One of my favorite candies is ‘Lot 100’ and, in my opinion, its mango flavor is the best among the rest. You can easily get the candy from a mom-and-pop store in Singapore. If you observe the packaging, you can find that Cocoaland Holdings (Bursa: 7205) is the manufacturer of the candy brand. The company is listed on Bursa Malaysia and this is a classic example of how investors can make money investing in companies that produce the products and services you regularly spend on.

Image: Cocoaland Holdings

We made this investment in early 2015 and sold it around seven months later for a capital gain of 65% — net of brokerage fees and currency adjustment. Through this article, I hope you could learn from our analysis of Cocoaland and reasons for investing and, finally, divesting.

Cocoaland manufactures confectionery products ranging from candy, snacks, wafers, cookies, soft drinks, and jelly.

Image: Cocoaland Holdings

The company also targets the B2B market. Cocoaland is the contract bottle manufacturer for companies like GlaxoSmithKline, Frasers & Neave, Ribena, Pokka, Coffee Bean, etc.

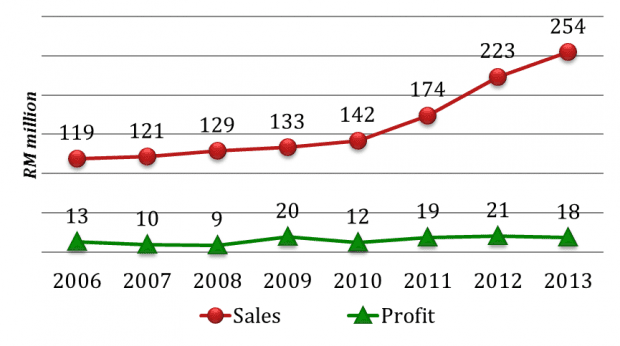

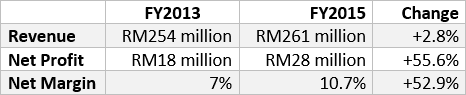

We know that the confectionary market is a competitive market. Take a walk down the candy aisle of any supermarket and you will discover an endless range of confectionery products made by Cocoaland’s competitors. Being a relatively small player, it is easy to assume that Cocoaland has a lot to lose if they competed head-on against the ‘giants’. Instead of turning this potential investment down right away, I sought to find out what set Cocoaland apart from its peers, especially after I noticed its revenue and profit had doubled over five years:

After my initial analysis, it was obvious that one of the primary successes for Cocoaland was its management’s ability to continuously build and expand the company’s distribution network.

Cocoaland’s products are not only well-distributed in hypermarkets, supermarkets and mini-marts in Malaysia and Singapore but the company also exports to more than 40 countries including the Middle East, Hong Kong, Taiwan, and Vietnam. I also found their products distributed online on Amazon!

Cocoaland is controlled by the Liew brothers (nine of them) who hold a 54.4% stake. Nine brothers (the fellowship!) collectively run the company and they have so far proved their capabilities in developing and marketing Cocoaland’s house brands successfully. The brands Lot 100, fruit10 and Sour+ are products of their ingenuity and hard work.

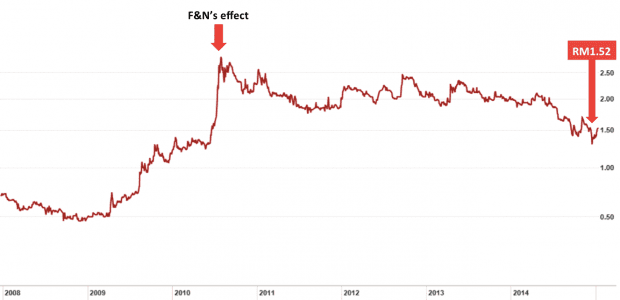

In 2010, Cocoaland welcomed a substantial shareholder, F&N Malaysia, who invested 23.08% in the company. F&N Group has one of the widest distribution networks in Malaysia and Southeast Asia. With F&N as a key strategic partner and major shareholder, Cocoaland’s distribution network could only grow and get stronger. It was a vital development that allowed Cocoaland to significantly strengthen its economic moat.

Financially, the company recorded increasing sales from 2006 to 2013.

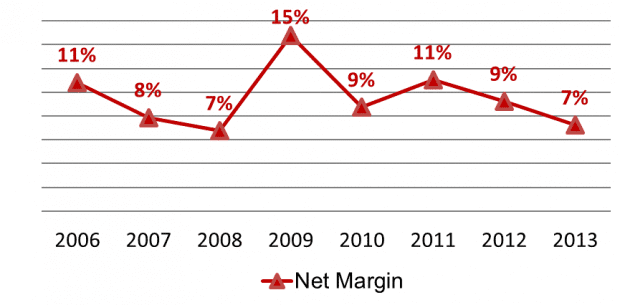

In 2008, net profit margin slumped to 7% when the company invested substantially in advertising and promotions for both domestic and international markets. Net margin recovered to 11% by 2011. With the major investment by F&N, Cocoaland expanded aggressively in 2012 and 2013. This resulted in higher start-up costs and reversed its net profit margin to 7% in 2013.

At that time of my analysis, Cocoaland just released its 9M 2014 financial results:

The result was unsatisfactory as revenue stalled when investors were expecting it to grow. Worse still, profit for the nine months ended September 2014 shrank by 14%. Along with the weaker US dollar (exports accounted for 35% to 40% of the company’s sales), the share price of Cocoaland dropped amidst the negativity.

Cocoaland share price. Chart: Financial Times

The management explained that the decline in profit was primarily due to higher start-up costs and rising overheads after the implementation of a minimum wage policy on 1 January 2013 in Malaysia. The company also spent aggressively on marketing in Vietnam, Indonesia, and China. These costs were incurred ahead to prepare for the company’s future growth and profitability is likely to return to normal levels a few years later.

Ignoring short-term pressure on its earnings, I looked through Cocoaland’s balance sheet and learned that it was remarkably strong: the company had no debt and a current ratio of 3.5.

The management also paid yearly dividends of 4.4 sen per share in 2010 to 6.5 sen per share in 2013. The dividend payout ratio was also sustainable – ranging from 50% to 60%.

Further insight revealed that the management had made a clear indication that Cocoaland would not be making any major investment in 2014 until earnings stabilized. This was an indication that the management was committed to improving its net profit margin.

With no significant CAPEX expected in 2014, there was more room for management to distribute any excess capital back to shareholders. In the event the management failed to improve on its earnings in the short term, I reckoned that the management could still increase the payout ratio to sustain dividends without putting too much strain on its balance sheet.

Cocoaland’s share price traded at RM1.52 as at 2 January 2015 – equivalent to eight times of my own calculations of adjusted cash flow. I liked the valuation and the stock also offered an attractive yield of 4.3%. So we bought.

A few months after our purchase, Cocoaland received a privatisation offer from Navis Asia at RM2.20 a share in May 2015.

A week after the announcement, Cocoaland received another competing privatisation offer from Anthoni Salim’s First Pacific Limited to acquire the company at RM2.70 a share. We took advantage on the positivity and divested our stake in Cocoaland in the open market at RM2.68 a share. After currency adjustment and fees, we netted 65% in capital gain.

From our experience, when a stock’s price moves too quickly ahead of its fundamentals, we become wary of holding it any longer. This is also in line with our investment process: to unlock value when the share price hits our appraisal of value.

After we sold, Cocoaland’s share price went as high as RM2.94 and First Pacific subsequently withdrew its privatization offer. Cocoaland also announced a 3-for-1 bonus share issue and profits lifted higher in FY2015 due to a better utilization rate of its previous investments, cheaper raw material costs (sugar), and weakening of the Ringgit against the US dollar.

Moving forward, the management expects to experience growth in its exports to China but I have other concerns. An exceptionally low sugar price and weakening Ringgit benefited the company’s bottom line in FY2015. The price of sugar in 2015 dropped to a level last seen during the subprime crisis which I believe is unsustainable and I fear that the trend will reverse in time to come (it seems to have turned already) and this will affect Cocoaland’s earnings in the short term.

The fifth perspective

From this case study, I wanted to prove to you that it is entirely possible to make exceptional returns (sometimes in just a few months!) when you learn how to identify the right opportunities in the stock market.

The problem for most people is that it requires a LOT of time to do the research necessary to spot an opportunity like Cocoaland – something that many full-time professionals don’t have. And even if you had the free time, doing research and analysis can be tedious and tiresome. It’s not everyone’s cup of tea!

If that describes you down to a ‘T’, then we invite you to check out Alpha Lab. In there, we give you a watchlist of companies that are fully researched and presented via a series of step-by-step videos, so you can learn how to identify high-quality companies and potentially profitable investments. All the research and analysis is done for you, so you don’t have to lift a finger to do it yourself.

If you’ve been looking for a “hands-free” way of investing in the stock market, this is it. You’ll probably never find a simpler way of making better, more profitable investment decisions. Click here to enter the Alpha Lab.