4 digital banking tips to automate and protect your finances

There are two principles from David Bach’s The Automatic Millionaire which primed the beginning of my journey to financial independence.

The first is to always pay yourself first,which doesn’t mean treating yourself to a restaurant meal every week or buying a new toy/gadget every month but investing in yourself. This could mean something as basic as funding your retirement account or signing up on that new Scrum Master class that costs a lot but would help you in your career in the long term.

The second is budgeting, which I’d admit, is hard to stick to. Like diets and New Year resolutions, it’s easy to start, but also easy to give up on.

Because of how digital our finances and financial services have become, managing and investing our money has become much more efficient and effortless, compared to just a decade ago. Though digital banking brings many conveniences and benefits, they do come with risks too!

The following are four tips on how I manage my finances automatically with the use of the banks’ digital apps and services. These will also protect you from scams, phishing, and breaches (though rare) in light of the recent scams in Singapore.

1. Digital banking safeguards

What good is automating finances if we’re still worrying about it?

Set limits to your bank accounts and debit/credit cards easily with just a few taps on the phone. This way, your card details (digitally stored on shopping apps for example), cannot be used against you, in the event of breaches which can sometimes happen.

Also, connect your debit card to a ‘sandbox’ savings account with little or no funds for extra security. When you need to withdraw cash from ATMs, transfer funds to those accounts with your digital banking app. These transfers are usually instantaneous.

Depending on your bank, some may not charge you any fees for low balances. Personally, I only use credit cards because:

- Easier on the cash flow. I don’t use my money first when I spend. Some stores also offer 0% instalment plans for specific cardholders.

- No fear of late payment. As long everything has been automated.

- Safety. In rare cases of credit card breaches, funds are easier to be retrieved or transactions can be cancelled with just a single call. (Banks usually have a dedicated hotline for credit card related queries.)

- Points, cashbacks, and perks. Few debit cards offer cashbacks. Even then, they’re not as attractive as credit cards. Perks like dining discounts do add up too!

When things are automated and easily tracked, you’ll have more mental space to manage your funds and be less susceptible to phishing/scams — which can happen to anybody because phishing scams make you your own worst enemy.

2. Having multiple accounts is good for you

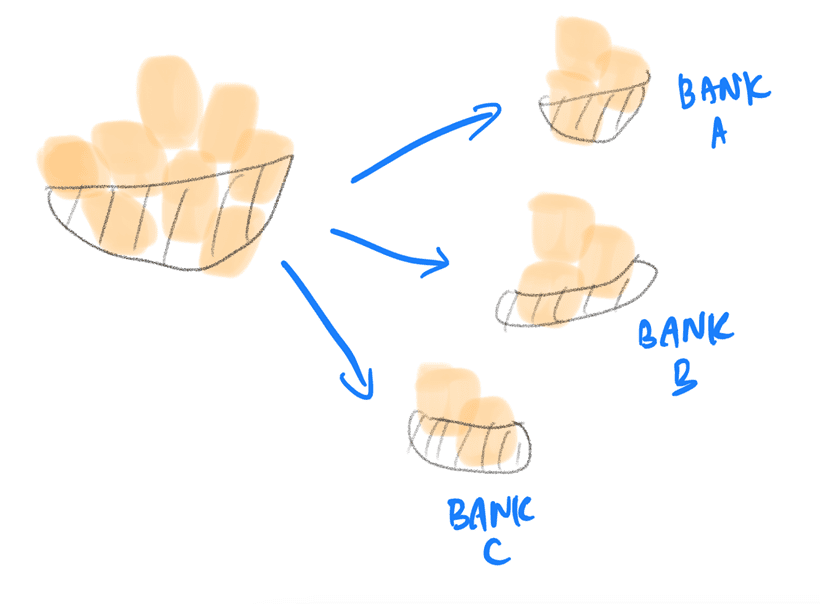

On the topic of security, even if your accounts are breached, having funds diversified across different banks will cushion the impact. For example, if you’ve got $30K but spread across three bank accounts ($10K each), you won’t lose all your money in a single breach. However, beware of minimum sums imposed by different banks and not to fall under them lest you get penalised!

3. Automatic money management

At the end of every month, my monthly wages are deposited directly to my savings account. Within the same week, thanks to the wonders of digital banking, pre-set sumsare automatically transferred to fund different accounts in other banks, investment, and roboadvisor accounts.

To make sure I do not incur any late fee or charges, every credit card I own has an active automatic GIRO payment set up for full payments. Within my investment and roboadvisor accounts, they too have automatic deductions and inter-portfolio transfers to make sure that I stay invested in the markets.

Not only do these save a lot of time, but with these rail guards in place, I tend to stay disciplined in my investment and financial planning. I focus more on the big picture and less on the smaller details (which are already automated).

4. Taking advantage of interest-free services

There are banks in Singapore that offer conversion of retail purchases into easy-to-pay 0% interest monthly instalment plans. For example, DBS has their My Preferred Payment Plan that allows any purchase above $100 to be converted to a maximum of six monthly payments at 0% interest. Other banks such as Citibank and UOB offer similar services, but with an interest rate.

This is an option to ease cash flow, and your freed up cash can be used elsewhere such as for emergencies or investing. Anything that beats parking your money in your bank account which only gives 0.5% of interest per year. However, it’s easy to get carried away with this, so be careful and always check your expenses! But if your credit card payment is automatically paid off monthly, that’s one less thing to worry about.

Also, check your bank’s promotional communiques on which stores offer 0% instalment plans. Courts, Ikea, and Apple are just a few of themany stores that offer easy financing to drive sales and patronage.

The fifth perspective

It’s also important to note that not every bank is equal. Choosing a bank is probably as important as choosing your insurance agent!

Personally, great customer service and a modern mobile banking app is extremely important, and this sets banks apart from one another. HSBC and Citibank are my personal favourites (the former has my primary bank account) with their prompt live agent chats (not available with OCBC and DBS) which saves precious time by offering prompt help when I truly require it. Clean interfaces mean a more efficient app as banks these days tend to upsell and bloat their banking apps with features/services we may not use much at all.

There you have it folks, four digital banking tips for worry and fuss-free management of your finances. Are you happy with your bank or will you be switching soon? Share your thoughts in the comments section below!

As long as it’s not ICBC, it’s OK. The most ridiculous bank I have come across. Penalise customers for not performing any transaction within a year by charging a fee. Say if you placed $50K with them. When I want to close the account a year ago, they said no need to close, it will automatically close after a year if no action. But after one year, they sent me a letter saying I need to pay US$10 for a dormant account. Then they said they will waive it due to C19 but reserve the right to charge me later. Wtf. Roti prata with me for more than a year. What they said they can go back on later. Gave up talking to them. The letter stated that it applies to both retail and corporate accounts. You win lor, the world largest bank.

Don’t be lure by a higher interest rate, I learned my lesson.