A chockful of events happened in 2020. The year started with the United States bombing and killing an Iranian general. COVID-19 broke out in China, then Italy, before spreading to the rest of the world. The United States elected Joe Biden and Kamala Harris.

It has also been a wild ride for equity markets: from a sudden meltdown to an almost as sudden recovery, then trending, then heading towards the end of the year with some additional reversals and corrections as the COVID-19 vaccine appears in sight. Looking back on 2020 with 20/20 hindsight (pun intended), three main themes jumps out, providing three takeaways.

1. Risky business

First, risk management was punished again. In 2019, the more risk you took, the more you were rewarded in investments. This year, surprisingly, a similar theme continued. To date, professional managers saw large losses, partly due to their curbing of risk-taking in March, while retail investors did the opposite, partly fuelling the rebound and further gain of American stocks.

For example, well-known funds such as the AQR Long-Short Equity Fund is down 18.3% this year, Renaissance Technologies is down 13.4%, and Warren Buffet’s Berkshire Hathaway is up by only 1.38%. This is despite the S&P 500 making a year-to-date return of 13.5%. Meanwhile, Goldman Sachs reported mid-year that stocks popular with retail investors such as Tesla and Apple enjoyed a 16-percentage point advantage over hedge funds and 25 percentage points over the S&P 500.

2. The stock market is not the economy

Second, although the stock market and real economy must be related in the long run, at any given point of time, the stock market need not reflect the fundamentals of the underlying real economy.

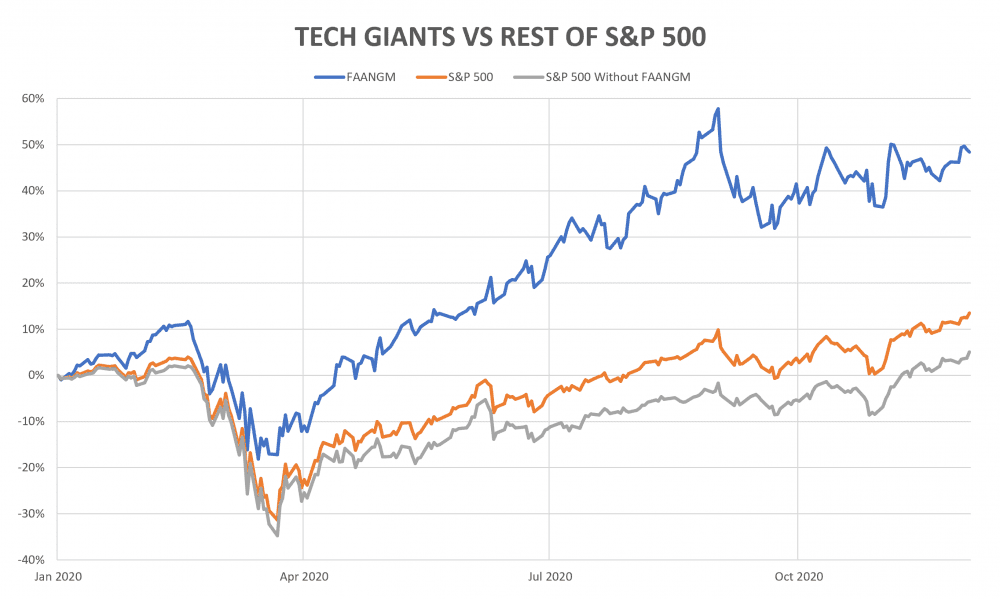

Much of the discussion initially about the recovery of COVID-19 was whether the economy will rebound in a V-shape or U shape. But to our surprise, stock markets did neither. It came out K-shaped, separating a few scalable tech-enabled players while the rest of the listed companies around the world suffered.

FAANGM stocks, referring to the six prominent American technology companies: Facebook, Amazon, Apple, Netflix, Alphabet and Microsoft, collectively enjoyed a year-to-date return of 48.4%, while the S&P 500 without FAANGM gained only about 5.11%.

It was an awakening for economists and investors alike who use the stock market as a gauge of the economy. Meanwhile, the unemployment rate – a key indicator for the real economy – shows an elevated rate of over 6.7% in the United States and peaking at 14.7%, a post-World War II high. (Meanwhile the unemployment rate in Singapore is 3.6%, the highest in a decade). Despite the struggling real economy, stock markets have recovered to record highs in August 2020.

3. Herd behaviour

Third, herding was prevalent. Herding occurs when people ignore their own information and instead follow the behavior of others. In a world with few assets yielding positive returns, the fear of missing out (FOMO) rises as investors clamour for the lottery-ticket investment.

Investors experience FOMO when they ‘missed out’ on some eye-watering stock rally that a friend might have profited from. Social media amplifies FOMO as friends and contacts broadcast their successes (usually while hiding their failures), inducing others to jump on the bandwagon. This one-sided selection of information distorts our perception. As a result, investors have increasingly tried to identify the next big thing, crowding into trades like Nikola.

Nikola is an example of a stock traded on FOMO and not on actual information. Nikola is an electric truck company which is pre-revenue, pre-production, and with one animated video trailer of its electric trucks, but whose market capitalization at one point reached that of Toyota, which sells millions of cars globally.

Most of the traders in various chat groups were not informed by scientific research or information about the company’s R&D or intellectual pursuits, but simply discussed the rocket-like returns, rallying almost 700% in one month. Since then, it was revealed to have over-exaggerated its marketing and its stock price saw a decrease of 77% since its peak in the second week of June. Despite its positive year-to-date performance of 90%, any investors who bought into the company after the initial large rally in May would have seen losses of almost 30%.

The fifth perspective

As we wrap-up the year, what do these three themes teach us? Before jumping head first into the financial markets after seeing a friend’s Instagram post on how their Pin Duo Duo investments afforded them a new car, we should ask ourselves three questions:

- Am I betting or am I investing? This question helps to define the loss tolerance. Betting is not necessarily bad, as it can correct price inefficiencies in certain stocks, but speculators placing bets on a particular asset should be prepared to loss all (or more, in the case of derivatives) of their trading account value. Although since March, the more risk you took, the more returns you received, such a payoff pattern does not hold true over longer investment horizons. Risk management will almost surely make a comeback, and we should be mentally and financially prepared when risks can change suddenly.

- Do I have a view that is more informed than the market, or am I just reacting to others’ information? Remember, you only have an information edge in an investment if you are acting on something that the market has not already incorporated. This question helps us to be more aware of whether we are acting due to irrational behavior. Although reacting to others’ information may be useful, do we think that the market has not yet perceived and incorporated such information in the stock prices?

- Is my bet or view expressed in an effective manner? Questioning ourselves forces us to be more rigorous. Just as an example, if I want to place a bet on the COVID-19 situation being prolonged, an obvious bet is to invest in Netflix as more people will stay at home. This would have provided a March-to-date return of 55%. An alternative way to bet on a prolonged COVID-19 situation would have been to bet on funeral services and pre-made casket companies such as Service Corporation International (March-to-date return of 40%) or Fu Shou Yuan (March-to-date return of 25%). Although more macabre, both those companies have substantially lower valuations, higher dividend yields, as well as more stable cash flows compared to Netflix (P/E of 82 with no dividends vs. 19.3 and 1.71%, and 27.5 and 0.98% respectively).

These three checklist questions can help us slow down our trading impulses and increase our self-awareness when investing in financial markets. Just as 2020 has been a hugely eventful year, it has also been highly educational.

Ben Charoenwong is an assistant professor of finance at the National University of Singapore (NUS) Business School and head of research at Chicago Global, a quantitative global investment fund. The views in this article do not represent those of NUS Business School nor those of Chicago Global. He does not have any direct personal investments in any companies mentioned above.