Chinese Company’s CEO, COO and Cash All Missing

Ultrasonic AG, a Chinese company listed in Germany has reported that its CEO, COO and cash have all gone missing. According to a statement released by the company, CEO Qingyong Wu and COO Minghong Wu are “not traceable” and “that most of the company’s cash funds at PRC and Hong Kong levels have been transferred being no longer in the company’s range of influence.”

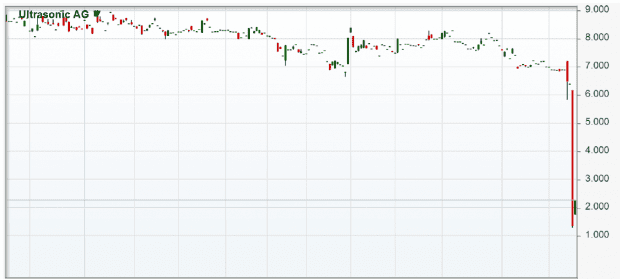

Not surprisingly, the German stock market reacted to the news and Ultrasonic shares plunged 71.6% in heavy volume closing at 1.798 euros on Tuesday.

Chart: Börse Frankfurt

Ultrasonic had been enjoying steadily rising revenues and profits. Revenues had grown from 49.9 million euros in 2008 to 163.8 million euros in 2013. Profits similarly grew from 8.4 million euros to 35 million euros over the last five years. The company ended 2013 with a cash balance of 108.5 million euros.

This case highlights how important it is to analyze not just a company’s business and financial performance — but the management team leading the company as well!

In fact, a company should fulfil all four investment quadrants – Business, Management, Financials, Valuation – before you even consider investing in its stock. Unfortunately in the case for Ultrasonic investors, it looks as if it’s near impossible to ever get their money back.

What safety is there if the Protector is the Plunderer?

Most politicians and corporate leaders in power have been suspected of plundering the wealth of the countries and companies respectively world wide but without any punishment because of possible collusion of the Enforcers-Investigators-Judiciaries as this is called WHITE COLLAR CRIME and the culprits are also White Collared and holding positions of power. Even Religious & Charity funds are not safe from these White Collar Criminals. Sadly even the Almighty appears to be silent as the name and teachings of the respective ‘gods’ are used to commit the crime.This could be due to the fact that most of the reps of the ‘gods’ are also dressed in white.

Well, in this case it looks like a couple of Chinese blokes made off with millions in euros leaving investors and stakeholders in the lurch.