Hongkong Land Holdings Limited (SGX: H78) is a leading property investment, management and development group with strategic assets located in major cities across Asia. Hongkong Land has a standard listing on the London Stock Exchange with secondary listings in the Bermuda Stock Exchange and the Singapore Stock Exchange. As at 11 December 2017, Hongkong Land’s share price on the SGX is US$7.33.

Founded in 1889, Hongkong Land has survived the First World War, four years of Japanese occupation in the Second World War, Black Monday in 1987, the Asian Financial Crisis in 1997, the Dotcom Bubble in 2000, and the Global Financial Crisis in 2008. Hongkong Land has proven to be resilient as it has withstood the hardest of times.

In this article, I’ll bring a comprehensive account of Hongkong Land’s recent accomplishments over the last 10 years, the challenges it currently faces, and the pipeline of projects where it can potentially derive its future income from. Here are the 11 things you need to know about Hongkong Land before you invest.

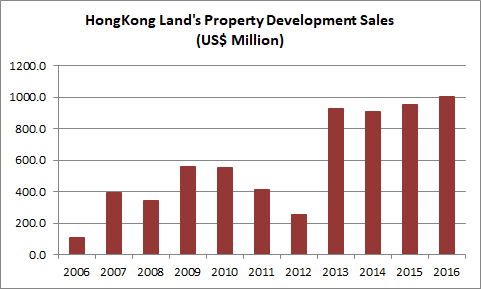

1. Hongkong Land recorded US$900 million to US$1,000 million a year in sales from its property development activities over the last four years. It is an improvement from a three-year decline from 2009 to 2012 when property sales dropped from US$558.2 million to US$252.1 million.. The improvement is mainly contributed by sales derived from its development projects located in Chongqing, China. They include Yorkville South, Yorkville North, the Bamboo Grove, the New Bamboo Grove, Central Avenue, Landmark Riverside and WE City. Thus, property development has become the fastest growing division of Hongkong Land.

Source: Annual Reports of Hongkong Land

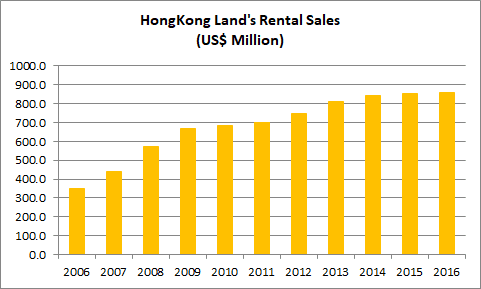

2. Hongkong Land owns and manages approximately 800,000 square metres of prime office and luxury retail properties located mainly in Hong Kong and Singapore. Over the last 10 years, the property investment division has achieved a CAGR of 9.4% in rental sales, from US$348.7 million in 2006 to US$858.8 million in 2016. This is attributed mainly to rental income derived from One Raffles Quay in 2007 and its 33% stake in the Marina Bay Financial Centre from 2010 onwards.

Source: Annual Reports of Hongkong Land

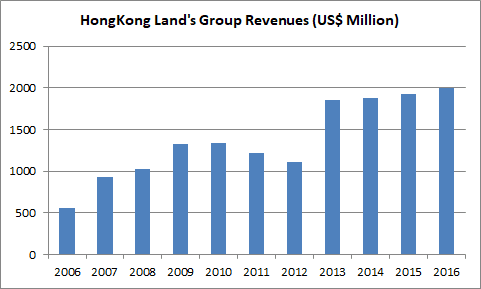

3. Overall, Hongkong Land has achieved a CAGR of 13.6% in group revenues over the last 10 years, from US$555.9 million in 2006 to US$1.99 billion in 2016. The growth is directly attributed to higher sales achieved from both property development activities and rental income from its investment properties during the period.

Source: Annual Reports of Hongkong Land

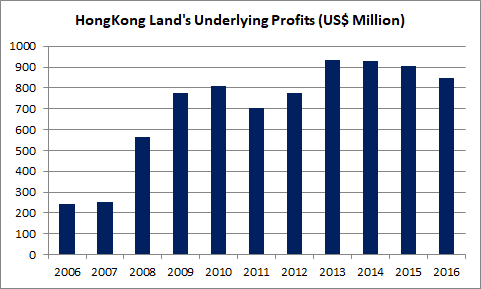

4. Hongkong Land has achieved a CAGR of 13.2% in underlying profits attributable to shareholders over the last 10 years, from US$244.7 million in 2006 to US$847.3 million in 2016. Thus, its profit growth is in line with its growth in revenues during the period. Now, here’s a question: Why do we look at Hongkong Land’s underlying profits instead of its shareholders’ earnings? This is because it’s better to assess Hongkong Land’s inherent ability to generate profits from its business operations and not from gains arising from revaluation of its investment properties. Using underlying profits is also helpful in calculating the Hongkong Land’s valuation. This is because shareholders’ earnings (which include revaluation gains) would greatly deflate its P/E Ratio, which in turn, implies that shares of Hongkong Land are undervalued.

Source: Annual Reports of Hongkong Land

5. From 2007 to 2016, Hongkong Land generated US$5.14 billion in cash flows from operations. During the period, it also received US$1.05 billion in dividends from its investments in associate and joint venture companies and raised another US$656.7 million in net long-term debt. In turn, Hongkong Land has spent:

- US$1.61 billion on renovation and development expenditures

- US$1.49 billion on acquisitions of associate & joint venture companies

- US$3.70 billion in dividend payments to shareholders

Hongkong Land has been using a combination of positive cash flows from operations, dividend income, and long-term borrowings to fund its property development activities in Chongqing, China and reward its shareholders with dividends. As at 30 June 2017, Hongkong Land has US$1.89 billion in cash reserves, a current ratio of 2.43, and a debt-to-equity ratio of 0.10.

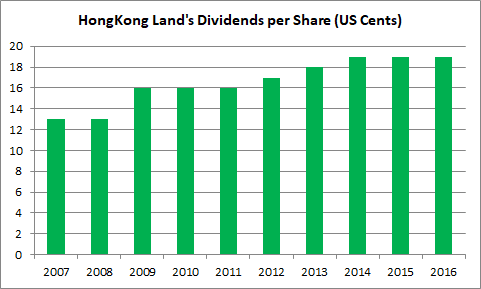

6. Hongkong Land has steadily increased its dividend per share from US$0.13 in 2007 to US$0.19 in 2016. As at 11 December 2017, the company is trading at US$7.28 a share. If Hongkong Land is able to maintain its dividend per share at US$0.19, its expected dividend yields is 2.6%.

Source: Annual Reports of Hongkong Land

7. Invariably, Hongkong Land faces several risks which are inherent to the property industry:

- As at 30 June 2017, Hongkong Land has US$1.97 billion worth of development properties held for sale mainly located in China. Thus, it is exposed to risks including weak demand among Chinese property buyers, financing restrictions, and changes in government policies relating to home ownership in China.

- As at 30 June 2017, Hongkong Land has US$30.4 billion worth of investment properties. It is presently the single largest category of assets on its balance sheet. The valuation of these properties is highly sensitive to key assumptions such as the adoption of capitalisation rates, which are derived from analysis of property sales transactions and valuers’ interpretation of prevailing investor requirements. Thus, minor adjustments made on these assumptions could have a significant impact on the valuation of these properties.

8. Moving on, Hongkong Land’s property development division has a portfolio of 6.75 million square metres of total development area. Of this, 4.69 million square metres is currently either under construction or to be developed in the future. As at 30 June 2017, Hongkong Land has accumulated as much as US$1.42 billion and US$997 million in unrecognised property sales in China and Singapore respectively.

9. In the first half of 2017, Hongkong Land added four new projects into its development portfolio. This improves its income visibility over the mid-term. The four projects comprise:

- 50%-owned Wuhan Salon Phase 2. It is a mixed-use project with a gross floor area (GFA) of 494,000 square metres. The completion of this project is scheduled to be in 2021.

- 33%-owned mixed-use site in Nanjing. It has a developable area of 217,000 square metres. The completion of this project is set to be in 2021.

- Eunosville. a residential project in Eunos, Singapore with a GFA of 98,000 square metres. The completion of this project is set to be in 2021.

- 49%-owned The Esse at Sukhumvit 36. Located in Bangkok, it is residential project with a GFA of 38,000 square metres. This project is set to be completed by 2020.

10. On 12 June 2017, Hongkong Land and Malaysia-listed IOI Properties Group Bhd jointly announced the signing of a memorandum of agreement to develop and manage a parcel of prime land measuring 1.1 hectares known as Central Boulevard. It is located within the Marina Bay and Central Business District of Singapore. Presently, IOI Properties Group Bhd will hold a 67% stake of the proposed joint venture with the rest held by Hongkong Land.

11. Looking ahead, Hongkong Land is expecting to derive rental income from its new investment properties which include:

- The fully-owned Exchange Square in Phnom Penh, Cambodia which was completed early 2017. As at 30 June 2017, approximately 26,000 square metres have been taken up by new tenants.

- In Beijing, China, Hongkong Land recently had a soft launch on 28 November 2017 for WF Central, a world-class retail, fine dining, and hospitality hub. WF Central offers 50,000 square metres of retail space and a 74-room Mandarin Oriental Hotel.

- In Indonesia, the construction of its 50%-owned Jakarta Land is due for completion in early 2018.

The fifth perspective

Hongkong Land has produced stable revenues and underlying profits, and delivered steady dividends to shareholders over the last 10 years.

Presently, approximately 76.5% of its assets are investment properties which will continue to contribute stable recurring income for Hongkong Land. In addition, it has built a pipeline of property development projects which would continue to improve its income visibility in the mid-term. It also has a relatively low-gearing ratio of 0.10 which gives it the option to borrow to finance future acquisitions and pursue joint venture opportunities whenever these they arise.

So, would Hongkong Land survive another 128 years from today? Time will tell. But for now, it is sufficient to say that Hongkong Land has built and maintained a legacy of strength, stability and resilience to ride through the market uncertainties of today.