I always hesitated to attend Berkshire Hathaway’s annual shareholders meeting for many years for one simple reason: Berkshire’s meeting always clashed with the bulk of local AGMs in Singapore – many of which I attend. But finally, I decided to head to Berkshire’s meeting this year on an invitation from my friend, Mark, who advised me to do so before Buffett kicks the bucket (hopefully not anytime soon!).

So I flew all the way to Omaha, Nebraska to attend probably the longest AGM I’ll ever sit through (over seven hours long — and I arrived two hours earlier to get good seats) and, undoubtedly, the best one I’ve experienced thus far. Warren Buffett and Charlie Munger answered questions with immeasurable clarity and wisdom – much of which could be applied not only to investing, but life as well. The duo also share a great sense of humor and are highly entertaining, which is perhaps the reason why I wasn’t much at all surprised when many of the people I met there told me they’ve been attending Buffett’s annual meetings for the last ten to twenty years.

My tag for Berkshire Hathaway’s annual meeting 2016.

With prices for hotels and accommodation spiking during the weekend the meeting is held, flying into Omaha from our neck of the woods can easily set you back a few thousand dollars. Which is why the irony wasn’t lost on me when the one year I finally decided to pay homage to Buffett in person, he decides to stream Berkshire’s annual meeting live on the internet for the first time. (You can watch a replay of the event for the next 30 days after the meeting.)

Fortunately (for me), what wasn’t captured on the live stream were some really good video snippets about Berkshire’s portfolio that were played before the meeting started. Trust me, the videos were extremely entertaining and humorous! Each video sent the crowd in the stadium into hoots of laughter and amusement. You really have to be there to witness the electricity and energy in the atmosphere.

So if you didn’t have the privilege of being there live, here are 33 quick things I learned from Berkshire Hathaway’s annual shareholders meeting. I strongly encourage you to watch the replay of the meeting because nothing, including this article, is better than watching the event yourself.

- Warren Buffett is 85 years old this year and his right-hand man, Charlie Munger, is 92. Despite their age, the pair show no sign of slowing down and are still extremely alert and mentally active. Here is a video I recorded of . (Buffett has a mean right hand.)

- Ignore short-term fluctuations in earnings and focus on normalized earnings. Many publicly-listed companies continue to fall into the trap of focusing on growing short-term profits quarter to quarter at the expense of long-term profitability. Buffett believes its wiser to focus on creating sustainable operating earnings and normalized earnings are a better indicator of long-term performance.

- Berkshire has shifted from an asset-light to asset-heavy business model. Buffett concurred with a shareholder who pointed out that the Berkshire has invested in companies that require a lot of capital, are over-regulated, and earn a lower return on invested capital. Berkshire Hathaway Energy and BNSF Railway are perfect examples of capital-intensive businesses in Berkshire’s portfolio. Buffett said that the ideal business is the one that requires no capital reinvestment but is yet able to grow and return excess capital back to shareholders every year. See’s Candies and Buffalo Newspaper are two companies that require little capital and yet continue to produce ample amounts of cash. But Buffett pointed out that it is no longer easy to find companies like that – and especially one that’s large enough to match Berkshire’s size.

BNSF Railway’s booth at the exhibition hall.

- Buffett and Munger are paying more attention on selecting businesses that have superior management. In the old days, Buffett always chanted the mantra of buying a business that even an idiot could run because sooner or later, an idiot will. This, however, doesn’t seem to apply for Precision Castparts, a recent acquisition that requires remarkable managers (in this case, Mark Donegan) to run the organization. Munger believes that as the world changes, it is necessary for Berkshire to revise their strategies. This also explains Berkshire’s shift to more capital-intensive companies.

- When asked about what they would do differently in life if they were to start afresh, Buffett said he would never start a textile business (Berkshire was originally a textile business) while Munger said he would wise up earlier in life. He humbly responded: “Now that I’m 92, I still have a lot of ignorance left to work on.”

- Reinsurance businesses are potentially going to face heavy competition in the next ten years. There are also limitations on what reinsurance companies can do with their float (compared to Berkshire which can buy stocks, companies, etc.). As a result, Berkshire fully divested its holdings in Munich Re and Swiss Re last year.

- Online retailers like Amazon have significantly disrupted the traditional retail industry and will cause more disruption in the future. According to Buffett, the full implications are yet to be seen and many traditional retailers have not figured out a way to ride on the e-commerce trend or counter it. However, Buffett isn’t all too perturbed by e-commerce as Berkshire is not tied to any specific industry. Munger also thinks that Berkshire’s biggest retailers (i.e. Walmart, Costco, etc.) are so strong that they’ll be among the last to be hurt.

One of the Walmart’s supercentres in Omaha. It’s HUGE; economies of scale at play.

- Just like a kid who drinks soda is happy, drinking a can of Coca-Cola can make you happy too. And if you’re happier, you are likely to live longer. That’s according to Buffett as he said he gets a portion of his daily calories from Coke and jokingly admitted his body is made of ¼ Coke. He also pointed out the consumption must be moderate to avoid obesity. This point is in response to critic who said Coke has negative health effects and questioned the ethics of Berkshire being a major shareholder of Coca-Cola.

- Berkshire would never engage in derivatives that involve collateral. Buffett thinks derivatives are a potential time-bomb and remain a danger to the financial system. Munger thinks it is best not to use them (though they have profited from using derivatives in the past).

- BNSF Railway is a business that Berkshire bought at an attractive price and an investment that Buffett would consider holding forever. However, coal volume is expected to decrease and over a 20-year period, Buffett expects a 57% reduction in coal fire output that would gradually decrease earnings over the years from coal shipments.

- When it comes to stock investing, Buffett recommends investors to get in the mental frame of mind of buying a business and not even have to look at its share price for the next five years. Don’t concern yourself with people making fast money or hitting the jackpot with IPOs. People win the lottery every day but that is no reason to be affected. Most importantly, you don’t want to get involved in a stupid game just because it’s available.

“You don’t get a quote on your farm every day, or every week, or every month. You don’t get it on your apartment house, if you own one. If you own a McDonald’s franchise, you don’t get a quote every day. You want to look at your stocks as businesses and think about their performance as businesses.” – Warren Buffett

- Berkshire would grow much bigger than it is today 49 years from now but the percentage gain wouldn’t be as fast as when the company was young according to Munger.

- Buffett does not think Clinton or Trump winning the US presidential election will have any impact on Berkshire’s businesses. He believes company ‘will do just fine’ after the election.

“We’ve operated under price controls. We’ve had 52% federal taxes applied to our earnings for many years. They were higher at other times but we’ve had regulations come along and in the end, business in this country has done extraordinarily well for a couple of hundred years and it has adapted to the society and the society has adapted to business. This is a remarkably attractive place in which to conduct a business.” – Warren Buffett

- The float in any insurance company may be classified as a liability on its balance sheet but it is in fact a huge asset for Berkshire. Float is the amount of insurance premiums collected but not yet paid out in claims. As a result, the accountant treats them as a liability. However, Buffett uses the float to invest and generate investment returns and is therefore considered a huge asset.

- Berkshire’s stock would be worth less if it is broken up by an activist investor. However, Buffett argued that it would be difficult to split Berkshire’s portfolio of companies as it is not easy to get so much cash today due to the size of Berkshire. An activist typically breaks up a conglomerate only if the stock trades at a significant discount. It is something that Berkshire’s shareholders need not worry about even after Buffett passes as his estate will continue to hold the largest stake in Berkshire for some time.

- Buffett has publicly stated in the past he would do a share buyback if Berkshire’s share price trades at 1.2 times book value or lower. Berkshire’s P/B is currently around 1.39 and Buffett mentioned that he would consider doing a share buyback at prices higher than 1.2 book value if he can no longer find attractive investment opportunities to allocate capital.

- The aircraft leasing business is a scary one. It is especially dangerous using short-term cash to finance long-term assets that leave a huge residual risk.

- Valeant Pharmaceuticals’s business model is enormously flawed and the management lacks integrity according to Buffett. Munger himself has publicly criticised the company and has said that Valeant’s business plan is ‘deeply immoral’. Famed activist investor Bill Ackman (who I had the pleasure to meet at the meeting) has a heavy stake in Valeant through his hedge fund Pershing Square Capital Management. Valeant’s share price has tumbled 90% in a year after short sellers targeted the stock.

“If you’re looking for a manager find someone that’s intelligent, energetic, and integrity. And if they don’t have the last, make sure they don’t have the first two.” – Warren Buffett

Photo of me and Bill Ackman. Bill Ackman has been actively defending his position in Valeant. Wish you all the best, Bill!

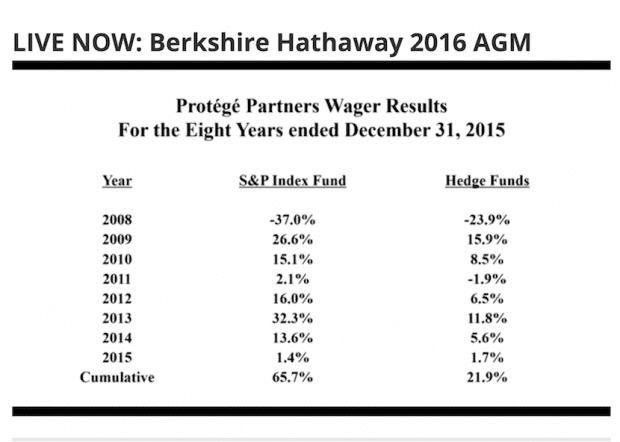

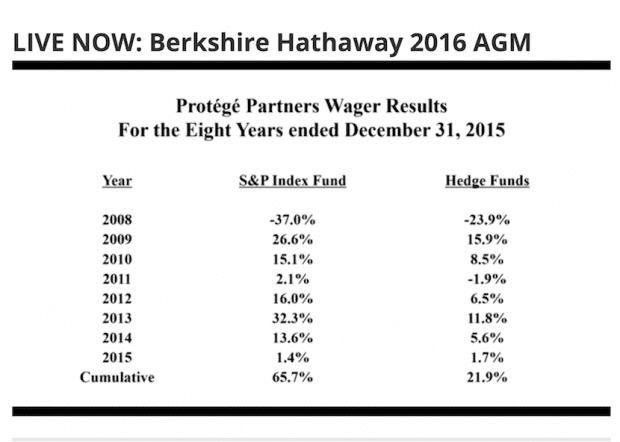

- Passive index funds like Vanguard’s S&P 500 ETF continue to outperform hedge fund managers. Buffett pointed out that the culprit for underperformance of hedge funds lies in their fees that erode investor returns when fund managers are paid 1.5-2% regardless of performance. In this case, it is a terrible result for the hedge funds’ clients but not a terrible result for the hedge fund managers! Passive funds, on the other hand, incur relatively little fees (just 0.05% in the case of Vanguard’s S&P 500 ETF).

Data used by Buffett during the AGM.

- Buffett subtly recommended the book Where are the Customers’ Yachts? by Fred Schwed. He read the book when he was ten years old. The lesson – Your brokers/consultants get rich but you get broke (if you listen to them) – has been told in this book since the 1940s.

- Credit rating agencies don’t understand Berkshire’s portfolio of diversified businesses that consistently generate stable operating earnings. However, Buffett did point out what keeps him awake at night, or the main underlying risk for Berkshire, comes from any CNBC (chemical, nuclear, biological and cyber) attack on the United States. As technology has improved, the ability for psychotic people to do mass damage has increased significantly. He worries about it as his insurance businesses would probably be hit the hardest but no one really knows what the odds of an attack happening are.

“If you were a psychotic back far enough you’d throw a stone at the guy in the next cave and it would sort of limit a relationship with damage due to psychosis and that went along through bows and arrows and spears and cannons and various things and in 1945 we unleashed something like the world had never seen and that is a popgun compared to what can be done now. There are plenty of people that would like to cause us huge damage…”

“If I knew how to reduce the probabilities of the CNBC-type mass attack, if I knew how to reduce the probability by five percent, all my money would go to that, no question about that.” – Warren Buffett

- Buffett doesn’t prioritise gender diversity when choosing whom to serve as a director for Berkshire. Instead, he focuses on finding people who are business-savvy, shareholder-oriented, and have a special interest in Berkshire. In that note, Buffett warned investors to be wary of listed companies that get ‘big names’ for its board of directors citing Theranos as an example: Three former members of presidential cabinets, two former senators, and two retired military officials who have little relevant expertise for the company’s success.

- Companies that carry out share buybacks at high valuations clearly demonstrate poor capital allocation behaviour. Often times, the buyback mandate will be justified as a way to prevent dilution during the annual meeting and shareholders tend to vote in favor of the resolution. However, Buffett pointed out this has nothing to do with preventing dilution. He said, “Dilution by itself is a negative and buying back your stock at too high a price is another negative. It has to be related to valuation and, as I say, you will not find a lot of press releases about buybacks that say a word about valuation.”

- Berkshire Hathaway’s business model is about the allocation of capital and thus offers great flexibility in responding to any change in business trends. Buffett pointed out that Sequoia Fund got too entrenched in Valeant as it accounts for more than 30% of Sequoia’s portfolio. As a result, Sequoia’s performance mirrors a pharmaceutical company. It’s important to take note of this if you’re managing your money and to diversify your stock holdings. It’s normal to have a company affected by industry factors but you have the flexibility to adjust your portfolio and adapt to any change in trends.

“For one thing, one big advantage we have is that we didn’t ever see ourselves as starting out in one industry. We went into department stores but we didn’t think about ourselves as department store guys. We didn’t think of ourselves as steel guys or tyre guys, or anything of that sort. We’ve thought of ourselves as having capital to allocate. If you start within a given industry, you focus and spend your whole time working on a way to make a better tyre or whatever it may be.”

“I think it’s hard to have the flexibility of mind that you have if you just think you have a (hopefully) large and growing pile of capital and trying to figure out what the next best move is that you can make with that capital. I think we do have a real advantage that way, but I think Amazon’s got a real advantage, too.” -Warren Buffett

- Buffett and Munger are always interested in studying the details of any business they plan to buy. Just like many people like to look at the details and statistics of a baseball game, the duo always try to know as much as they can about the microeconomic factors of any investment. Munger said that business and microeconomics are sort of the same term.

“Micro-economics is what we do and macro-economics is what we put up with.” – Charlie Munger

- Buffett and Munger have personal investments outside of Berkshire. Munger personally owns Costco stock while Buffett owns a REIT — Seritage Growth Properties. As a rule of thumb, Buffett said he would stay away from any investment that could cause any potential conflict of interests with Berkshire. Seritage REIT has a market cap at less than $2 billion and is considered too small for Berkshire in any case.

- Know what you can’t do and stay away from it. Buffett and Munger believe if you can just follow this simple principle and have the right temperament, a combination of patience and opportunism, you’ll do fine with your investments.

“You do not need IQ in the investment business that you need at certain activities in life but you do have to have emotional control.” – Warren Buffett

- Investing is more than a science, it is also an art. Buffett said no amount of due diligence can definitely predict if a business or its management will continue to perform well in the future.

“Assessing the probabilities of business threats being a minor problem, or a major problem, or a life threatening problem – it’s a tough game but that’s what makes our job interesting.” – Warren Buffett

- The low interest rate environment causes an investment to cost more than when interest rates are high. Low interest rates typically mean cheap money chasing very few good investments. As a result, the deal tends to be more expensive.

“A bird in hand is worth two in the bush. But a bird in hand now is worth about nine-tenths of a bird in the bush in Europe (due to negative interest rates).” – Warren Buffett

- There is no one-size-fits-all incentive plan for all companies. For example, GEICO doesn’t tie its incentives entirely to profits. To qualify for an incentive, one must work for more than a year and as one climbs the ladder, the incentive has a multiplier effect. There are also two variables that will determine an employee’s bonus compensation: profits and strategies that help to grow the business. This way, executives don’t have to worry about long-term plans that are beneficial for the company hurting profitability in the short-term and, thus, their compensation. In certain cases, Buffett lets executives decide the compensation plan that makes the most sense for them and the company.

“If you reward somebody with some share of the profits and the profits are being reported using accounting practices that cause profits to exist on paper that aren’t really happening. In terms of underlying economics then people are doing the wrong thing and it’s endangering the bank and hurting the country and everything else. That was a major part of the cause of the Great Financial Crisis – the banks were reporting a lot of income they weren’t making, and the investment banks were too.”

“We want it simple and right and we don’t want to reward what we don’t want. Those of you with children, just imagine how your household would work if you constantly rewarded every child for bad behaviour. The house would be ungovernable in short order.” – Charlie Munger

- Walmart is likely to see higher payables days and a lower cash conversion cycle. Walmart is getting of a lot of pressure competing with Amazon and one of the things the traditional retailer did was to request its suppliers to extend its payable days. While Walmart may have successfully reduced its working capital, that move shouldn’t change the underlying economics — that Amazon is disrupting the retail industry.

- Real estate market is not as attractive as it was in 2012. Buffett pointed out there are certain properties that are being sold today at very low cap-rates (property yield) and even if one can borrow money cheaply at lower than the cap rate, it is great temptation to invest but still not wise.

- Buffett would not mind paying to have his current job. Would you pay to have your current job? This is a good psychological question to ask whether you love your job and the people you’re working with. As the late Steve Jobs once said: “The only way to do great work is love what you do.” Warren Buffett undoubtedly passes the test. This is the reason why Buffett is so good at what he does and if you’ve not found your passion, keep searching for it.

Tq Rusmin for this write up. Interesting read. You mentioned that Buffet bought a REIT using his personal account. I am just wondering why he should be buying a REIT, which might not generate better returns than if he were to invest directly in the operating business? His partner invested in Costco which is a direct operating business.

You’re welcome!

Unfortunately, the question asked during the meeting was about how Buffett prioritizes between personal investments and Berkshire’s. He didn’t explain why he invested in the REIT.

good stuff

great job rusmin 🙂

“Real estate market is not as attractive as it was in 2012. Buffett pointed out there are certain properties that are being sold today at very low cap-rates (property yield) and even if one can borrow money cheaply at lower than the cap rate, it is great temptation to invest but still not wise.”

nice.

Thanks SMK! 🙂

Interesting article. I was in Omaha too in that year. By the way, i couldn’t click the underlined statement for video of Buffett throwing newspaper. Do you have direct link for me to click?

Hi Tony,

Yup, here’s the link: https://fifthperson.wistia.com/medias/vp9zopmngb

hi is it easy to get to omaha from singapore for the berkshire AGM?

also will the proxy form from our local brokerage firm reach us on time to confirm the attendance of the AGM?

It would be a really long flight to reach Omaha. You can take a direct flight to San Francisco but you still need transit to Omaha. I encourage you to book in advance.

For the AGM tickets, I got it from my friends. You just need to own a few B shares and there are instructions you need to follow to get them to send you the tickets.

https://www.theinvestorspodcast.com/how-to-attend-the-berkshire-hathaway-annual-meeting/