Freight Management Holdings Berhad (FMHB) is a multimodal intermediary forwarding agent between exporters, importers, and carriers. It is mainly present in nine operating countries including Malaysia, Australia, Indonesia, Thailand, and Vietnam. As of 30 September 2019, FMHB is worth approximately RM171.7 million in market capitalisation.

In this article, I will walk you through its business operations, long-term financial performance, and valuation. Here are 11 things to know about FMHB before you invest:

1. FMHB is a middleman that acts as a one-stop centre for exporters and importers by helping them select the most cost-effective, reliable route to ship their goods. FMHB will engage relevant sea, air, and rail carriers to provide the actual shipping service. FMHB also provides supporting services such as documentation, insurance, and claims required to ship goods from one place to another. Forwarders like FMHB are also referred to as non-vessel operating common carriers.

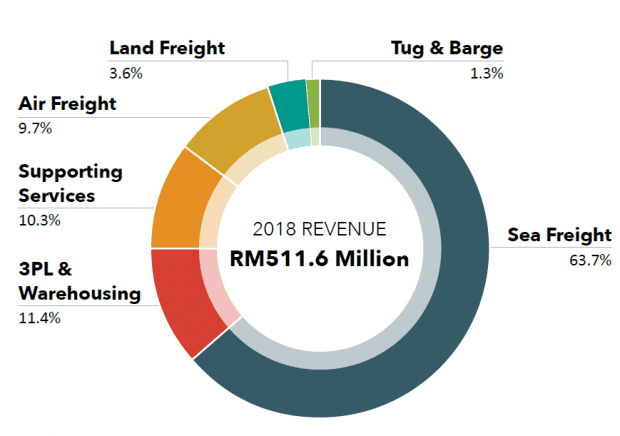

2. FMHB categorises its business into six segments: Sea freight, 3PL (third-party logistics) and warehousing, supporting services, air freight, land freight, and tug and barge. FMHB owns zero inventory and only owns property and equipment such as warehouses, trucks, trailers, tugs, and barges to assist with its logistics business.It does not own vessels, cargo aircrafts, or freight trains. It engages with external various sea, air, and rail carriers to ship the goods of its customers instead. Its tugs and barges ply the Straits of Malacca between Singapore, Peninsular Malaysia, and southern Thailand and cater mainly to the construction and oil & gas industries. In the highly fragmented freight forwarding industry, FMHB owns less than 1% of the regional market share.

3. Revenue has increased at a compound annual growth rate (CAGR) of 15.0% over the last 14 years, from RM83.0 million in 2005 to RM511.6 million in 2018.

Revenue has increased steadily during both good and bad times because of the company’s diversified customer base which include Novozymes (pharmaceuticals) and Johnson & Jonson (consumer staples) to Royal Selangor (pewter). Some of these industries like pharmaceuticals and consumer staples are also more resilient to economic downtimes. In 2018, revenue grew 10.9% year-on-year and all business segments achieved year-on-year growth except for the tug and barge segment.

| Segment | Revenue CAGR (2005-2018) | Revenue CAGR (2017-2018) |

|---|---|---|

| Sea Freight | 10.5% | 12.2% |

| 3PL and Warehousing | 18.3% | 23.5% |

| Supporting Services | 13.9% | 14.5% |

| Air Freight | 8.0% | 9.9% |

| Land Freight | 0.2% | 15.0% |

| Tug and Barge | 1.0% | -59.6% |

4. Revenue contribution from the tug and barge segment peaked at 10.9% in 2009 and has since decreased to an all-time low of 1.3% (RM6.5 million) in 2018. The decline is mainly due to the completion of the two integrated resorts in Singapore in 2010 as well as the slowdown in the oil and gas industry over the period. Competition is stiff in the tug and barge segment [U3] and demand for construction materials [U4] dropped after the two resorts were opened. FMHB plans to exit the segment by disposing its entire 49% stake in the business. FMHB has temporarily halted its rail freight service between Malaysia and Bangkok, Thailand as the reliability of shipments is affected by the mostly single-track railways in Thailand. Meanwhile, the sea freight segment was the largest revenue contributor in 2018 at 63.7%.

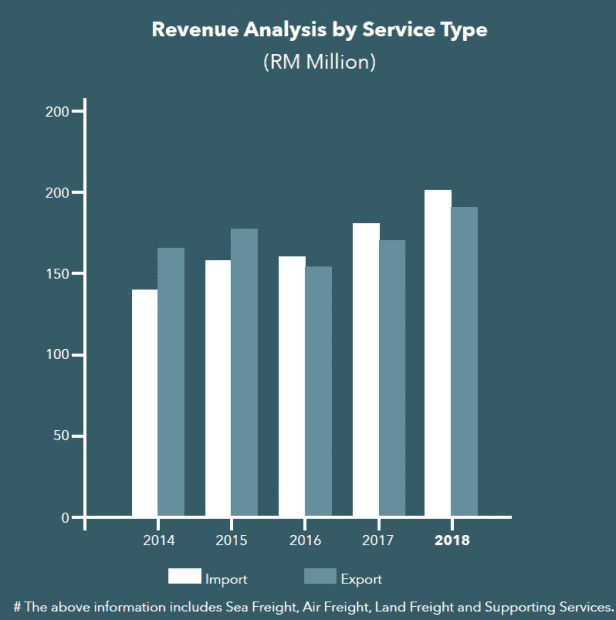

5. FMHB is less affected by changes in foreign exchange rates as it obtains approximately equal proportion of revenue from both import and export markets. It also derived 75.3% of its revenue from Malaysia in 2018.

6. A major risk that FMHB faces is increasing freight rates. Since the bankruptcy of Hanjin Shipping – the world’s seventh largest carrier – in 2017, the shipping industry has been in consolidation due to poor market conditions caused by the lasting aftershocks of the Global Financial Crisis. The number of carriers that contributed to 70% of total carrier capacity decreased from 15 to 10 between January and June 2018. As a result, carriers have stronger bargaining power compared to freight forwarders like FMHB. Furthermore, freight rates are affected by fluctuations in oil prices.

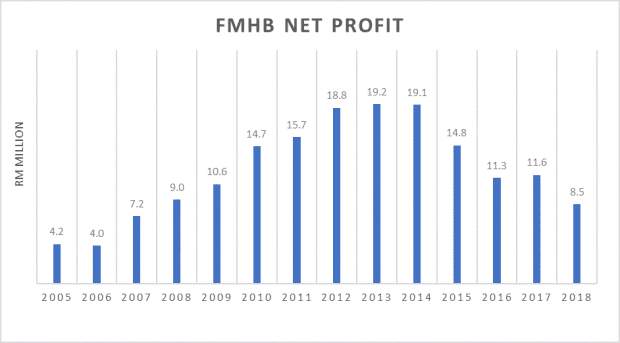

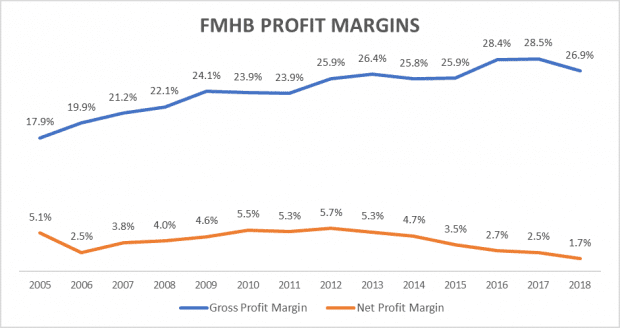

7. Net profit excluding one-off items has increased at a CAGR of 5.6% over the last 14 years, from RM4.2 million in 2005 to RM8.5 million in 2018. In 2018, net profit fell by 26.7% y-o-y. The drop is due to higher freight rates as a result of the consolidation of carriers as well as higher oil prices. Total operating expenses grew at a CAGR of 14.9% from RM80.7 million in 20o5 to RM490.3 million in 2018 in tandem with revenue growth.

8. FMHB’s net profit margin has been decreasing over the years. Its net profit margin will be further compressed if an online platform like Freightos exists to connect freight forwarders with shippers in the regions that FMHB’s operates in. The platform allows shippers to view and compare quotes instantly, intensifying competition between freight forwarders. However, the freight forwarding industry is in need of digital transformation and FMHB will need to improve its digital initiatives to remain competitive.

9. As at 5 October 2018, five directors collectively owned a 66.9% stake in FMHB. Chua Tiong Hock and Khua Kian Keong are non-independent non-executive directors and own indirect interests in FMHB through Singapore Enterprises Private Limited. They also serve as executive directors of Vibrant Group Limited which is listed on the Singapore Exchange.

| Substantial Shareholder | Designation | Shareholding (2018) |

|---|---|---|

| Chew Chong Keat | Managing director | 24.1% |

| Singapore Enterprises Pte Ltd | - | 20.1% |

| Yang Heng Lam | Executive director | 18.3% |

| Gan Siew Yong | Executive director | 4.4% |

10. From 2005 to 2018, average annual free cash flow was RM10.5 million. Spikes in capital expenditure happen mostly when FMHB spends on the expansion of warehousing space as well as acquisition of land, containers, and vehicles. In 2018, the average cash-flow-to-net-income ratio was 1.2.

11. From 2005 to 2018, FMHB average annual earnings per share (EPS) was RM0.07. The reason we use average EPS is because FMHB’s business is cyclical in nature, and using an average allows us to smooth out the company’s earnings. As at 30 September 2019, FMHB’s share price is RM0.615. Therefore, its normalised P/E ratio is 8.8 which is below its historical average of 9.3.

The fifth perspective

Even though Freight Management’s current P/E ratio is below its historical average and its dividend yield of 7.1% looks enticing, it’s uncertain whether the company can maintain its dividend in light of its declining profit margins and high dividend payout ratio (its payout ratio was 109.9% in 2018).

FMHB also doesn’t have a wide economic moat as exporters and importers will generally go for the lowest-priced freight forwarding service, and carriers carry considerable bargaining power. Investors may want to seek a higher margin of safety when considering FMHB.

This article is really appreciable!!

Since this hits my area of interest,

I would like to share Global Forecast for logistic industry(2018- 2023) which you may be interested in seeing: https://www.linkedin.com/feed/update/urn:li:activity:6619960814944251904