Ok! It is here… finally.

I was fairly excited to hear the news that a REIT ETF is coming to the Singapore market.

At The Fifth Person, we reckon the idea of investing in a REIT ETF is a good alternative for anyone who wants to passively invest in a basket of REITs and build a steady flow of dividend income. So the good news is that you can invest in the SGX APAC Dividend Leaders REIT ETF starting 20 October 2016. The ETF invests in a diversified pool of REITs in Asia Pacific excluding Japan. (Let’s called this ETF the SGX REIT ETF).

The first thing you need to take note is that the SGX REIT ETF will be traded just like a normal stock in two currencies – the U.S. dollar (SGX: BYI) and the Singapore dollar (SGX: BYJ). While it is easy for anyone to buy the ETF once it is floated on the market, I expect not many will go through the entire 80-page listing prospectus, but please go through it!

Here five key points I picked out from the prospectus for you to consider if you’re thinking of investing the SGX APAC Dividend Leaders REIT ETF:

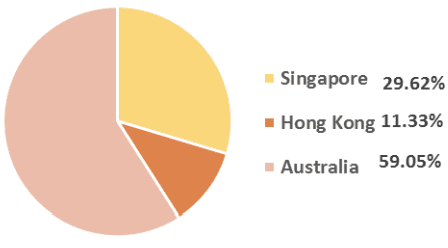

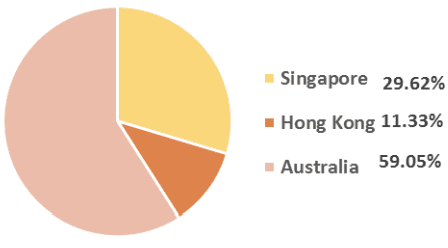

1. A large percentage of the SGX REIT ETF is in Australian REITs

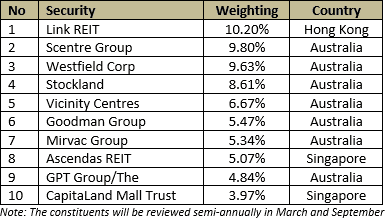

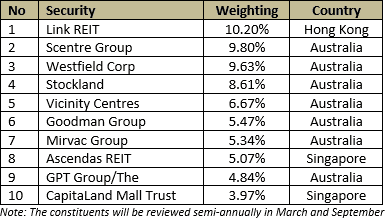

As at 29 September 2016, the top 10 securities in the SGX REIT ETF are:

After assessing its constituents, I become less upbeat about the ETF for retail investors primarily because a large constituent of the ETF is made up of Australia REITs (59%).

As the portfolio of Australian REITs in the SGX REIT ETF is fairly substantial, you need to know that a portion of its distributions will be subjected to Australia withholding tax, currently at 15%. It is also important to note that that the distributions paid by the pool of listed REITs are also subjected to Singapore corporate income tax rate which is currently at 17%. This tax is applicable at the fund level but not at the individual level.

One of the great advantages of investing in Singapore is that investors (local resident or not) are exempted from tax on dividends and capital gains. The Singapore government waives tax on both individual and corporate levels as long as a REIT pays out 90% of its distributable income to unitholders. So you lose a bit of this in the SGX REIT ETF.

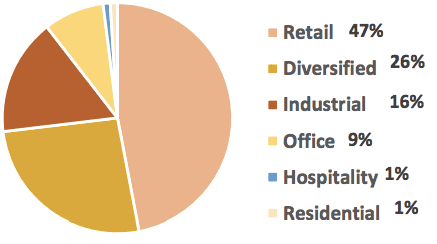

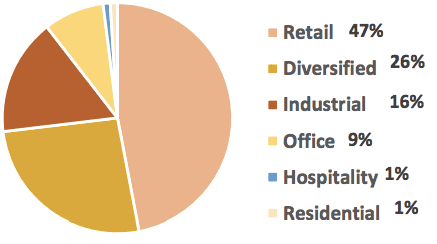

2. Well-diversified across different sectors

Individual REITs usually focus on a key sector.

For example, CapitaLand Mall Trust focuses on retail mall assets. Parkway Life REIT concentrates its portfolio on healthcare assets like hospitals. While there are REITs with exposure to more than one sector, it is hard to see a REIT possessing the kind of sector and geographical diversification you have in the SGX APAC Dividend Leaders REIT ETF.

A diversified basket of REITs can automatically offer investors built-in portfolio diversification to reduce non-market risk while paying consistent dividends – since its focus is only on stable income-producing assets.

Simply put, your neighbours’ grandmother can invest in a basket of REITs in one ETF and she does not need to…

- Know how to pick the right REIT

- Spend a great deal of time monitoring all of them

- Subscribe to any rights issue by any REIT

- Attend any annual general meeting

She can still peacefully enjoy a game of mahjong with her friends knowing that her portfolio is well-diversified and fairly low risk.

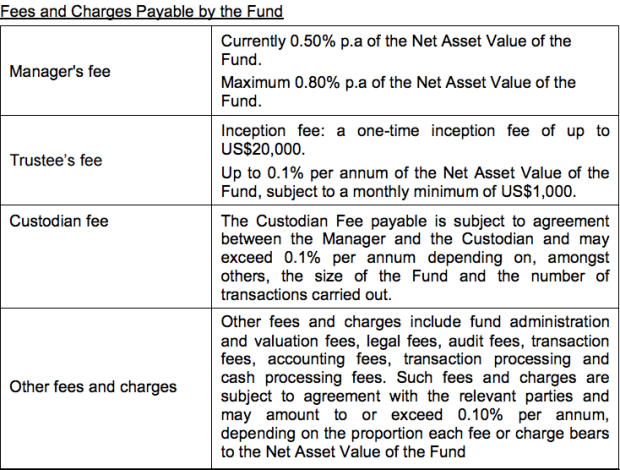

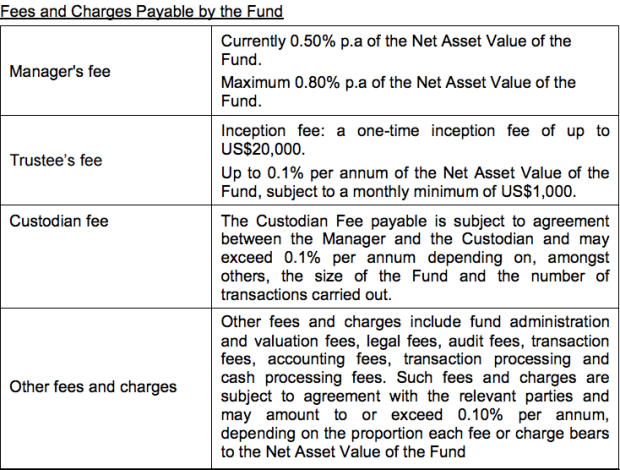

3. Relatively high expense ratio

Generally, an ETF is attractive for investors because it has extremely low fees compared to mutual funds. For example, the SPDR STI ETF has an annual expense ratio of only 0.30% and the Vanguard REIT ETF has an even lower expense ratio of 0.12%. On the other hand, the indicative total expense ratio of the SGX REIT ETF is approximately 0.65% (including manager and trustee fees). It is considerably more expensive compared to the first two ETFs.

4. Relatively low dividend yield after cost

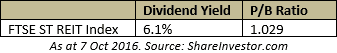

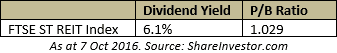

The table below shows the yield and P/B ratio of the SGX APAC Dividend Leaders REIT Index (which the ETF is based on) as at 30 September 2016.

![]()

![]()

Phillip Capital, the manager of the SGX REIT ETF, is targeting a gross yield of 5.07% and dividends will be paid out to investors every six months. However, we can expect a lower net dividend yield of less than 4.5% after deducting expenses such as corporate tax, withholding tax and manager fees.

At the time of writing, the average distribution yield of all Singapore REITs is 6.1%. The two healthcare REITs listed in Singapore, First REIT and Parkway Life REIT (two extremely stable and low-risk REITs), are trading at distribution yields above 5%. All this is comparatively higher than the net dividend yield offered by the SGX REIT ETF.

5. It’s not perfect – but it is still better than the fixed deposit

If you’re someone who has never invested in a Singapore REIT, you may find the SGX REIT ETF an attractive alternative to earn a higher return compared to your measly fixed deposit rate.

Since I already have several investments in Singapore REITs that offer good return, stability, and a higher dividend yield (we cover which REITs to pick in Dividend Machines™), I personally won’t be investing the SGX APAC Dividend Leaders REIT ETF. Rather, I will put it on my watchlist and maybe take another look at it when a better valuation comes around in the future.

Read more: 5 reasons why you should invest in S-REITs