3 reasons why you shouldn’t pay off your home loan immediately – even if you can

Of the many daydreams that I’ve had, I often think about paying off my home loan faster. After all, it is the biggest loan that I have and not having to make monthly mortgage repayments would provide me with more cash on hand. It would remove my largest liability and give me peace of mind by removing the psychological cost of debt.

It’s a tempting thought and I have really considered withdrawing large sums of money from my own savings account to do so, but here are my three reasons why I ultimately didn’t, and why you shouldn’t too.

1. Opportunity cost

If you live in Singapore, there are two common options that homeowners consider when financing a home — a bank loan or HDB loan (ranging from 1.5% to 2.6% interest p.a.). Though banks may raise their interest rates, historically, it has never gone higher than 4%.

On the other hand, if we look at the annualised average returns of my favourite stock market index – the S&P 500 – it is at a solid 10%! So instead of using your money to reduce your home loan, you can invest in an S&P 500 ETF (or similar) to earn a higher return. In other words, the stock market can essentially help you ‘pay off’ your mortgage over the long term.

Consider two hypothetical homeowners with 30-year loans. Tom steadily increases his mortgage repayments every year and accomplishes his goal of paying off his entire home loan five years early. (Fun fact: there’s a prepayment penalty for paying off your home loan early with the bank; there’s no prepayment penalty for HDB loans.)

On the other hand, Harry maintains his mortgage payments and invests his extra funds in the stock market. He takes a longer time to pay off his home loan. But besides his owning property free and clear at the end, he also owns a stock portfolio that has significantly appreciated in value over the last three decades!

The risk from investing is that the stock market can be volatile over the short term and crashes will happen in certain years. However, stock markets tend to rise over the long term. Therefore, disciplined and steady investment in the stock market over a long period is a must.

2. A rainy day

Emergency funds are extremely important. It can be used in times of emergencies or unexpected events. By having a reserve fund, you’ll be protected from the need to take a loan with very high interest rates. By accelerating your home loan repayment, you will have less cash (or liquid assets that you can liquidate quickly) in the event of emergencies.

If your wealth is locked up in your home, you’ll find it very difficult to liquidate your wealth when money is needed urgently. Selling a property can take months, and you may be forced to accept a lower sales price if the money is urgently needed.

3. Inflation

Inflation drives many things up. Cost of goods and services become more expensive as the value of each dollar decreases over time. On the other hand, this also means that the value of your outstanding home loan decreases over time in dollar terms; paying off $500k 30 years from now is cheaper than paying $500k today. Of course, banks charge you interest on your loan to keep up with inflation. But if inflation is higher than the interest rate you pay, then your loan actually becomes cheaper in real terms.

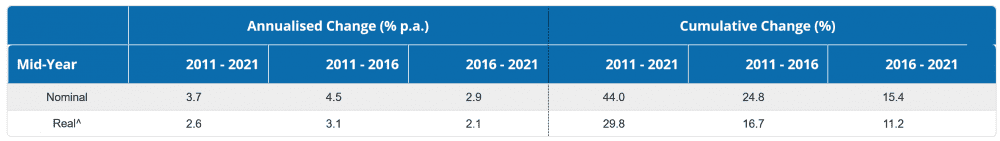

Another point to consider is the rise of your income over time. From 2016 to 2021, wages in Singapore have risen by 2.1% in real terms. As long as your wages are rising in tandem with inflation, you should be able to keep up with the rising costs and pay off your home loan over time.

The fifth perspective

Though it’s tempting to pay off your home as soon as possible to achieve freedom from debt, remember that the path to financial independence isn’t a sprint but a marathon. While paying off your debt is good thing, it’s more important to start investing today and grow your wealth in the years and decades to come.

I’m really not sure I completely agree with you regarding your statement that “Though banks may raise their interest rates, historically, it has never gone higher than 4%.” I’m willing to stand corrected, but in and around 2006 to 2007 the mortgage rates were generally significantly higher than that. At the time we had a large lump sum to invest and we used some of it to clear our mortgage. Sure we could have ploughed it into another investment, but we’ve never regretted freeing ourselves from the bank. At the time the risk-free returns offered by government bonds etc were significantly lower than mortgage rates. Owning their own home outright is for many, maybe most people, an empowering feeling.

Hey Jonathan! Sincerest apologies as I’ve forgot to include my source and disclaimer. My claim of 4% is from https://www.moneysmart.sg/home-loan/sibor-vs-sor-trend and it peaked circa 2006 – which as you pointed out when rates were significantly higher. Also note that this is only for bank home loans Singapore.

I too, look forward to the day when my loan will be paid off! However, it’s also important to consider putting eggs in different baskets such as a larger emergency fund or wider insurance coverages for unforeseen circumstances. Money like many other resources, is finite.

However, I may change my tune if I’ve struck lottery or have ‘enough’ income-generating assets 😄 More eggs!

Thanks for this article. I used to work in SG last time and now i’m back to KL and can’t wait to clear my condo debt here by paying off earlier. On the other hand like you said, stock market can grow 10% annually over time compared to property, financial independent have to be a marathon (which i really hate it) haha cos I haven’t secured by passive income yet. In Malaysia our bank loan interest is 3-4% much higher, the place I’m paying cost me RM460k (720sq ft) for 30 years. Renting income can be as low as RM1500-Rm2200. Service charge monthly is RM330, loan payment is RM2000+ hate all that but again, property growth is slow, stock market is more volatile but the return can be much higher. Thanks again to reassure my financial independent journey.

Hey Shenyl. That’s right! Investing (property included) should be like baking a cake and there shouldn’t be any need to change your approach too often. Stick to the (mortgage) plan and see your assets’ value rise over the years and decades! As how Oscar Wilde put it, “To do nothing at all is the most difficult thing in the world”