Frasers Hospitality Trust (FHT) (SGX: ACV) was listed on the SGX on 14 July 2014. It is a trust established to invest in hotels and service residences located in prime locations worldwide. As at 31 December 2017, FHT has a portfolio of 15 properties worth S$2.16 billion.

In this article, I’ll cover FHT’s developments since its listing, its financial results, and discuss its plans towards the immediate future. Here are the key things you need to know about Frasers Hospitality Trust before you invest.

Initial portfolio

1. FHT was listed with an initial portfolio of 12 properties worth S$1.67 billion. These properties are leased to independent hotel and service residence operators under long-term master lease agreements. The tenure of these agreements (all commencing from 14 July 2014) include:

- 20+20 years. FHT has eight properties currently leased under this arrangement: InterContinental Singapore, Frasers Suites Singapore, Frasers Suites Sydney, Frasers Place Glasgow, Frasers Suites Queens Gate, Frasers Place Canary Wharf, Frasers Suites Edinburgh, and Novotel Rockford Darling Harbour.

- 10+10+10+10 years. FHT has two properties currently leased under this arrangement: Park International London and Best Western Cromwell London.

- 10 years. FHT leases the ANA Crowne Plaza Kobe to K.K. Shinkobe Holding and the retail component of this property to Y.K. Toranomon Properties under this arrangement. This lease period is fixed for 10 years and is not renewable upon its expiry.

- 3+3+3 years. FHT leases the Westin Kuala Lumpur to JBB Hotels Sdn Bhd under this arrangement.

Acquisitions

2. Since its listing, FHT has made three acquisitions:

- On 7 July 2015, FHT completed the acquisition of Sofitel Sydney Wentworth for A$224.0 million. The hotel has 436 guest rooms and suites and operates under the Accor Hotel Group, an experienced international hotel operator. Currently, this property derives income from a master lease agreement with a term of 20+20 years.

- On 15 June 2016, FHT completed the acquisition of Maritim Hotel Dresden for €4 million. The hotel has 328 rooms and is leased to Maritim Hotelgesellschaft, part of the Maritim Group via a master lease agreement. The lease tenure is not stated in the announcement document for this proposed acquisition.

- On 20 October 2016, FHT completed the acquisition of Novotel Melbourne on Collins for A$237.0 million. The hotel has 380 rooms and also operates under the Accor Hotel Group. This property also derives income from a master lease agreement with a term of 20+20 years.

Financials

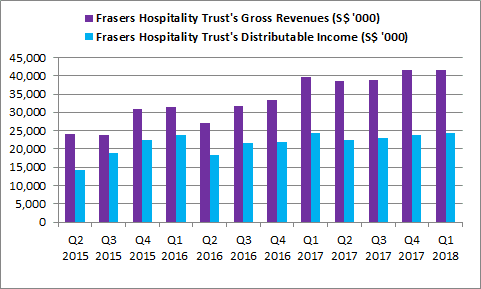

3. FHT has achieved steady growth in gross revenue and distributable income over the last three years. Gross revenue increased from S$24.0 million in Q2 2015 (the quarter ended 31 March 2015) to S$41.6 million in Q1 2018. Distributable income climbed from S$14.3 million in Q2 2015 to S$24.4 million in Q1 2018. The following are events that have contributed to FHT’s growth since 2015:

- The acquisitions of Sofitel Sydney Wentworth and Novotel Melbourne on Collins have driven growth in both revenue and net property income for FHT’s portfolio in Australia during the three-year period.

- Maritim Hotel Dresden contributed its first full-year financial results in FY2017.

- Westin Kuala Lumpur reported higher revenue and profits in 2017 as it achieved higher occupancy rates due to ongoing renovations at a competing hotel, strong corporate demand, and higher banqueting events which has driven food & beverage sales.

- FHT has so far only reported one significant dip in revenue and profits in Q2 2016. This was due to weaker demand for its properties in London due to concerns over terrorism which arose from the Paris attacks in November 2015. InterContinental Singapore also reported lower sales due to renovation works during the period.

Source: Quarterly Reports of Frasers Hospitality Trust

4. FHT declared 5.04 cents in distribution per unit (DPU) over the last trailing 12 months. As at 27 January 2018, FHT is trading at S$0.81 per share. If FHT is able to maintain its DPU, its expected gross dividend yield is 6.22%.

| Q2 2017 | Q3 2017 | Q4 2017 | Q1 2018 | Total | |

|---|---|---|---|---|---|

| DPU (in Singapore cents) | 1.21 | 1.24 | 1.28 | 1.31 | 5.04 |

Source: Quarterly Reports of Frasers Hospitality Trust

5. FHT has a 33% gearing ratio as at 31 December 2017 which is comfortably below the 45% regulatory limit. This means FHT still has debt headroom to fund acquisitions and asset enhancement initiatives to unlock potential value from its existing properties. Presently, its effective cost of borrowing is 2.8% and 88.5% of FHT’s borrowings are currently at fixed interest rates.

Income visibility

6. As of 30 September 2017, FHT derives income from 15 master leases of its properties. None of these leases will expire over the next five years. Excluding the master lease for Novotel Melbourne on Collins, the weighted average lease expiry (WALE) for is 16.3 years. (The WALE calculated is exclusive of the renewal of leases after the expiry of the initial term.)

Growth drivers

7. In January 2018, FHT completed the renovation of Novotel Rockford Darling Harbour which began in April 2017. The hotel has been renamed Novotel Sydney Darling Square. FHT is in line to relaunch the hotel to benefit from the new International Convention Centre in Sydney.

8. FHT is embarking on an asset enhancement initiative to convert Best Western Cromwell London to ibis Styles London Gloucester. The project is estimated to cost £2.2 million which will rebrand the hotel in line with the ibis Styles brand. FHT expects to finalise the design by August 2018 and complete the project by February 2019.

9. In 2014, FHT was granted the right of first refusal (ROFR) for 18 properties from the acquisition pipeline from its sponsor, Frasers Centrepoint Limited (FCL), and strategic partner, the TCC Group. As at November 2017, FCL and TCC Group own a 22.6% and 38.3% interest in FHT respectively. Since its listing, FHT has acquired only one property from its sponsor — Sofitel Sydney Wentworth — and have 17 properties left in the pipeline:

| Property | Country |

|---|---|

| Capri by Fraser, Changi City | Singapore |

| Fraser Place Robertson Walk | Singapore |

| Fraser Place Manila | The Philippines |

| Fraser Residence Sudirman Jakarta | Indonesia |

| Le Meridien Angkor, Siem Reap | Cambodia |

| Crowne Plaza Hotel, Kunming | China |

| Holiday Inn Hotel, Kunming | China |

| Fraser Suites Beijing | China |

| InterContinental Adelaide | Australia |

| Hyatt Hotel Canberra | Australia |

| Capri by Fraser, Brisbane | Australia |

| Fraser Suites Perth | Australia |

| Fraser Place Melbourne | Australia |

| Fraser Suites Kensington, London | United Kingdom |

| Capri by Fraser, Frankfurt | Germany |

| Capri by Fraser, Barcelona | Spain |

| Plaza Athenee, New York | United States |

Source: IPO prospectus of Frasers Hospitality Trust

Risks

10. FHT’s financial results are impacted by the performance of its hotels and service residences. This is because all master lease agreements of FHT were structured with a variable rent component where the rent is computed based on the gross operating revenue and gross operating profits (GOP) of the property. FHT will report stronger results when its properties perform well and vice versa if they perform poorly. Hence, FHT faces the risks associated with the hospitality industry including economic conditions, fall in commercial and leisure travel demand, increase in supply of new hotels, airline/transport strikes, terrorist attacks, spread of infectious diseases, etc.

At the same time, FHT has also structured a fixed rent component into all of its master lease agreements. It is a minimum amount of rent which is receivable by FHT in the event the variable rent is lower than the stated fixed rent. So there is a level of downside protection for FHT if its properties perform poorly in the future.

The fifth perspective

Since its listing, Frasers Hospitality Trust has proved itself to be rather resilient in the face of the Paris attacks in November 2015 and delivered steady growth in distributable income to unitholders thus far. With a low gearing ratio of 33% presently and an extensive pipeline of ROFR properties, FHT is currently in a healthy position to grow its portfolio to increase and diversify its future income.

FHT is still trading at 8% below its IPO price. DPU has also dropped from 7.56 cents in FY15 to 5.04 cents in FY17, mainly due to its right issue which enlarged its share base thereby diluting returns.

Next right issue may be in the pipeline?

Hi JN

I can’t speculate. But, with a pipeline of ROFR properties, issuance of rights shares is one of the methods where FHT can use to fund its acquisition of new assets in the future which enables it to remain below 45% in gearing ratio as required.

There are some who viewed Rights Issue negatively as it dilutes the original returns of a REIT. I think, Rights Issue should be viewed on a case by case basis. Personally, I’m okay with a REIT having a Rights Issue exercise to expand its property portfolio. This is because it is a chance for the REIT to not only increase its income but also to diversify its source of income, thus, adding more stability to its portfolio. With that said, of course, it depends what property it intends to buy and the effects to its DPU.

So, I believe one should study the Prospectus of the Rights Issue or any documents related before getting into it.