Winner takes all: Why you should invest in the rise of the super app

Recently, a trend has emerged in which certain businesses have begun expanding into business lines that appear to be unrelated to their core competency.

For instance, Shopee, an e-commerce company, recently expanded into the financial services sector. In a more extreme case, AirAsia, a low-cost airline carrier, began offering hotel bookings, food delivery, and payment services. This is what most of us refer to as the ‘super app’ trend.

What is a super app?

Super apps are a centralised platform for services and offerings grouped under one umbrella. The super app trend is most prevalent in China, with popular examples such as WeChat, Alibaba, and Alipay. These Chinese applications frequently attempt to cram as many features as possible into a single application.

WeChat allows you to do more than message your friends and see their updates on a feed. It can also be used to get a loan to buy your next car. WeChat mini programs also allows third-party developers to create their applications on the platform. It is worth noting that, while the use of super apps is more prevalent in China, the trend is also quickly spreading globally.

Why the super app is gaining popularity

This trend baffled me initially because we have been taught that diversification away from the core business typically signals 1) that the company lacks room for growth in its core business, so expanding into new business lines is a necessity, and 2) given the lack of expertise in these new fields, diversification typically leads to ‘diworsification’.

So, why are businesses taking this route? One primary reason appears to be rising customer acquisition costs (CAC) — the cost of marketing to convince new customers to make purchases from businesses. As CAC grows, competitive advantages are shifted away from the supply side and begin to revolve around controlling the demand side.

The dominance of online shopping has increased retailer competition, resulting in increased CACs and advertising costs. In fact, CACs have risen to the point where businesses are discovering that it is cheaper to find new customers the old-fashioned way – via retail and physical advertisements. The same trends can be seen across the board on Google Adwords, Baidu, Shopee Ads, and other platforms.

Adapting to the new digital reality

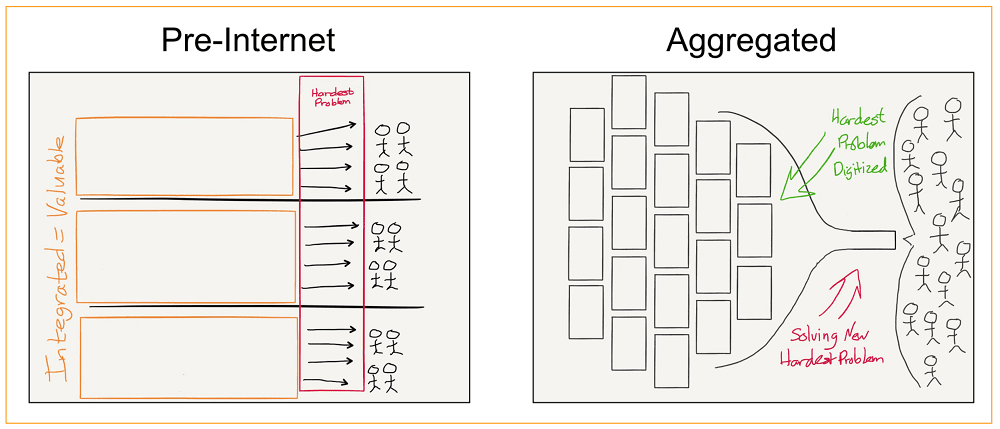

Aside from rising CAC, the availability of internet access and its growing influence on individual consumers have significantly reduced the barriers to entry for new brands; incumbent companies can no longer monetise their customers to the same level previously.

If margins are excessively high, there is a real risk that a new startup will enter the market and attempt to undercut the incumbent. This issue was not as concerning in previous decades. Even if a new company could undercut an established competitor on price, it still had to deal with the significant hurdle of distribution. It makes no difference if your startup can sell mattresses for a fifth of the cost if customers cannot find a way to purchase them.

However, the game has shifted and the internet has revolutionised the consumption and distribution of products and services. Many incumbent companies no longer have the same competitive edge as they used to. Businesses have discovered that they must keep margins low to compete, hoping to make up for it through volume. This model further reinforces the widely mentioned ‘winner takes all’ dynamic by emphasising scale to remain competitive.

Simultaneously, companies such as Amazon realised a decade ago that aggregating consumers and providing them with the best customer experience (rather than squeezing every last dollar out of them) would give them control of this scarce resource (the customer base) while also allowing them to grow to unprecedented levels.

In addition, most anti-trust laws in the world work in favour of consumers. Simply put, governments worldwide have generally been silent as long as consumers benefited from lower prices or increased competition. As a result, businesses begin to rewrite the conventional business playbook. Rather than excessively monetising their customer base, platform businesses began focusing on increasing their visibility and acquiring as many users as possible. The idea is that if a platform can capture and control the entire customer base, suppliers will have no choice but to pay the platform to gain access to their customer base.

The rise of super apps is also fueled by a shift in how the ad-supported app economy operates. Companies like Facebook that primarily profited from tracking users across multiple websites can no longer be confident that their ads will result in a purchase elsewhere. Historically, this data sharing enabled apps to easily track users as they navigate the internet, providing advertisers with a strong signal about the types of ads to which specific individuals will respond. Simply put, if businesses cannot acquire customers effectively through targeted advertising, they will turn to platforms for direct access to a defined user base with a high propensity to purchase.

App monetisation method 1: Reselling the user base

Platform businesses can generate additional revenue by aggregating their customer base and then selling access to this captive group to a brand owner. This is feasible due to the numerous benefits of scaling within CACs.

For example, Shopee can afford to pay a premium to acquire new users because they have a wide variety of ways to monetise their users. In comparison, a small brand owner can only offer their customer a single product category. This allows the super app to capture all of its user base and ‘sell’ it to brand owners at a much lower cost than if the brands went out and acquired the customers themselves.

These brands and suppliers are increasingly willing to pay to gain access to the platform’s user base, as this is frequently viewed as more effective use of marketing dollars, as super app users have a higher propensity to purchase than a potential customer acquired elsewhere through traditional marketing campaigns.

App monetisation method 2: Cross-selling

We primarily associate Grab with ride-hailing or food delivery, but its business model is arguably based on users purchasing high-margin products such as insurance and hotel reservations down the line.

By leveraging an existing customer base (ride hailing and food delivery), Grab has significantly reduced the barriers to success when launching adjacent business lines (insurance, hotel reservations). The high-frequency nature of ride-hailing and food delivery also provides a channel for continual customer acquisitions.

While Grab is has yet to turn profitable and its current valuation is questionable, its potential growth is huge if the company can successfully navigate the competitive landscape in its home markets.

The fifth perspective

I believe that consumer trends will shift toward super apps over the next decade. This business model shift will present opportunities for investors for the foreseeable future. But in a winner takes-all economy, not every super app will succeed. The critical question is which platform can continue to deliver value in a world dominated by super apps. Investors that can successfully identify the winning platforms will profit handsomely from their investments.