Founded in 1966, Public Bank Berhad is presently the second largest Malaysian-listed bank (after Maybank) and ranks among the top 10 largest in Southeast Asia by market capitalisation. As of 26 May 2019, Public Bank’s market cap stood at RM87.4 billion.

I recently received its latest annual report and will be covering Public Bank’s latest financial results and valuation figures. As such, here are 12 things to know about Public Bank before you invest:

1. In 2018, Public Bank generated RM7.10 billion in profit before tax (PBT). The table below lists the top five key segments that contributed the most profit in 2018:

| Segment | PBT (RM millions) | Percentage of Total Revenue |

|---|---|---|

| Domestic Consumer Banking and SME Lending | 3,972.1 | 55.9% |

| Public Islamic Bank Bhd | 618.6 | 8.7% |

| Public Mutual Bhd | 667.6 | 9.4% |

| Domestic Corporate Lending | 558.5 | 7.9% |

| International Operations | 690.7 | 9.7% |

| Others | 593.7 | 8.4% |

| Total Profit Before Tax | 7,101.2 | 100.0% |

Source: Public Bank 2018 annual report

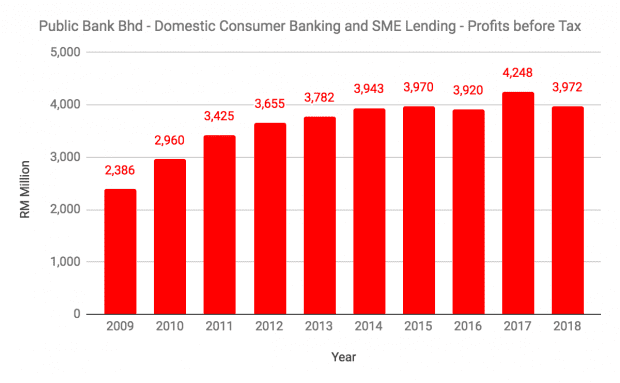

2. Domestic Consumer Banking and SME Lending: Over the last 10 years, PBT grew by a compound annual growth rate (CAGR) of 5.8% from RM2.4 billion in 2009 to RM4.0 billion in 2018. This was contributed by several key factors including growth in loans, advances, and financing and a steady reduction in gross impaired loan (GIL) ratio during the decade. LAF assets increased from RM108.1 billion in 2009 to RM255.3 billion in 2018 due to the management’s focus on growing the bank’s portfolio in mortgages on residential and commercial properties. Over the same period, GIL ratio fell from 1.3% in 2009 to 0.5% in 2018 – the lowest in the local banking industry.

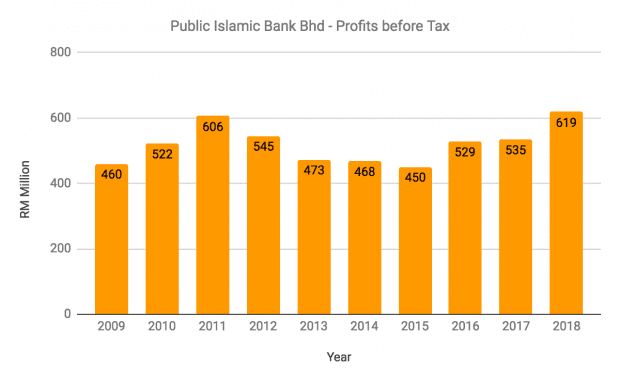

3. Public Islamic Bank: The segment recorded a third consecutive year of PBT growth from RM450 million in 2015 to RM619 million in 2018. This was mainly contributed by faster growth in gross financing and advances. Over the last 10 years, gross financing and advances grew by a CAGR of 13.6% from RM14.6 billion in 2009 to RM45.9 billion in 2018, and GIL ratio fell from 1.0% in 2009 to 0.6% in 2018.

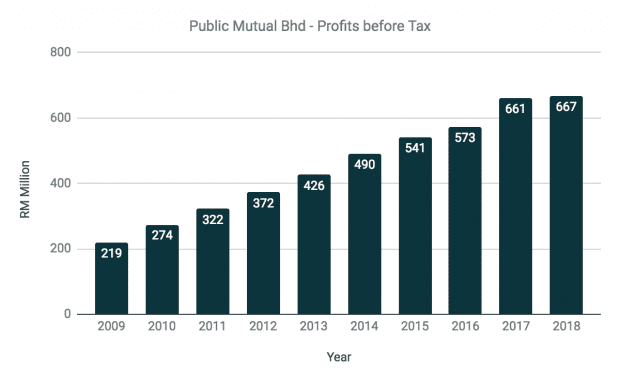

4. Public Mutual: Over the last 10 years, PBT grew by a CAGR of 13.2% from RM219 million in 2009 to RM667 million in 2018. This was in tandem with Public Mutual’s growth in assets under management (AUM) for the last 10 years, which grew from RM35.6 billion in 2009 to RM78.7 billion in 2018. With a 37.2% market share, Public Mutual is among the leading mutual fund companies in Malaysia and currently manages a total of 147 unit trust funds.

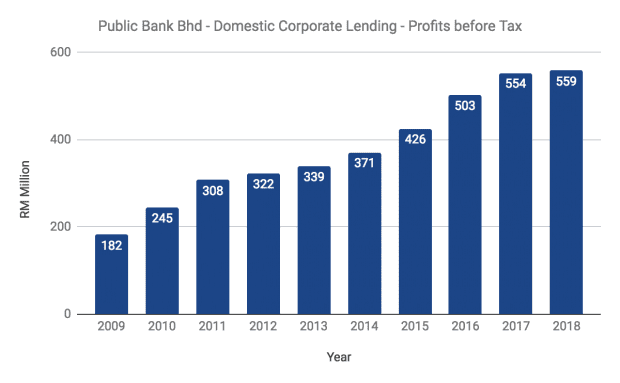

5. Domestic Corporate Lending: Over the last 10 years, PBT grew by a CAGR of 13.3% from RM182 million in 2009 to RM559 million in 2018. This was attributable to growth in loans, advances and financing to corporate clients and a reduction in GLI during the period. Loans, advances and financing grew from RM16.0 billion in 2009 to RM41.0 billion in 2018. This segment also has the lowest GIL ratio as it serves large companies where the level of loan defaults are lower; GIL ratio fell from 0.8% in 2009 to just 0.1% in 2018.

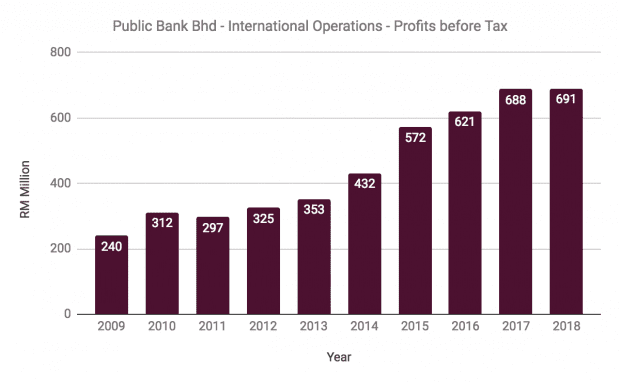

6. International Operations: Over the last 10 years, PBT grew by a CAGR of 12.5% from RM240 million in 2009 to RM691 million in 2018. This was attributed to growth from Public Financial Holding Group and Cambodian Public Bank Plc, and the addition of Public Bank Vietnam as a fully-owned subsidiary after Public Bank acquired the remaining 50% interest for US$76.6 million in 2016.

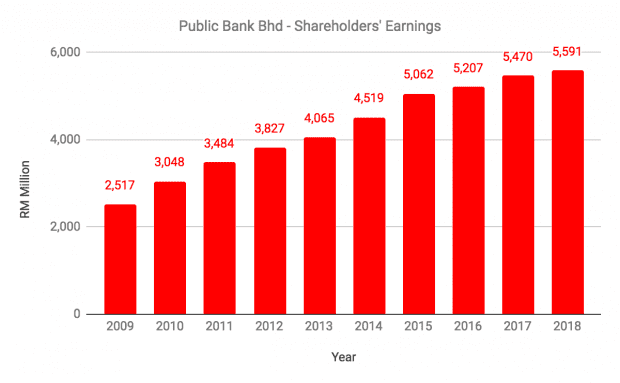

7. Shareholders’ earnings grew by a CAGR of 9.3% from RM2.5 billion in 2009 to RM5.6 billion in 2018. This was due to a stable performance from Public Bank’s domestic consumer banking and SME lending segment over the last 10 years, and growth from Public Islamic Bank, Public Mutual, domestic corporate lending activities, and international operations in Hong Kong, Cambodia, and Vietnam. In 2018, Public Bank posted an overall GIL ratio of 0.5% and a cost-to-income ratio of 33.0%, which makes it the most cost-efficient banking group in Malaysia.

8. As at 31 December 2018, Public Bank has a total capital ratio (TCR) and Loan Loss Coverage (LLC) of 16.8% and 126.0% respectively. Its TCR is above the 8.0% minimum required by Bank Negara Malaysia and 2.5% additional capital buffer requirement for 2019 onwards. Its LLC is above the current industry average of 96%. The two ratios indicate that Public Bank is well-capitalised enough to absorb loan losses and remain stable during a bad economic downturn. Presently, Public Bank has a ‘A-’ credit rating by S&P.

9. Public Bank remains committed to grow its business while maintaining a strong balance sheet and low cost structure. The management has six key performance targets for 2019:

| Key Performance Indicators | 2018 Results | 2019 Target |

|---|---|---|

| Net Return on Equity | 14.8% | 13%-14% |

| Cost-to-Income Ratio | 33.0% | 34%-35% |

| Gross Impaired Loan Ratio | 0.5% | <1% |

| Total Capital Ratio | 16.3% | >13% |

| Gross Loans | RM317.3 billion | 5% Growth |

| Deposits | RM339.2 billion | 5% Growth |

Source: Public Bank’s Annual Report 2018

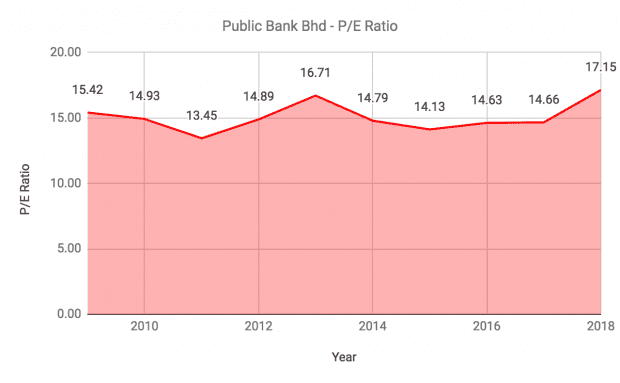

10. P/E ratio: As at 26 May 2019, Public Bank Bhd is trading at RM22.52 per share and generated RM1.444 in earnings per share. Therefore, its current P/E Ratio is 15.30, which is near its 10-year average of 15.08.

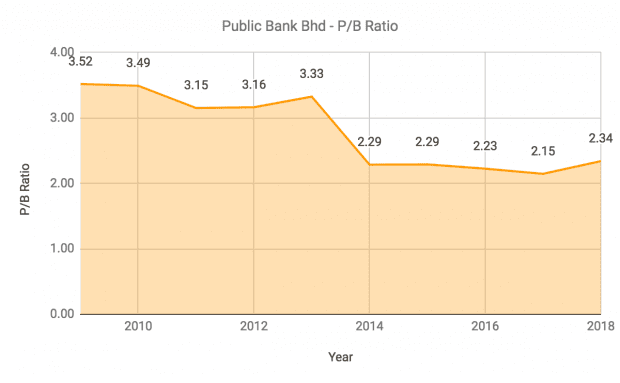

11. P/B ratio: As at 31 December 2018, Public Bank has net assets per share of RM10.55. Therefore, its current P/B Ratio is 2.13, which is below its 10-year average of 2.79.

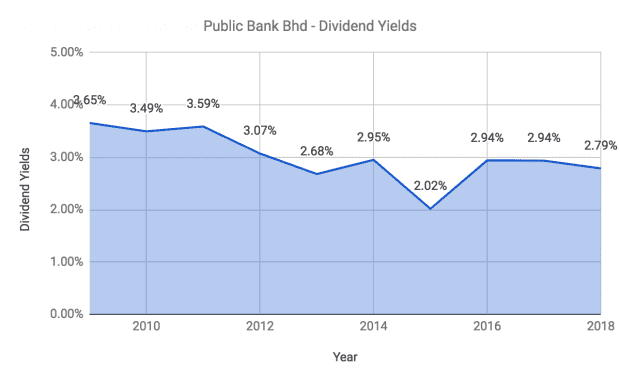

12. Dividend yield: Public Bank has a track record of paying a growing dividend per share (DPS) over the last 10 years (and more). DPS increased from 41.3 sen in 2009 to 69.0 sen in 2018. If Public Bank maintains its DPS at 69.0 sen, its dividend yield is 3.06% based on current share prices. The yield is near its 10-year average of 3.01%.

The fifth perspective

In summary, Public Bank has delivered consistent growth in revenue, shareholders’ earnings, and dividends over the last 10 years (in fact, for far longer than that). It has also become more and more cost-efficient over the years, and maintains a solid balance sheet with its TCR and LLC well above the minimum regulatory requirements.

In terms of valuation, Public Bank is trading relatively near its historical averages but do note that the stock trades at a premium compared to banks in Malaysia and Singapore. In comparison, Maybank and DBS Bank trade at a P/B of around 1.3 to 1.4. Public Bank’s track record and popularity among Malaysian investors makes it a stock market darling, and discounts will be hard to come by as long as it continues to perform into the future.