The strategic restructuring and scheme resolution of CapitaLand was approved by shareholders at the recent extraordinary general meeting held on 10 August 2021. The approval sets into motion the privatisation of CapitaLand Limited (CL) and the new listing of CapitaLand Investment Limited (CLI).

Insights into the business of CLI was shared at a private media briefing and at the EGM for shareholders. What can shareholders and investors expect from the newly restructured CLI moving forward? Here are eight things I learned.

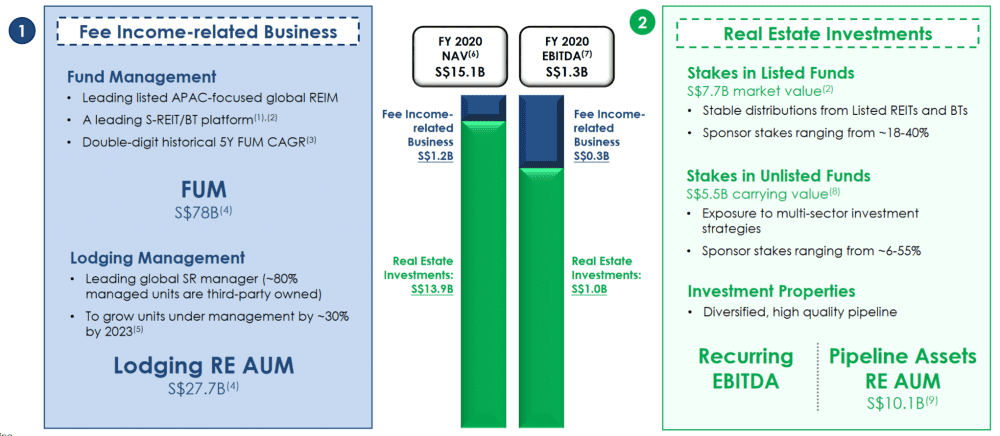

1. CLI’s new business model includes its fee income-related businesses and real estate investments. The fee income-related businesses (highlighted in blue) comprises fund management and lodging management – two areas where CLI manages third-party capital for a fee. For real estate investments (green), CLI generates recurring income through its stakes in REITs and private funds.

According to CEO Lee Chee Koon, CLI will place greater emphasis on growing fee-related income, while real estate investments will form a pipeline for potential assets which can be converted and monetised to funds under management (FUM) to grow the fee income business.

2. Stakes in listed REITs and business trusts provide distribution income for CLI, while unlisted funds provide opportunities to expand into new sectors and geographies. Approximately S$10.1 billion worth of pipeline assets has been planned for monetisation in the next 3-4 years.

3. CFO Andrew Lim explained that both fund management and lodging management are grouped under fee income-related business as both business models essentially charge a fee for managing assets. In fund management, CLI seeds its REITs and funds with 20-30% of its capital and manages capital from other parties. In the lodging business, CLI is hired to operate the businesses of third-party hospitality and long-stay assets such as service residences. However, the growth of fee-related earnings (FRE) and the key performance indicators of each business are different due to their different operational nature.

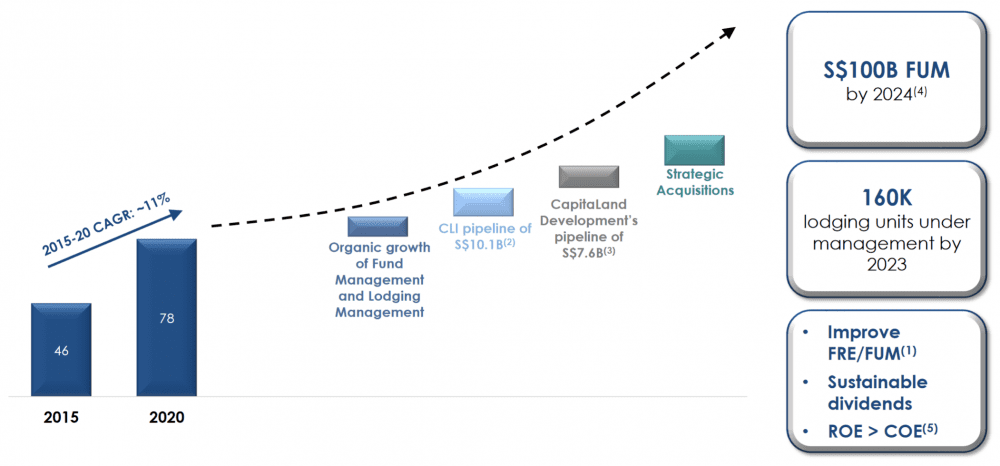

For fund management, the ability to charge fees, attract investor capital, and increase assets under management (AUM) is contingent on CLI’s ability to bring to market distinctive and novel products that sit higher on the risk-return curve. A key indicator of success for CLI’s fund management is the growth of its FRE/FUM ratio. Historically, CL’s fund management business has been able to generate an average FRE/FUM ratio of 40 basis points. The historical five-year FUM compound annual growth rate (CAGR) from 2015 to 2020 is 11%.

For the lodging business, the average FRE/FUM ratio is about 70 basis points. Key to the growth of the lodging business is the ability to grow its hospitality assets under management. The CFO projected that growing its assets to 160,000 keys and beyond will drive margin growth and enable CLI to match best-in-class operators such as Marriot or IHG.

4. The management considers several factors before investing in new economy assets including a region’s population growth, its rate of urbanisation, and the alternative use of assets. For example, in the logistics space with typical rental lock-in periods of 8-9 years, the CFO said that the management must be selective of the regions where they invest as competing logistics properties could easily be built in places where land is abundant, like Europe.

In contrast, the CFO shared that that there is a development team in India buying up logistics assets as the region has a growing population and provides the option to convert logistics warehouse into other uses.

5. On the potential creation of new REIT products, the CFO shared that any new REIT that CLI launches has to be of a large enough size in order to be successful in Singapore’s mature REIT market. He said that smaller-sized REITs (up to S$1 billion dollars) are unable to attract large institutional investors and unlikely to trade well. Compared to established REITs, smaller REITs tend to experience challenging growth with an acquisition typically requiring an equity fund raising from investors.

CLI also has to ensure there are no duplicates between its REITs. For example, CLI owns a portfolio of data centres in Europe under Ascendas REIT, which requires CLI to resolve an overlap if it were to launch a pure-play data centre REIT.

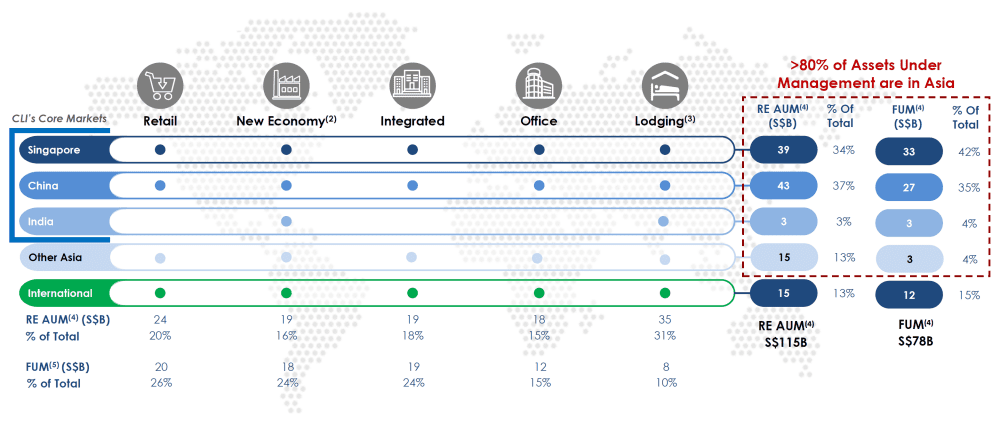

6. On competition with large competitors such as Mapletree, the CEO shared that the real estate sector is a trillion-dollar economy, with enough room for multiple players in the asset management space. CL’s key strength is its focus on Asia which makes up 80% of AUM. The CEO also mentioned that retail space in China is one of the biggest strengths that CL has built up compared to other players. The management’s view is that Asia is positioned for continued growth in the next 5-10 years, with many REITS expected to be anchored in China. India is another region where CL has a strong presence in.

On the recent news that a competitor ESR is buying ARA, a unitholder wanted to know CLI’s plan to maintain its competitiveness. While the management cannot comment on the transaction, the new entity CLI aims to increase its fund management business from S$78 billon currently to S$100 billion by 2024. It also plans to work with strategic partners to create new funds and develop new assets such as business parks and data centres.

7. Unitholders wanted to know why CapitaLand Integrated Commercial Trust (CICT) units were given to shareholders as consideration for the scheme, instead of other REITs such as Ascendas REIT. The management explained that CICT’s units were the most liquid when compared with other listed REITs and would provide sufficient market demand to facilitate shareholders trading.

The management added that the number of CICT units to be distributed comprised a relatively low percentage of CICT’s total issued shares. CL’s current ownership stake in CICT is 28.9%. The distribution of CICT units represents approximately 6.0% of CICT units outstanding and will lower CapitaLand’s stake in CICT to 22.9%, which is in line with its holdings in other listed funds such as Ascendas REIT.

Shareholders will have a window of one month to trade any odd lots through the appointed brokerages — DBS Vickers, Phillip Securities, and UOB Kay Hian — from 16 September to 14 October 2021. This is applicable to both CLI shareholders and CICT unitholders.

8. A shareholder asked about the intrinsic stock price of the new entity, CLI. The management expects CLI shares to trade at NAV upon listing (scheduled for 16 September 2021), which is S$2.823 per share. CLI’s dividend policy will mirror CL’s which is to distribute at least 30% of annual cash PATMI. The management team has decided to maintain an unchanged dividend policy for CLI in the near term and will undertake a review when there is greater visibility of a more normalised operating environment in the next 12 to 24 months.

The fifth perspective

The restructuring has provided an immediate unlocking of value for shareholders with the privatisation of CapitaLand’s development business. CapitaLand’s share price has increased since the restructuring was proposed and reflects the market’s appreciation for the more streamlined fee-income and fund management structure. Moving forward, shareholders can continue to participate in the growth of the newly listed CapitaLand Investment as it moves towards a more asset-light and capital-efficient business model.

Liked our analysis of this AGM? Click here to view a complete list of AGMs we’ve attended »

Wonderful insights on the CLI. Great tks.

I am a vested interest of CapitaLand.

Is there any postulation of the dividend or dividend yield (based on 2.8 price) fr the earning in current CLI businesses?

tks

Thanks YK! The management’s response on CLI’s dividend policy is that a dividend of at least 30% of annual cash PATMI (profit after tax and minority interest) will be declared at the end of the financial year. Thus it would not be possible to provide any dividend yield figures till CLI’s annual cash PATMI is reported.