ComfortDelGro Corporation Limited (CDG) is an integrated transport service provider with operations in Singapore, United Kingdom, Australia, China, Vietnam, and Malaysia. Its four key segments — public transport, taxi, automotive engineering, and testing services — contributed over 97% of its 2018 revenue.

Most people know CDG as a taxi business that is being disrupted by ride-hailing platforms like Grab and Gojek. I had a similar impression until I did a deeper dive into the company’s business model. In reality, 70% of CDG revenues come from its majority stake in public transport operator SBS Transit, with a meagre 20% coming from its namesake taxi business. In fact, most of the acquisitions CDG made in 2018 were bus companies.

With this more accurate view of CDG’s business, I attended its 2019 AGM for insights on the company’s prospects. Here are eight things I learned from the 2019 ComfortDelGro AGM:

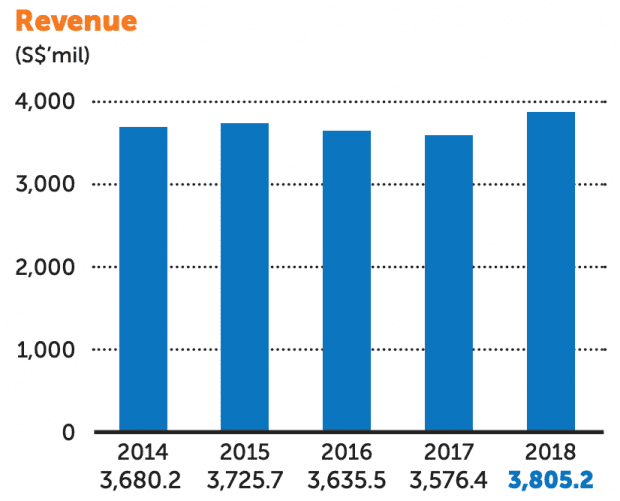

1. CDG’s revenues increased 6.4% year-on-year to S$3.81 billion in 2018, while profits were up marginally to S$303.3 million. The surge in revenues was caused by a string of acquisitions that were completed in 2018. The largest of these acquisitions was Buslink, an Australian bus company that was acquired for A$190.9 million. Observant readers might have noticed that CDG’s 2017 revenues were reported as S$3.97 billion and not the S$3.58 billion as shown in the 2018 annual report. Due to the adoption of a new accounting standard — SFRS(I) 15 Revenue from Contracts with Customers — CDG’s past revenues were adjusted downwards. On the profit side, the company’s taxi and automotive engineering segments posted their second consecutive profit decline in three years. However, strong performance from the company’s public transport segment made up for the drop.

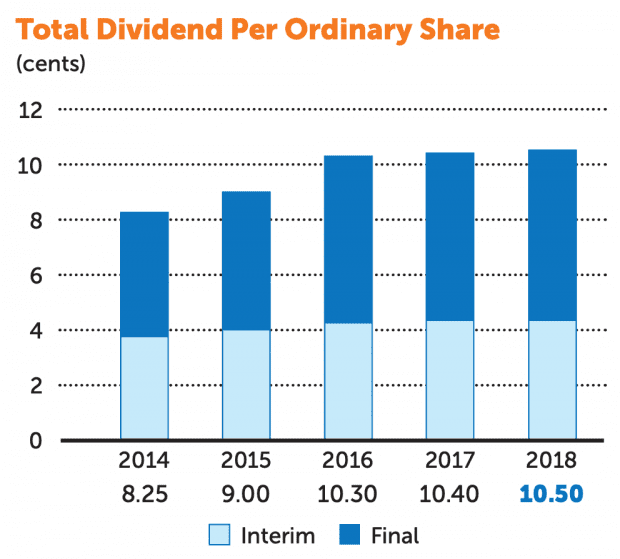

2. CDG’s dividend was increased to 10.5 cents per share in 2018, from 10.4 cents per share the year before. This is the company’s tenth consecutive dividend raise, having raised its dividend payout every year since 2008. At this level, CDG is paying out 74.9% of net profits in dividends.

3. CDG’s net cash position dwindled to S$16.2 million in 2018 from S$273.9 million the year before. The company’s net cash position is at its lowest since 2011, after it took on S$248 million of debt in the year to finance its acquisitions. Despite this, the company is comfortable with its current financial position, and will continue to pursue an acquisition-driven growth strategy going forward. CEO Yang Ban Seng said that the group continues to look for acquisition opportunities in both land transport and other adjacent businesses.

4. In his prepared remarks, CEO Yang Ban Seng outlined a number of the company’ initiatives as part of its transformation strategy. In late 2018, the company started a US$100-million corporate venture capital fund to ‘focus on investments in mobility technologies and solutions’. Besides this, the company has hired data science specialists to generate additional insights on the company’s existing base of data. Going forward, the company is looking to adopt robotic process automation and to develop a chatbot to improve customer service. The company will also focus on extracting the synergies they expect from the acquisitions completed in 2018.

5. A shareholder pointed out that most of CDG’s acquisitions involved small companies and asked management about its acquisition strategy. According to the CEO, the company does not intentionally look for small companies. Instead, these acquisitions were opportunistic in nature. However, most of these acquisitions turned out to be small plainly because the willing sellers were usually owners of family businesses with no prospective successor. In terms of its acquisition strategy, the company focuses on businesses situated in areas that it already has a presence in. Beside the possible synergies that will stem from economies of scale, these acquisitions place CDG in a better position to bid for larger projects.

6. Another shareholder asked about CDG’s plans to help its taxi drivers in the face of disruption by ride-hailing firms. While competition in the taxi space is still heated, the CEO shared that the company’s taxi business has stabilised of late. In fact, the taxi business’ 1Q 2019 figures showed 10% growth quarter-on-quarter. Going forward, the company is working to reduce its operating costs, and in turn share some of these savings with drivers. For instance, the company has been converting a portion of its fleet from diesel to hybrid to avoid paying the S$3,400 tax levied on diesel vehicles every year. While daily rental for these hybrids are higher than its diesel counterpart, hybrid vehicles are more efficient and will create savings for the drivers over the long term. The company is also looking at adopting a profit-sharing model, in which rental fees are reduced in exchange for a share of drivers’ daily takings. According to the CEO, this is a more equitable model compared to its existing model of collecting a fixed daily rental from drivers.

7. The same shareholder asked if CDG had considered introducing taxi-pooling services. The CEO responded by saying that the company has considered entering the pooling space but, in his view, most commuters take taxis for the luxury of getting chauffeured alone between two destinations. While he acknowledges that there is a market for ride-pooling services, he currently does not see substantial savings for customers who share a ride. Despite this, the company will continue evaluating the viability of such a service.

8. Another shareholder noted that the Singapore government is moving towards a contracting model, and asked if SBS Transit would still benefit from increased public transport fares. Chairman Lim Jit Poh responded by saying that SBS’s bus and Northeast Line (NEL) operations have transitioned to the contracting model, in which operators tender for contracts and are paid accordingly. As such, the company does not bear any revenue risk, but will not benefit from higher fares. However, the company’s Downtown Line (DTL) operations have not transitioned to this new model. This means that higher DTL fares will continue to benefit SBS Transit’s bottom line.

Liked our analysis of this AGM? Click here to view a complete list of AGMs we’ve attended »