Established in 1961, Ajinomoto (Malaysia) Berhad has grown into a well-known manufacturer and distributor of food seasoning products in Malaysia. As at 22 August 2019, the company is worth RM1.08 billion in market capitalisation.

In this article, I’ll cover the company’s business segments, latest annual results, and stock valuation. Here are 10 things to know about Ajinomoto Malaysia before you invest:

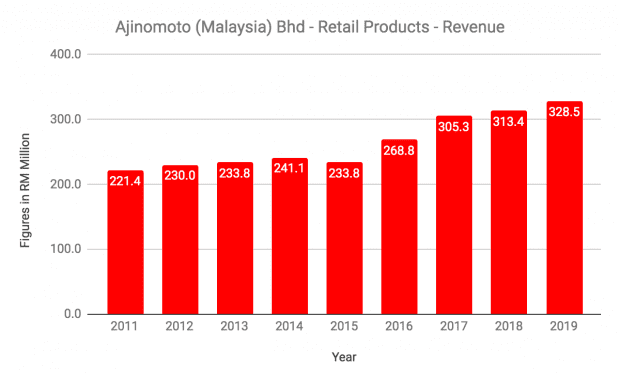

1. Retail products: Starting with just Ajinomoto seasoning, this division has since expanded its product range to include chicken stock, seasoning for local dishes, and sweeteners. In March 2019, Ajinomoto Malaysia launched a brand-new all-in-one seasoning product — Rasa Sifu — which adds taste to wok-based delicacies. Segment revenue has grown at a compound annual growth rate (CAGR) of 5.1%, from RM221.4 million in 2011 to RM328.5 million in 2019.

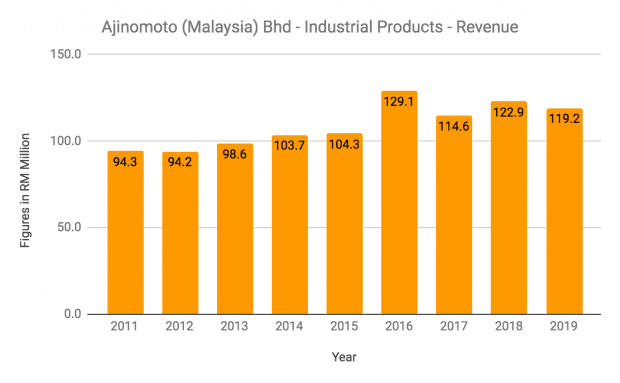

2. Industrial Products: This division manufactures and supplies savoury seasoning products under the brand name — TENCHO — to industrial food manufacturers to produce instant noodles, seasoning, snacks, sauces, and a wide range of processed foods. In 2019, the division introduced a new TENCHO product for the dairy industry. segment revenue has grown at a CAGR of 3.0%, from RM94.3 million in 2011 to RM119.2 million in 2019.

3. The company’s export revenue currently accounts for 38.5% of total revenue, up from 32.7% in 2010. This is attributed to faster growth in exports to Asia and the Middle East, compared to slower sales growth in Malaysia during the period. The rate of sales growth for each geographical segment from 2010 to 2019 are as follows:

| Geographical Segment | 2010 Revenue (RM millions) | 2019 Revenue (RM millions) | CAGR | Proportion of Total Revenue in 2019 |

|---|---|---|---|---|

| Malaysia | 191.4 | 275.4 | 4.1% | 61.5% |

| Asia | 64.5 | 105.2 | 5.6% | 23.5% |

| Middle East | 25.7 | 61.5 | 10.2% | 13.7% |

| Others | 3.1 | 5.6 | 7.0% | 1.3% |

| Total | 284.6 | 447.7 | 5.2% | 100.0% |

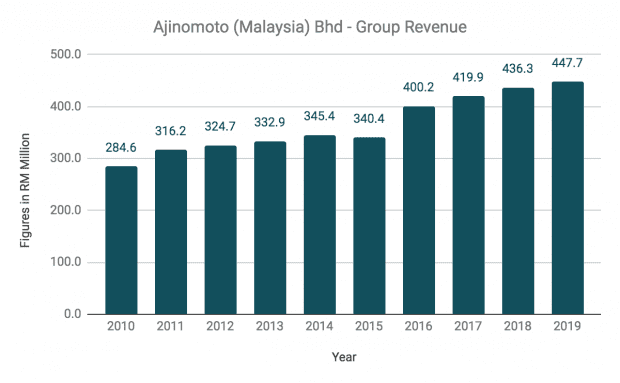

4. Group revenue has grown at a CAGR of 5.2% from RM284.6 million in 2010 to RM447.7 million in 2019. The company also improved its margins during the period due to the raising of product prices which exceeded the rise in raw material costs and operating expenses.

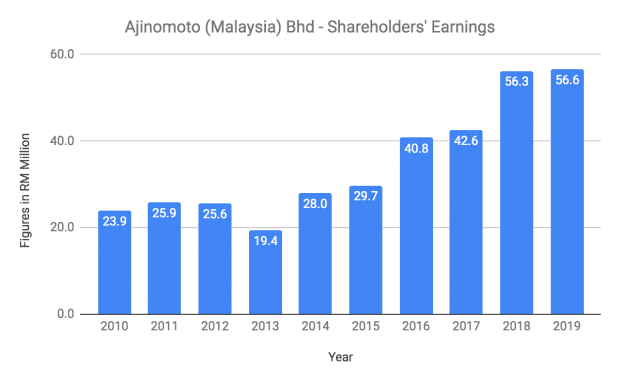

As a result, shareholders’ earnings increased at a CAGR of 10.0%, from RM23.9 million in 2010 to as high as RM56.6 million. The company’s 10-year return on equity average is 11.09%.

Note: 2017 shareholders’ earnings exclude a one-off gain of RM145.1 million for a compulsory land sale to the government for the development of the MRT project.

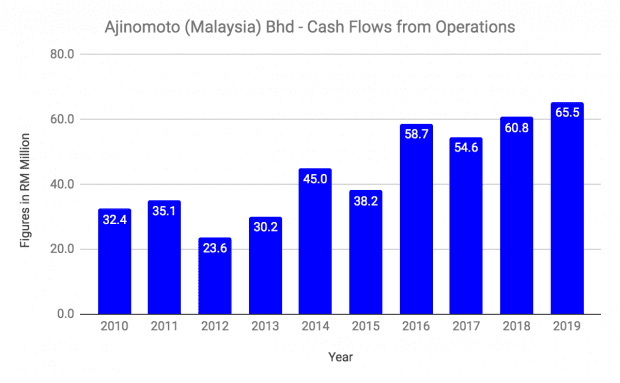

5. From 2010 to 2019, Ajinomoto Malaysia generated RM444.1 million in cash flows from operations and RM27.4 million in interest income.

Out of which, the company has spent on RM10.9 million in net capital expenditures and RM216.6 million in dividend payments to shareholders. The low net capex figure over the last 10 years is mainly due to the land disposal gain of RM145.1 million mentioned above.

6. As at 31 March 2019, Ajinomoto Malaysia has no long-term borrowings and RM465.3 million in shareholders’ equity. It has current assets of RM455.7 million and RM56.1 million in current liabilities, giving it a current ratio of 8.12.

7. On 12 February 2018, Ajinomoto Malaysia announced that it would acquire two million square feet of freehold land located at Techpark @ Enstek in Negeri Sembilan for RM81.20 million. The company plans to develop and construct new manufacturing facilities to meet the rising demand for its products.

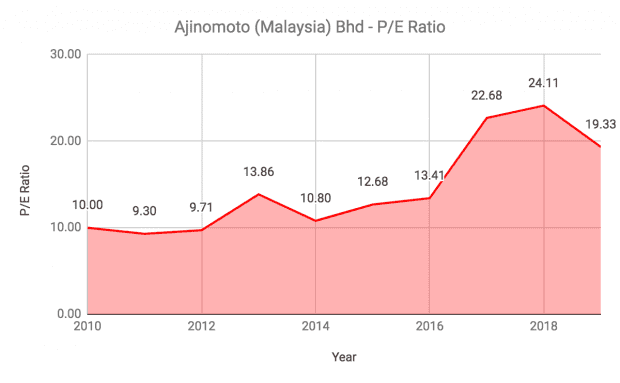

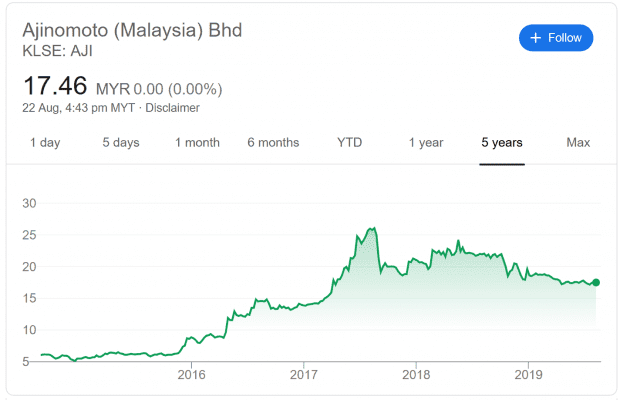

8. P/E ratio: Ajinomoto Malaysia recorded earnings per share of RM0.931 for FY2019. Based on its share price of RM17.46, its current P/E ratio is 18.75, which is above its 10-year average of 14.59.

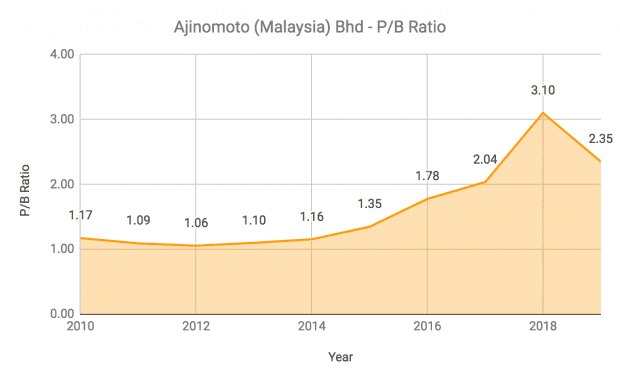

9. P/B ratio: As at 31 March 2019, Ajinomoto Malaysia has net assets per share of RM7.65. Thus, its current P/B ratio is 2.28, which is also above its 10-year average of 1.62.

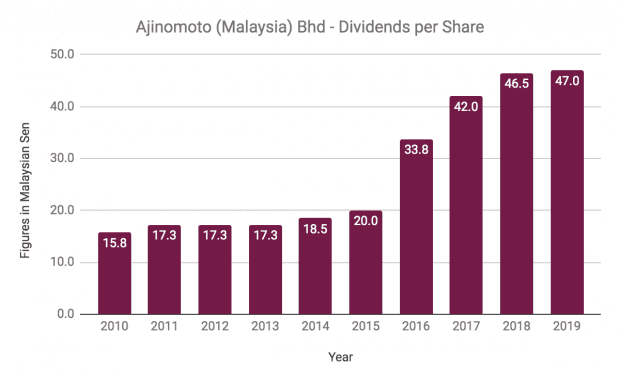

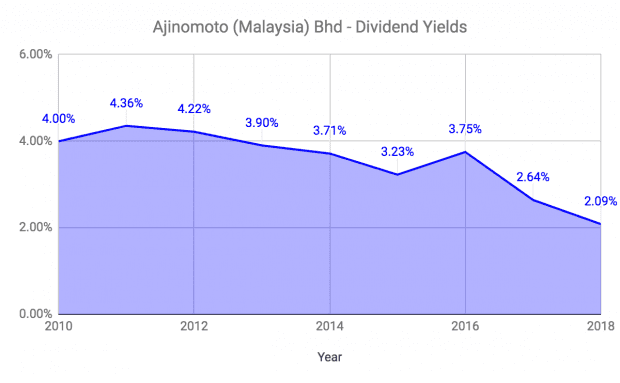

10. Dividend yield: Ajinomoto Malaysia declared a record dividend of RM0.47 per share in FY2019.

Assuming the company maintains its dividend, then its current dividend yield is 2.69%, which is below its 10-year average of 3.45%.

The fifth perspective

Ajinomoto Malaysia has delivered steady growth in revenues and earnings over the last 10 years. Its share price rose sharply in 2017 due to the one-off land disposal gains that year.

Although, the price has come down since, Ajinomoto Malaysia is still trading above its historical average valuations and value investors may prefer to wait for a more attractive valuation.