Heineken Malaysia Berhad, a brewery that specializes in the marketing and sale of beer within Malaysia, was founded in 1964 and became a publicly listed company on Bursa Malaysia the following year. The company boasts an impressive portfolio featuring renowned brands such as Heineken®, Tiger Beer, Guinness, and Anglia.

After two years of challenging business conditions due to the pandemic, Heineken Malaysia achieved a record financial year in 2022. Here are eight things I learned from the Heineken Malaysia AGM.

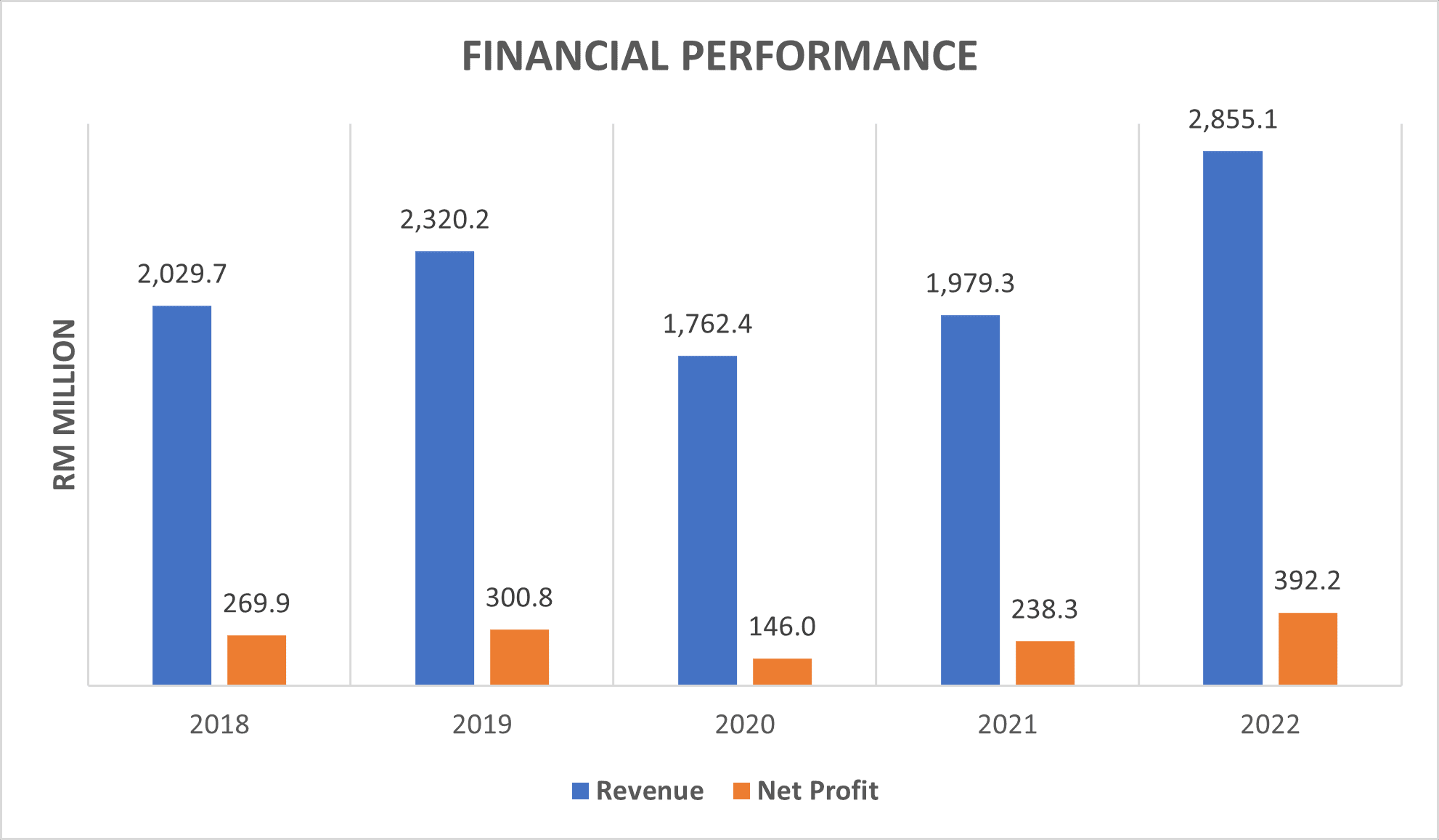

1. Driven by heightened sales volume and the surge in pent-up demand following the reopening of Malaysia’s international borders, Heineken Malaysia witnessed a remarkable 44.2% year-on-year increase in revenue, reaching RM2.9 billion in 2022. This remarkable growth was further facilitated by an improved sales mix, with a notable increase in the sales of premium beer, prominently led by the popularity of Heineken®. Additionally, the company implemented price increases on their products in 2022. Due to commercial sensitivity, the management opted not to disclose the revenue breakdown by brand category and specific cost management initiatives.

| Year | 2018 | 2019 | 2020 | 2021 | 2022 |

| Dividend per share | 94 sen | 108 sen | 51 sen | 81 sen | 138 sen |

As seen in the chart and table above, Heineken Malaysia’s financial performance surpassed its pre-pandemic levels across metrics including revenue, net profit excluding other income, and dividend per share. This was despite higher raw material costs in 2022.

2. Revenue in Q1 2023 grew 6.0% year-on-year to RM740.2 million because of price adjustments and a better sales mix driven by the premium portfolio. Net profit decreased 3.0% year-on-yearto RM109.9 million in Q1 2023 because of higher promotional and marketing expenses as well as a shorter sell-in period for Chinese New Year 2023.

3. The alcohol-free brew segment is an emerging category that is steadily gaining momentum. Managing director Roland Bala acknowledges the potential of this segment in Malaysia, drawing insights from the success of similar products in developed markets worldwide. He believes in the importance of providing consumers with freedom of choice and ensuring the availability of alcohol-free brews as part of the company’s product offerings. This perspective aligns with the growing trend of consumers seeking alternative options and healthier alternatives, creating opportunities for the alcohol-free brew segment in the Malaysian market.

4. According to Bala, the demand for beer during the pandemic primarily originated from off-trade channels, including supermarkets, convenience stores, and sundry stores. Following the pandemic, there is still a notable demand for beer from off-trade channels, as many consumers prioritize convenience in their purchasing decisions. However, as customers gradually return to on-trade outlets such as pubs, clubs, restaurants, and food courts to socialize, these establishments are experiencing a recovery in business. This indicates a positive trend for on-trade businesses as consumer behaviour evolves and the desire for in-person experiences and social interaction re-emerges.

5. The convenience store franchise chain FamilyMart made the decision to discontinue the sale of alcohol in Malaysia. This move has raised concerns among shareholders, as there is a worry that other competitors in the market may also follow suit. It’s worth noting that alcohol sales have only made a small contribution to the overall revenue of FamilyMart Malaysia. Chairman Dato’ Sri Idris Jala provided reassurance to the concerned shareholder by highlighting that the company has experienced a consistent increase in historical sales volume. He further emphasized that while there may be shifts in demand between different channels and retailers, the overall demand for beer is expected to remain steady.

6. The chairman revealed that Heineken Malaysia sources its primary ingredients, namely barley and hops, from Europe, Australia, and the United States in a sustainable manner. However, the company encountered supply chain disruptions and cost increases due to global geopolitical conflicts. To address this challenge, Heineken Malaysia leverages the global procurement arm of its parent company, allowing them to obtain volume discounts and thereby mitigate the impact of cost increases. This strategic approach helps the company navigate the complexities of the supply chain and maintain a more stable cost structure.

7. The majority of the brewer’s capital expenditure is focused on production and capacity expansion. In 2022, spending on property, plant, and equipment reached its peak at RM170.5 million. However, it is anticipated that these expenditures will normalize in the subsequent years, starting from 2023.

8. The management of Heineken Malaysia is actively working on building and enhancing its business-to-consumer e-commerce platform, Drinkies, with the aim of creating a sticky experience for consumers. As part of this strategy, the company has partnered with approximately 250 bars, known as Star Bar partners, on Drinkies. Through this collaboration, consumers have the opportunity to purchase vouchers at favorable rates and redeem their preferred beers later at any Star Bar outlet. Additionally, consumers can earn coins on the Drinkies platform, which can be used to redeem more beer. While the impact of these initiatives is yet to be fully realized, the management is optimistic about their potential.

Similar anticipation applies to the Heineken BLADE, a plug-and-pour gadget that dispenses fresh beer in quantities of up to 10 litres, designed to last for a month. This innovative mobile draught system targets smaller consumer bases in bars, pubs, and even home parties. While the impact of this initiative is still to be observed, it is seen as a promising venture for Heineken Malaysia.

The fifth perspective

As we navigate the endemic period and witness the gradual return of international tourists, the short-term outlook for Heineken Malaysia appears promising. However, it is important to consider the global headwinds that may pose challenges. Ongoing geopolitical tensions can result in supply chain disruptions, while inflationary pressures may impact consumers’ disposable incomes.

On a local level, the growing conservatism within the country and an operational environment that may lack business friendliness should be taken into account. Despite these factors, Heineken Malaysia can continue to capitalize on its strong brand equity as a means to drive growth in the market.

Liked our analysis of this AGM? Click here to view a complete list of AGMs we’ve attended »