Can the strength of the ringgit be sustained?

The Malaysian ringgit is turning out to be the best-performing currency in the region, so far this year. This is a sharp reversal of its fortunes, after being heavily sold down in November-December last year.

I believe this has much to do with our improved exports and outlook, and in particular Bank Negara’s new ruling (announced in December), which mandates that at least 75% of all export proceeds to be converted into the local currency.

Prior to this, many exporters kept their sales in US dollars, either onshore (in foreign currency accounts) or offshore. There are reasons for this, such as to pay for future imports of raw material, intermediate goods and capital equipment, as well as to repay foreign currency loans – and perhaps also on speculations that the longer-term downtrend of the ringgit will persist.

The result has been stagnant forex reserves for the country despite its running trade surpluses year in, year out.

The positive impact of this forced conversion of export earnings on the ringgit is clearly evident, particularly at the initial stages.

I believe the sharp rise in Bank Negara’s short-term US dollar borrowings (in the form of currency swaps) is, at least in part, the central bank’s way of managing the surge in ringgit demand.

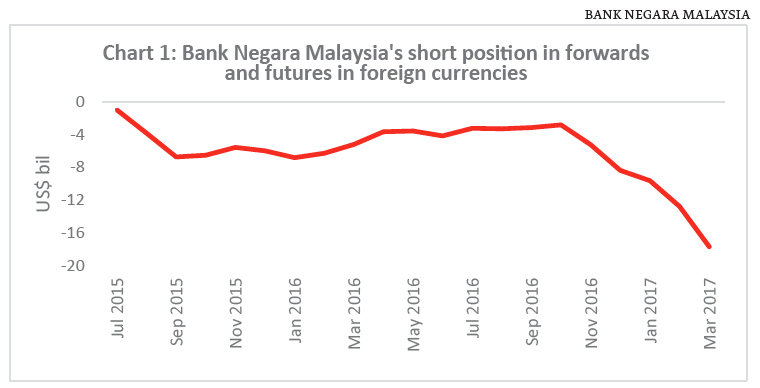

Bank Negara’s outstanding short position hit an all-time high of nearly US$18 billion ($25 billion) at end-March (see Chart 1).

Basically, the central bank is borrowing US dollar (from exporters) for ringgit with an agreement to reverse the exchange upon the expiry of the swap.

It is likely that exporters may also be selling forward their future US dollar earnings (as conversion is now required by law) given the prevailing expectations of greenback weakness in the near term. This adds to demand for the ringgit.

The strong demand for ringgit is driving its appreciation against the US dollar.

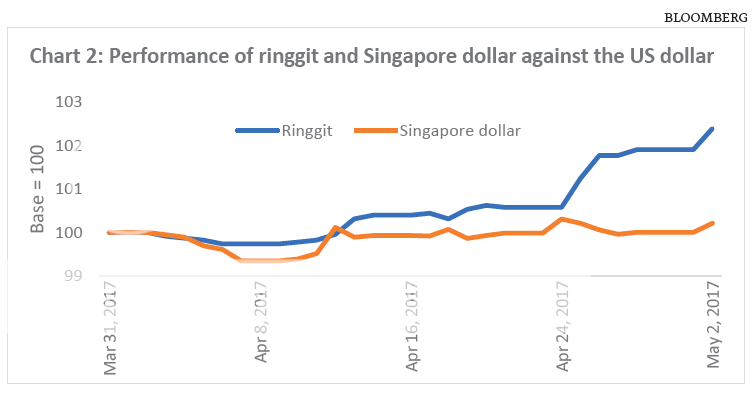

Whilst it is true the greenback has weakened against most currencies in recent weeks, we’ve also outperformed our neighbours.

Chart 2 shows the ringgit outperforming the Singapore dollar when benchmarked against the US dollar.

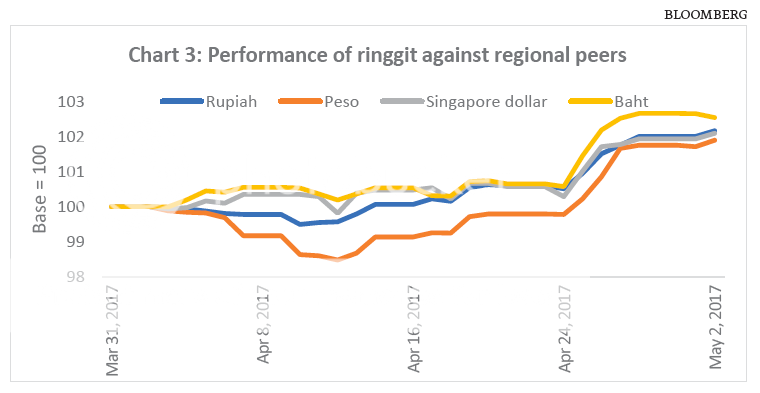

Chart 3 reflects the outsized strength of the ringgit relative to its regional peers – the Singapore dollar, Thai baht, Philippine peso and Indonesian rupiah.

Can ringgit strength be sustained?

I suspect after the initial acceleration process, the pace of ringgit conversion (demand) will taper off – as will the appreciation of the ringgit.

For starters, about 70% of Bank Negara’s US$18 billion currency swaps will have to be settled within the next 3 months. Unless they are rolled over, the central bank will either have to buy US dollar from the market or draw down on its reserves. The balance of the swap contracts have expiry dates of up to one year.

Depending on the timing of further interest rate hikes in the US, the ringgit may even weaken anew – unless exports keep growing quickly and therefore, continuously supplying more and more US dollar to the market.

Clearly, the continued strength in our exports is critical to keep up the demand for – and value of – the ringgit.

This article first appeared in The Edge Singapore Market Report.