The main attraction of Asia-Pacific (APAC) REITs as an asset class is the stable, sustainable payout of dividends to investors and its possibility for price appreciation. This assumption was challenged in early 2020 as the global outbreak of the COVID-19 pandemic roiled real estate markets across the globe, leading many to question the asset class’s predictable market history and the viability of dividend payouts.

Since the impact of the pandemic, many segments of APAC REITs have gradually recovered from the economic shock as governments and central banks helped stabilise the real estate sector with monetary and fiscal policy measures.

Progressing into 2021, we will look at the key tailwinds, structural and emerging trends unfolding for the asset class. Here are 8 things every APAC REIT investor should know moving forward.

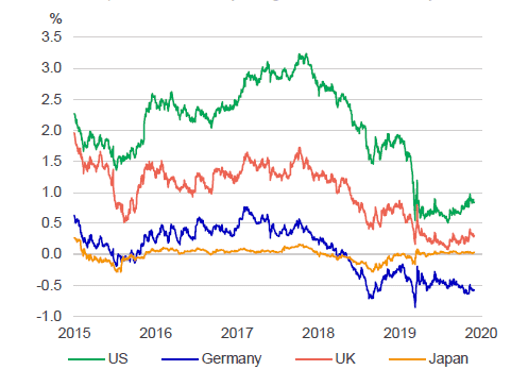

1. A low interest rate environment reduces borrowing costs and remains supportive for the asset class. Interest rates are expected to be lower for longer as central banks ease monetary policy to mitigate the economic impact from COVID-19. Developed markets’ 10-year government bond yields have steadily declined since December 2015.

During the last rate cut cycle from 2008 to 2015, APAC REITs performed well in a low-rate environment, outperforming broader equity markets.

Leverage ratios of APAC REITs across various segments remain healthy.In April 2019, the Monetary Authority of Singapore increased the aggregate gearing limit for S-REITs to 50% from 45% in April 2019. This is to allow APAC REITs greater flexibility in their capital structure management.

In Hong Kong, a consultation is in progress to increase gearing levels to 50% from 45%. The average gearing of APAC REITs well below regulatory threshold of 50%.

| Name of REIT | Country | REIT Sector | Leverage Ratio |

|---|---|---|---|

| CapitaLand Integrated Commercial Trust | Singapore | Retail | 35.1% (as of 4 June 2020) |

| Ascendas REIT | Singapore | Industrial | 36% (as of 29 June 2020) |

| Link REIT | Hongkong | Retail | 19.2% (as of 31 Mar 2020) |

| Mapletree Logistics Trust | Singapore | Industrial | 39.3% (as of 31 Mar 2020) |

| Mapletree Commercial Trust | Singapore | Industrial | 33.3% (as of 31 Mar 2020) |

| Frasers Centerpoint Trust | Singapore | Retail | 35.9% (as of 30 Sep 2020) |

| Frasers Logistics & Commercial Trust | Singapore | Industrial | 37.4% (as of 15 Apr 2020) |

| Mapletree Industrial Trust | Singapore | Industrial | 37.6% (as of 31 Mar 2020) |

| Mapletree Noth Asia Commercial Trust | Singapore | Diversified | 39.3% (as of 31 Mar 2020) |

| Fortune REIT | Hong Kong | Retail | 22.4% (as of 31 Dec 2020) |

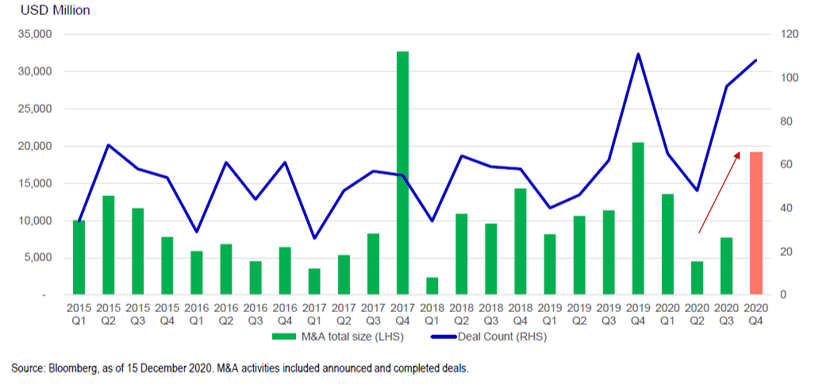

2. Merger and acquisition (M&A) activities picked up across major APAC REIT markets. M&A activities in Australia, Singapore, and Hong Kong REIT markets rebounded in Q4 2020, nearing pre-COVID levels in Q4 2019.

A low interest rate environment and greater debt headroom levels are supportive of distribution per unit (DPU) accretive acquisitions. REITs with structural growth exposures could seek further acquisitions to drive DPU growth in 2021.

3. Policy responses from governments and relief packages totalling up to 20% of GDP helped to stabilise REITs in the region. In Singapore, under the tax transparency treatment, S-REITs are not taxed on income distributed to unitholders. A timeline extension has been given to S-REITs to qualify for tax exemption. S-REITs with FY2020 ending 31 March 2020 and 31 December 2020 have up to 31 March 2021 and 31 December 2021 respectively to distribute to unitholders at least 90% of their taxable income derived in FY2020. A S$100 billion stimulus package representing 19% of the nation’s GDP was also rolled out by the government.

In Hong Kong, The Mandatory Provident Fund Schemes Authority (MPFA) issued two sets of revised guidelines to enable greater flexibility of investments in REITs. Up to 100% of the funds of the Mandatory Provident Fund (MPF) can now be invested in REITs listed in Australia, UK, and USA compared to 10% before. And up to 10% of MPF funds can now be invested in REITs listed in Canada, France, Japan, Singapore, and Netherlands, compared to 0% previously. A relief package of HK$320 billion representing 11.5% of Hong Kong’s GDP was rolled out.

In Australia, The Reserve Bank of Australia started quantitative easing for the first time in 2020. It also rolled out a federal and state stimulus package A$320 billion, representing 17% of Australia’s GDP. Commercial and residential landlords whose tenants’ rent have been reduced due to COVID-19 are eligible for land tax relief (as of 31 December 2020).

Now let us look at the various structural and emerging trends for the various REIT sectors and their outlook ahead.

4. Work-from-home trends are reshaping commercial/office REIT sector strategies. Businesses and people are rethinking work culture as work-from-home arrangements at workplaces gain traction. This is because companies are able to realise lower rental costs and expenses. Employees also enjoy reduced commute time, enabling better work-life balance.

Emerging trends such as the ‘hub-and-spoke’ model which is based on flexible workspaces and working styles are expected to support demand for business parks. Companies which have reduced their presence in central business districts are redeploying their offices in business parks located outside the city limits. In the near future, we could also be seeing more options for people to work near their preferred locations in a secure work environment equipped with amenities.

In Australia, office asset valuations are expected to be stable and continue to draw institutional interest given attractive capitalization rate spreads and longer weighted average lease expiries (WALE). In Hong Kong, demand remains neutral given spot rent differentials as focus shifts towards decentralized Grade A offices.

In Singapore, demand remains neutral given lower net supply due to urban renewal schemes while demand from tech companies helps to buffer downside impact.

5. Digitalisation enhancing the role of retail malls. Retail REITs were the hardest hit with the pandemic necessitating national lockdowns and social distancing requirements. To mitigate the effects from COVID-19, suburban retail malls in Singapore have accelerated their digital marketing plans to help their tenants sell products online or delivery services for food and beverage tenants. As more people began working from home, these suburban malls have ramped out digital offerings to capture sales in their neighbourhoods.

In Singapore, with the reopening of the economy, suburban malls could see a faster recovery on larger immediate local catchments with limited dependency on office crowds and tourists. Long-term fundamentals remain resilient due to low retail space per capita and limited supply. In Hong Kong, neighbourhood malls are also deemed to be more resilient and defensive in times of economic slowdown.

In Australia, the global structural e-commerce tailwind is relatively immature and is expected to further fuel growth. The share of online retail trade to total retail trade currently stands at 11.5% as at August 2020 (according to the National Australia Bank), a significant jump from 9.3% as at January 2020.

Faster e-commerce adoption will require greater supply chain investments from low-penetration industries such as the grocery sector. Supermarkets in Australia have, on average, an online retail sales rate at less than 5%. To gear up for anticipated sustained growth in their online sales platform, investments in fulfilment centres and demand for third partly logistics are expected to continue rising. Suburban retail malls continue to outperform operationally. However, the near-term outlook is dependent on shopper traffic returning to pre-COVID levels.

6. Acceleration in e-commerce trends drive growth in the logistics and industrial sector. Industrial REITS with exposure to logistics warehousing and data centres stood out amidst the COVID-19 environment, displaying defensiveness, stable cash flows and high-income visibility.

Driving the resilient performance of industrial and logistics sector are strong property fundamentals like low vacancies, limited speculative development, strong covenants, and long WALE. Pricing for core assets is expected to remain firm.

In Australia, end-user demand is high as third-party logistics and e-commerce digests supply. In Singapore, REITs with geographical diversification, resilient tenant base, and structural growth exposure remain favourable. Data centre assets with long WALEs and built-in annual step-ups are also preferred.

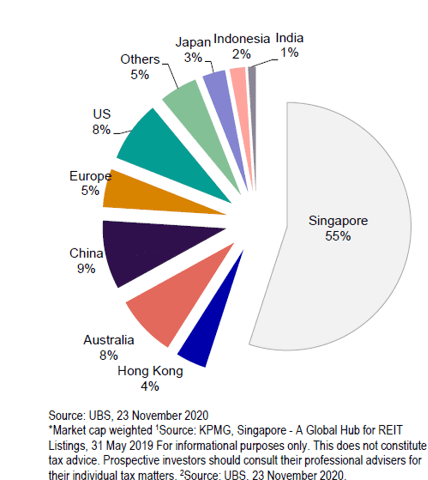

7. Geographical diversity and supportive regulatory environment for Singapore REITs. From 43 S-REITs, 39 S-REITs own assets in international markets. S-REITs remain a global REIT hub for investors, with more than 40% of S-REIT assets held outside Singapore.

S-REITs listed on Singapore Exchange (SGX) are granted tax transparency treatment generally on rental and related income from Singapore properties. They are currently exempt from taxation on income derived from investments in foreign properties.

Currently, Singapore’s development limit of total asset value is 25% and gearing limit is 50%. Compared to Hong Kong, development limit and gearing limit of S-REITs are higher which supports investment opportunities and flexibility even for smaller REITs.

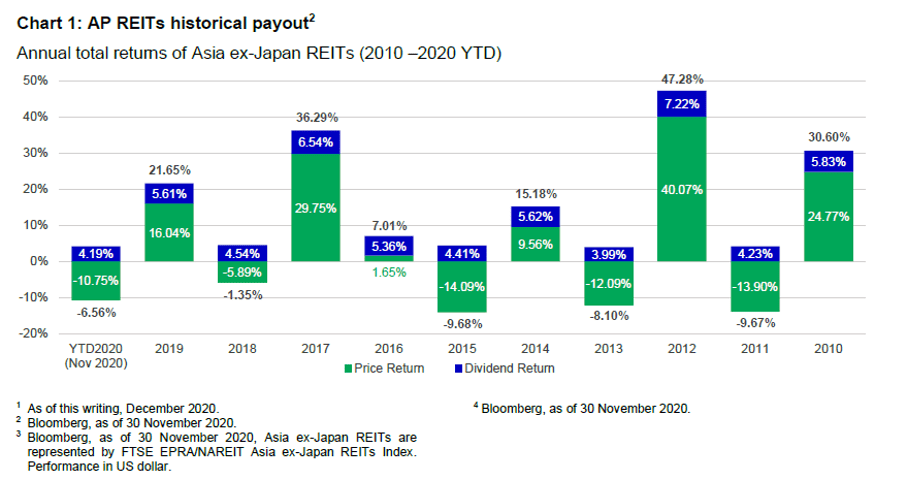

8. APAC REITs historical and forward yields remain attractive in the current ‘lower for longer’ interest rate environment. Over the past 10 years, APAC REITs have provided, on average a 6.8% annualised return, with 5% of the total return coming from dividend payouts. To put this dividend yield in perspective, Asia (ex-Japan) equity markets offered on average a 5.4% total return, with only 2.4% coming from dividends over the same time period.

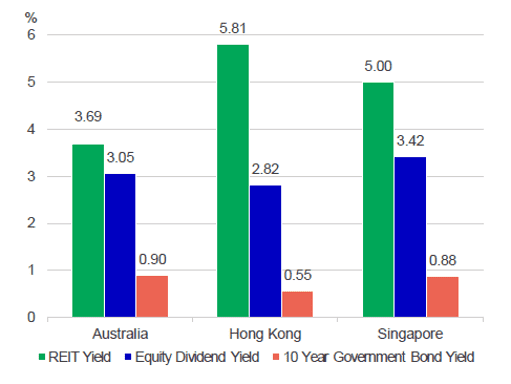

From an income perspective, APAC REITs offer relatively attractive forward yields compared to broader equities and government bonds. The table below shows the projected 12-month REIT yield, equity dividend yield Bloomberg consensus, and local 10-year government bonds.

The fifth perspective

COVID-19 has exerted unprecedented influence across different REIT sectors, with industrial, logistics, and data centres being key beneficiaries of digitalisation while retail and hospitality suffered disruption. It remains to be seen how accelerating trends of online retail and working-from-home would alter commercial real estate strategies and consumers shopping behaviour.

In the selection of quality REITs amidst a volatile environment, the focus remains on investing in quality real estate which can hold their capital values and cashflows. Key qualitative factors investors should continue looking out for include rental outlook, occupancy trends, pipeline from sponsors and strength of acquisition team. Quantitative factors include earnings quality, DPU growth potential, debt profile, and WALE.

As the roll out of the vaccine fuels expectations of a wider recovery and reopening of global economies, the pandemic’s impact on the top line (e.g. rent, occupancy rates) should taper off in 2021. However, the recovery will come with speed bumps (e.g. mutation of virus, subsequent lockdowns, etc).

As investors’ search for yield continues, the current low interest rate environment should underpin strategic acquisition of assets while remain supportive of demand for APAC REITs.

Finally, just a quick reminder: 2021 applications for Dividend Machines are closing on Sunday, 14 March 2020, at 11:59 p.m. If you’re looking to learn how to invest in dividend stocks and REITs and build multiple streams of passive dividend income, then we urge to check out Dividend Machines before it closes.

Happy investing and we hope to see you on the inside!