All views expressed in the article are based solely on The Fifth Person’s independent opinion.

With over 220 million paid subscribers, Netflix is the most popular streaming service in the world and a stock market darling. Since early 2007, when Netflix began its pivot to streaming, its stock price has returned a massive 16,210% (as of end-2021). This means that every US$10,000 invested with Netflix then would now be worth US$1.63 million!

However, Netflix’s stock price has since plunged 42% since its October peak of US$691. Why has Netflix fallen so much? And is there an opportunity to have a look at the stock right now?

Why Netflix’s stock has crashed

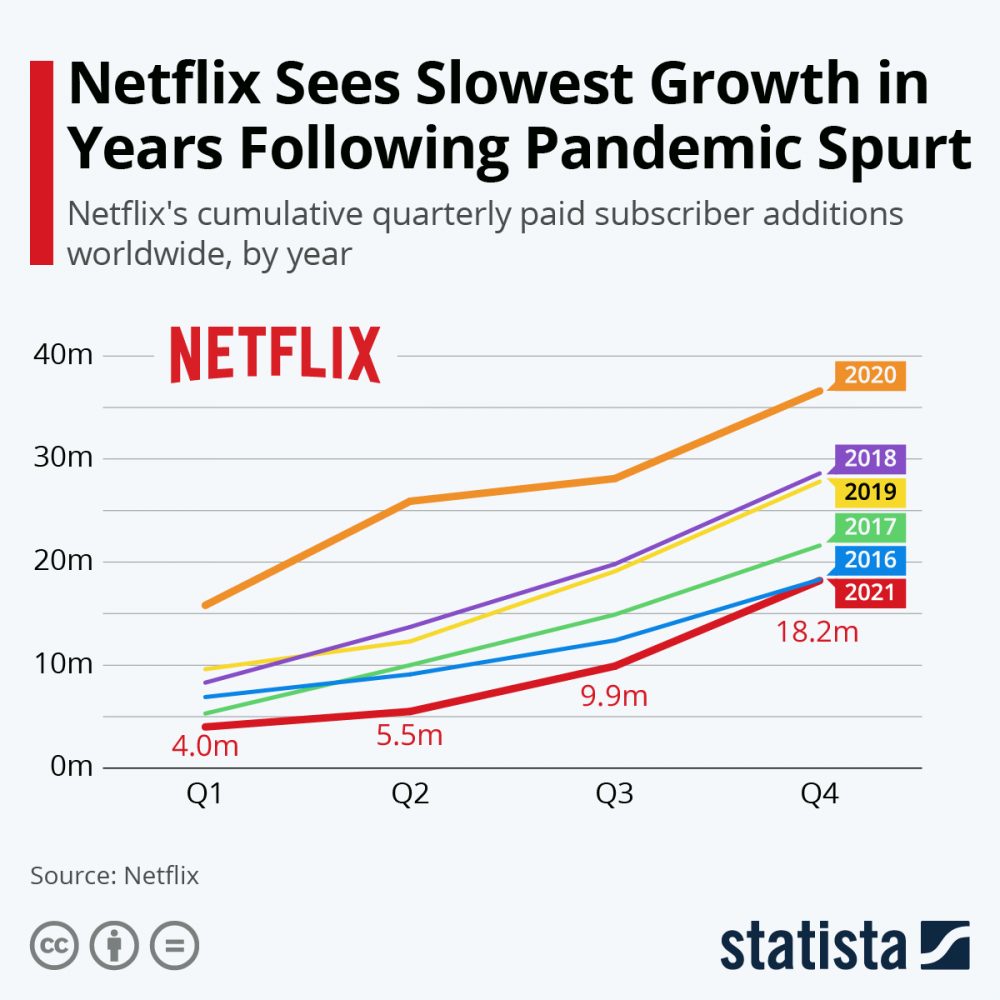

Just like any high-growth stock that’s priced to perfection, any slowdown in Netflix’s growth metrics will cause a reaction to its stock price. In Netflix’s case, the market tends to keep a watch out for the company’s subscriber growth. In 2021, Netflix added 18.2 million net new subscribers – the lowest gain since 2016. Compared to previous years, it’s clear that the company’s growth has slowed dramatically.

In its Q4 2021 letter to shareholders, Netflix management explained that the slowdown was due to a ‘COVID overhang’. Which means that the pandemic and stay-home lockdowns encouraged more people to sign up for Netflix in 2020, when they might have otherwise subscribed later.

‘In addition, while retention and engagement remain healthy, acquisition growth has not yet re-accelerated to pre-Covid levels. We think this may be due to several factors including the ongoing COVID overhang and macro-economic hardship in several parts of the world like LATAM.’

However, the management also guided that Q1 2022 net subscriber growth will be 2.5 million, compared to 4.0 million for the same quarter a year ago. This has spooked investors that Netflix’s golden days of growth may be over.

The runway for Netflix

It remains to be seen whether Netflix’s recent slowdown is mainly due to a COVID overhang (which would imply that growth will eventually return to pre-pandemic levels), or due to increasing competition in the industry. My opinion is that it’s a bit of both.

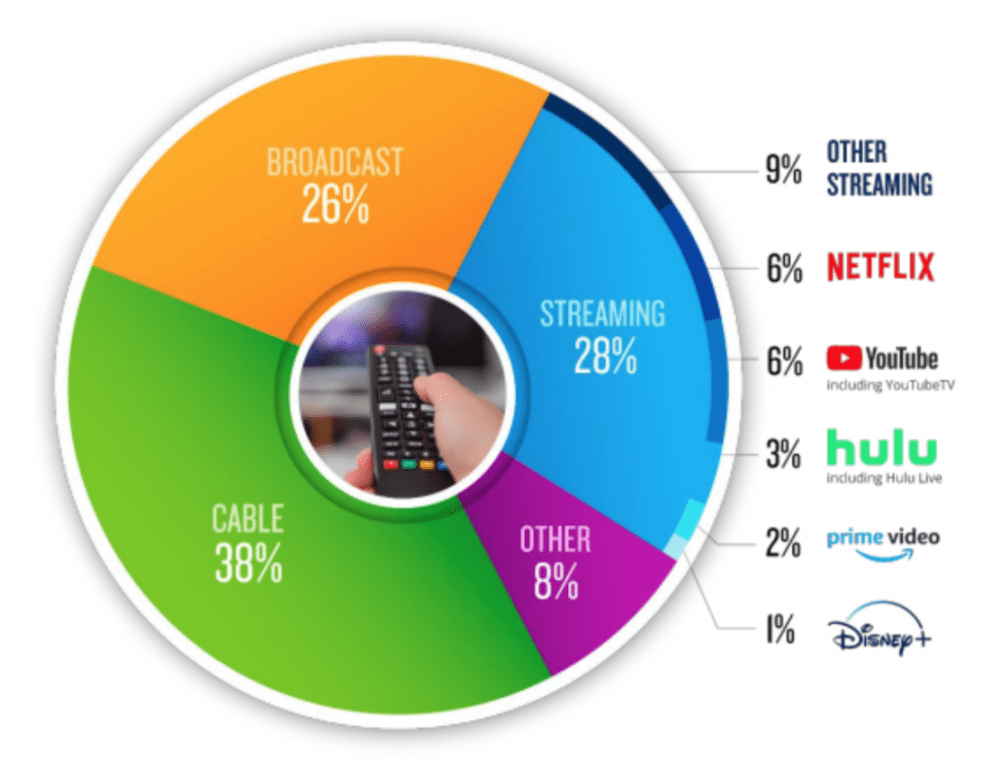

Led by the initial success of Netflix, the streaming industry is now home to a plethora of streaming providers including Disney+, Hulu, Amazon Prime, HBO Max, Peacock, Apple TV+, YouTube TV, etc. All these streaming providers — each with their own exclusive line of movies, shows, and content — are fighting for the same subscriber dollars and eyeballs. Netflix is still the market leader, but the pie is increasingly being divided.

At the same time, the runway for Netflix and other streaming providers has some way to go. From the pie chart above, streaming only accounts for 28% of total U.S. TV time. We can expect this slice to grow in years to come as cord-cutters make the move from cable TV to streaming. So despite the competition, Netflix’s share of the overall pie will grow as long as it continues to deliver high-quality, exclusive content to its subscribers.

Netflix Originals

In the streaming industry, content is king. Netflix understood that it would eventually lose the rights to its licensed content as other players entered the industry, and that exclusive content would be critical to the company’s future. Netflix released its first original show — House of Cards — in 2013 which was well-received by critics and viewers alike. Since then, Netflix has gone on to produce exclusive hits like Stranger Things, Orange is the New Black, The Crown, Black Mirror, The Queen’s Gambit and, of course, Squid Game — Netflix’s most watched series of all time.

Netflix has become a production powerhouse in its own right. Since 2013, the company has released over 2,000 original titles. In 2021, Netflix was the most Emmy-winning and most nominated TV network, and the most Oscar-winning and nominated movie studio.

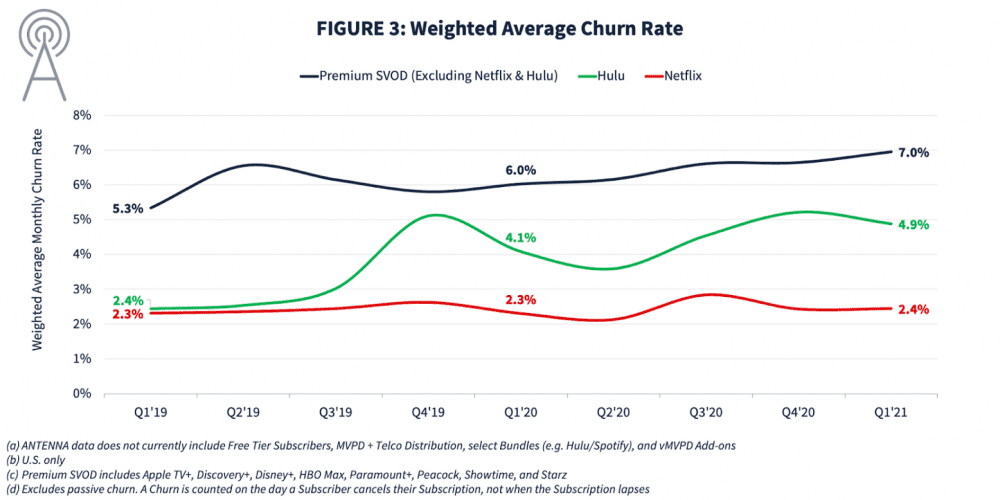

Netflix’s original content strategy has paid off handsomely and, in turn, helped to build the most loyal customer base in the streaming industry. According to studies, Netflix has the lowest churn rate among its peers at just 2.4%. (A churn is counted when a customer actively cancels their subscription.)

Pricing power

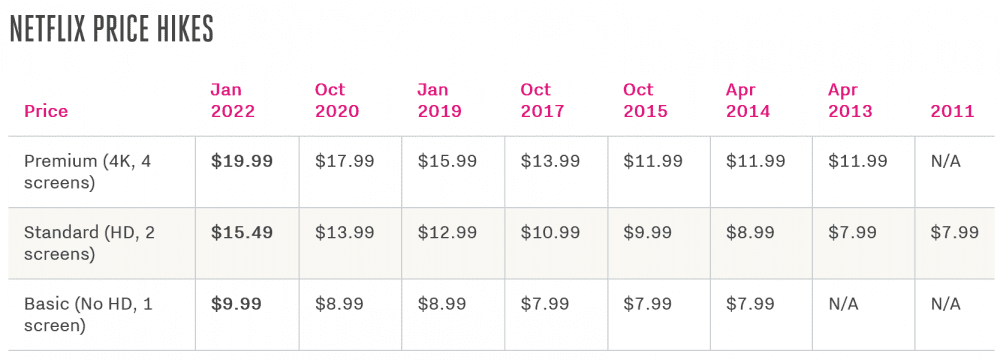

Netflix normally enters a new market by offering low prices to attract customers. But Netflix also knows that once its customers are in, they tend to stick — which is also why the company has steadily increased its prices in recent years.

This trend can be observed in the U.S., Netflix’s most mature and penetrated market. Netflix’s premium plan – which offers 4K resolution and allows four screens to be streamed simultaneously — now costs US$19.99. The plan has jumped in price by two dollars roughly every two years since 2017.

Netflix understands that most people share a Netflix subscription which CEO Reed Hastings acknowledged back in 2016:

‘Password sharing is something you have to learn to live with, because there’s so much legitimate password sharing, like you sharing with your spouse, with your kids …. so there’s no bright line, and we’re doing fine as is.’

With four people sharing a premium plan (which allows four screens), that works out to just five dollars a month per person; there is still room for Netflix to steadily increase its prices in the future.

Financials

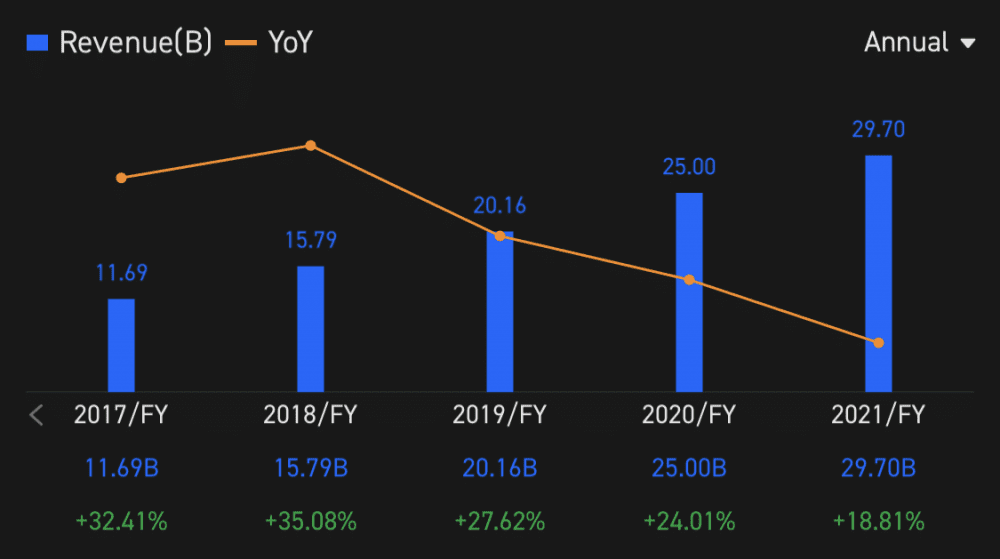

Netflix’s revenue has grown US$11.7 billion in 2017 to 29.7 billion in 2021 – a compound annual growth rate (CAGR) of 26.2% over four years. However, growth has slowed down in more recent years as competition heats up in the streaming industry.

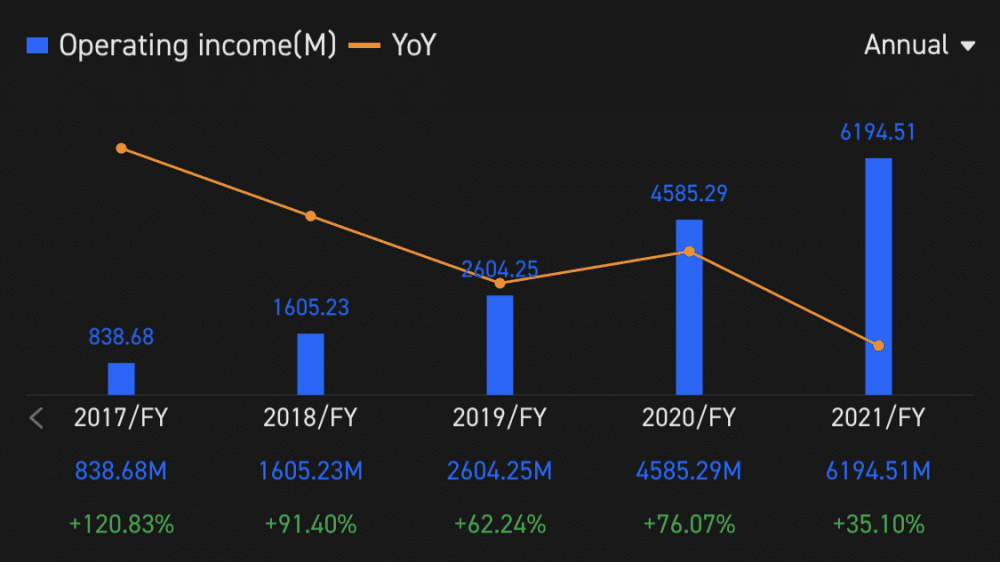

Netflix’s operating income growth is more impressive, increasing from US$838.7 million in 2017 to US$6.2 billion in 2021 – a CAGR of 64.9% over four years.

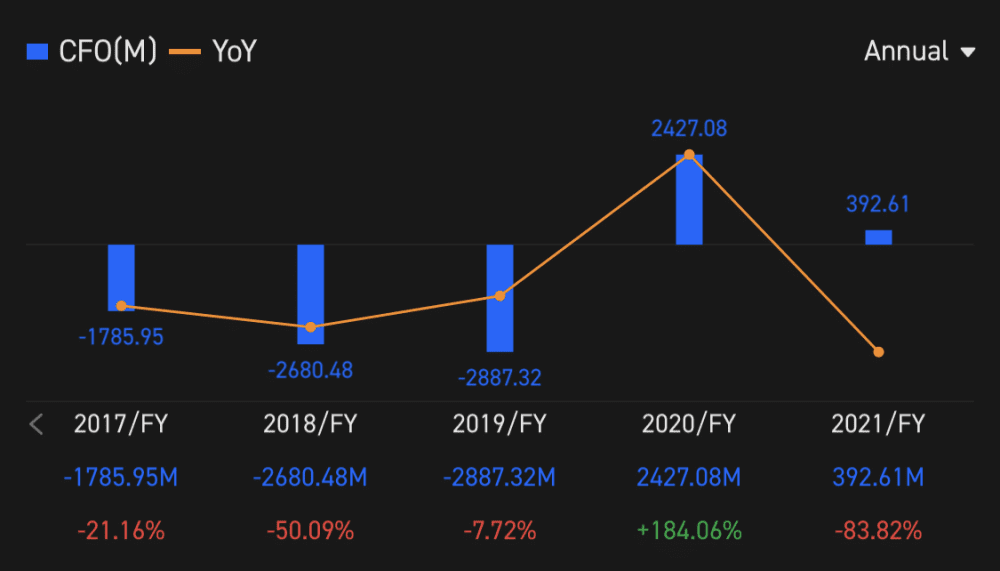

However, Netflix’s cash flow is a lot choppier. The company’s cash flow from operations turned negative in 2015 when it started ramping up its library of original content. Producing high-quality TV shows and movies isn’t cheap.

The Netflix Original movie ‘Red Notice’ starring Dwyane Johnson, Ryan Reynolds, and Gal Godot cost US$200 million to produce. Not every show is a nine-figure production (Squid Game cost around US$20 million), but Netflix produces over a hundred new titles every year and it all adds up.

Cash flow turned positive again in 2020, but Netflix will continue to invest heavily in original content for the near future to set itself apart from its competitors. As of 31 December 2021, Netflix has a total of $23.2 billion in content obligations — content that the company has committed to producing/licensing in the future.

The fifth perspective

As the pioneer in its industry, Netflix has become synonymous with streaming today. At its stock price of US$398 (as of 16 February 2022), Netflix’s P/E ratio works out to 35.4, which is fair value for an industry leader which still has room to grow.

The global streaming industry is expected to grow at a CAGR of 12% and hit US$842.9 billion by 2027. Although competition is fierce, Netflix has the size, first-mover advantage, and original content to remain a major player alongside heavyweights like Disney and Amazon.

Get the latest news, analysis, and financials about Netflix and other U.S. stocks on the moomoo trading app. FUTU SG via moomoo trading app offers one of the most competitive trading fees across US, HK, SG & China A Shares with live market data.

When you successfully register for your securities account via the moomoo app, you will get to enjoy 180 days of unlimited commission-free trading for the U.S., Hong Kong, and Singapore stock markets (platform fees still apply). You would also gain free access to Level 2 market data for the U.S. stock market; Level 1 market data for the Singapore stock market; Level 1 market data for China A Shares. And from now till end February 2022, you will also receive one-month’s worth of Level 1 Hong Kong market data for free!

Investment products available through the moomoo app are offered by Futu Singapore Pte. Ltd., a capital markets services licence holder regulated by the Monetary Authority of Singapore. Futu Singapore’s parent company, Futu Holdings Limited, is backed by world-class investors which include venture capital affiliates of Tencent, Sequoia Capital and Matrix Partners.

Open you FUTU SG securities account today with the moomoo app here. Terms and conditions apply.

This article was written in collaboration with Futu Singapore Pte. Ltd.

The content is provided for entertainment & informational use only. The information and data used are for purposes of illustration only. No content herein shall be considered an offer, solicitation or recommendation for the purchase or sale of securities, futures, or other investment products. All information and data, if any, are for reference only and past performance should not be viewed as an indicator of future results. It is not a guarantee for future results. Investments in stocks, options, ETFs, and other instruments are subject to risks, including possible loss of the amount invested. The value of investments may fluctuate and as a result, clients may lose the value of their investment. Please consult your financial adviser as to the suitability of any investment. This advertisement has not been reviewed by the Monetary Authority of Singapore.