REITs are a perennial favourite among local investors in Singapore. REITs offer a relatively high dividend yield and provide diversification to a portfolio, as real estate tends to perform differently than stocks and bonds. Unlike real estate, however, REITs are publicly traded, which means they can be easily bought and sold on stock exchanges, providing liquidity for investors.

REITs also provide exposure to other types of property which are typically out of reach for the typical property investor like shopping malls, office buildings, hospitals, data centres, business parks, and more.

If you’re new to REITs or investing in general, an easy way to gain exposure to REITs is by buying a REIT ETF. REIT ETFs provides diversified exposure to a basket of REITs, reducing the risk of investing in a single REIT. At the same time, even though an ETF gives you diversified exposure, you still need to do some amount of research on an ETF and whether it aligns with your risk profile and investment goals.

Here are seven factors we will consider:

- ETF components. Knowing an ETF’s components is important because it can provide insight into the type of assets the ETF holds and how those assets are weighted within the ETF. If an ETF holds a large percentage of a particular sector or security, that sector or security may have a significant impact on the ETF’s performance.

- Expense ratio. The lower the expense ratio, the better.

- Assets under management (AUM). A higher AUM typically indicates that more investors are buying shares in the ETF, which can make it easier for investors to buy and sell shares in the ETF.

- Distribution yield. The higher the yield, the better. It’s important to note that the distribution yield is not the same as the ETF’s total return. An ETF with a high distribution yield may not necessarily perform better in terms of total return.

- Distribution frequency. Quarterly, semi-annual, annual.

- Return since inception. The higher the return, the better. Returns are calculated on a NAV-NAV basis and assuming all distributions are reinvested.

- Tracking error. Tracking error is a measure of how closely an ETF’s performance follows the performance of its underlying benchmark index. Tracking error should not exceed 2%.

In Singapore, there are five REIT ETFs listed on the Singapore Exchange (SGX). Here they are below, listed in in order of their listing date.

Phillip SGX APAC Dividend Leaders REIT ETF

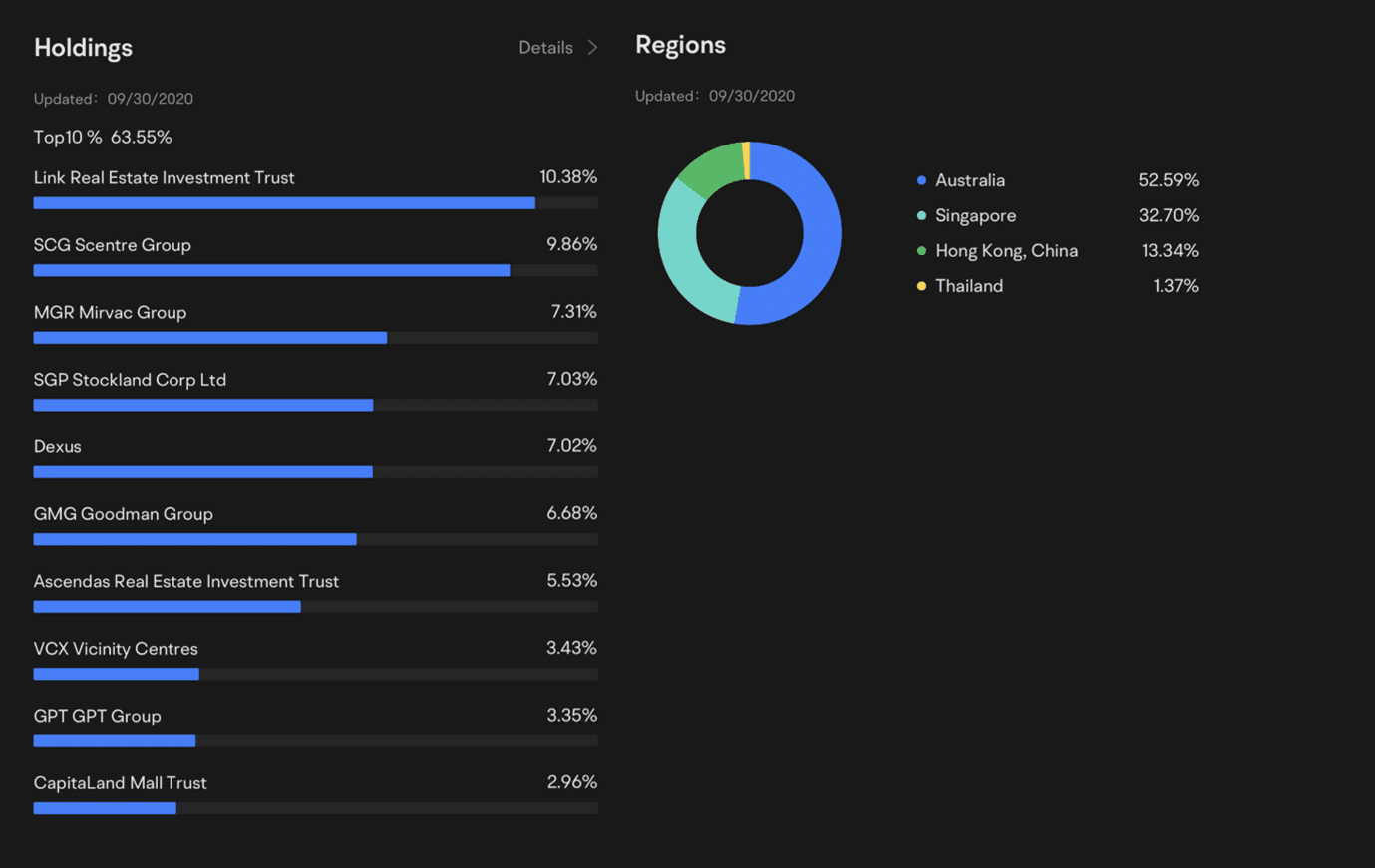

Phillip SGX APAC Dividend Leaders REIT ETF tracks the performance of the iEdge APAC Ex-Japan Dividend Leaders REIT Index. The Index is ranked and weighted according to the highest total dividends paid in the preceding 12 months. The ETF was launched in October 2016.

| Expense Ratio | AUM | Yield | Distribution Frequency | Return Since Inception | Tracking Error | |

| Phillip SGX APAC Dividend Leaders REIT ETF | 1.03% p.a. | US$11.2 million | 4.85% | Semi-annual | 2.08% p.a. (as of Nov 2022) | 1.59% |

NikkoAM-Straits Trading Asia Ex-Japan REIT ETF

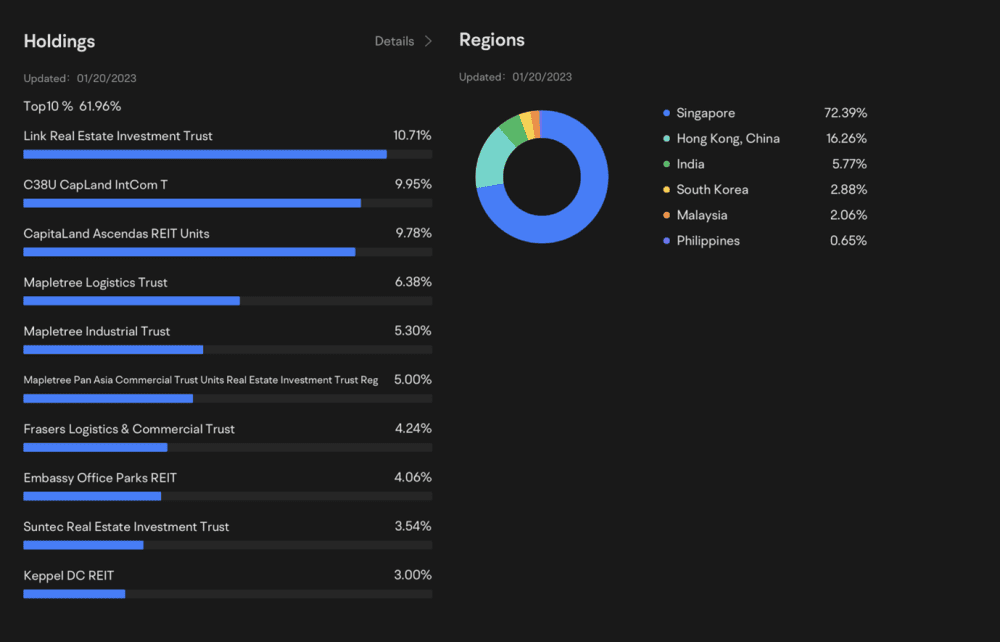

NikkoAM-Straits Trading Asia Ex-Japan REIT ETF tracks the performance of the FTSE EPRA Nareit Asia ex Japan REITS 10% Capped Index. The ETF provides investors with exposure to a basket of REITs in the Asia ex-Japan region. The ETF was launched in March 2017.

| Expense ratio | AUM | Yield | Distribution Frequency | Return Since Inception | Tracking Error | |

| NikkoAM-Straits Trading Asia Ex-Japan REIT ETF | 0.58% p.a. | S$394.23 million | 5.28% | Quarterly | 2.66% p.a. (as of Dec 2022) | 0.31% |

Lion-Phillip S-REIT ETF

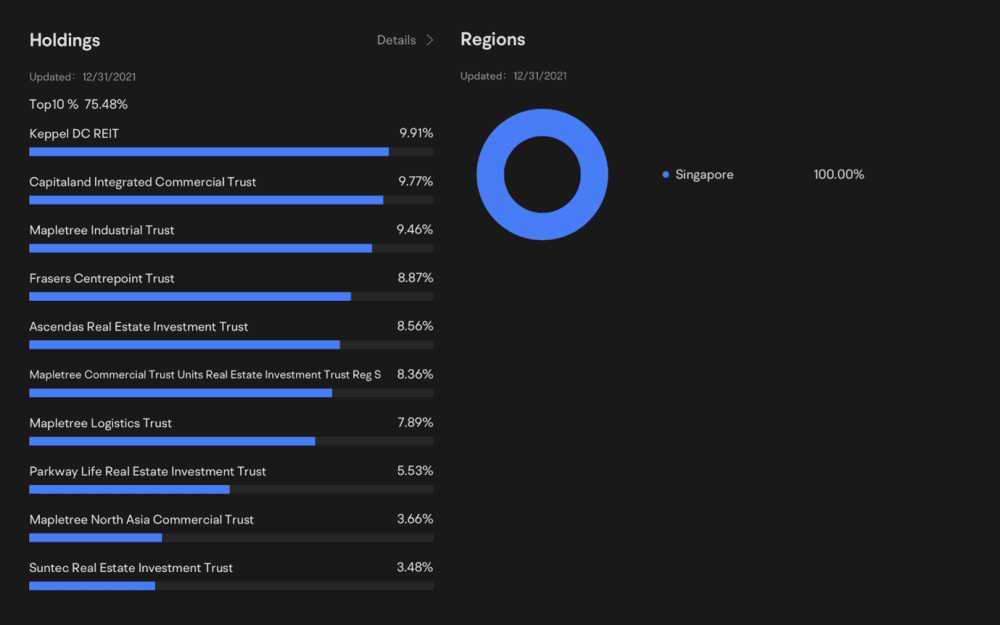

The Lion-Phillip S-REIT ETF tracks the performance of the Morningstar® Singapore REIT Yield Focus Index, a market capitalization-weighted index that comprises S-REITs listed on the SGX. The ETF was launched in October 2017.

| Expense ratio | AUM | Distribution Yield | Distribution Frequency | Return Since Inception | Tracking Error | |

| Lion-Phillip S-REIT ETF | 0.6% p.a. | S$291.8 million | 5.20% | Semi-annual | 2.5% p.a. (as of Nov 2022) | 0.5% |

CSOP iEdge S-REIT Leaders ETF

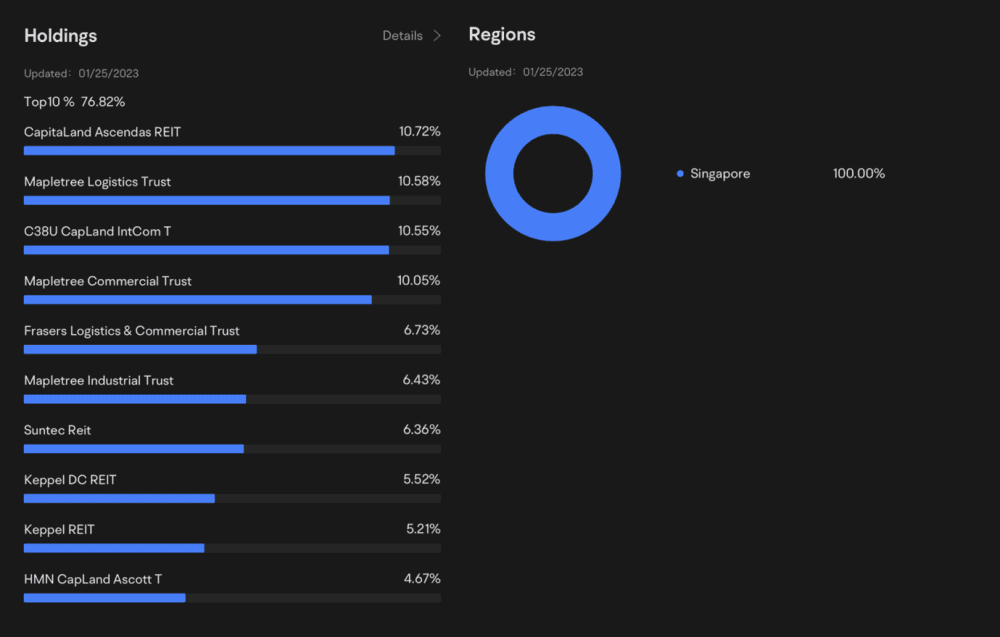

CSOP iEdge S-REIT Leaders ETF tracks the performance of the iEdge S-REIT Leaders Index ETF. The index measures the performance of the most liquid SGD REITs listed on the Singapore Exchange. The ETF was launched in November 2021.

| Expense ratio | AUM | Distribution Yield | Distribution Frequency | Return Since Inception | Tracking Error | |

| CSOP iEdge S-REIT Leaders ETF | 0.6% p.a. | S$91.4 million | 4.8% | Semi-annual | -12.5% (as of Dec 2022) | 0.33% |

UOB Asia Pacific Green REIT ETF

UOB Asia Pacific Green REIT ETF tracks the performance of the iEdge-UOB APAC Yield Focus Green REIT Index. The index is composed of a selection of REITs from the Asia Pacific region that have a focus on sustainable and environmentally-friendly properties. The ETF was launched in November 2021.

| Expense ratio | AUM | Distribution Yield | Distribution Frequency | Return Since Inception | Tracking Error | |

| UOB Asia Pacific Green REIT ETF | 0.5% p.a | S$68.67 million | 4.3% | Semi-annual | -16.37% (as of Dec 2022) | 0.52% |

Which is the best pick?

To reiterate, the ‘best’ ETF for you is the one that aligns with your risk profile and investment goals. At the same time, a look at the data above can give you some quick insights into the ETFs:

- Phillip SGX APAC Dividend Leaders REIT ETF, although listed the longest, is the least popular ETF with an AUM of only US$11.2 million. It also has the highest expense ratio at 1.03%.

- NikkoAM-Straits Trading Asia Ex-Japan REIT ETF and Lion-Phillip S-REIT ETF are the largest ETFs by far, and have very comparable expense ratios, yields, and returns. The key difference between these two ETFs though is that the former also invests in REITs outside of Singapore, while the latter is purely focused on Singapore REITs. Depending on your geographic preference, one may suit you better than the other.

- CSOP iEdge S-REIT Leaders ETF only launched in November 2021, but the index it tracks — iEdge S-REIT Leaders Index — has been around since 2014. The index has a five-year annualised return of 6.5%, which beats the 2.5% annualised return from Lion-Phillip S-REIT ETF (the only other Singapore REIT-focused ETF) over roughly the same period. CSOP iEdge S-REIT Leaders ETF’s negative return is due to unfortunate timing as it was launched right before stock market prices fell.

- UOB Asia Pacific Green REIT ETF was also recently launched in November 2021 and stands out as an ESG-focused ETF. The index it tracks — iEdge-UOB APAC Yield Focus Green REIT Index – was launched in 2010 and has a five-rear annualised return of 2.97%. Notably, 84% of the ETF’s holdings are outside of Singapore and you may want to do more research on the individual components if you’re unfamiliar with them. Similarly, the ETF’s negative return is due to it launching just before stock market prices fell.

Knowing this, investors who are looking for a 100% Singapore REIT ETF will go for either Lion-Phillip S-REIT ETF or CSOP iEdge S-REIT Leaders ETF. (Although it must be pointed out that many Singapore REITs own foreign assets in their portfolios as well).

Those who want more exposure to Hong Kong, China, and India alongside Singapore will consider NikkoAM-Straits Trading Asia Ex-Japan REIT ETF, and those who are leaning toward greener practices can consider UOB Asia Pacific Green REIT ETF.

The fifth perspective

REIT ETFs are a quick and easy way to gain exposure to a diversified selection of REITs. At the same time, it’s still important to do your own research outside of this article before you invest. Just like investing in a stock, investing in an ETF also requires due diligence!

For investors who prefer to manage your own portfolios, picking your own REITs also gives you a few advantages. Firstly, you get to create your own personalised ‘REIT ETF’ tailored for your exact preferences (e.g., you may not like some of the components and/or their weights when you buy an ETF). Secondly, you get to save on the management fees that the ETF charges every year. Thirdly, many REITs pay quarterly distributions, while four of the five REIT ETFs pay a semi-annual distribution. Finally, the potential for higher returns: REITs can potentially provide higher returns than REIT ETFs, especially if you invest in individual REITs that perform well.

With REIT prices largely depressed at the moment, this may be an opportune time for dividend-seeking investors to consider REITs for their portfolio.

Buy Singapore REITs and REIT ETFs anytime all on one convenient trading platform with the moomoo app. Moomoo SG via moomoo trading app has announced a lifetime $0* commission on US market for eligible clients. They are offering one of the most competitive trading fees across US, HK, SG & China A Shares with live market data.

When you successfully register for your moomoo SG universal account via the moomoo app, you will get to enjoy $0 commission-free* trading for the U.S. stock markets. You would also gain free access to Level 2 market data for the U.S. stock market; Level 1 market data for the Singapore stock market; Level 1 market data for China A Shares.

Investment products available through the moomoo app are offered by Moomoo Financial Singapore Pte. Ltd (Moomoo SG), a capital markets services licence holder regulated by the Monetary Authority of Singapore. Moomoo SG’s parent company, Futu Holdings Limited, is backed by world-class investors which include venture capital affiliates of Tencent, Sequoia Capital and Matrix Partners.

Open your moomoo SG universal account today with the moomoo app here. *Terms and conditions apply. Platform and other fees apply.

All views expressed in the article are the independent opinions of The Fifth Person. Neither moomoo Singapore or its affiliates shall be liable for the content of the information provided.

The content is provided for entertainment & informational use only. The information and data used are for purposes of illustration only. No content herein shall be considered an offer, solicitation or recommendation for the purchase or sale of securities, futures, or other investment products. All information and data, if any, are for reference only and past performance should not be viewed as an indicator of future results. It is not a guarantee for future results. Investments in stocks, options, ETFs, and other instruments are subject to risks, including possible loss of the amount invested. The value of investments may fluctuate and as a result, clients may lose the value of their investment. Please consult your financial adviser as to the suitability of any investment. This advertisement has not been reviewed by the Monetary Authority of Singapore.

The distribution yield indicated is after deducting expense ratio?

Hi Kim Meng,

Fees are deducted from the net asset value of the ETF.

https://www.investopedia.com/ask/answers/071816/how-are-etf-fees-deducted.asp

Adam, do you know what is the turnover of these ETFs. I am not sure if i am using the right term, but its whether they (these reits etf) buy and sell the REITS in the portfolio alot resulting in burning of cash ?