I saved $100k by age 30 and how you can do it too

‘Better skip your five-dollar Starbucks.’

‘“Stop buying bubble tea.’

‘You need to start investing now.’

‘Don’t eat out too often. It’s expensive.’

Why do I need to budget, invest and sacrifice the things that I enjoy doing? Why do I have to think about a second source of income? Why are the people on the internet giving me unsolicited advice? Why can’t I just live paycheck to paycheck and enjoy life?

As a student, I had (at most) a few hundred dollars in my bank account at any one time and I was content! It was more than enough for the occasional movie, bubble tea runs, fast food trips. And when Chinese New Year came and went, I’d have a few hundred extra from ang paos which I’d spend on a night out with my friends.

From a debt-ridden family, the idea of having more than four digits in my bank account was very alien – it felt almost impossible. So, as a young kid, I gave up the notion of ever becoming rich and decided to live a stress-free life by enjoying every single day to the fullest. After all, why not? I had no burdens as a kid, and this was my chance to enjoy life! (#YOLO)

After graduating and landing my first job, things did not change much. Money would come into my pocket and leave very quickly too. My expenses rose in tandem with my income. Repeat, rinse, no profit.

Until I met my girlfriend (now wife) and we started discussing the life ahead of us. What next? We wanted to get married. We wanted a place to call our own. Kids would be great. How much would all this cost?

2015: The first of a hundred steps

It was 2015. Nine months after my first paycheck, we both decided that we should both achieve at least $100,000 in six years’ time (by my 30th birthday). It was an arbitrary number, but we felt that with that sum of money, life would be much better.

It was a monumental task. The both of us were starting out in our careers with low salaries, student debt, and plenty of responsibilities. But a journey of a thousand miles begins with a single step. So we started our journey by breaking $100,000 into 100 smaller pieces. Every $1,000 we earned and saved meant we’re 1% closer to our goal.

2016: Saving was not enough

It was now 2016. Through countless days of scrimping and eating cai fan (no fish), I had managed to save up $10,000 by the age of 25! It was a slow grind but seeing five figures in my bank account was something I never knew was possible and continued to motivate me towards a six-figure sum.

However, with nearly a year gone from the start of the plan, I had to do more than just save money. True, I was closer to my goal now, but I needed to move the needle.

What started as a simple ’how to be richer’ Google search, led me to my first personal finance book, The Millionaire Fastlane by MJ DeMarco. To be honest, it was my first introduction to personal finance. I didn’t understand much from the book except that I shouldn’t be trading time with money. Time is finite and simply exchanging that with money (earning a salary in other words) isn’t a great way to get rich.

One thing led to another, and my first investment was the simple fixed deposit. The concept was straightforward: put money in the bank, lock it up, get a small percentage back at zero risk. I know now that fixed deposits aren’t really an investment, but it sounded pretty good to me back then.

Quickly, I put half of my entire net worth (around $5,000) into a one-year term deposit at 1% interest and waited patiently. In my third month into this ‘investment’, I realised that to double my money, I would need to wait for a hundred years. I needed to find another way.

2017: Grind, grind, grind

Almost a year later, money still in the bank, and eating cai fan for most of my meals. Nothing changed much except for the fact that I had a change of job which meant a slight pay raise. Though it was just a few hundred dollars more every month, it made my goal feel more attainable.

This year was different though. This was the year that my girlfriend and I had planned to get married. To prepare financially, we both took up small side hustles that gave us a few extra hundred bucks per month. We tried working at cafés, writing gigs, building websites, and other odd jobs. Those jobs never really moved the needle for us, but allowed us to move toward our ‘$100k by 30 goal’ by cushioning both daily and wedding expenses.

As for our wedding, we did most of it in Malaysia — we bought our bridal suit and gown, photography package, and even held our wedding dinner at a nice restaurant in Johor Bahru. We had to tap into our savings for sure, but the side hustles definitely cushioned most of the expenses by almost half!

At the end of year, and after our wedding costs, we both had approximate savings of $50,000 each. I was age 27. Three more years to go.

2018: Building momentum

Though trading money with time isn’t a good idea to be rich, it’s definitely a quick way to earn some money. The side jobs that we took on not only supplemented our income, but they also humbled us in the pursuit of financial freedom.

2018 was also the first time in both of our lives that we both boarded a plane to visit a different country for our honeymoon. It was an indescribable feeling, to experience something like this in your late 20s.

It was this year when I was first exposed to the concept of investing and trading. After all, with only less than three more years to go, we had to think of alternatives to double our $50k to $100k each.

There were two things that accelerated us toward our goal. After our honeymoon in 2018, we both opened accounts with a robo-advisor, chose the lowest risk profile, and began depositing $100 per month into that.

The second thing I did was to take $1,000 and tried my hand at trading stocks. As a complete newbie in the world of trading and investments, I quickly lost my $1,000. My losses compounded and it was really painful. Back then, even $50 meant a few days’ worth of meals. However, I noticed that my funds in my robo-advisor were doing fine. Sure, it was slow and steady, but it was much better than fixed deposits and made me feel at peace compared to trading stocks. So now I knew what not to do.

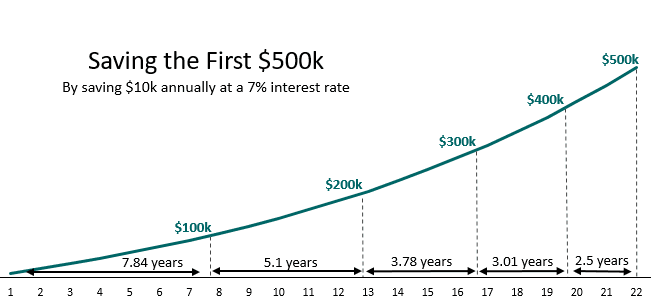

I also learned the difference between trading and investing stocks. Investing takes time for significant results; there will be a slow grind in the beginning, but it will snowball as the years go by.

2019-2020: Planning a home

At the age of 28, I had an approximate savings of $70,000. I had achieved 70% of my goal! With two more years to go, I had to maintain a consistent rate of $1,250 of savings per month to reach $100k by 30.

Amongst the many financial plans we had, one of them was to stop renting (we had rented together since age 25), and to buy a home of our own which would cost less than renting. With the help of grants from HDB to bridge our CPF shortfall, we were able to secure a flat at the end of 2019. We moved in before the pandemic hit in March 2020 and spent less than $5,000 for renovations (just simple refurbishments and fresh coats of paint). And oh, we were also expecting our first child!

Fast forward to the end of 2020, our investments started to really pay off and moved our wealth to the mid-$80k range. With travel, restaurants, and entertainment closed, most of our income went straight into our investment portfolios, CPF top-ups, and cash savings. It was really satisfying to see our investments grow in value. Instead of trading time with money, we were using time to grow our money… passively.

$100k by 30!

Months before my 30th birthday, I finally achieved my goal of reaching $100,000 across my savings, robo-advisor, and brokerage accounts. It was a liberating feeling to have achieved something that I had set out to do so many years ago.

To summarise my journey, here are the few key things that I’ve done:

1. Get a side hustle while young. Starting out in life usually means a lower salary. Get a side hustle to supplement your income. You will have less time and energy as you get older.

2. Save as much as possible. Eat economically as often as possible; that could either mean cooking more at home or eating cheaply (but make sure healthily too!).

3. Work on your debts. Markets will always go up or down, but debts with interest will always bring you down. Since my first paycheck seven years ago, I diligently made monthly payments to pay off my student loan, and occasionally paid off larger sums whenever I received a bonus or commission.

4. Indulge only occasionally. My first overseas trip (also in my life) was years after my first paycheck for my honeymoon. There will be plenty of opportunities to travel in the future when you’re more financially stable. However, it’s also important to reward and pamper yourself to prevent burnouts along the journey.

5. Start reading. If books bore you, there are tons of videos and podcasts on personal finance and investing online. Start learning from people who have gone through financial hurdles, obstacles and challenges and apply them to yourself.

6. Start investing now. As Ramit Sethi, author of I Will Teach You To Be Rich, put it:

‘Investing should be very boring—and very profitable—over the long term. I get more excited eating tacos than checking my investment returns.’

I would not have achieved $100k by 30 if not for the steady and continuous deposits into my robo-advisor portfolios and brokerage accounts years ago. Now, passively, the assets have appreciated in value so much that short-term volatility no longer bothers me. That’s what everyone should aim for – long-term asset appreciation.

The fifth perspective

After I reached my goal, I recently realised that $100k isn’t the prize, but the lessons that I learned along the way. Now with this short but precious experience, I am now aiming for $1 million dollars by 40.

Like how I visualised $100,000 many years ago, I’m now breaking up $1 million into smaller parts where $10,000 = 1% of my $1 million goal. I may need to do more than just save and invest moving forward, but I hope I’ll be able to get back to you in 10 years’ time on how I’ve done it!