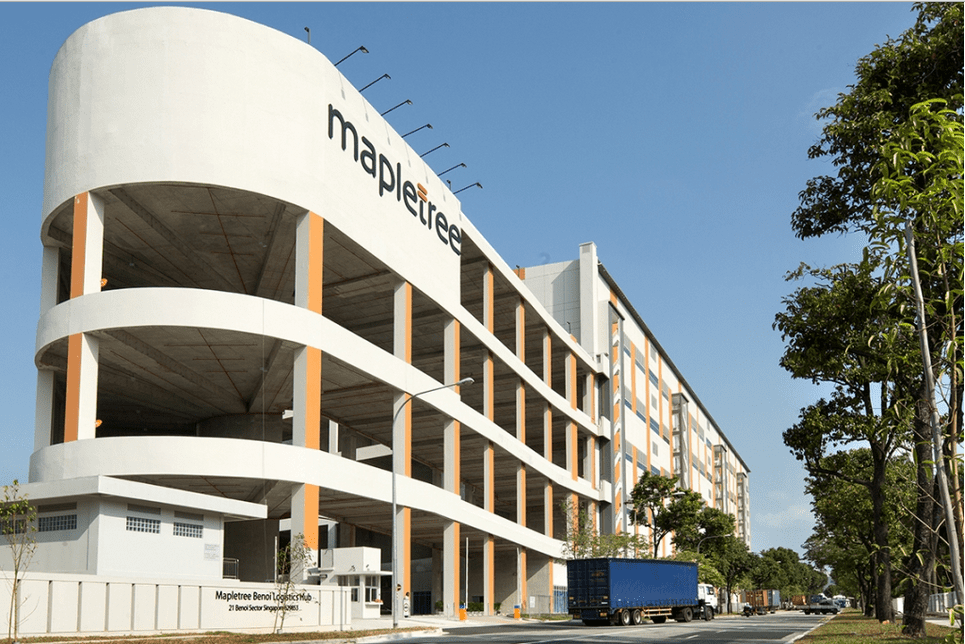

Photo: Mapletree Logistics

Singapore has a high level of corporate transparency and one minority shareholder pointed out during the AGM that Mapletree Logistics should disclose the remuneration of key managers to promote better overall standards of corporate governance.

Chairman Paul Ma, however, rejected his suggestion and said disclosing the remunerations of individual employees do not affect the fees charged to the REIT anyway. Simply put, the remunerations have nothing to do with the REIT. When the shareholder continued to press his point, Ma boldly replied:

“There is a difference between transparency and nosiness.”

Loud laugher was heard after the chairman made his remark. He continued:

“If the remuneration is charged to the REIT, then there is no qualm about it. If it’s not affecting the REIT, then there is no need to (disclose).”

According to this recent Business Times article — Check out REIT manager’s fee, not just dividend — Mapletree Logistics Trust has among the top five highest fees paid relative to its revenue. Its chairman, however, urged everyone to look beyond the surface as the operations, challenges, and costs vary among each REIT. For example, Mapletree Logistics is the only REIT that has a presence in eight markets each with its own operating costs compared to a REIT that’s only operating in one market.

Not wanting to be seen as avoiding the question, CEO Ng Kiat broke her silence on issue of remuneration toward the end of the Q&A:

“In life, we do not just work for the salary or money. It is the challenges we hope we can achieve for the vision of the portfolio. The team looks beyond salary compensation.”

It was rousing enough for the audience as a round of applause was heard when she finished her speech and when the chairman candidly told her she would no longer go to him for a pay raise!

Besides that, Mapletree Logistics’ AGM this year was kicked off with comprehensive presentations by three lady directors: CEO Ng Kiat, CFO Wong Mei Lian, and Head of Asset Management Chen Tze Hui. Their presentation slides can be viewed online.

Moving on, here are…

8 Quick Things I Learned from Mapletree Logistics’ AGM 2015:

- If you had invested in Mapletree Logistics Trust since its IPO in 2005, your return on investment would be 75%. However, this takes into account riding through the 2008/9 financial crisis. If you’d invested during the heart of the crisis instead, your return on investment would have tripled by now (though this with the benefit of hindsight!).

- Mapletree Logistics doesn’t just own assets located in Singapore. Its total revenue is contributed from multiple countries: Singapore (46%), Japan (20%), Hong Kong (14%), South Korea (9%), China (6%), Malaysia (5%), and Vietnam (<1%). This diversification of Mapletree Logistics’ assets and revenue reduces geographic risk and gives the REIT better degree of dividend sustainability. Mapletree Logistics’ overseas expansion also allows the REIT to position themselves for the regulatory challenges of owning local industrial assets and the risk of tenants moving out of Singapore to save on operating costs.

- Mapletree Logistics entered its 8th market in Australia through the acquisition of a freehold cold-store warehouse operated by a blue-chip tenant, Coles Supermarkets. A unitholder was concerned about the acquisition’s low property yield (5.6%) compared the portfolio’s overall yield (5.9%). CEO Ng Kiat believes the acquisition will eventually be yield accretive due to built-in annual rent escalation in the mid-term. Besides the asset is 100% occupied and boasts an extremely long weighted average lease expiry of 19 years – which increases the portfolio’s revenue predictability.

- Mapletree Logistics is interested in entering the India and Indonesia markets but has no presence there as of yet. The title of land ownership is highly ambiguous in these two countries and Mapletree Logistics will stay away until they find a partner who reduce or remove this key risk.

- By diversifying their assets into multiple countries, it also means Mapletree Logistics has smaller foothold in each country. This means the REIT might not compete as effectively (in terms of economies of scale) with rivals who have their assets concentrated in one country. For example, Mapletree Logistics only owns one warehouse property in Vietnam and Australia. The chairman argued that the REIT can continue to grow with support from their sponsor who has a strong presence in Vietnam. A case in point, Mapletree Logistics started with one asset in South Korea and grew it to 11 properties over the years. In Australia, the chairman believes it is a good start and the REIT will not stop at just one asset.

- Mapletree Logistics’ reported gearing is at 34.3% but investors should note that this figure is not inclusive of the perpetual bonds Mapletree Logistics has issued that have an annual interest of 5.35%. Why is this debt not included in the gearing ratio? This is due to accounting treatment which allows perpetual bonds to be treated as equity because they have no maturity date. To be conservative, it is better to take the perpetual bonds into account and Mapletree Logistics’ true gearing becomes 41.5% instead.

- 80% of Mapletree Logistics’ total debt is successfully hedged and have fixed interest rates. This allows the REIT to have a higher degree of certainty in its distribution per unit.

- With the ongoing effort by the Singapore government to make industrial rents more affordable, recent land tenders only offer a 20-year lease. The relatively short lease is a major concern for investors in industrial REITs. With shorter land leases, there will be lower capital appreciation and might turn off some tenants from renting the land to build their factories, warehouses, etc. So is this a concern for Mapletree Logistics? Let’s take a look at its portfolio of assets:

From the table above, the majority of Mapletree Logistics’ leases expire beyond 30 years and should not be a concern for the near future. According to CEO Ng Kiat, there are two assets that have their leases expiring next — one in 11 years and another in 17 years. And these assets will be divested if the opportunity arises.Lease Expiry (Years) % of Net Tangible Assets No. of Assets < 30 13 18 31-60 55.7 54 > 60 4.3 7 Freehold 27 38

Love these summary updates on companies? – Get more AGM updates from your favorite companies here.