3 investment strategies that might do better than dollar-cost averaging

Dollar cost averaging has been around for a long time and has this is a commonly adopted practice among both retail and professional investors.

What is Dollar Cost Averaging?

Dollar cost averaging is a strategy where the investor places a fixed dollar amount into an investment vehicle (stocks, bonds, mutual funds, etc.) on a regularly recurring schedule, regardless of the share price.

Dollar cost averaging “forces” the investor to follow a disciplined method when making investments. Due to the fixed dollar (total) amount invested each time, the investor will buy more shares when the market is lower and fewer shares when the market is higher.

However, are there other strategies apart from dollar cost averaging that we should know:

1. Lump Sum Investing

Lump sum investing involves parking a significant size of our portfolio into an investment vehicle at once, instead of putting in bit by bit on a regular basis. (Of course, this is assuming that the investor starts with a significant sum to invest, then he/she is faced with deciding how to best deploy that sum)

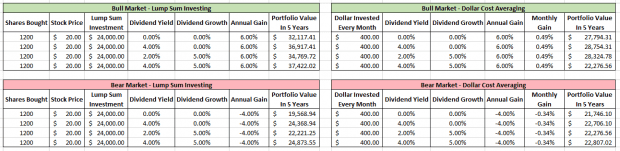

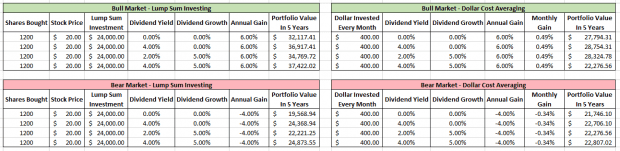

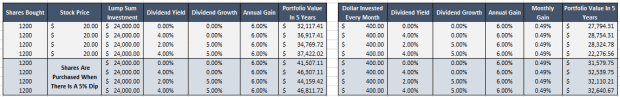

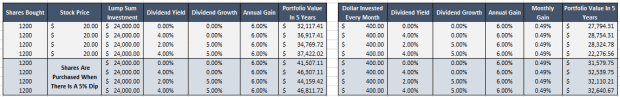

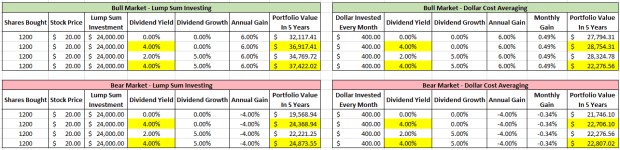

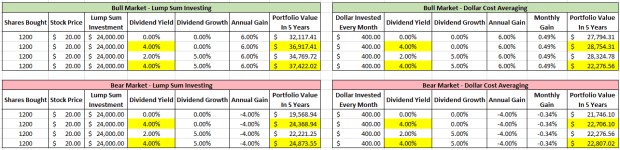

A comparison of lump sum investing vs. dollar cost averaging

Investor Takeaway: For stocks that pay a significant dividend, or have significant annual dividend growth, investing a lump sum at the beginning of the period beats the dollar cost averaging strategy, even in a sustained down market.

2. Value Averaging

Value Averaging is a strategy where the investor sets a fixed growth rate for the portfolio and adjusts the periodic additions to the portfolio to keep the growth of the portfolio constant. In other words, the investor calculates the predetermined amount for the value of investments in future periods, and makes an investment accordingly for each future period.

If the portfolio falls in value from one period to the next, the investor makes a larger contribution. If the portfolio rises in value above the target rate, the investor makes a smaller contribution.

By following this strategy, the investor buys more shares when shares are cheaper and fewer shares when the shares are expensive.

This strategy is a bit more complex to manage, as it requires the investor to track the portfolio performance and calculate the contribution needed for the next period to maintain a constant growth in the value of the portfolio. It might also require large periodic additions of capital during falling markets, i.e. “catching the falling knife”.

Bull Case

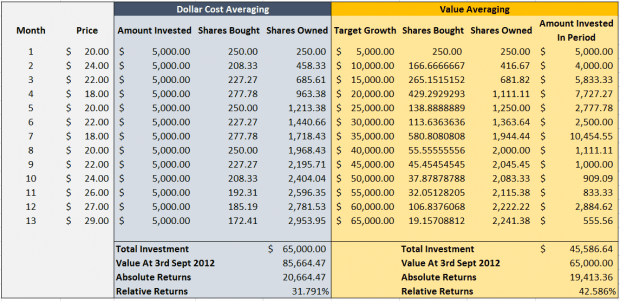

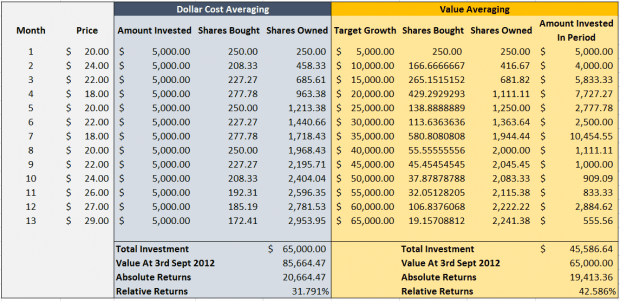

A comparison of value averaging vs. dollar cost averaging (bull case)

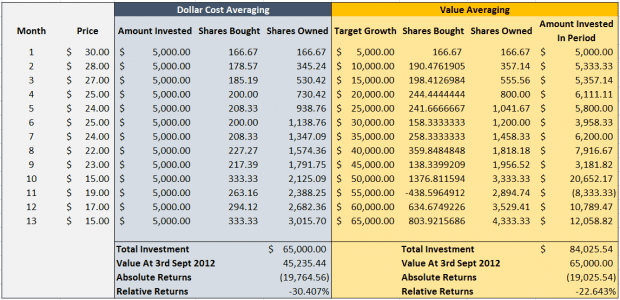

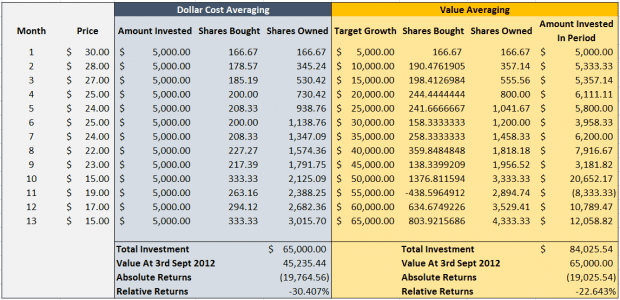

Bear Case

A comparison of value averaging vs. dollar cost averaging (bear case)

Investor Takeaway: The value averaging strategy can provide a much greater return to the investor than a dollar cost averaging strategy even though the total number of shares purchased is lower and the total amount invested is less.

3. Buying the Dip

The “buy the dip” strategy requires the investor to follow his target stocks and/or funds in order to make investments when the valuations have dropped. The investor would increase positions to capitalise on an expected upswing after a stock has shown a significant dip in price. It is basically like buying shares at a discounted sale price, but this strategy also requires utmost patience and discipline.

A comparison of buying the dip (left) vs. dollar cost averaging (right)

Investors Takeaway: Buying the dip allows investors to time their lump sum and periodic investments while waiting for a more favourable price.

Conclusion

Dollar cost averaging works, but under limited conditions. Dollar cost averaging works best in a down market with stocks that pay no dividend or only a small dividend.

If we have the capital available to make a lump sum investment, particularly with stocks that offer a significant dividend yield, then lump sum investment will beat dollar cost averaging under most conditions. (See below)

In addition, if we have a steady stream of investable income, value averaging or buying the dip are more lucrative investment strategies too.