CICT’s first foray into the Australian market.

The CEO shared that CICT will increasingly look to foreign markets for growth opportunities as Singapore is limited in size. Outside Singapore, Germany and Australia will be CICT’s immediate focus as CICT has already established a presence in these two countries. However, Singapore will remain CICT’s core market and comprise at least 80% of its portfolio in the medium term.

The fifth perspective

This year marks the 20th year of listing for CICT. With the reopening of Singapore’s economy and the relaxing of borders restrictions, the outlook looks optimistic for CICT as it marks two decades. As the one of the largest REITs in Asia Pacific, CICT has the scale and resources to capture growth opportunities in Singapore and abroad.

Liked our analysis of this AGM? Click here to view a complete list of AGMs we’ve attended »