3 important things to consider when investing in 2017

Happy new year, everyone!

When we look back at 2016, we can see that it was a pretty eventful year for investors. Amid a slowing global economy, we saw China’s stock market bubble burst, oil prices crash, the introduction of negative interest rates in Japan, a growing 1MDB scandal, a surprise Brexit referendum, and the shock election of Trump – each event causing volatility for markets around the world.

So as we head into 2017, what are the macro-events that could affect our investments in the coming year? While there are many things that could happen (and some no one would be able to even predict), here are three main things we at The Fifth Person are looking at when investing in 2017:

1. Rising interest rates

On December 14, the U.S. Fed finally raised interest rates for only the second time in a decade. The 0.25% increase was widely expected, however, the Fed also revealed that it plans three more interest rate hikes in 2017.

While there’s no guarantee that the Fed will indeed follow through on its plans, the prospect of much higher interest rates in the coming year is something that we as investors have to consider.

How will this affect your investments? A higher interest rate obviously means that it is more expensive for companies to borrow money. Here are some things to look at when analysing a company:

- What is its debt/equity ratio?

- What is its average debt maturity?

- What proportion of their loans are on fixed interest rates vs floating interest rates?

- If interest rates do hike three times in 2017, can the company afford the higher cost of borrowing?

2. Rising U.S. dollar

A by-product of higher interest rates is a stronger U.S. dollar as more capital flows into the country to take advantage of the higher interest.

How will a stronger U.S. dollar affect companies?

- A stronger U.S. dollar is good news for companies that export to the American market as their products will become cheaper for US consumers and businesses.

- A stronger U.S. dollar is bad news for companies that import from the American market as their costs of doing business increase

- U.S. companies that earn income overseas are likely to face a forex loss when they convert their foreign-currency earnings back to U.S. dollars.

- Foreign companies that earn income in U.S. dollars are likely to see a forex gain when converting that U.S.-dollar income back to their home currencies

- Foreign investors (like us) that own U.S. stocks or stocks denominated in U.S. dollars will also enjoy a forex gain when converting our holdings back to our home currency

Because of the strengthening U.S. dollar, the Chinese yuan also lost 7% of its value against the greenback in 2016. While China likes to keep its currency cheap, a fast depreciating yuan will trigger capital outflows which will threaten the country’s economic growth. The Chinese government has stepped in to stabilise the yuan by using its foreign exchange reserves, imposing new rules on yuan transfer, and expand its currency basket (which is used to value the yuan) to reduce the weighting of the U.S. dollar.

This isn’t just about the U.S. dollar, though. By extension, forex changes are something we always need to consider whenever we invest in foreign markets like Hong Kong, Malaysia, Thailand, etc.

3. Market P/E

The U.S. stock market has been on a massive bull run since 2009 after the Great Recession. The Dow and S&P 500 are at all-time highs and investors are waiting with bated breath to see if (or when) the Dow will hit 20,000 points for the first time in its history. It went as close as 19,974 in December.

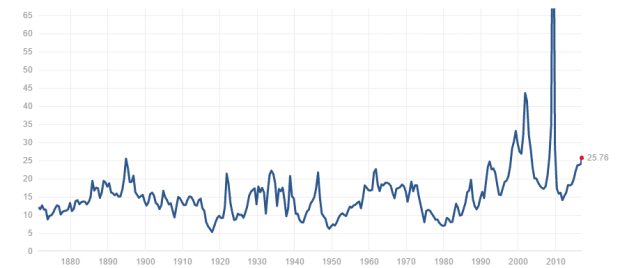

From a valuation perspective, the U.S stock market is on the high side as well. The Dow and S&P 500’s current P/E ratios are at 21.22 and 25.76 respectively.

S&P 500 P/E ratio 1871-2016. Source: Multpl

Historically, as you can see from the chart above, the S&P 500 usually hits a range of 20-25 before correcting downwards. Of course, you also see the index rising above 25 times earnings during extreme bubbles before crashing back down. We won’t know for sure just how much higher the index can climb, but is the U.S. stock market expensive by historical measures? It sure is!

Knowing this, it makes sense to be cautious when investing in the U.S. market when prices and valuations are so high. It is much harder to find opportunities in an expensive market.

In comparison, Hong Kong’s Hang Seng Index’s P/E ratio is at 10.86. The Hang Seng’s historical average is 12.5. The Hong Kong market is relatively cheap and it is a lot easier to look for bargains there – which is why we are more focused on Hong Kong at this point.

As an investor, it’s useful to know the overall valuation of the market you’re investing in to get a gauge of where prices are.

The fifth perspective

So there you have the three main macro factors we consider when we look for markets and companies to invest in. Besides this, of course, the fundamentals of a company must still pass our criteria before we jump in — whether it’s a value-growth stock, deep value stock, dividend stock, or REIT.

So as we move into 2017, we’d like to thank you for being a reader of The Fifth Person, and we look forward to sharing more of our investment ideas and analysis, so you can make better, more profitable investment decisions in the year to come!