CapitaLand Commercial Trust (CCT) was listed on 11 May 2004 as the first commercial REIT on the SGX. It invests in a portfolio of 10 commercial properties in Singapore worth S$10.4 billion as of 31 December 2017 and, hence, remains the largest commercial REIT in the country.

In this article, I’ll bring a detailed account of the performance of each property owned by CCT, their impact to CCT’s financial results, and discuss CCT’s plan to deliver sustainable returns in the future. Here are 15 things you need to know about CapitaLand Commercial Trust before you invest.

Property portfolio

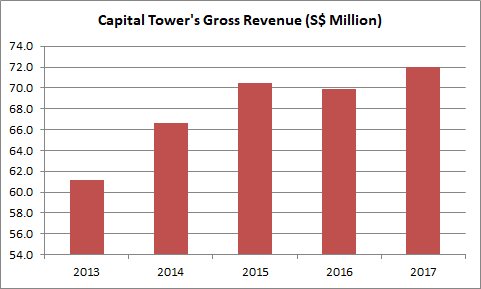

1. Capital Tower is a 52-storey Grade-A office building which is linked to the Tanjong Pagar MRT station. In 2017, the building is valued at S$1.36 billion, accounting for 13.1% of CCT’s total portfolio value. It enjoys a 99.4% occupancy rate with key tenants such as GIC Private Ltd, JP Morgan Chase Bank, and CapitaLand Group. Overall, it reported growth in gross revenue from S$61.2 million in 2013 to S$72.0 million in 2017.

Source: Annual Reports of CapitaLand Commercial Trust

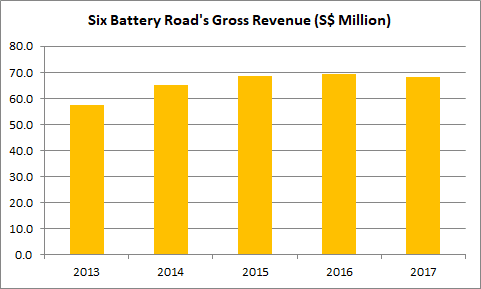

2. Six Battery Road is a 42-storey Grade-A office building located in the Raffles Place precinct. It is worth S$1.40 billion, accounting for 13.5% of CCT’s total portfolio value in 2017. Presently, the office building is enjoying a 99.9% occupancy rate with Standard Chartered Bank as a key tenant. Overall, Six Battery Road has maintained gross revenues of S$68-70 million a year over the last three years.

Source: Annual Reports of CapitaLand Commercial Trust

3. CapitaGreen is a 40-storey Grade-A office tower situated at the heart of the Singapore’s central business district. It is CCT’s first redevelopment project undertaken with its partners, CapitaLand and Mitsubishi Estate. CCT initially owned a 40% stake in CapitaGreen, which was subsequently raised to 100% after the exercise of call options to buy over the remaining stakes from its partners. In 2017, CapitaGreen is worth S$1.62 billion, accounting for 15.5% of CCT’s total portfolio value. It is fully occupied and made its first full year contribution in 2017, generating S$89.8 million in gross revenue. It is now among the largest income contributors to CCT.

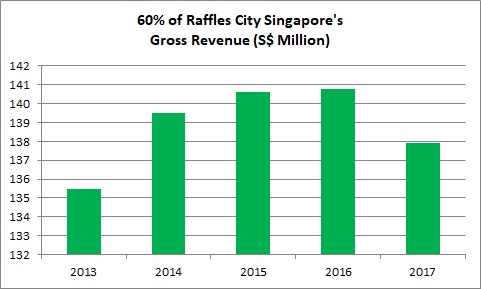

4. Raffles City Singapore is one of Singapore’s largest integrated developments comprising a 42-storey office building, a retail mall, a convention centre, and two hotels located right in the Raffles City precinct. CCT owns a 60% stake while the remaining 40% stake is owned by its sister REIT, CapitaLand Mall Trust. In 2017, CCT’s investment in Raffles City Singapore is valued at S$1.96 billion, accounting for 18.8% of total value of its portfolio. It enjoys a 98.3% occupancy rate. Overall, CCT has made between S$135-140 million in gross revenue annually from its stake in Raffles City Singapore over the last five years.

Source: Annual Reports of CapitaLand Commercial Trust

5. HSBC Building is a 21-storey office tower that is currently leased to HSBC Bank. It is worth S$456.0 million, accounting for 4.4% of CCT’s total portfolio value. CCT has received a fixed revenue of S$20.4 million since 2013. The current lease to HSBC Bank will expire in April 2019.

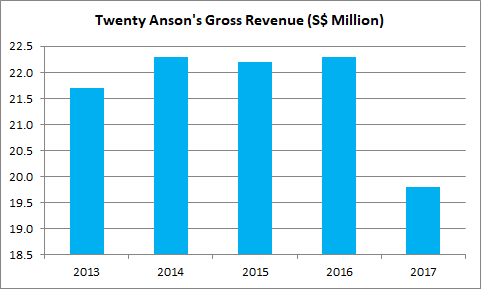

6. Twenty Anson is a 20-storey office building located in Tanjong Pagar. It is worth S$433.0 million, accounting for 4.2% of CCT’s total portfolio value. Gross revenue dipped from S$22.3 million in 2016 to S$19.8 million in 2017 due to a dent in occupancy rate.

Source: Annual Reports of CapitaLand Commercial Trust

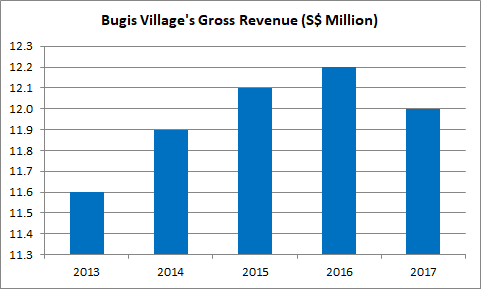

7. Bugis Village comprises 34 restored pre-war shophouses which are tenanted to offices, music schools, tuition centres, restaurants, salons, and retail outlets. It remains a small portion of CCT’s portfolio as the properties are valued at S$44.0 million in 2017. Over the last five years, Bugis Village has made S$11.5-12.0 million a year in gross revenues. All leases to its tenants will expire on 31 March 2019.

Source: Annual Reports of CapitaLand Commercial Trust

Group financials

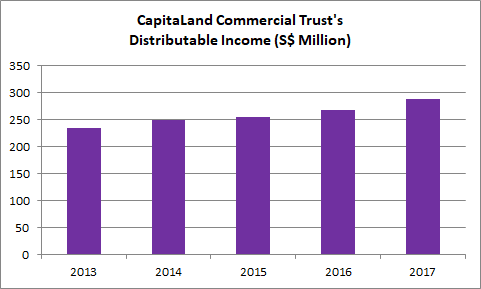

8. Overall, CCT has achieved a CAGR of 7.6% in gross revenue over the last five years, from S$251.5 million in 2013 to S$337.5 million in 2017. This is mainly attributed to higher revenue achieved by Capital Tower in the five-year period and the inclusion of CapitaGreen into CCT’s portfolio. In line with its revenue growth, CCT has achieved a CAGR of 5.4% in distributable income, rising from S$234.2 million in 2013 to S$288.9 million in 2017.

Source: Annual Reports of CapitaLand Commercial Trust

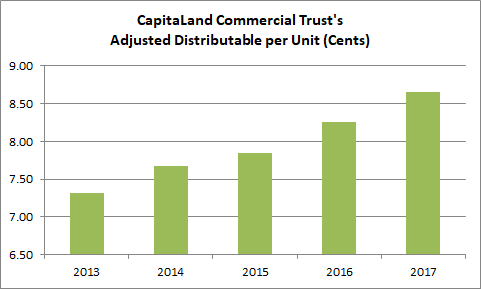

9. Likewise, CCT has grown its adjusted distribution per unit (DPU) from 7.31 cents in 2013 to 8.66 cents in 2017. As at 3 April 2018, CCT is trading at S$1.83 a unit. Thus, if CCT is able to maintain its DPU at 8.66 cents, its expected gross dividend yield is 4.7%.

Source: Annual Report 2017 of CapitaLand Commercial Trust

10. As at 31 December 2017, CCT has a gearing ratio of 37.3% and remains below the regulatory limit of 45% set by the MAS. CCT’s cost of debt is 2.6% a year and 80% of its borrowings are at fixed interest rates. Standard & Poor’s recently upgraded CCT’s long-term credit rating from ‘BBB+’ to ‘A-’ with a stable outlook.

Read also: 5 important factors you need to consider before you invest in any REIT

Income visibility

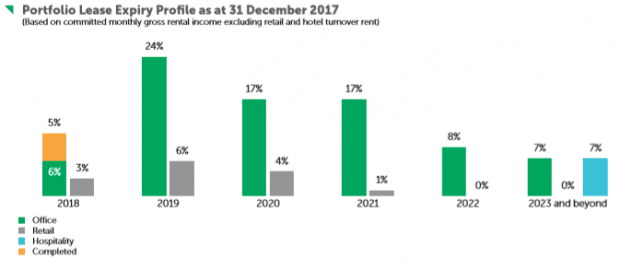

11. As at 31 December 2017, CCT is enjoying a 97.3% occupancy rate for its portfolio and has a weighted average lease term to expiry (WALE) of 5.9 years. As a percentage of monthly gross rental income, 40% of its leases will expire starting in financial year 2021 and beyond. Thus, this adds to CCT’s income stability in the immediate future.

Source: Annual Report 2017 of CapitaLand Commercial Trust

Divestments

12. On 11 September 2017, CCT completed the divestment of Wilkie Edge for S$280.0 million. The disposal was intended for CCT to recycle its capital for the acquisition and redevelopment of properties.

13. On 20 June 2017, CCT completed a 50% divestment of One George for S$591.6 million. Similarly, the divestment was intended for CCT to recycle its capital for the acquisition and redevelopment of properties mentioned below.

Growth prospects

14. On 13 July 2017, CCT announced that it formed a joint venture with CapitaLand Ltd and Mitsubishi Estate to redevelop Golden Shoe Car Park into a landmark integrated development in Raffles Place. Under this agreement, CCT, CapitaLand Ltd, and Mitsubishi Estate own a 45%, 45%, and 10% stake respectively. Upon completion, the development will feature 29 floors of Grade-A office space, an eight-storey 299-unit serviced residence, and 12,000 square feet of ancillary retail space. This project is estimated to cost S$1.82 billion with its completion to be scheduled in the first half of 2021. Similar to the previous redevelopment of CapitaGreen, CCT has been granted a call option to purchase the remaining 55% stake owned by CapitaLand Ltd and Mitsubishi Estates within five years after the new property receives its temporary occupancy permit (TOP).

15. On 1 November 2017, CCT completed the acquisition of the Asia Square Tower 2 for S$2.15 billion. It is funded from S$1.12 billion in bank borrowings, S$690.4 million from the issuance of rights, and S$340.1 million in disposal proceed from Wilkie Edge and One George Street. Asia Square Tower 2 is a Grade-A office building measuring over 1.22 million square feet in gross floor area in the Marina Bay Financial District. It enjoys a 90.5% occupancy rate as at 31 December 2017.

The fifth perspective

CapitaLand Commercial Trust has built a track record of delivering growth in both gross revenue and distributable income over the last five years. Its latest acquisition, Asia Square Tower 2, will be reporting its first full financial year in 2018 and be a main growth contributor in the near future. Meanwhile, the redevelopment of Golden Shoe Car Park is expected to be a catalyst for growth over the mid-to-long term.

Due to its merits, CapitaLand Commercial Trust’s share price has risen strongly over the past year and its gross dividend yield is now on the low side at just 4.7% — which is also lower than the 6.14% yield it recorded in 2016 (based on 2016 DPU of 9.08 cents and a share price of S$1.48 as at 31 December 2016). CCT’s yield is one of the lowest among 39 REITs listed in Singapore.

As I write, the dividend yield of Singapore REITs ranges between 4.5-9.0% per annum. (For more details, please feel free to check out Singapore REIT data.) So it looks like one might have to wait for a better time to pick up shares of CapitaLand Commercial Trust.

Read also: Top 10 Singapore REITs that made you money if you invested from their IPOs